By multiple metrics, cruise company Carnival (CCL 0.29%) (CUK 0.19%) had a great year in its fiscal 2023 (ended in November). The company had all-time high revenue of $21.6 billion. And based on its current record bookings, fiscal 2024 is shaping up nicely as well.

However, I believe that there’s an important Carnival metric that’s been completely overlooked and underappreciated by investors: The company introduced 3.5 million people to cruises last year, and this might be the key to reaching management’s financial goals, as I’ll explain.

But first, what is Carnival’s goal?

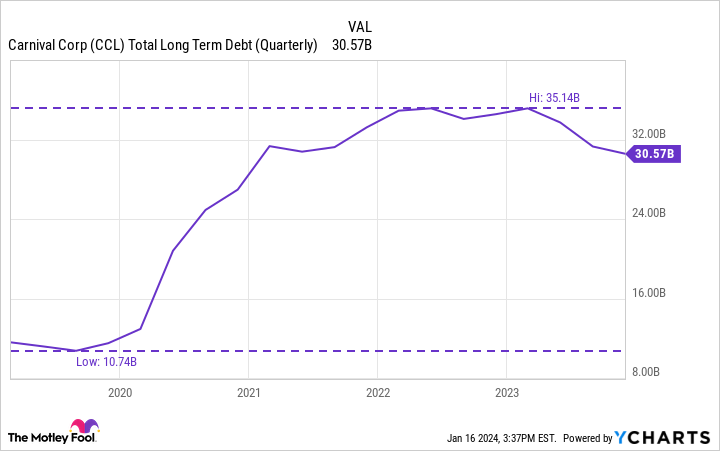

Carnival couldn’t prevent taking a massive hit during the pandemic. The company wasn’t allowed to sail, but it had high fixed costs nevertheless. Its long-term debt consequently skyrocketed from around $11 billion to over $35 billion in a matter of months.

CCL total long-term debt (quarterly), data by YCharts.

The chart above doesn’t illustrate any sort of failure on Carnival’s part; it was simply the cost of survival amidst a pandemic. But now that the company is sailing again, it has to get its debt down to something more manageable.

Specifically, management is targeting “investment-grade leverage” by 2026. While management didn’t give a precise number that it considers as investment grade, it wouldn’t be surprising if the company needed to repay at least half its current outstanding debt to get in the ballpark.

Companies can’t pluck money from thin air, so Carnival will need to fill its cruise ships and operate with urgent efficiency to generate billions of dollars of excess cash to repay its long-term debt.

What’s encouraging is that its debt is already down $4.6 billion from its peak. So management is making progress, but it still has a long way to go, and it needs to maximize profits over the next few years. This is where 3.5 million new cruisers come into this conversation.

Why new cruisers matter

Circling back to what I said before, cruise operators have high fixed operating costs. For example, one of the company’s largest expenses is fuel. And its fleet will consume the same amount of fuel whether the ship is full or mostly empty.

The more that Carnival can fill its cruise ships with passengers, therefore, the better its profits are going to be.

According to data from the Cruise Lines International Association cited by Expedia, a whopping 85% of people who have taken a cruise say that they want to take another one in the future. Therefore, if a cruise company can entice someone to give it a try once, chances are it has won that passenger for the long term.

In other words, winning new cruisers is something that picks up momentum over time. The 3.5 million new customers Carnival booked in 2023 will likely come back for another cruise. And the snowball effect can continue this year as it wins over more new customers.

Taken together, I believe it’s likely that occupancy levels for Carnival’s ships will go up, allowing it to generate higher profits as it leverages its fixed costs. Indeed, investors might already be seeing some of this, considering the company’s occupancy levels are sitting at their best booked position on record, according to management.

Does this make Carnival stock a buy? It might for some, but it doesn’t for me, at least not yet. The company will be directing substantial cash flow toward its debt in coming years. That will make it stronger and could position it for better stock performance someday. But for now, it won’t be using cash to reward shareholders — it can’t yet.

Once its debt gets down to more manageable levels, then management could direct its attention more to shareholder returns. That’s when I might become interested in buying a position. But that’s still likely quite a ways off.

Nevertheless, Carnival’s shareholders should be encouraged with the tangible progress the company is making toward its 2026 goals.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.