Editor’s note: Seeking Alpha is proud to welcome Winged Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

PATRICK T. FALLON/AFP via Getty Images

Business Overview

Hawaiian Electric Industries, Inc. (NYSE:HE), incorporated in 1891, served the state of Hawaii for nearly 130 years. It is the parent company to its subsidiaries engaging in electric utility, banking, and infrastructure investment business in Hawaii. The company’s utility subsidiary, Hawaiian Electric, provides electricity to 95% of Hawaii’s population in the islands of Oahu, Hawaii, Maui, Lanai, and Molokai, using various energy sources, including renewable energy. American Savings Bank is its banking subsidiary that helps Hawaii grow by serving consumers and businesses through loans and savings. HE’s newest subsidiary, Pacific Current, invests in infrastructure to help achieve the company’s economic and environmental goals for clean energy.

Investment Thesis

Hawaiian Electric Industries’ stock price has dropped nearly 70% from its peak due to the concern of being at fault for the devastating Maui Wildfire that killed nearly 100 people. The decline in stock price caught my attention to investigate the potential risk and reward behind it. If Hawaiian Electric Industries were not found liable for the fire, this can be an opportunity to purchase a stake in a utility giant in Hawaii at a huge discount. However, if found liable, the possible outcomes for the company may not be bright. The future of Hawaiian Electric Industries remains uncertain, but I believe the downside risk outweighs the potential reward, so I’ll choose to wait for a better pitch.

“The stock market is a no-called-strike game. You don’t have to swing at everything – you can wait for your pitch.” – Warren Buffett

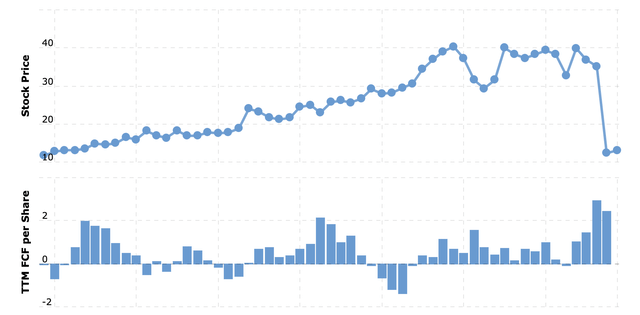

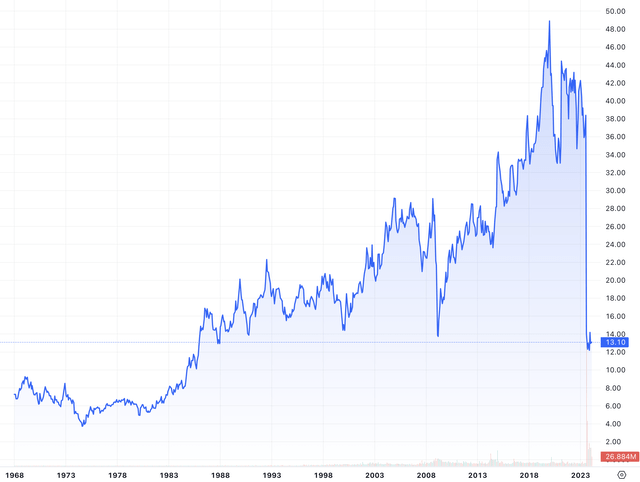

HE Historical Stock Price (Seeking Alpha)

Potential Outcomes

On November 8, 2023, Hawaii Governor Josh Green announced the One Ohana Initiative. This initiative includes the Maui Recovery Fund, which aims to raise $175 million to provide legal support for families affected by loss or severe injury. Hawaiian Electric has committed $75 million to this fund, with the remaining $100 million supported by other entities including the State of Hawaii, Maui County, Kamehameha Schools, Spectrum, and Hawaiian Telcom. According to Hawaiian Electric Industries’ filing with state regulators, Hawaiian Electric has $165 million in insurance coverage. Furthermore, as highlighted in the 4Q 2023 earnings call, the holding company and its utility division holds $137 million and $106 million in cash, respectively. Additional financing of $200 – $250 million in liquidity is also possible through leveraging its accounts receivable. Therefore, there is no doubt the company can fulfill the commitment for the Maui Recovery Fund. However, if Hawaiian Electric Industries are found liable for the wildfires and damages, the liability is estimated to be nearly $4.9 billion (Capstone) which far exceeds what the company holds in liquidity. Therefore, by exploring each outcome (Not Liable and Liable), it would allow us to examine the upside and downside risk of the investment opportunity.

Optimistic Scenario: Not Found Liable

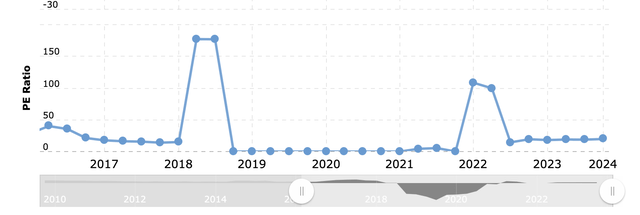

If Hawaiian Electric were found not liable for the Maui wildfires, I can see an opportunity for the stock to multiply two to threefold. With the company’s current cash reserves and potential financing through accounts receivable, raising its $75 million commitment to the Maui Recovery Fund should pose no significant challenge. Hawaiian Electric’s historical PE range was between 14 – 17, and it sits at a PE of 6.99 with the current (2/25/2024) stock price of $12.68. Therefore, if Hawaiian Electric were found not liable, the most favorable and optimistic case would probably have the stock price recover to its former PE range, a potential two or three-bagger.

HE Historical PE (Macrotrends)

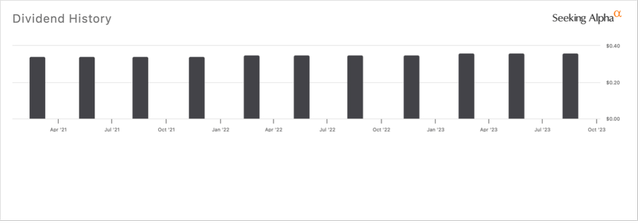

Furthermore, if Hawaiian Electric were not found liable and everything went back to normal, the company would most likely resume their dividend. With the current stock price and assuming the company will resume back to its previous dividends, the dividend yield would be approximately 11.30%. This scenario would allow investors to benefit not only from potential capital gains resulting from an increase in stock price but also an attractive dividend yield.

Dividend History (Seeking Alpha)

Valuation

I’ve utilized a 10-year DCF model to determine Hawaiian Electric’s intrinsic value. Chart below shows the inputs for the valuation.

| Inputs | |

| 5-Year Average FCF | $109 Million |

| Outstanding Shares | 110 Million |

| Discount Rate | 10% |

| Growth Rate | |

| Pessimistic | 3% |

| Normal | 4% |

| Optimistic | 5% |

| TV Growth Rate | 3% |

Source: Author’s Calculation

I chose to use a 5 year average of FCF considering that Hawaiian Electric Industries’ FCF and EPS has fluctuated over the years, rather than showing a consistent growth. Furthermore, I conducted a sensitivity analysis on the company’s growth rate and weighing each intrinsic value by different probability. According to SolarReviews Hawaii’s electric rate has grown 4.36% annually from 1997 to 2022. Therefore, I chose 4% as the normal growth rate and giving a higher weight on the probability of 60%. With the given inputs, Hawaiian Electric Industries’ intrinsic value is calculated as $16.67, which gives a 23.96% margin of safety relative to the current purchase price (2/25/2024).

| Probability | ||

| Pessimistic | 20% | $3.11 |

| Normal | 60% | $9.99 |

| Optimistic | 20% | $3.57 |

| Intrinsic Value | $16.67 | |

| Current Price | $12.68 | |

| Current MoS | 23.96% |

Source: Author’s Calculation

The intrinsic value seems to be relatively low compared to its stock price, but Hawaiian Electric has been traded with high P/FCF multiple historically. Chart below shows the comparison between FCF per share and its stock price. Therefore, a 23.96% discount on its intrinsic value can also mean that it is more deeply discounted compared to what it has been trading throughout the years.

Pessimistic Scenario

Considering its current cash position and annual net income of $200 million, financing the entire fire damage would be extremely challenging. Given its status as a utility provider serving 95% of Hawaii’s population, it is unlikely that the company would resort to complete liquidation. I believe that some of the responsibilities will be shared with other entities as we have seen in Maui Recovery Fund and eventually, in the long run, Hawaiian Electric will be able to recover its profitability as it receives governmental aid and increasing rates by the Hawaiian Public Utility Commission. In my opinion, the worst-case scenario for Hawaiian Electric may be very similar to the outcome of PG&E Corp (NYSE:PCG). PG&E needed to raise the Fire Victim Fund of $13.5 billion: half in cash and stock. In the case of PG&E, it raised $9 billion through stock sale, diluting its outstanding share. In worst-case scenario, Hawaiian Electric might need to do the same.

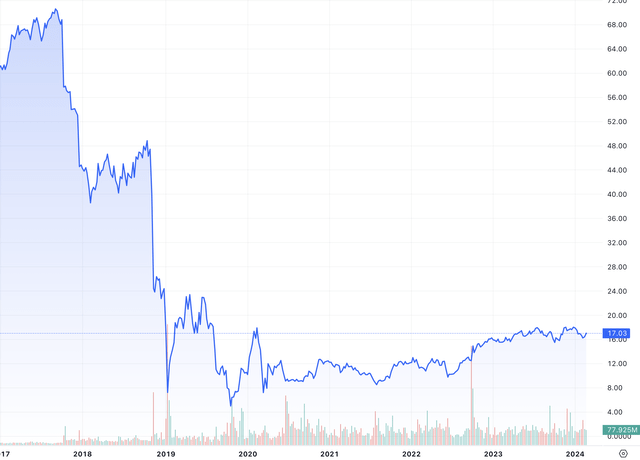

Chart below shows the dilution experienced by PG&E’s shares following the California fire incident. PG&E initially had around 500 million outstanding shares, and the number went up to a range of 1.9 billion to 2.1 billion outstanding shares. Seeking Alpha contributor Vlae Kershner’s analysis precisely estimated the dilution of PG&E, where nearly 1.5 billion shares were issued to raise $16.95 billion. Due to the share dilution, PG&E’s EPS went down from $1.97 in 2018 to $0.19 TTM.

PG&E Outstanding Shares (Seeking Alpha)

The outcome of share dilution is clear with PG&E’s current stock price and PE ratio. PG&E’s stock price has been trading significantly lower than its previous peak, but its PE ratio has returned to its previous range of mid-teens, as shown in the chart below.

PG&E Stock Price (Seeking Alpha) PG&E PE Ratio (Macrotrends)

Valuation

My primary concern lies in the potential share dilution if Hawaiian Electrics were to replicate PG&E’s outcome. Even if Hawaiian Electric were to recover its profitability, the share dilution will significantly affect its EPS, which would eventually reflect in the company’s stock price.

Hawaiian Electric’s EPS from 2014 to the trailing twelve months (TTM) has varied between $1.6 and $2.3, showing more of fluctuation rather than consistent growth. Considering the possibility of raising electricity rates, I chose the higher EPS of $2.3 for the analysis. Utilizing the average PE ratio of 15.5 over the years, I calculated three different outcomes of share dilution: 4x (mirrors PG&E), 3x, and 2x which projected the stock price to be $8.84, $11.88, and $17.82, respectively. Using today’s stock price of $12.68, each share dilution would allow Hawaiian Electric to raise $4.2 billion, $2.8 billion, and $1.4 billion for each scenario. In my opinion, it would be most likely that Hawaiian Electric would dilute in between 3x to 4x as it will raise about $2.8 billion to $4.2 billion (This amount can be affected if the stock price declines steeper due to the filing of bankruptcy). However, even though Hawaiian Electric were to return to its previous net income and PE ratio, the stock would be trading between $8.84 to $11.88 which is lower than the current stock price.

|

4x Share Dilution |

3x Share Dilution |

2x Share Dilution |

|

|

EPS |

$ 2.30 |

$ 2.30 |

$ 2.30 |

|

Diluted EPS |

$ 0.57 |

$ 0.77 |

$ 1.15 |

|

Average PE |

15.5 |

15.5 |

15.5 |

|

Estimated Stock Price |

$ 8.84 |

$ 11.88 |

$ 17.83 |

|

Current Outstanding Shares |

110,000,000 |

110,000,000 |

110,000,000 |

|

Diluted Shares |

330,000,000 |

220,000,000 |

110,000,000 |

|

Total Outstanding Shares |

440,000,000 |

330,000,000 |

220,000,000 |

|

Total Equity Raised |

$ 4,184,400,000 |

$ 2,789,600,000 |

$ 1,394,800,000 |

Source: Author’s Calculation

All of the inputs for the DCF model are identical with the optimistic scenario, except diluting the shares by fourfold. The DCF model tells a similar story that Hawaiian Electric may be overvalued, indicating a decline in intrinsic value from $16.67 to $6.85, with no margin of safety in the current stock price.

| Inputs | |

| 5-Year Average FCF | $109 Million |

| Outstanding Shares | 440 Million |

| Discount Rate | 10% |

| Growth Rate | |

| Pessimistic | 3% |

| Normal | 4% |

| Optimistic | 5% |

| TV Growth Rate | 3% |

Source: Author’s Calculation

| Probability | ||

| Pessimistic | 20% | $0.78 |

| Normal | 60% | $2.50 |

| Optimistic | 20% | $3.57 |

| Intrinsic Value | $6.85 | |

| Current Price | $12.68 | |

| Current MoS | -85.18% |

Source: Author’s Calculation

Conclusion

After reviewing all the possible outcomes of Hawaiian Electric’s situation and considering the information currently available, I believe it may be premature to consider taking a position in the company. This can be a two to three-bagger opportunity if the company were not found liable. However, I believe the downside risk outweighs the potential rewards at the current stock price. The current stock price at $12.68 (2/25/2024) does not yield any margin of safety if Hawaiian Electric were to undergo bankruptcy proceedings, leading to a significant share dilution. Unless Hawaiian Electric’s stock price goes below my pessimistic assumptions, I’ll opt to wait for a better pitch.