Shares of CRISPR Therapeutics (CRSP -0.91%) climbed 54% in 2023, according to data provided by S&P Global Market Intelligence. The biotech company is developing a number of promising gene-therapy treatments for serious illnesses, but it doesn’t currently have any products for sale on the market.

CRISPR Therapeutics passed multiple important milestones last year, and the stock moved higher when that news was released. The company is navigating the tricky and expensive regulatory-approval process for its first commercially available treatment. Until it has regular cash flows from product sales, the stock’s valuation has to reflect significant uncertainty and speculation about the company’s potential sales and profits in the future.

Image source: Getty Images.

CRISPR published important news this year

In April, CRISPR announced that it had submitted its first biologics-licensing application to the U.S. Food and Drug Administration (FDA). There’s no guarantee that the application will be approved, but it’s a major step in the right direction. These submissions are typically backed by significant clinical data, and the announcement put an approximate time table around potential sales that was previously unknown. The stock jumped 40% higher during April and May as a result.

That promising news was followed by a few difficult months for the stock. High-profile investor Cathie Wood’s ARK Innovation ETF (NYSEMKT: ARKK) sold CRISPR positions. That generated some investor hesitation at a time when macroeconomic conditions were discouraging risk.

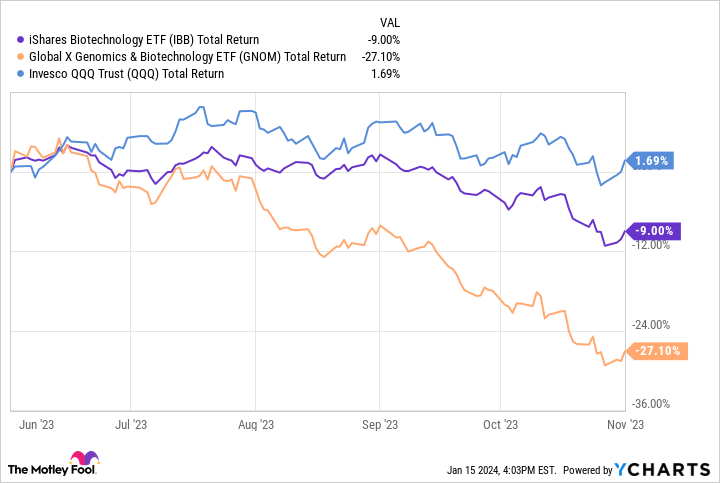

CRISPR didn’t report any particularly bad financial results or updates on clinical trials or regulatory approvals during its mid-year slide. It’s a company that’s burning cash and hasn’t brought a treatment to market yet. That makes it prone to shifting market forces and investment sentiments, and the sentiment was poor for biotech and innovative genomics stocks during that period. CRISPR’s relatively high-risk profile fueled a sell-off as market conditions deteriorated.

IBB, GNOM, CRSP Total Return Level data by YCharts.

That all turned around in November and December, as the company published two very bullish updates. CRISPR gained regulatory clearance in the U.K. for its first treatment, Casgevy, on Nov. 16. This came on the heels of positive developments in the regulatory process with the FDA, and it made investors optimistic that the company’s pending approval in the U.S. was more likely to be successful. Those hopes were confirmed on Dec. 8 when the drug was cleared for treatment of sickle cell anemia and beta thalassemia in the United States.

What’s next for CRISPR Therapeutics

Enormous steps toward revenue and cash flow were taken this year, justifying the stock’s gains. There’s still plenty of uncertainty in this story, which opens the door to investor risk. Even with regulatory approval, CRISPR still needs to agree on pricing with government and private medical payors, and this step has thwarted its peers in the past. The partnership with Vertex Pharmaceuticals (VRTX 0.77%) should be very valuable in this regard, but it means that CRISPR only takes 40% of the product sales, with the lion’s share flowing to its partner.

This might mark the first step toward major market disruption spearheaded by CRISPR. Gene-editing therapies can improve the safety, efficacy, and cost of treating various diseases. The company has a pipeline with several more candidates in different stages of development, with cancer, cardiovascular disease, and neurological conditions among the target areas. It’s going to take significant money and time to establish CRISPR as a self-sufficient biotech company, but the potential is enormous.

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CRISPR Therapeutics and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.