- UK flood warnings have risen by 170% in the past year, reaching 1,578

- Cost of insuring a flood-prone home has risen by average of £99 in last year

- Government grants are available to upgrade homes that have flooded before

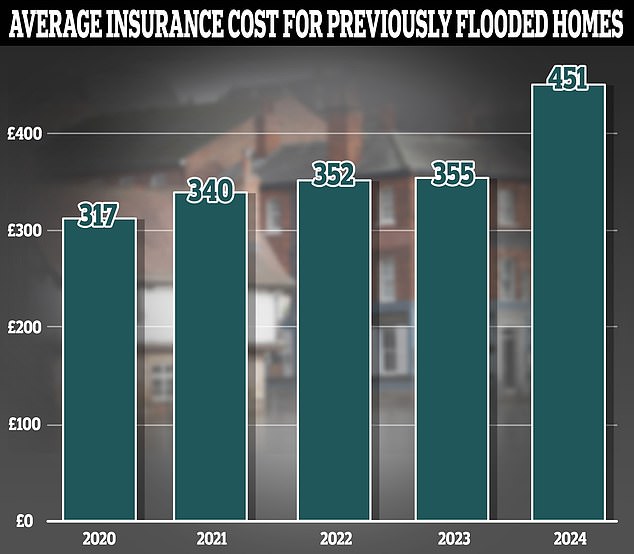

The cost of insuring a property that has previously been flooded has risen by £99 in just one year as the number of flood warnings issued continues to rise, research claims.

You can expect to pay an average home insurance premium of £451 per year on a property that has previously been flooded as of January this year, data from Compare the Market shows, rising 28 per cent from £352 in January 2023.

The rise in premiums comes as the number of flood warnings issued in 2023 surged by 170 per cent, reaching 1,578.

This is compared to just 584 in 2022 and 871 warnings in 2021, according to Environment Agency data obtained by Compare the Market via a freedom of information request.

Steep rise: The cost of insuring a flood-prone home has risen by £99 in a year

The rise in flood warnings, Compare the Market said, was partly due to the UK’s battering by storm Agnes, storm Babet and storm Ciaran in the latter months of the year.

Helen Phipps, director at Compare the Market, said: ‘With storms and flooding becoming more frequent, it’s a good idea to review your home insurance policy and to check if you are living in a flood-risk area.

‘The home insurance market has seen a decline in the number of people taking out a policy over the last three years, meaning many households could be left uninsured, and out of pocket, if stormy weather or floods cause damage to their homes.

‘The good news is that UK households seem to be taking action – we saw an 80 per cent jump year-on-year in visits to Compare the Market for home insurance after Storm Isha this January.’

How can people in flood-prone areas get insured?

For those who own a property that is at risk of flooding, the cost of insuring your home will be higher due to the added risk of doing so.

In some high-risk areas, it may be hard to find an insurer who is willing to sell you a policy at all.

Joint schemes run by the Government and insurance firms, such as Flood Re, can offer those at a high risk of flooding capped insurance prices for those whose homes have more than 1.3 per cent chance of flooding.

Owning a property in close proximity to a body of water is also likely to increase the cost of your insurance, even if it has never flooded before.

Can you get cover? Homes in flood-prone areas can be difficult to insure, with some providers refusing to offer policies due to the high flood risk

According to data form the Environment Agency, warnings for fluvial floods, or the flooding of waterways like rivers, jumped to 1,295 in 2023, compared with just 405 the year before.

Compare the Market said the cost of insuring a property near a water body has risen by 29 per cent, or £48, per year in January, to £204 from just £166 previously.

However, this figure is only six per cent higher than the cost of insuring a property that is not situated near water, with the average cost of home insurance having risen by £48 year-on-year to £204.

It said: ‘Flood cover is generally included as standard in most buildings and contents insurance policies, and will cover your home and its contents against water damage.

‘Homeowners should note, however, that there can be important exclusions depending on their level of cover. For instance, most policies do not cover damage to parts of your home like fences, gates, and hedges.

‘Comparing policies online could help you form a better understanding of the different options available, and you may find a deal that is more affordable or a better fit for your circumstances.’