PeopleImages/iStock via Getty Images

The verdict of the markets on the Fed’s proceed is quite clear. Markets ran up sharply, stock prices and bond prices rose. Bond yields fell sharply as the market cheered the Federal Reserve’s latest proceed to signal lower interest rates ahead sooner than it had previously expected. Lower interest rates are usually good for markets; they’re good for stocks and they’re having exactly that impact right now. But then markets always react to the here and now and we can’t be so sure that the Fed has made the right policy proceed for the longer run. By acting to defend the low unemployment rate and to avoid any possibility of recession, the Federal Reserve appears to be ready to cut interest rates persistently in an environment where the unemployment rate is already near a 50-year low. What could possibly go wrong?

When Donald Trump was the President-elect, in the December 2016 FOMC meeting (for which transcripts are available) we could see that at least one Federal Reserve member was quite concerned about the policies of a president who expected to engage in fiscal stimulus at a time that the unemployment rate was already low (4.5%) -not as low as it is now. That situation has changed markedly. The Fed seems to look at the economy and handicaps risk very differently now. The unemployment rate is at 3.7% and the Fed seeks to keep it low and cut rates and guesses that inflation will still fall. What, me worry?

The Fed seems to have found a way to have its cake and eat it too

The Fed thinks it has found a way to have its cake and eat it too. By that I mean the Fed thinks that it can cut interest rates, provoke the economy, make progress on inflation reduction, and keep the unemployment rate near its cycle lows. This is quite a magical Fed funds rate path. So far, the Fed has really done nothing except to furnish guidance to markets that it’s willing to be easy with policy in the future. The Fed is using its communication and forward guidance to prod markets to lower interest rates which is a 180° turn from where the Fed used to be before its December meeting. Prior to this meeting we thought that the Fed was telling the markets that there could be another rate hike and that the Fed did not want to tip off a policy of steady rates because it was afraid the market would get ahead of it and start looking for rate cuts and reduce the degree of financial pressure it was counting on to lower inflation. Instead, the Fed has jumped with both feet into exactly that position by essentially urging the markets to look for lower rates by telling the markets it would be giving them lower rates sooner rather than later.

500-point moves aren’t what they used to be

The Fed’s announcement spurred a more than 500-point jump in the stock market which is quite significant. However, in 1987 the market fell by 500 points in one day and that was considered a market crash. It’s important to recollect that in 1987 when the market did this, 500-points was a much larger percentage change. The drop was a one-day event, (with after-shocks, or course) and the market dug itself out of its hole and kept rising thereafter. It’s important not to take any one action by the market on any single day as a bellwether for what is going to happen in the future. And, in this case, it’s unclear if the policy tact that the Fed has taken is going to be a walk in the park instead of a dangerous jaunt through a minefield.

Declaring victory in the third quarter…

This victory by the Fed that is being declared by the press and endorsed by the markets is very much a work in progress. I can recall a Super Bowl in which Tom Brady’s Patriots were so far behind at halftime no one thought they had a chance and yet they won that game. There was another against Seattle with Seahawks on the two yard line or so with seconds left and the Hawks about to score the winning touchdown, but were foiled by an incredible Patriot interception on the goal line! Yikes! Anyone that follows sports closely, probably knows that there’s a game-cast feature on ESPN that, with a game in progress, will tell you the probability that the team that’s ahead is going to win. These probabilities are in all likelihood gathered from scores in previous games at the same stage in order to discern what the probability is that a team with a 10-point guide at the end of the third quarter also be ahead at the end of the game. Betting sports fans know that it’s not a good idea to count your winnings before they’ve been paid. And, of course, monetary policy is a game that’s played on a continuum without a real end. But the Federal Reserve is signaling now and betting that it’s able to reduce interest rates at a time that inflation continues to run over the top of its target for the 34th month in a row even as the Fed looks ahead to the probability of another 24 months or so of excessive inflation before it’s PCE inflation measure gets into its target of 2%. If that comes to pass the Fed that wants us to believe it is serious about its 2% target, yet it would have gone 4.8 years continuously above target. So what good is such a ‘target?’

Repealing the laws of economics

Everyone seems focused on the achievement of a soft landing and avoiding a recession. However, I’d admire to look at this in a different way, putting this ‘soft-landing’ and ‘recession’ language aside. Let’s simply note that the unemployment rate continues to be near a 50-year low and what the Federal Reserve is proposing is that, armed with forecasts that don’t see the unemployment rate rising much and with inflation still significantly above its target (but so-far falling), the Fed intends to cut interest rates substantially and consistently. What could possibly go wrong with that? Cutting interest rates with inflation already over the top of the target and with the unemployment rate already very close to a 50-year low as a strategy would have earned you a flunking grade in any economic class attended in the past 50 years- until perhaps the last 12 or 18 months when the world seems to have changed. I’m not sure how or why it’s changed and certainly in the wake of Covid we’re having less international competition, less global connectedness, more inflation, higher wages, a tighter labor market, and so far, worse productivity- and yet the Fed seems willing to boldly go where no central bank has gone before.

From Paul Volcker Powell to Arthur F. Burns Powell?

In my view monetary policy has lost its grounding, its backing. When Arthur F Burns was Fed Chair there were five monetary aggregates and Burns essentially played five card Monte with these five aggregates jumping from one to the next in order to maintain the policy he wanted to carry out. There are two keys here: one is that Burns did not have a preferred aggregate but rather would jump from one to the other. The second key is that Burns had an objective for interest rates and what he was really doing was using various monetary aggregates to find one that would maintain what he wanted to do. This is backwards policymaking. So having a proliferation of gauges to refer to gives the central bank a lot more flexibility to proceed policy around and to maintain anything that it wants to do. This is very different from when Paul Volcker was Chairman and Volcker was laser-focused on the inflation rate he was determined to bring it down. He devised a strategize to lean on monetarist operating procedures to allow him to get interest rates up where he thought they needed to be to control inflation. That was successful. Under Volcker policy figured out what its tool would be, and what its objective would be, and the Fed unswervingly used its tool to accomplish its objective.

Five Card Monte in the new Millennium

But, have we reverted bait and switch policy-making? Are we going back to playing some version of five card Monte? I asked this question because what has happened is that the Fed has broken away from its habit of looking at year over year inflation rates to set policy. The Fed long ago stopped looking at monetary aggregates for guidance. Instead, the Fed targets inflation as measured by the PCE and if commodity prices have become unstable the Fed will revert to looking at the core PCE. Two choices only. And that has been pretty much ‘it’ until recently. Now what has happened is that the Fed has begun to look at inflation over different horizons; you hear various Federal Reserve members talking about three-month or six-month inflation so if we’re going to look at 12-month, six-month or three-month inflation, and if we’re to consider the core and the headline PCE, right there we have six different metrics to look at. But why stop there? There are now and there have always been components in the price index that begin to look rogue at different points in the business cycle. And there has always been a tendency to say well if we take out this, or if we take out that, inflation is much lower, or much higher, or in any event it’s much different. And now people have various subtractions they want to make.

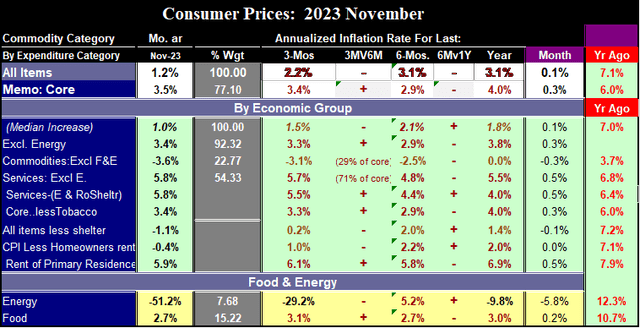

Various CPI components (Haver Analytics and FAO Economics)

Here we see a sample of some CPI categories and some of the progressive inflation rates over 3-Mo, 6-Mo, and 12-Mo. Picking among these categories for ‘guidance’ can create a feast of opportunities. And as we look as some of the shorter gauge recollect they can be volatile. Should the Fed be making policy today off a 3-month inflation rate?

From an approach that’s Confucian to one that’s Confusin’

Some want to take out the cost of housing; they want to take out rent; they want to take out the price of used cars. In fact, if you take out most of these things that I’ve mentioned you have much less than half of the price index left. Do you really want the Fed making monetary policy based on what’s happening in 30% or 40% of the price index? And considering all of these price measures, over different horizons there could easily be over 20 different inflation metrics to use to deduce what inflation is in order to ascertain what a policy should be! Welcome to monetary policy under Jay Powell. Shelter costs are about 30% of the CPI, food is 15%, energy another 7.5% or so, new and used motor vehicles are about another 8%…and on it goes – or off it comes!

Political environment is super-charged

The political environment is supercharged; we’ve never seen the Federal Reserve under so much pressure as it is now. Donald Trump began by jawboning the Fed. However, people who grasp how the Fed works, realized that his bombastic public statements had no effect on the Fed because, apart from nominating new Fed members, the President has no power over the Fed once people have been appointed. The real power over the Fed comes from Congress because the Fed was created by an act of Congress. And with Democrats in control of Congress a great deal of pressure welled up. Even now their pressure continues. First, Congress claimed that it would protect the Fed against Trump’s bombast but before too long this turned into an attempt by progressives to handle the Fed and to enhance the Fed’s responsibility for goals regarding racial harmony, and climate change this of course included the Fed’s ordinary conduct of policy where progressives wanted the Fed to make the unemployment rate as low as possible and to do nothing to provoke it to rise. Is that even possible?

Gravity does not necessitate that you believe in it for it to work…

The progressives have set the Fed to a task that may be unattainable. They are interested in a lot of social goals; some of them with economic impact, and they want the Federal Reserve to be on board to follow their vision. Unfortunately, in economics there seems to be some tension between some of the goals progressives would have and the outcomes that the Fed is trying to produce. The Phillips curve for example which has come under some attack in recent years nonetheless sketches out of relationship between inflation and unemployment indicating, at least in the short run, you can have less unemployment at the cost of more inflation or you can have less inflation and more unemployment. But the Fed needs to keep both low. Progressives want to have their cake and eat it too. It’s not clear that the Fed can deliver on this. Although it can produce policies that in the short run may seem admire they’re consistent. But, in the longer run, it is not so clear that there won’t be a piper to pay and this is my concern about current Fed policy. The Fed can’t be expected to follow and procure every objective that is put on its plate. In fact, part of the Fed’s failure to accomplish its objectives may have been that progressives pressed the Fed too much to accomplish objectives in other areas.

Regardless, the laws of economics have not been repealed and policy is going to have to be conducted within the constraints of economic reality. Reality may have undergone a benevolent shift but the constraints are still there. In the post Covid world some of that reality may have shifted. But prior to Covid there was a great deal of international competition that seemed to keep the lid on price inflation in some sense regardless of Fed policy. After Covid it’s not so clear that’s going to be true, as productivity has performed worse, the labor market is tighter, wage pressures are greater, unions are stronger and have achieved larger pay increases for their members, and even non-organized workers have been able to extract more benefits from employers because of tight labor market conditions – conditions that the Fed seeks to preserve. That may demonstrate harder than patting your head and rubbing your belly in a circular motion at the same time.

Fantasyland is in Florida

One of the things that surprised me about the Fed’s policy shift in December is that it seems to have come as some of these short-term inflation indicators have backed off some of the better readings that we had seen earlier in the summer. The Fed may yet get some help from weak oil prices; there is global weakness, and with that we’ve seen some weakness in commodity prices as well. But oil prices are importantly influenced by the OPEC-plus cartel. Beyond that I simply noticed that a variety of price trends no longer seem quite as beneficial as they were and, of course, the structural conditions and behavior in the labor market is much less conducive to the notion of supporting a 2% inflation rate. The Fed never mentions wages. I take this as evidence that political pressure on the Fed is strong since progressives want higher wages even though higher wages push inflation up. Have your cake with extra frosting too!

Right or not, here it comes…

Maybe the Fed is doing the right thing. Maybe the world has changed. Maybe the economy can function smoothly with higher wages. Maybe there will be a productivity offset. Maybe for the first time in history the economy will be able to continue to grow with the tight labor market without creating inflation… And maybe not. Typically, we try to see the central bank making policy based upon trends and events we’ve experienced rather than by conjuring relationships that we’ve never seen work before in the past. Jerome Powell and his Fed may demonstrate to be the Houdini Fed that pulled a rabbit out of an empty hat… or it will represent a return to the five-card Monte ways of policymaking under Arthur F Burns. Time will tell.