Despite the market reaching all-time highs, there are still plenty of undervalued stocks in the market. As I continuously deploy new contributions, these are some of the stocks I’ll be looking at buying, as they represent great value in a time of exuberance.

This list of five companies is a great start if you’re looking for stock ideas in today’s market.

1. PayPal

PayPal (PYPL 1.39%) is by far one of the most undervalued stocks in the market. The payment processor has multiple products beyond the checkout experience that consumers are familiar with and is still growing at a healthy pace.

In the fourth quarter, PayPal’s revenue rose 9%, and earnings per share (EPS) increased 61% to $1.29. Despite these strong figures, the market prices of PayPal’s stock make it seem like a company with no or declining growth.

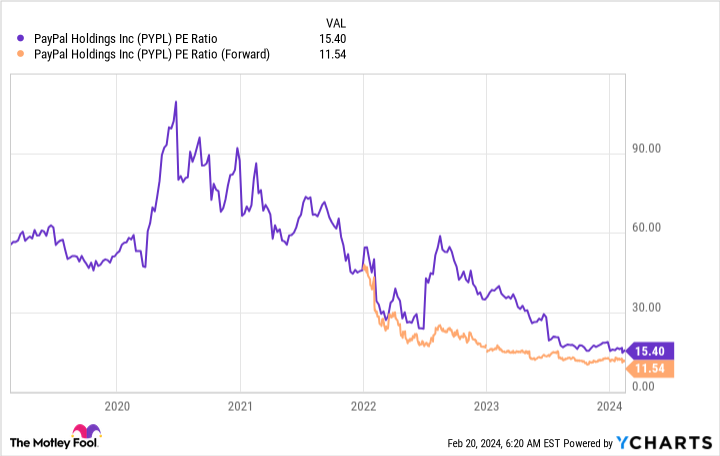

PYPL PE Ratio data by YCharts

With the stock trading for an unbelievably cheap 11.5 times forward earnings and with a strong business, PayPal’s stock is a no-brainer buy.

2. MercadoLibre

MercadoLibre (MELI -10.38%) is often dubbed the “Amazon of Latin America,” but it’s a lot more than that. While MercadoLibre has an e-commerce and logistics business like Amazon, it also has a fintech offering that gives it even more reach.

Both its commerce and fintech divisions have done quite well, with the segments’ revenue rising 76% and 61% year over year, respectively, on a currency-neutral basis. Furthermore, MercadoLibre’s margins have dramatically expanded over the past few quarters.

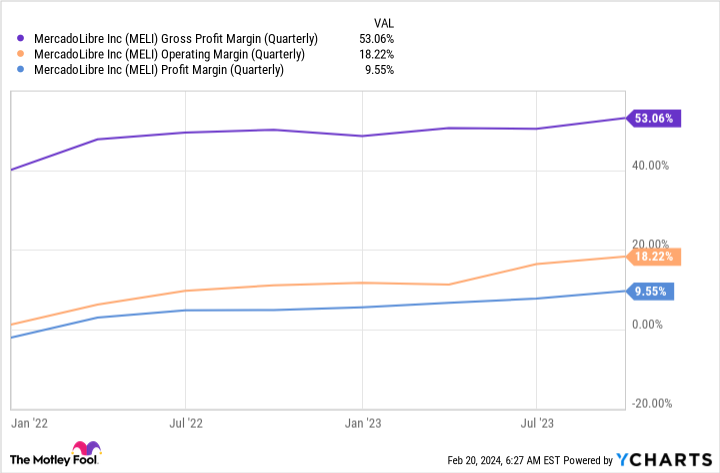

MELI Gross Profit Margin (Quarterly) data by YCharts

With the stock trading at around 6.8 times sales (well below its decade-long average), it remains a great buy today.

3. Airbnb

Airbnb (ABNB -1.68%) consistently proves doubters wrong. Whether it was COVID-19, a recession, or municipalities cracking down on short-term rentals, multiple events should have ended the company.

But it just keeps growing.

Airbnb’s Q4 revenue rose 17% year over year, with nights and experiences booked increasing by 12%. Despite this success, the stock trades at a cheap 26 times free cash flow (Airbnb’s earnings are currently skewed due to a couple of one-time events that render the price-to-earnings ratio useless).

As a result of its cheap stock price, Airbnb has enacted a massive stock buyback program. Airbnb will spend up to $6 billion on stock repurchases. If Airbnb deploys those funds within a year, it will have a total effectiveness of just under $5 billion, as it spent $1.1 billion on stock-based compensation in 2023.

With Airbnb worth shy of $100 billion, that means shares outstanding will shrink by around 5% — a huge win for investors. Because the business is doing well and management recognizes its cheap stock price, Airbnb looks like a solid buy now.

4. dLocal

dLocal (DLO 0.31%) is a company few have heard about. It provides payment processing services for emerging market countries like Indonesia, India, Peru, and Egypt that large customers like Amazon, Nike, and Shopify can use to easily access these markets without developing their payment systems.

This product has proved wildly popular, and dLocal’s revenue growth reflects that. In the third quarter, revenue rose 47% year over year thanks to total processed volume rising 69%. dLocal is also profitable and produced earnings per share of $0.14 in Q3.

Despite its success, dLocal’s anonymity in the marketplace causes it to have a dirt-cheap stock price of 21 times forward earnings. That level of growth combined with a low price is a recipe for a stock that can skyrocket, which makes me want to own more dLocal shares.

5. Visa

Lastly is Visa (V -0.05%), the credit card processing giant. Visa is a staple in many portfolios, as the stock has consistently beaten the market over long periods thanks to constant growth, share buybacks, and improving profitability.

Its results for the fiscal first quarter of 2024, ended Dec. 31, 2023, continue that trend, with revenue growing 9% and EPS increasing 20% year over year. Even with this strength, Visa’s stock trades for 32 times earnings — one of the consistently lowest valuation points over the past five years.

Visa is a long-term strong executor, showing no signs of slowing. With a portfolio staple like Visa on sale for the first time in a while, investors would be smart to scoop some up to balance out some of the high-growth companies on this list.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Airbnb, Amazon, DLocal, MercadoLibre, PayPal, Shopify, and Visa. The Motley Fool has positions in and recommends Airbnb, Amazon, MercadoLibre, Nike, PayPal, Shopify, and Visa. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.