Feverpitched

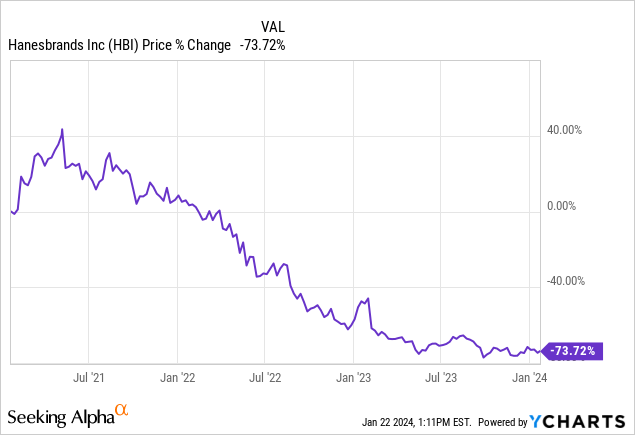

Investors facing the downturn of retailer Hanesbrands (NYSE:HBI), which has witnessed a decline of -73% over the past three years, may soon discover a ray of hope.

The company is currently engaged in discussions regarding the potential sale of its second most crucial brand, Champion.

A recent alert from Seeking Alpha has indicated that the deadline for takeover bids is set for Feb. 21, and apparently, a notable level of interest has been expressed by various brands.

Yet, the crucial question lingers: what value could Hanesbrands fetch for its prized Champion brand?

And what’s just as important is how this will affect the company’s future and, more importantly, what it means for investors.

In this article, I answer these questions.

Selling Champion: The Only Way Out

Hanesbrands seems deeply in trouble right now.

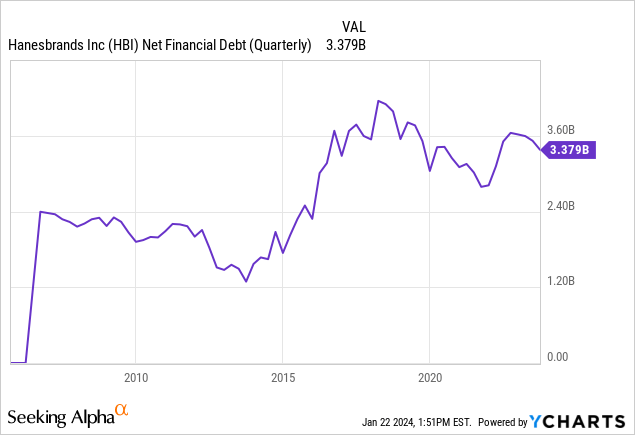

Revenues have been shrinking for 6 straight quarters (year-over-year) and the company is carrying more than $3.3 billion in net debt.

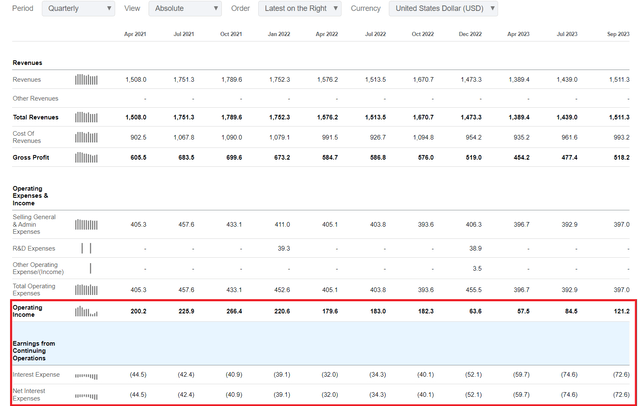

The business has also been losing money every quarter since Q4 2022 due to poor operating performances and massive net interest expenses which obliterate most of the operating profit that it has been able to generate.

Hanesbrands operating income and net interest expenses (Seeking Alpha)

In its latest quarter, the company generated $121 million in operating income but had to pay almost $72 million in net interest expenses. That’s almost 60% of operating income that is currently being used to service debt. On top of this, the company is undergoing a deep restructuring and thus booking some restructuring charges each quarter, which means that the bottom line stays deep in the red.

No wonder, the company announced on September 19, 2023, that it was evaluating strategic options for its global Champion business.

What is Champion worth?

A strategic sale of Champion, at a reasonable price, might cause the company to deleverage and become profitable again. Which would increase shareholder value and boost trust among investors.

It’s quite impossible to find exact sales figures for Champion. Apparently, they are a well-guarded secret. Other authors, here on Seeking Alpha, also haven’t been able to find the exact numbers. Geoffrey Seiler, however, made some claims of what this brand might be worth. I like Geoffrey’s vision that the brand could be worth between $750 million to $1 billion in a realistic setting and perhaps $1.2-$1.7 billion in a more optimistic way (based on analysts’ projections).

Assuming that a substantial portion, approximately 80%, of Hanesbrands’ sales in its Activewear division can be attributed to the Champion brand, it suggests that Champion generated an estimated $1.28 billion in revenue for the year 2022. Projections for 2023 indicate a potential revenue decline to around $1 billion, considering the reported approximately -20% decrease in sales based on recent quarterly reports.

An offer for the Champion brand of around $1 billion (1x sales) therefore seems quite fair. It might even be quite cheap. But considering recent poor performance (-20% growth), a $1 billion offer is not that bad in my opinion.

However, it’s crucial to acknowledge the existing uncertainties here due to incomplete financial data. The ultimate valuation will heavily hinge on factors like profit margins, the real revenue numbers, and the perceived long-term growth potential.

If there’s significant interest, there’s a possibility that Champion could also command a higher multiple, ranging from 1.2x to 1.5x sales, bringing the valuation closer to $1.2-$1.5 billion.

For now, I’m willing to bet on a value of around $1 billion.

What $1 Billion might do for the company and for shareholders

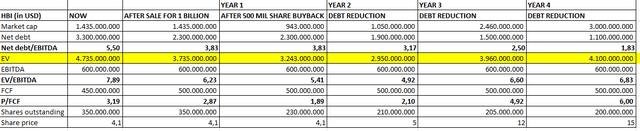

Assumptions of what could happen with HBI after selling Champion brand (Author model)

In the table above, you can see a small simulation that I made for Hanesbrands in case of a $1 billion takeover price for Champion.

First of all, you will see that net debt goes down immediately with $1 billion the moment the sale is completed. Why? HBI will receive 1 billion in cash, and thus net debt will go lower from $3.3 to $2.3 billion. This will reduce its Enterprise Value (EV) from 4.7 billion today to 3.7 billion tomorrow. Notice that the share price stays the same in this theoretical situation. In reality, there might be a positive reaction to the news.

Also, notice that its net debt/EBITDA leverage ratio would improve immediately from 5.5x to 3.81x. This would give much more financial stability to the company and would put it out of immediate danger of breaching any covenants.

Year 1 Assumption:

During 2024 (YEAR 1) I assume the company will generate around 500 million in FCF, and I assume that it will use this exclusively to pay back debt. However, at the same time, I have assumed the company will use its royal cash position of $1 billion to buy back some shares, as they are now sitting at a ridiculously low valuation. So in this model, I assume that HBI will reward shareholders and might buy back $500 million worth of stock. This would lead to a share reduction of around 120 million shares at current prices (-34% of total shares). This would create massive shareholder value if the company can continue to book around $500 million in free cash flow for the foreseeable future and just reduce debt organically. Net debt will therefore stay flat in year 1, because $500 million FCF is being generated by the company and used to reduce debt. While $500 million of cash is being spent to buy back stock.

Year 2 Assumption:

The company now starts the year with 230 million shares outstanding instead of 350 million. And the company is carefully reducing debt, by generating free cash flow of around $500 million per year. This time, the company spends $400 million on debt reduction and $100 million on buying back shares. In this model, I assume that it can buy back around 20 million shares at $5 a piece, but of course, this would depend on the real average purchase price. I’m just showing the reader what could be possible here. So HBI ended year two after selling the Champion brand with $1.9 billion in net debt instead of $3.3 billion and with 210 million shares outstanding instead of 350 million. That’s what I call shareholder value creation.

Year 3 Assumption:

HBI again reduced its debt by $400 million thanks to strong free cash flow, and the net debt/EBITDA ratio is now comfortably around 2.5x. The company is finally healthy again. During the year, the company also used some excess cash to buy back an extra 5 million shares at around $12 apiece. You will have noticed that the share price went from $4 to $12. The company is doing better again, so investors are willing to pay more for the stock. As you can see, even with a 200% rally in share price, the enterprise value of the company would still be below what it is now. The enterprise value would be $3.9 billion compared to $4.7 billion today, and shares would have tripled from $4 to $12. This is due to fewer shares outstanding and the massive improvement in net debt. This is actually very realistic if management can execute.

Year 4 Assumption:

More of the same. Debt reduction of $400 million and 5 million shares bought back during year 4. At a share price of $15, the company would still be dirt cheap (P/FCF of 6x) and be financially healthy (net debt/EBITDA of 1.8).

Conclusion

Selling the Champion brand for around $1 billion could be the smartest move here for Hanesbrands and its investors.

When using reasonable assumptions, like a consistent free cash flow of $500 million per year (in line with historical averages) and a nice buyback program after the sale, to reward its loyal shareholders (and activist investor), the company could create massive value for existing shareholders.

A share price above $15 in 3 to 4 years seems very reasonable and if management executes well, the shares might quote even higher. This gives the stock more than +275% upside potential by 2028.

If, however, management fails to execute, then investors could be in for a lot more pain. This whole thesis depends on a selling price of $1 billion for the Champion brand and a solid free cash flow to reduce debt. If management fails to achieve its targets and/or if it doesn’t get a deal or less money for Champion, the entire thesis is in shambles and Hanesbrands might continue to fall and perform poorly.

Always invest carefully and never invest more than you are willing to lose. This is a high risk/high reward turnaround story. But I believe Hanes is definitely worth a small gamble based on these potential prospects.