Richard Drury/DigitalVision via Getty Images

Shares of Heron Therapeutics (NASDAQ:HRTX) have recovered quite a bit in the last few months, but the stock is only slightly above the levels it traded at the time of my last article’s publication in April 2023. The company replaced CEO Quart at the time and was basically in survival mode in the last couple of quarters due to Zynrelef’s lack of traction in the post-operating pain market, and I argued that it can create value but that it faces a tough road ahead and that it needs to address the low cash balance.

I must say I am impressed by the progress on several fronts – the shoring up of the balance sheet and spending cuts that have ended the survival mode, and the regulatory and development execution to get the expanded label for Zynrelef as fast as possible which the company has done and to get a more user-friendly version of Zynrelef on the market which is still not there yet but getting closer.

However, no significant progress was made on the most important front – revenue growth of the product portfolio. Aponvie’s launch looks like a bust for the prevention of post-operative nausea and vomiting (‘PONV’) and getting traction with Zynrelef will still require the mentioned product presentation improvement and significant promotional efforts. The road ahead is still difficult but I believe Heron is now in a better position than it was a year ago.

Cash burn to drop considerably due to cost cuts and gross margin improvements

Heron ended September 2023 with $77.5 million in cash and equivalents. The company managed to raise $30 million by diluting the shareholder base and it secured a $50 million loan of which $25 million is still available. Shoring up the balance sheet was very important as cash was running low – it would have been only $22.5 million if the company did not raise cash and down to around $10 million at the end of 2023.

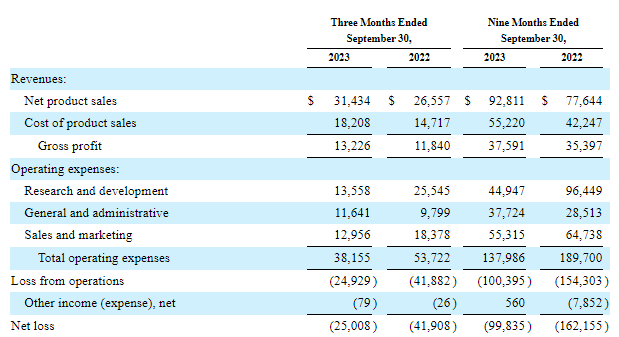

Cutting expenses was painful but necessary. Management says total operating expenses (excluding share-based compensation, depreciation, and amortization) will drop from $182 million in 2022 to $135 million in 2023 and to $108-116 million this year. These improvements have become visible in the income statement as the net loss has narrowed in the last reported quarter and the first nine months of 2023.

Heron Therapeutics Q3 2023 report

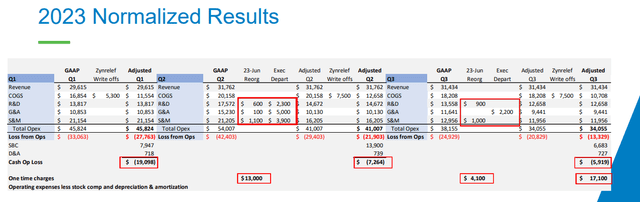

And while the income statement still shows a $25 million loss in Q3 and $99.8 million for the first nine months of 2023, operating cash burn was only $7.3 million and $5.9 million in Q2 and Q3 of last year, respectively, and a good chunk of the net loss was due to Zynrelef inventory writedown and one-time charges related to layoffs and cost cuts.

Heron Therapeutics investor presentation

Interestingly, the significant reduction in spending had no significant negative effect on the product portfolio’s growth rates. I seriously doubt the numbers would have been significantly better if spending stayed near $200 million in 2023.

Heron’s gross margins have been either not great or terrible ever since the launch of Cinvanti in 2018. It dropped from the 70s range in 2018 to the low 40s at one point in 2022, despite the company’s promises for improvements. The new CEO Craig Collard sounded more realistic last year and while there were no improvements in the next two quarters due to Zynrelef’s inventory writedowns, he expects the gross margin to reach 62% in Q4 2023, 68-70% in 2024, and over 75% in 2025 and beyond, driven by increased batch sizes, operational efficiencies, and no more inventory writedowns.

The improved gross margin and modest revenue growth in 2024 could get the company to the guided cash flow breakeven and if the trajectory continues to improve, it should become profitable in 2025.

I also believe there is additional room to cut R&D spending (which will be north of $50 million in 2023 even if we exclude share-based compensation) as the company does not have a pipeline beyond the Zynrelef product presentation projects such as the Vial Access Needle for which FDA approval is expected later this year and the prefilled syringe with the development expected to end sometime in 2026. As each of these projects is completed, R&D costs should further decrease.

These steps were critical for Heron to survive and the stabilization phase is likely over. The company can now focus on returning to stronger growth, a piece that is still missing and that remains critical if we are to see significant value creation in the following years.

Zynrelef – label expansion and CrossLink partnership secured and should help accelerate growth in 2024

Last month, Zynrelef received FDA approval to expand the product label to include “soft tissue and orthopedic surgical procedures including foot and ankle, and other procedures in which direct exposure to articular cartilage is avoided.” It was previously approved for foot and ankle, small-to-medium open abdominal, and lower extremity total joint arthroplasty procedures in adults. The company estimates the expanded label now covers 13 million procedures a year, up from 7 million.

This and the recently announced partnership with CrossLink could lead to some growth acceleration of Zynrelef going forward, but I am not expecting miracles. Not until the product presentation improves. The first step in that direction is the potential approval of the Vial Access Needle (‘VAN’) later this year as it could speed up the Zynrelef withdrawal time from one minute or more to 20-30 seconds. Heron’s market research and customer feedback since launch indicate the current Vented Vial Spike (‘VVS’) can be cumbersome and that improved withdrawal would be significant and increase adoption.

However, I am always careful about putting too much faith into market research, especially considering Heron’s prior research that indicated Zynrelef would be preferred over Pacira BioSciences’ (PCRX) Exparel. Exparel is still a half-a-billion-a-year product while Zynrelef’s run rate is barely in the double-digit millions after nearly three years on the market.

Getting to the prefilled syringe phase is probably critical and should represent the final and most important step, but it is not expected before September 2026.

I am still skeptical of Zynrelef’s potential to return to more significant growth until (at least) the approval of the VAN, and (likely) until the approval of the prefilled syringe, but I do expect growth to accelerate in the following quarters.

Aponvie looks like a bust

I said last year that the launch of Aponvie was a wild card, but I was highly skeptical of its potential until it was confirmed in the quarterly numbers. Several quarters in, Aponvie is barely selling with less than $1 million in net sales in the first nine months of 2023.

The company shared some positive indicators such as the growing number of ordering accounts and some positive early experiences driving increased use, but as of today, I do not see Aponvie sales coming close to Zynrelef, let alone becoming significant in the following years. This is still very much a “show me” story.

Upside potential

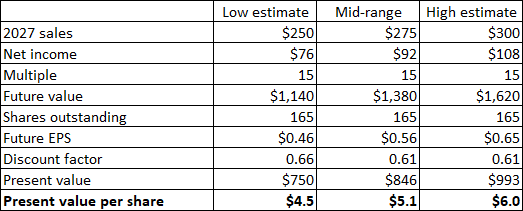

Back in 2022, I reduced my 2027 total net sales estimate range from $500-600 million to $400-450 million, and the valuation range from $15-20 to $9-11 per share.

Even this reduced scenario seems highly unlikely now, and I am further reducing it to $250-300 million with an assumption of Zynrelef getting to more than $100 million in annual sales, driven by the expanded label, the CrossLink partnership, the potential approval of Vial Access Needle in the third quarter and of the prefilled syringe in 2026. The valuation range assumes gross margins will reach or exceed 75% and that operating costs will slightly decrease from 2024 levels as a result of lower R&D expenses which I expect will be partially offset by increased SG&A expenses. These assumptions translate to a net present value of $4.5 to $6 per share.

Author’s estimates

The reduction is not only driven by reduced net sales and lower net margin assumptions but also by the increased share count as the company was forced to dilute the shareholder base to get the much-needed cash. The valuation also assumes the company will either refinance or pay back in cash the $150 million in outstanding 2026 convertible notes and that Heron will have a positive net cash position by the end of 2026.

Risks

Most of today’s article was about the difficulties and risks, but I will summarize and mention other risks:

- The company may be out of the woods financially with the strengthening of the balance sheet, improved gross margins, and prospects for cash flow breakeven by the end of 2024, but reaching cash flow positive is by no means guaranteed, and getting there may not result in share price gains in the absence of topline growth.

- I have not mentioned the oncology products Cinvanti and Sustol. Their net sales need to remain stable or grow slightly going forward to ensure continued stability as they still represent the majority of Heron’s net sales. Cinvanti is still, by far, Heron’s largest product, and the company will need to defend its patents in court against several generic filers. Losing in court would be devastating for Heron and, in the absence of growth from other products, would put the company at risk of ruin. The Markman hearing last summer appeared to have gone well and it has improved Heron’s legal position in the upcoming trial.

- For the mentioned upside potential to be materialized, we would need to see more than just cost-cutting and improved gross margins. If Zynrelef’s sales growth does not accelerate despite the recent label expansion, CrossLink partnership, and the expected VAN approval later this year, I am doubtful there will be other avenues for value creation other than the unlikely sudden surge in net sales of Aponvie.

- If the growth and gross margin trajectory do not go as planned, Heron may need to raise cash again and at very unfavorable terms to existing shareholders.

Conclusion

Heron may be out of the woods in terms of near and medium-term risk of bankruptcy, but it still needs to cross several obstacles before it can become a true growth stock. The risks are still significant, but I can see a path to decent and potentially significant value creation in the following quarters and years.

The expanded label of Zynrelef and the partnership with CrossLink are steps in the right direction and could, together with Vial Access Needle approval later this year put the product on a path to growth acceleration in 2025 and potentially more significant growth acceleration if the prefilled syringe version is approved in 2026.