winnond

Investment thesis

I started paying closer attention to healthcare real estate investment trusts [REIT] because the Fed’s pivot in monetary policy seems to be approaching as inflation is cooling down, and the real estate industry is expected to be one of the primary beneficiaries of the change. Among REITs, I believe that the ones exposed to Healthcare facilities are in pole position due to favorable American demographic shifts. Healthcare Realty’s (HR) management’s business approach looks very sound to me as it does not prioritize growth at all costs and prefers sustainable financial performance improvement instead. According to my valuation analysis, the stock is approximately fairly valued and offers a solid 7.7% dividend yield. All in all, I think that the stock is a good choice for investors who prefer a high and safe dividend yield and assign it a “Buy” rating.

Company information

HR is a self-managed and self-administered REIT that owns, leases, manages, acquires, finances, develops, and redevelops income-producing real estate properties associated primarily with the delivery of outpatient healthcare services throughout the United States.

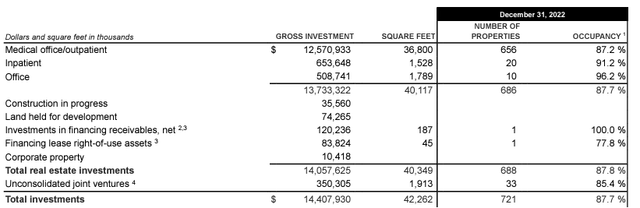

The company’s fiscal year ends on December 31. According to the latest 10-K report, HR had 688 real estate properties in its portfolio.

Financials

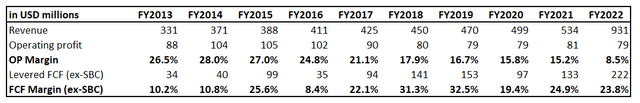

HR demonstrated strong performance over the last decade with an impressive 12.2% revenue CAGR and solid free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] dynamic.

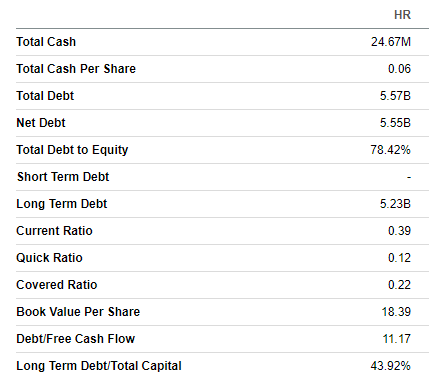

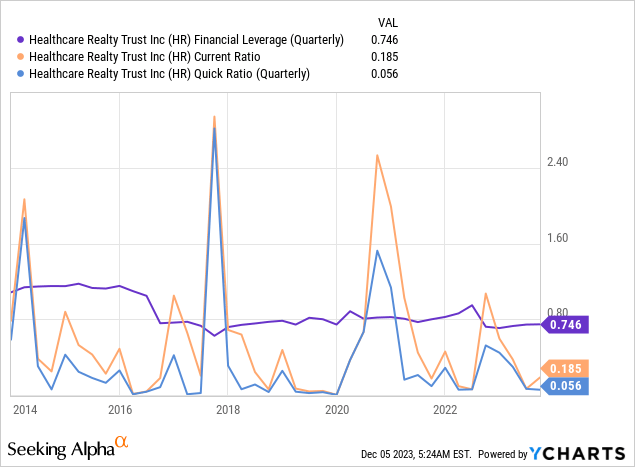

The latest quarterly earnings were released on November 3, when the company topped revenue estimates but missed the FFO and bottom line. Revenue increased by 11.7%, but the FFO remained flat at $0.39. HR’s balance sheet might look weak with low liquidity metrics and high leverage, but I do not consider it to be a substantial risk as long as the company’s operating cash flow is solid.

Seeking Alpha

Moreover, it is also important to cite that the current liquidity and leverage measures align with the last decade’s averages. If the company managed to almost triple its revenue over the last decade with the same consistent capital allocation approach, I do not consider HR’s balance sheet as weak. What is important is that HR consistently paid dividends to shareholders over the last decade. The forward dividend yield is high at 7.7%, and the dividend looks safe considering the 77.5% TTM payout ratio.

I think that secular trends are favorable for Healthcare Realty Trust. First of all, as new generations of Americans become more health-conscious, the demand for healthcare services is expected to show a strong secular dynamic. The higher demand for healthcare services means that healthcare providers will also seek additional facilities for rent, which is favorable for companies appreciate HR. Another positive secular trend is the aging U.S. population, as the population is, on average, older than it has ever been. Before the pandemic, Purdue Global forecasted that healthcare job growth would outpace the average of all other occupations. As the pandemic highly likely made people more health conscious, I believe that Purdue Global’s forecasts were correct.

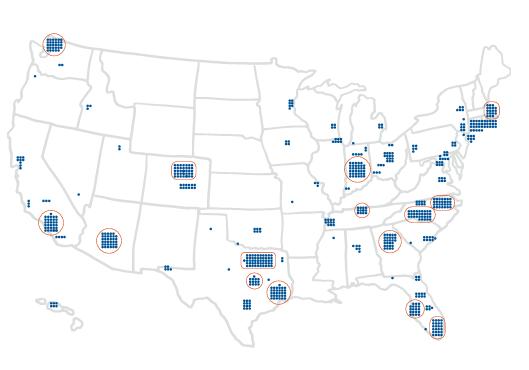

As we have seen above, healthcare REITs will likely benefit from demographic and behavioral changes in the U.S. population. Now, let me narrow down to the strategic positioning of Healthcare Realty Trust. I appreciate the broad geographic diversification of the company’s assets without heavy concentration in one state, which will likely make the business more resilient as different states show different macroeconomic dynamics.

HR’s latest earnings presentation

Apart from diversifying geographically, Healthcare Realty’s wide tenant diversification represents a compelling indicator for prospective investors. According to the latest 10-K report, the company does not rely on any single tenant for 10% or more of its consolidated revenue. This robust tenant diversification protects HR from over-dependence on a limited number of major clients, enhancing its resilience. Moreover, the absence of a dominant tenant underscores the company’s adeptness at cultivating relationships with various customers, showcasing a high degree of management adaptability.

Besides positive developments for the top line, it is also important that the management does not ignore two other important pillars for any business: the cost side of the profitability equation and the spare capital allocation. During the latest earnings call, the management emphasized its commitment to controlling costs to keep operating expenses growth within a 2.5% run rate. A strong commitment to disciplined capital allocation and sustaining the current dividend level was also emphasized.

All in all, I believe that HR is well-positioned to capitalize on positive secular trends in the healthcare industry. The management does not prioritize growth at all costs and is committed to financial and capital allocation discipline. HR also looks well-rounded, given its solid geographical and tenant diversification. Sound management is the critical success factor for the company to be able to absorb positive secular trends.

Valuation

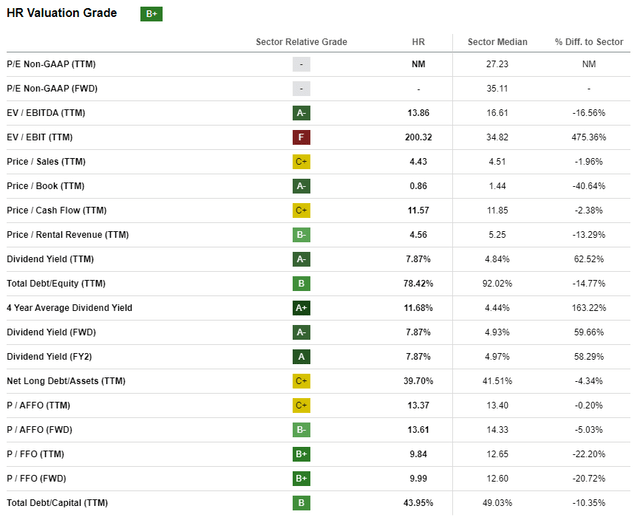

HR tanked by 20% year-to-date, significantly lagging behind the broader U.S. stock market. Seeking Alpha Quant assigns an elevated “B+” valuation grade because most of the multiples look attractive compared to the sector averages.

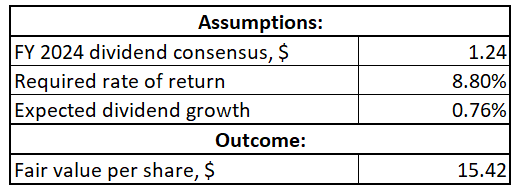

I want to proceed with the dividend discount model [DDM]. I use an 8.8% recommended by valueinvesting.io WACC as a required rate of return. Consensus dividend estimates project a $1.24 payout in FY 2024, which I also include into my calculations. I use a 0.76% CAGR for the dividend growth, which is the pace of the last decade.

Author’s calculations

My DDM simulation shows the stock’s fair value is $15.42. It is very close to the current stock price, which means HR is approximately fairly valued with a limited upside or downside potential.

Risks to consider

The current environment characterized by a tight U.S. monetary policy presents a significant temporary headwind, and the timing of the Federal Reserve’s pivot adds an extra layer of uncertainty to the business. Elevated borrowing costs limit Healthcare Realty’s ability to ensure financing for expansion under favorable terms. Additionally, the unpredictable interest rate policy landscape introduces increased uncertainty, which weighs the overall investors’ sentiment towards the real estate industry.

Seeking Alpha Quant assigns Healthcare Realty’s stock a low “D” momentum grade, which indicates weak investor sentiment. Such a negative dynamic is a risk for potential investors because the trend is likely to be broken by a strong positive catalyst. Without a strong catalyst appreciate the pivot in the Fed’s rhetoric, the stock price might uphold its steady downward trend. Investors should be ready to foresee for capital gains on the stock for multiple quarters.

Bottom line

To deduce, HR is a “Buy”. The stock offers a safe and high 7.7% dividend yield, which I consider attractive given the stock’s fair valuation. The management’s reasonable business approach increases HR’s chances to absorb positive secular trends in American healthcare.