Juan Jose Napuri

Just over six weeks ago, I wrote on Hecla Mining (NYSE:HL), noting that there was no reason to chase the stock after its recent rally above US$4.70. This is because it was still trading at a large premium to net asset value and in line with its historical cash flow multiple (~13.2x vs. ~13.0x), suggesting a limited margin of safety. Since then, the stock has suffered a ~19% correction on the back of weaker-than-expected Q4/FY2023 results with lower production year-over-year at Keno Hill (*), extreme weather events at Greens Creek, and limited contribution from Lucky Friday. The good news is that 2024 will be a much better year, and the stock is now more reasonably valued with a better technical setup following its December/January correction.

In this update we’ll look at the Q4 results, recent developments, and where the stock’s updated buy zone lies:

(*) Hecla discussed safety concerns in Q3 that would impact Keno Hill production while the company worked to improve best practices. (*)

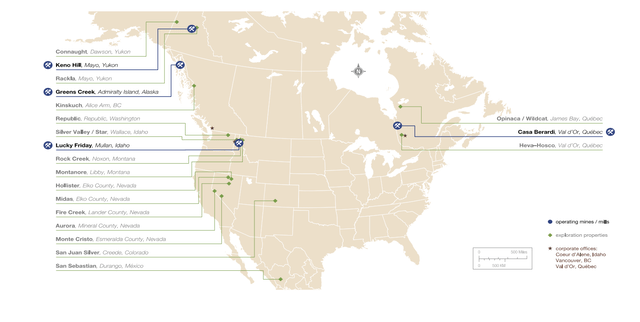

Hecla Mining Operations – Company Website

Q4 & FY2023 Production

Hecla Mining (“Hecla”) released its Q4 and FY2023 production results earlier this month, producing ~2.95 million ounces of silver and ~37,200 ounces of gold. This translated to a 19% decline in silver production and a 14% decline in gold production from Q4 2023 levels, affected by a limited contribution from its #2 mine by scale, Lucky Friday, which was down for over four months while the company worked to develop a new secondary egress to bypass the damaged portion of the #2 Shaft. Unfortunately, the company saw additional softness from two weather events at Greens Creek in Q4 and a much weaker Q4 than I expected out of Keno Hill with the company sharing in its Q3 call that safety was not up to its standards and that it was going to take time to improve safety culture and rework its processes to improve overall safety performance (*).

(*) Hecla shared in its Q3 call that its all-injury frequency rate at Keno Hill was near four, more than quadruple the company’s all-injury rates at Lucky Friday and Greens Creek, which are both below one. (*)

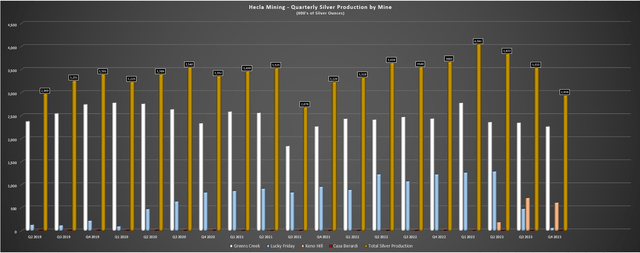

Hecla Quarterly Silver Production by Mine – Company Filings, Author’s Chart

Digging into the operations a little closer, Keno Hill came up well short of my estimates in Q4 and Hecla’s internal estimates, with the asset producing just ~608,300 ounces, a significant miss vs. soft guidance of 800,000 to 1.0 million ounces in Q4 provided on the call. This resulted in annual production coming in well below guidance at just ~1.50 million ounces of silver, but the company noted that operations appear to be improving with ~9,500 tons mined at Bermingham in December. Given the safety issues, I wouldn’t expect an immediate turnaround here, but the silver lining is that Hecla is having exploration success (suggesting the potential for reserve growth) and grades and coming in at better than planned levels to date vs. what its block model had forecasted.

“Keno has produced 900,000 ounces this year, 700,000 ounces in the third quarter. I expect in the fourth quarter we will produce between 800,000 and 1.0 million ounces.”

– Hecla Mining, Q3 2023 Conference Call

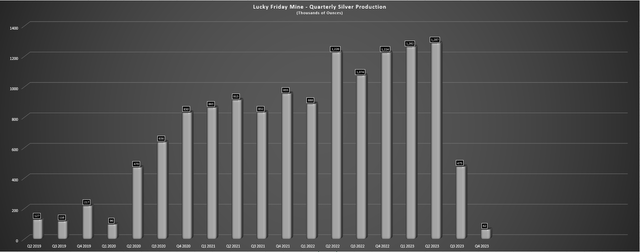

Lucky Friday Mine Quarterly Silver Production – Company Filings, Author’s Chart

Moving over to Lucky Friday, production came in a paltry ~62,000 ounces of silver with the suspension of mining operations, resulting in annual production falling short of planned levels at just ~3.09 million ounces of silver (down 30% year-over-year). That said, this is a mine benefiting from higher grades at depth and a new mining method that has de-risked the asset, ultimately setting it up to produce closer to 5 million ounces of silver per annum. So the setback in H2-2023 is disappointing and left Hecla well short of company-wide guidance (~14.3 million ounces of silver produced vs. ~16.7 million ounces expected at midpoint). The good news is that mining has since restarted on January 9th (in line with plans) and it should be able to ramp up to full production levels by the end of Q1.

Keno Hill Operations – Company Website

Unfortunately, while Greens Creek was picking up Keno Hill and Lucky Friday’s slack with higher-than-planned production, Q4 production slipped to ~2.26 million ounces of silver and ~14,700 ounces of gold, down 4% and 2% sequentially, while silver production was down 7% year-over-year. This was partially offset by higher gold production helped by positive grade reconciliation, but throughput was affected by road blockages and unplanned mill downtime due to weather events in November and December (12 days of lost production). The result was throughput coming in below its goal of 2,600 tons per day at 2,393 tons per day. Still, this was a solid quarter and year overall, with annual production of ~9.7 million ounces of silver (marginally lower), and a 26% increase in gold production with consistent free cash flow generation despite weaker lead/zinc prices.

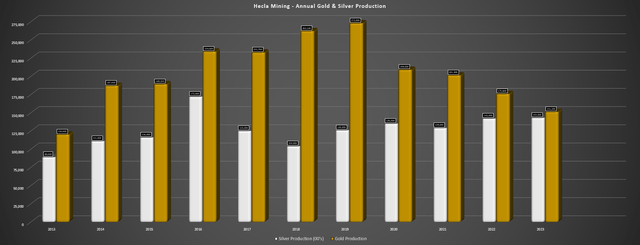

As for annual production, gold output declined over 13% to ~151,200 ounces, missing initial guidance of 160,000 to 170,000 ounces because of changes made at Casa Berardi (East Mine UG operations closed in July). Meanwhile, silver production was up marginally year-over-year to ~14.3 million ounces but below plan considering the addition of a third silver mine at Keno Hill with the Alexco acquisition. The good news is that 2024 should be much better, and I would expect an even better 2025 with a full year of output from Lucky Friday and Keno Hill hopefully pushing closer to its initial goal of 2.5 to 3.0 million ounces of silver production (initially planned for 2023).

Hecla Mining Annual Gold & Silver Production – Company Filings, Author’s Chart

2024 Outlook

As for Hecla’s 2024 outlook, the company should see silver production come in above 17.5 million ounces in 2024 based on its revised guidance provided last September, offset by lower gold production that’s expected to come in between 105,000 to 125,000 ounces. This is due to declining grades and higher costs related to inflationary pressures which have made underground mining less feasible than it was previously. Hence, the decision was to take the East Mine offline and close the West Mine this year which was shown to have attractive economics until mid-2024. The result is that Hecla will be shifting to open-pit mining at the 160 Pit vs. underground mining previously, which was the long-term vision for this asset anyway. Unfortunately, this will impact total production at the mine given that the underground deposits will no longer provide a bridge until permits are in hand on the higher-grade open pits (WMCP and Principal).

The good news here is that this asset will remain in production and Hecla will be able to keep its workforce in a competitive region vs. letting go of its workforce like First Majestic (AG) when it placed Jerritt Canyon in care & maintenance. The other positive is the strong gold price should allow this asset to provide some free cash flow in the 2024-2027 period while the 160 Pit is being mined for future tailings deposition. Finally, while production is certainly lower at Casa Berardi, Hecla still has a relatively long mine life at this asset assuming the successful receipt of permits, so it will not be seeing one of its key assets head offline like Fortuna Silver (FSM) in 2025 with San Jose. And, while not up to Hecla’s standards yet, Keno Hill should be able to offset this loss in silver-equivalent production with 3+ million ounces post-2025 if Hecla can get this Yukon asset running like it initially envisioned.

Hecla Portfolio – Company Website

Finally, it’s worth noting that while the company is not spending aggressively, Hecla has a solid portfolio of exploration/development assets in Tier-1 jurisdictions, including its Rackla Project in Yukon and its previously producing Nevada operations. In an upside-case scenario, one of these assets could move into production in the next decade, giving Hecla a fifth mining operation. In summary, while the higher silver production in 2024 is being overshadowed by significantly less gold production, this was unprofitable production that it made sense to take offline, and we should see an even better year in 2025 if Hecla can meet its ~20 million ounce silver production goal.

Recent Developments

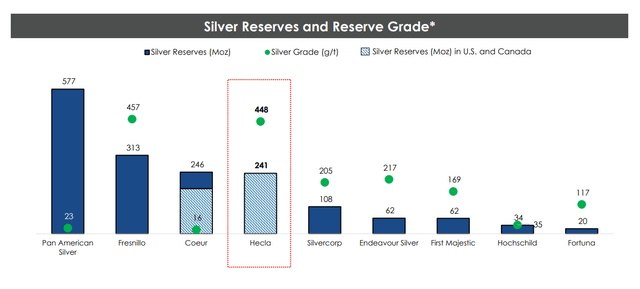

As for recent developments, many gold producers have seen a tailwind from the gold price, but the silver producers have had a tougher time with margin expansion. This is because the silver price continues to languish relative to gold at the same time as inflationary pressures have remained sticky which has put a dent in margins. The good news is that Hecla is not up against a sharply rising Mexican Peso like most of its peers and the company also has some of the highest-grade and longest-life mines in its peer group. Hence, while I am less optimistic about reserve replacement for most Mexican silver producers this year due to rising cut-off grades and little help from the silver price, I don’t see this as an issue for Hecla which uses conservative silver price assumptions ($17.00/oz) and whose grades far exceed the industry average.

Hecla Silver Reserves & Reserve Grade – Company Presentation

Valuation

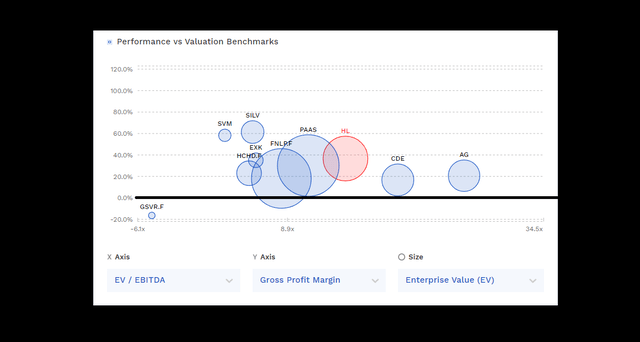

Based on ~620 million shares and a share price of US$4.00, Hecla trades at a market cap of ~$2.48 billion and an enterprise value of ~$3.0 billion. This makes it one of the highest capitalization silver miners next to Fresnillo (OTCPK:FNLPF) and Pan American Silver (PAAS), and well ahead of other names like First Majestic, Coeur Mining (CDE), and SilverCrest Metals (SILV). And this higher capitalization and multiple relative to peers can largely be justified by its solely Tier-1 operating portfolio, higher margins on balance than its peer group, and its relatively long mine lives. This is especially true relative to miners with razor-thin margins like Guanajuato Silver (OTCQX:GSVRF) and Endeavour Silver (EXK) which are expected to see another year of sub 10% all-in sustaining cost [AISC] margins if silver prices don’t improve.

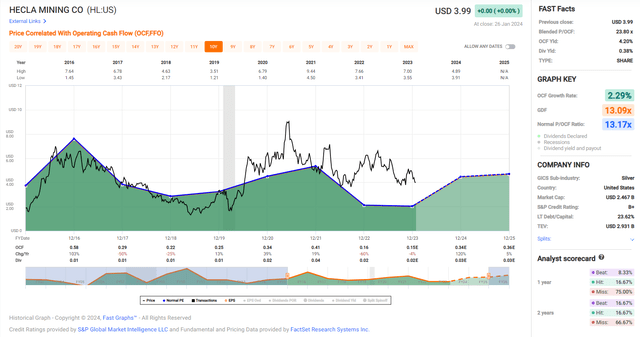

Hecla Mining vs. Peers – Margins, Valuation – Finbox Hecla Historical Cash Flow Multiple vs. Current Valuation – FASTGraphs

So, is Hecla undervalued at today’s levels?

As the chart above highlights, Hecla has historically traded at ~13.2 cash flow (10-year average) and trades at ~10.5x cash flow today based on FY2024 estimates of $0.38. That said, the company continues to trade at a premium to its estimated net asset value of ~$2.34 billion and (~1.06x), and the best time to buy the stock has typically been when it’s traded below 0.90x P/NAV like in September 2022. Plus, if we apply a 35% discount to fair value to my estimated fair value estimate of US$5.40 (1.5x P/NAV, 13x cash flow), Hecla’s low-risk buy zone has not been reached and currently comes in at US$3.52 or lower. Obviously, this level may not be reached on the downside, but this is where the stock would become more interesting from an investment standpoint with an adequate margin of safety.

Summary

Hecla Mining had a tough year in 2023 with a significant stoppage at Lucky Friday, a change in the previous mine plan at Casa Berardi, and weather-related downtime in Q4 at Greens Creek. Unfortunately, Keno Hill also had its issue with an elevated all-injury frequency rate in addition to near-misses that have forced Hecla to take a deeper to change some of its processes and equipment to ensure it creates a sustainable and safe operation in the Yukon. On a positive note, Hecla is positioned for a strong 2024 with throughput continuing to improve at Greens Creek, a full year of output from Keno Hill, and a 4+ million ounce year for silver production from Lucky Friday. This will be partially overshadowed by another high-cost year at Casa Berardi, but at least the core silver business should be back to firing on most cylinders (the key will be getting safety right at Keno Hill).

Hence, with easy comps on deck starting in Q3-24 and the benefit of stronger gold prices at Casa Berardi and Greens Creek, I would view any pullbacks below US$3.52 for HL as buying opportunities.