Block (SQ -0.28%) stock surged higher last week after the company announced its fourth-quarter results and provided guidance for 2024. Investors were pleased to see the company’s cost-cutting efforts come to fruition and gross profits improving, and its guidance for the upcoming year gave even more reason for optimism.

Block is well positioned in some key demographics, and with the company getting a handle on its expenses, the stock has explosive upside potential. Here’s why Block could be a no-brainer for investors today.

The dual engines of Block: Powering payments and personal finance

Jack Dorsey and Jim McKelvey founded Block, then known as Square, in 2009 with the mission of helping small and medium-sized businesses accept credit card payments. At the time, solutions were clunky and expensive, and its product used technology to create a more convenient and accessible payment solution. Its Square payment solutions generated $3.1 billion in gross profit in the past year.

Another considerable part of Block’s business is the Cash App. In its early days, the Cash App simplified peer-to-peer payments, making it easy for users to transfer money. Block has since expanded its offerings on the Cash App to provide users with banking and investment services. This part of its business was responsible for $4.3 billion in gross profit last year.

Block addressed its rising expenses

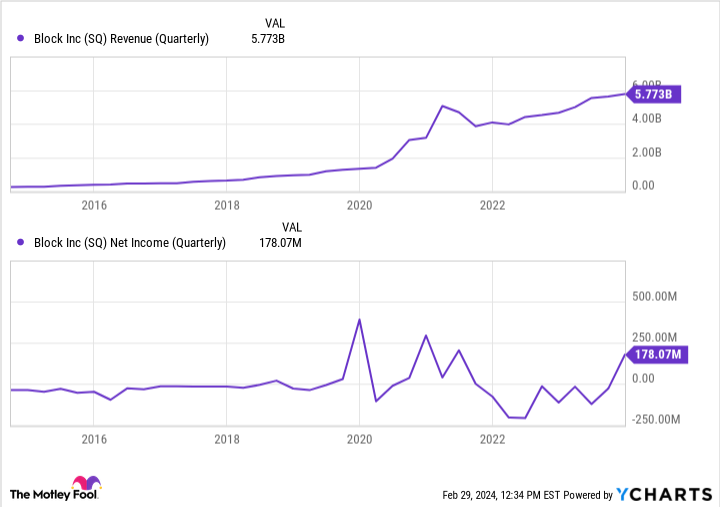

It hasn’t always been smooth sailing for Block investors. In 2019, Block’s net income was $375 million. However, its expenses far outpaced its revenue in the following years as the company expanded its reach and product offerings. As a result, its net income declined every year through 2022, when it posted a $541 million loss. Block faced rising scrutiny for these increasing costs, and as a result, its stock dropped 87% from its peak price of $289 per share in August 2021 to October 2023.

In November, the company laid out plans to streamline its operations and become more efficient. In CEO Jack Dorsey’s letter to shareholders, he said that the company would keep a cap on its number of employees at 12,000 “until we feel the growth of the business has meaningfully outpaced the growth of the company.”

Block immediately went into action with its cost-cutting initiatives in the fourth quarter, and the company posted a net income of $178 million while adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $562 million outpaced analysts’ estimates. The company saw excellent growth across Square and Cash App, as gross profits grew 18% and 25% compared to last year.

SQ Revenue (Quarterly) data by YCharts

The company’s net income situation is improving, and analysts were impressed with Block’s measures to cut costs. In 2023, Block’s adjusted operating margin was 4% and it rose to 9% by the fourth quarter. What had investors most optimistic about Block’s earnings call was its guidance for 2024. Block projects a gross profit of $8.65 billion, or 15% growth from last year. It also projects that its operating income margin will be 13%, up from 9% in the fourth quarter.

What’s next for Block

In Block’s letter to shareholders, Dorsey told investors the company would focus on growth and making more impactful work. Block has reorganized its Square team and is taking steps to leverage artificial intelligence (AI) to help sellers manage more of their business and grow their customer base. Dorsey believes that its “seller platform will prove to be our superpower” as it works to reinvigorate growth across this offering.

Image source: Getty Images.

Block is also working to make the Cash App one of the top banking services provided to households earning $150,000 or more. The company finds that customers who direct deposit $2,000 or more with the Cash App are 6 times more engaged with its other features. To attract more customers, it plans on offering 4.5% yields on savings accounts for direct deposits while better integrating Cash App Card and its buy now, pay later solution, Afterpay, into its app.

The good news for Block is that it is well positioned among younger generations. According to The Motley Fool’s Generational Investing Tools survey, Cash App is the most used investing app across all generations, with 38% of respondents saying they use it. Usage is highest among millennials and Gen Z, with 54% and 50% of respondents stating they use the app at least once a month or more.

Block stock is a buy today

Analysts were pleased with Block’s fourth-quarter results and forward guidance, with several raising their price targets and upgrading the company to a buy rating. After its recent rise, the stock is valued at 2.2 times sales and 24 times forward earnings. The company must prove it can continue to execute its cost efficiencies and improve its margins, and it has done a solid job thus far.

Given its positioning among younger generations, its improving efficiency, and its focus on integrating its Square and Cash App products, I think Block stock is an excellent stock to buy today and hold for the next several years.