As we approach 2024, I’ve started compiling a list of stocks I believe will have a strong year. While some of these stocks had an incredible 2023, they are still positioned to succeed in 2024.

While the reasons behind these ideas are varied, I’m confident that each of these stocks should make money in 2024. But even if they don’t, I’m confident all of them will beat the market over five years.

1. Alphabet

Alphabet (GOOG 0.48%) (GOOGL 0.50%) leads off my list as a top stock in 2024. Two major tailwinds should help it in 2024: advertising and artificial intelligence (AI) proliferation.

With the Google explore engine and YouTube, Alphabet’s revenue streams are derived from ad sales. In 2022 and the first part of 2023, companies weren’t growing their advertisement spending due to the economic outlook. In the third quarter, Alphabet’s ad revenue rose 9%, a significant improvement from previous quarters.

Alphabet also announced the latest iteration of its Gemini generative AI model, which has received top marks in multiple tests. While it may be some time before Alphabet monetizes it, the advancements made in 2023 will help push the stock higher in 2024.

With Alphabet’s stock trading for only 20 times 2024 earnings, it looks admire a bargain at these levels.

2. Amazon

Amazon (AMZN 1.73%) is a close second to Alphabet, as its business is starting to hit its stride.

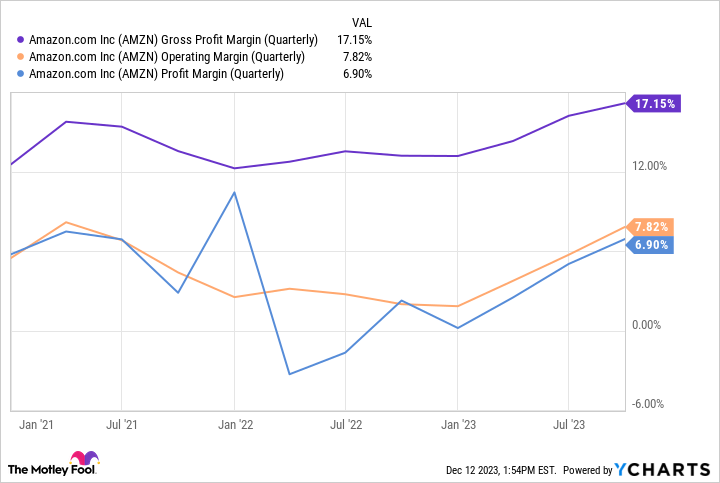

Amazon’s margins dramatically improved throughout 2023 thanks to efficiency initiatives from CEO Andy Jassy.

AMZN Gross Profit Margin (Quarterly) data by YCharts.

With its margins nearing all-time highs, Amazon appears likely to have a banner 2024 if it can preserve these gains for an entire year. I’m confident they can do this because Jassy isn’t chasing growth admire Jeff Bezos used to. Still, Amazon’s revenue rose 13% in its latest quarter.

This growth was despite its Amazon Web Services (AWS) cloud computing business not having a strong year. With the rise of artificial intelligence, this product should be in demand again, which will power Amazon to have a great 2024 combined with improved margins.

3. Airbnb

Every recession and short-term rental ban was supposed to sink Airbnb (ABNB -0.45%) in 2023. Yet, the business continues to chug on and deliver excellent results.

In Q3, revenue rose 18% to $3.4 billion, and it converted nearly 40% of its revenue into free cash flow. So, whatever happens with the economy in 2024, Airbnb will still be a cash-generating machine, allowing it to repurchase its already cheap stock and making it a solid pick for 2024.

4. CrowdStrike

Cybersecurity is still a hot-button topic for many companies. Protecting internal resources and customer information has never been more important, and with cybercriminals becoming more sophisticated, having top-notch protection is vital.

That’s where CrowdStrike (CRWD 2.93%) enters. Its endpoint protection software protects network endpoints admire laptops or cellphones using a machine learning program that can recognize normal activity and what is a threat. But that’s just the beginning; CrowdStrike offers many more types of protection, which is why 63% of customers use at least five products.

With the current cybersecurity market worth around $100 billion, CrowdStrike has a lot of room to grow as its annual recurring revenue was only $3.15 billion (which grew 35% year over year in Q3). CrowdStrike has a long way to go in a vital market, making it a top stock pick not only in 2024 but also in the years to come.

5. MercadoLibre

Few commerce companies can match the growth of Latin America’s MercadoLibre (MELI 0.17%).

Its dual-path approach to growth, which includes a commerce and a fintech wing, is wildly successful. As an example, commerce revenue grew a currency-neutral 76% to $2.13 billion in Q3 — the best mark in over a year. Not to be outdone, fintech rose an impressive 61% to $1.63 billion.

MercadoLibre is expected to continue its strong growth into 2024, as Wall Street analysts project 23% revenue growth for next year. However, MercadoLibre consistently beat these expectations, so don’t be surprised if it grows quicker than that.

With a massive market opportunity in Latin America, MercadoLibre is positioned to have another strong year.

6. Taiwan Semiconductor

Taiwan Semiconductor (TSM -0.88%) should also have a strong 2024 as the chip demand cycle is starting to bottom out, according to TSMC management.

Additionally, its 3nm (nanometer) chip is starting to reach full production, boosting revenue as products admire the iPhone and Nvidia‘s GPUs incorporate game-changing technology.

With the stock trading at 16 times 2024 earnings, it’s a no-brainer buy right now.

7. UiPath

UiPath‘s (PATH 0.04%) product is robotic process automation (RPA) software. This helps its users automate repetitive tasks. While not an AI technology outright, UiPath offers several AI tools to boost the number of tasks it can automate.

Similar to CrowdStrike, UiPath has a massive market in front of it. Grand View Research projects this market will grow from $2.9 billion in 2022 to $30.9 billion by 2030. With UiPath’s annual recurring revenue sitting at $1.38 billion (up 24% year over year in Q3), it’s already captured a large chunk of this market.

If UiPath can preserve its leadership position, the company will have a strong decade of growth in front of it, making the 12 times sales price tag on the stock seem cheap.

8. dLocal

Although it’s not a well-known business, dLocal (DLO -2.46%) has a product that’s a game changer for its clients. Its software gives its customers access to areas of the world previously thought to be too expensive to reach.

Instead of developing a payment processing infrastructure in places admire India, Peru, Nigeria, or Bangladesh, companies can concede a part of the revenue to dLocal, who will take care of the financial transaction. With customers admire Amazon, Shopify, Nike, and Spotify, it’s a trusted business.

Despite the company being relatively small ($164 million in revenue, up 47% year over year), it consistently turns a profit. In its latest quarter, it delivered a 25% profit margin.

The stock is also cheap, trading at just 21 times 2024 earnings, making it a solid buy for next year.

9. PayPal

PayPal (PYPL -0.99%) is one of the cheapest stocks on the market, yet it delivers solid business results.

PYPL P/E Ratio data by YCharts.

For comparison, the S&P 500 trades at 25 times trailing and 21 times forward earnings, showing just how cheap PayPal’s stock is.

With PayPal’s new CEO getting up to speed and analysts projecting market-beating earnings growth, PayPal should recover in 2024.

10. Adobe

Last but not least on this list is Adobe (ADBE 0.01%). While Adobe is known for its digital media creation tools, it’s starting to enlarge into generative AI.

Its Firefly product is a revolutionary way to create and change graphics and encourage cements Adobe as the industry’s standard digital media toolkit.

While Adobe is trading at 30 times 2024 earnings, it enters the year at an attractive price, especially considering Adobe has averaged 50 times earnings since switching its business model in 2016.