noel bennett/iStock Editorial via Getty Images

It does seem as though we are headed for an increasingly volatile period in the global luxury goods market, with slowdown jitters increasing today after a poor trading update from recently-covered Burberry (OTCPK:OTCPK:BURBY)(OTCPK:OTCPK:BBRYF).

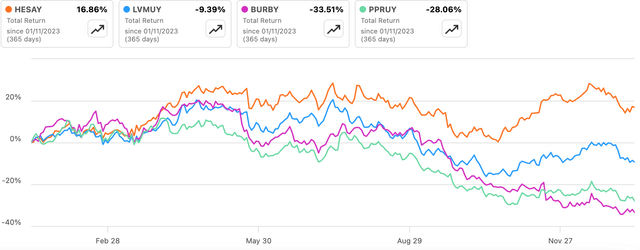

As I commented in that piece, iconic leather goods retailer Hermès (OTCPK:OTCPK:HESAY)(OTCPK:OTCPK:HESAF) has so far lived up to its ‘best-in-class’ billing, with sales growth still healthily in the black as per its most recent quarter. As a result, these shares have continued to perform well, delivering a circa 16% total return over the past 12 months, handily outperforming peers by a wide margin:

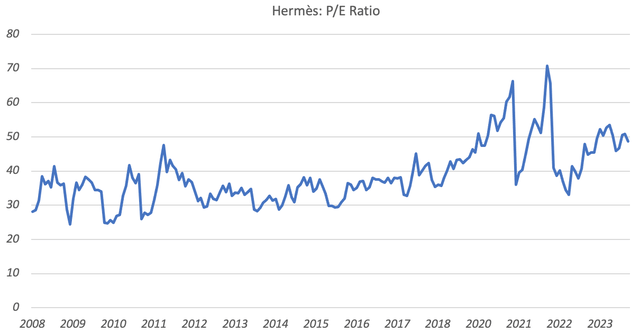

Downturns are often what separate the best from the rest, and with the company less macro sensitive than peers I think we are about to see Hermès’ best-in-class status confirmed from an operational perspective. Even so, at circa 50x EPS this isn’t a name that needs to be chased at this point, and I see better value in peers.

Why Hermès Is Best In Class

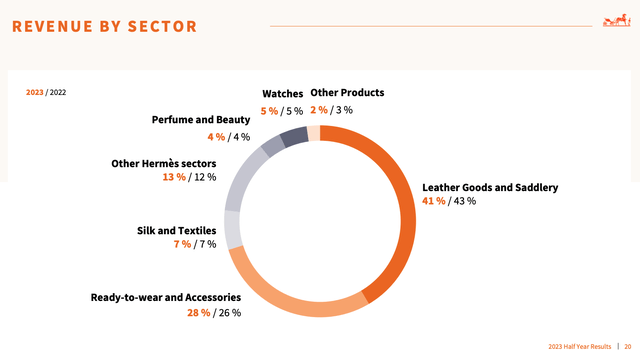

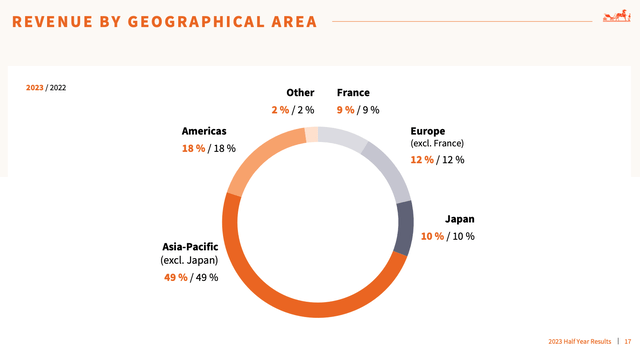

I won’t go over too much old ground in terms of Hermès’ business. Most readers will be well aware that it is a luxury monobrand whose main activity is the selling of incredibly expensive handbags to the global rich, which can retail for six, even seven, figures a unit at the top end. Line extensions into accessories, clothing, perfumes and so on also form a significant part of its business these days. Below is an overview of 1H’23 sales by sector and geography:

Source: Hermès 1H’23 Results Presentation Source: Hermès 1H’23 Results Presentation

Hermès is an exceptional business, with operating profit margins currently in excess of 40%. On a 27.5% tax rate, it generated net operating profit after tax of roughly €3.9 billion over the trailing-twelve-months through 1H’23 (the last period we have full financial data for). This was generated from less than €4 billion in property, plant & equipment and inventory, highlighting how incredibly profitable the brand is.

One reason why this is the case is because retailing typically exhibits a lot of fixed cost leverage. Hermès operates a relatively light store footprint – around 300 or so globally – over which it can leverage its circa €13 billion in annual sales. Sales density is vastly superior to the likes of Burberry, driving excellent profitability and more than offsetting crafting costs and a lack of presence in the wholesale channel, which Hermès avoids for brand management purposes.

Best In Class Status About To Be Confirmed, Again

It appears as though we are in the midst of a broader slowdown in the global luxury market. Today (Friday 12th), peer Burberry delivered a tough trading update, revealing a 7% fall in quarterly sales (-2% at constant FX) and a 4% fall in same-store comps. It further slashed adjusted operating profit guidance by around 20%, which itself was also downgraded by a similar amount in the previous quarter.

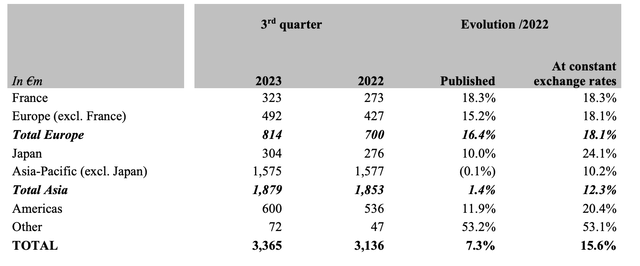

Read across to Hermès is not easy, for the simple reason that its customer base is very different. Put simply, Hermès customers are less aspirational and skew more to the ultra-wealthy. This lowers its macro sensitivity across the cycle. For instance, in Q3 2023, the latest quarter we have sales data for, Hermès delivered global organic sales growth of 16% year-on-year. That was 7ppt better than peer LVMH (OTCPK:OTCPK:LVMUY)(OTCPK:OTCPK:LVMHF), 15ppt better than Burberry and 25ppt better than Kering (OTCPK:PPRUY)(OTCPK:PPRUF), and testament to the company’s brand strength, pricing power and resilient customer base.

Further proof can be found in its performance in the Americas. There, Hermès delivered outstanding 20% FX-neutral sales growth in Q3. This region has been the canary in the coal mine for other luxury players as spending has been moderating due to waning stimulus money and other headwinds such as the resumption of student loan repayments in the United States. More broadly, U.S. luxury sales growth exploded between 2019 and 2022, and it was always going to require a period of digestion simply because growth rates were so far above trend. This is normal and to be expected, yet Hermès continues to post blockbuster growth well ahead of the market. At risk of stating the obvious, its customers are not spending stimulus money or saved-up student loan repayments.

Source: Hermès Q3 2023 Trading Update

One area that might look a little soft is Asia ex-Japan, which ‘only’ grew by 10% YoY at constant currency. The key point to appreciate here is that Chinese sales were redirected to the home market during COVID, whereas previously this cluster would also spend as tourists in Europe and America. Travel restrictions upended this dynamic, which is now returning to normal. That is why European sales were up a strong 18% YoY, with 10% Asian growth looking exceptional in the context of this very tough comp.

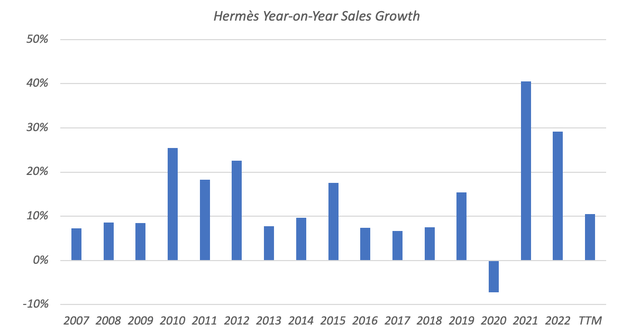

Finally, let us have a look at performance during other luxury market downturns, such as 2016 and 2009. In 2016, Hermès delivered impressive 7.5% YoY sales growth, while in 2009 it grew sales by 8.5%:

Data Source: Hermès Annual Reports

Suffice to say both figures were comfortably ahead of the broader luxury market. I expect the company to deliver outperformance as it navigates this downturn too, once again confirming its best-in-class status.

HESAY Stock Is Still Expensive

Despite this, Hermès stock remains expensive. Trailing-twelve-month EPS amounts to $4.13 per ‘HESAY’ ADS, implying a TTM P/E ratio of 49.2 based on the current $203 stock price. Investors often point to the fact that Hermès stock is usually expensive, but this is only true to an extent, and it has traded for sub-30x EPS at various points in the not-too-distant past.

Data Source: Yahoo Finance, Hermès Annual Reports, Author Calculation

Hermès’ current inflated P/E multiple likely reflects recent high growth, with the company recording a sales CAGR of 17% since 2019. This pull-forward of demand in the COVID years is not sustainable, even though Hermès can continue to materially outperform the expected 5% CAGR of the broader global luxury market due to its pricing power. The 2007-2019 sales CAGR of 12% is a much more reasonable yardstick, including multiple ‘normal’ cycles, and would represent impressive growth if repeated over a similar timeframe going forward.

With HESAY stock at circa 50x TTM EPS, investors should prudently bake in a circa 4-5% annualized headwind from long-term EPS multiple contraction, meaning aggressive growth in per-share earnings and dividends is needed to offset this. While multiples for peers like LVMH (~21x TTM EPS) and Burberry (~11x TTM EPS) do in part reflect relatively lower quality businesses, they also come with much less onerous future growth requirements. As such, I attach a Hold rating to Hermès stock, at least until a sub-40x EPS valuation, mapping to ~$165 per ADS based on the company’s current earnings power.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.