Stephen Brashear

Hexcel Corporation (NYSE:HXL) is a company that I have covered for years, and the reality is that, as an aerospace engineer, I am extremely enthusiastic about the company’s product and the role composites play in future commercial airplane developments, as well as advancement in mobility and defense. Despite this, its stock price has struggled. For a company that plays such an important role in advanced composites solutions, you would expect a bit more stellar performance. However, that the company is facing some challenges is partially also driven by the softness observed during the pandemic in commercial airplane demand, and that is a volume that you don’t build back overnight. And shipset value of composites increased with each new airplane development, and airplane developments also do not happen overnight.

So, I do see significant long-term potential for the stock, but its share price appreciation in the near-term might not always reflect this. In this report, I will discuss the company’s most recent earnings results, providing a discussion of its key end markets, discuss the company’s guidance, and provide a stock price valuation.

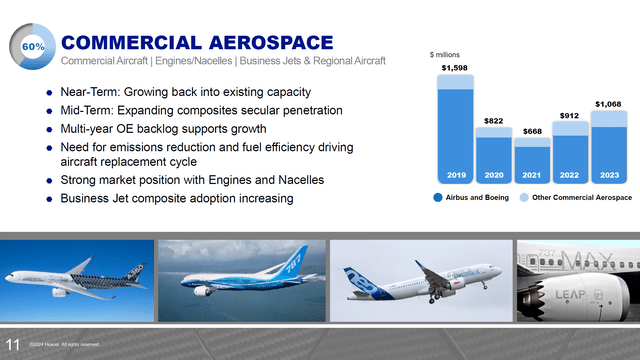

Hexcel Sees Commercial Aerospace Growth But Softer Single Aisle Demand

The commercial aerospace revenues accounted for 60% of the full year revenues compared to 58% a year earlier. In total, revenues of $1.068 billion signaled 17% growth in revenues compared to 36.5% growth a year earlier. The revenue growth is primarily slowing down because single aisle production is not pacing as well as initially hoped. Both Boeing and Airbus are seeing relatively low year-over-year increases in deliveries. Airbus deliveries rose 11% while Boeing deliveries rose 10% in 2023. Single aisle deliveries increased 12% for Airbus and just 3% for Boeing, which does explain the lower growth rates in commercial aerospace revenues. At the same time, A350 deliveries rose just 3% year-over-year while Boeing 787 deliveries looked better. What holds, however, is that overall the ramp up trajectory is more challenging than what Hexcel had hoped for. And that has translated into lower revenue growth as suppliers also started to build through buffers they had built throughout the year to accommodate higher production rates and minimize disruptions to higher rates.

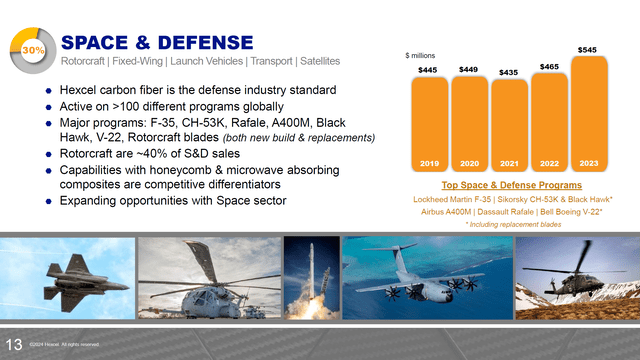

Space & Defense Revenues Tick Up

Space & Defense revenues tend to provide an appreciable stability providing companies with predictable revenues and profits. However, in the current defense market there is upward pressure, and Hexcel has been able to benefit from some transitionary effects on some programs as well as one-time purchase orders that padded a very strong year for the Space & Defense business, with revenue growth of 17% in line with the revenue growth we observed in the commercial aerospace segment.

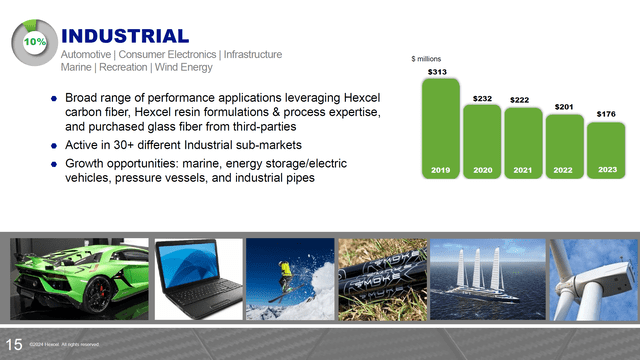

Industrial Sales Continue To Decline

Industrials used to be one of the segments that I liked about Hexcel because of its exposure to wind energy that would provide a revenue stream supported by energy transition trends. However, Hexcel has been deprived from that wind energy work and its revenues have been coming down ever since. The company has identified opportunities in consumer electronics and marine, but the reality is that its revenues declined 12.4% to $176 million, and while the company has identified opportunities, it is unclear when and whether we will see a turnaround at the Industrial segment.

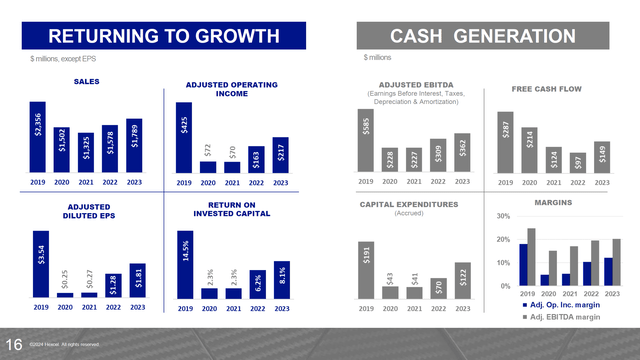

Income and Free Cash Flow Growth Outpace Revenue Growth

In 2023, Hexcel faced inflationary pressures including labor and raw material cost inflation and was sized bigger than demand materialized but even with those headwinds the results were good. Revenues grew 13.3% while adjusted income and adjusted EBITDA grew 33% and 17.2% and free cash flow grew 54%. So, despite a challenging year with some narrow body softness as well as cost headwinds, the metrics trended ahead of revenue growth.

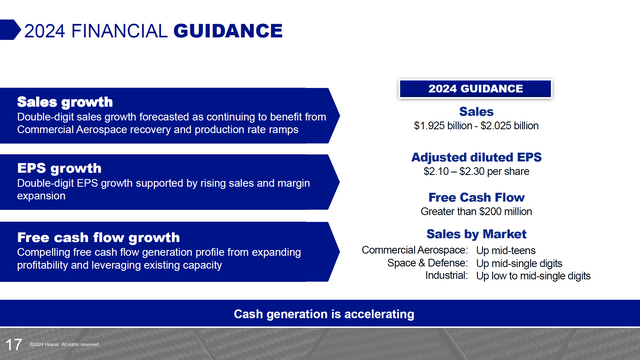

Hexcel Is Confident In The Future

While there are some headwinds, Hexcel is confident in the future with revenues expected to grow 10% at the midpoint and free cash flow to grow to $200 million from $149 million in 2023. Commercial Aerospace sales are expected to be up mid-teens compared to 17% in 2023 and Space & Defense sales are expected to be up mid single digits compared to 17% in 2023. So, the Space & Defense sales are going to be experiencing lower growth rates in 2024 which likely is not a sign of weakness but 2023 was exceptionally strong with one-off purchases. More positive is the sales growth expectations for Industrials. Hexcel expects that sales will be up low to mid-single digits which would halt a multi-year trajectory of falling sales.

Further showing management’s confidence is the most recent increase of the quarterly dividend. The quarterly dividend is now $0.15 up 20% from the $0.125 quarterly dividend previously. The forward yield of 0.84% is not a great one, but I would take any dividend on the condition that its stock price value trends positively.

Hexcel Corporation Stock Remains A Buy

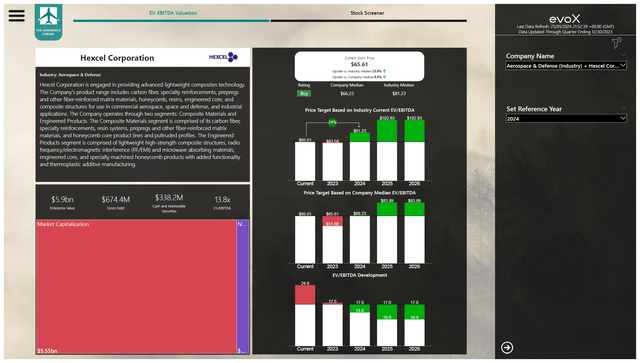

Following the publication of its full year results, Hexcel Corporation stock has lost around 8% of its value. If the company EV/EBITDA provides the right valuation base that would indicate that the stock is more or less fairly value at current prices. However, I do believe that Hexcel at the very least should be trading in line with peers which would provide 24% upside with a $81.25 price target.

Conclusion: Hexcel Corporation Could Be A Buy After Sell Off

Hexcel Corp. stock has sold off post earnings, and indeed the EBITDA for 2023 was around 10% weaker than expected. And there are some headwinds, so I am sure some investors have found their reason to sell the stock. However, I do think that as a specialist in advanced composites, Hexcel Corporation deserves to trade in line with peers. As a result, I am assigning a buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.