Dilok Klaisataporn

By Erik Norland

Those who worry about the possibility of durably higher inflation argue that the quarter century of low, stable inflation rates was a consequence of the end of the Cold War, globalization and just-in-time supply lines. Now, many of those factors have reversed. Military spending is on the rise worldwide as global tensions mount. Nearshoring and friendshoring are moving production out of China and into places like Vietnam and Mexico but at an increased cost. Finally, just-in-time-delivery has proven to be fragile and creates a strong potential for supply chain disruptions. These factors, combined with shrinking workforces in China, Korea, Japan and much of Europe, could put upward pressure on wages and inflation.

But there is a counter-argument: technology continues to advance rapidly, and generative AI could pose a threat to many middle-class service professions. And inflation has begun coming down in many countries, led by the United States.

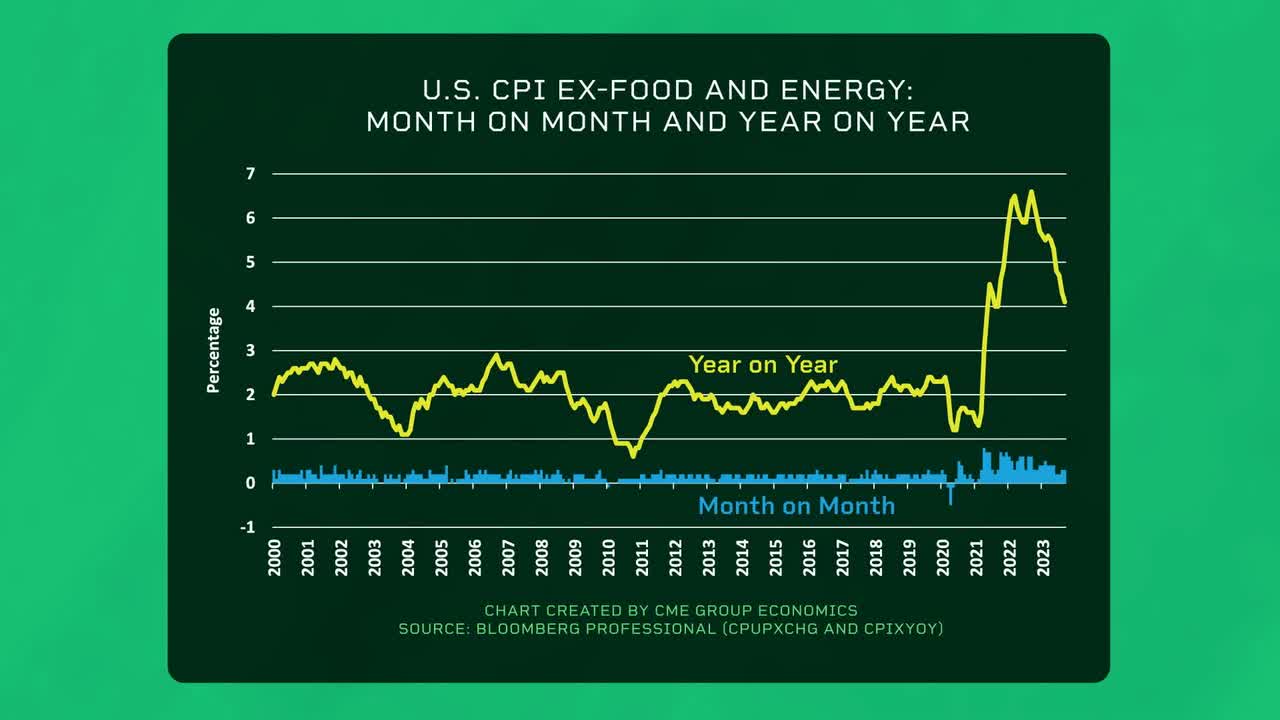

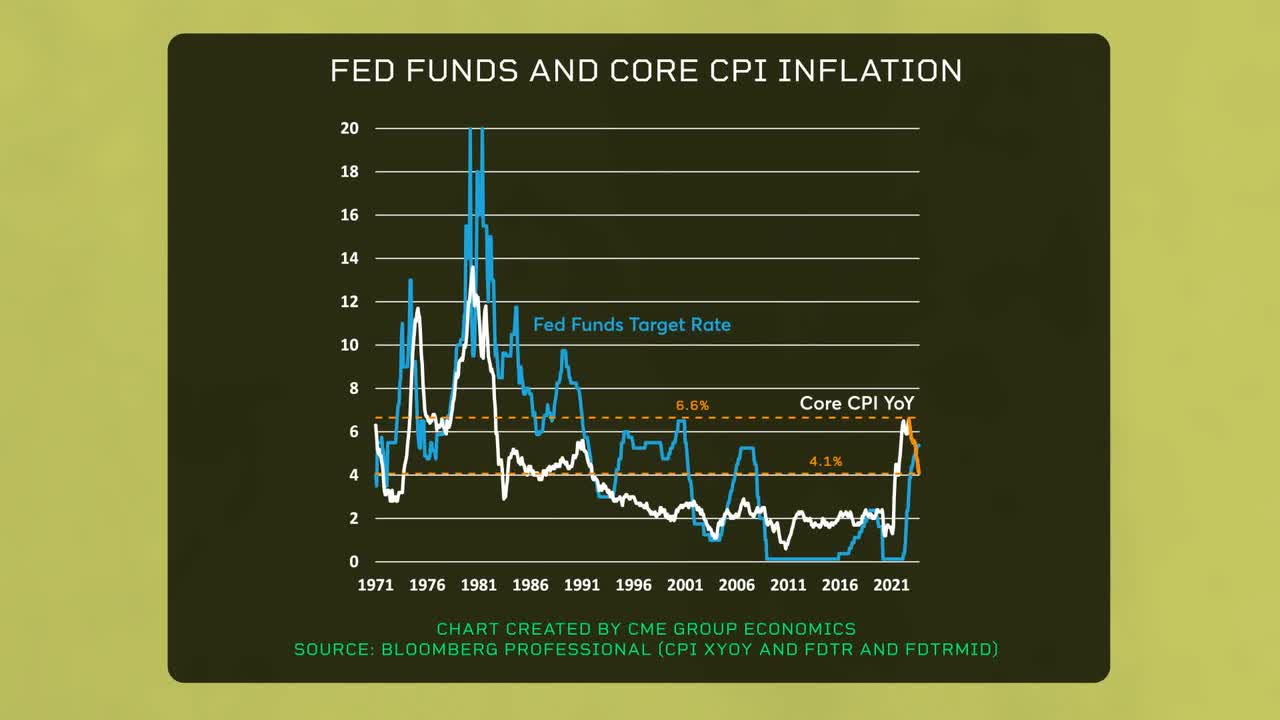

In the U.S., core inflation has fallen from 6.6% YoY to just 4.1%, and most of the remaining increase has come from one component: owners’ equivalent rent. Outside of owners’ equivalent rent, U.S. inflation is running at just 2.1% year-on-year. After a massive global tightening of rates, economies may also slow significantly, reducing inflationary pressures.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.