Jeremy Poland

Halliburton’s (NYSE:HAL) stock has been range bound between 28 and 42 USD per share over the past two years. A situation driven by robust oil supply growth, continued uncertainty regarding the health of oil demand, and stalling company fundamentals.

Halliburton continues to believe that the current upcycle will be extended, a sentiment shared by most service companies. This is supported by continued discipline by both operators and service companies, as industry players continue to prioritize profits over growth. For example, from 2024 onwards EOG (EOG) plans on returning in excess of 70% of free cash flow to shareholders. Operator discipline may extend the current upcycle, but it also limits upside for service companies.

Halliburton’s stock looks relatively inexpensive based on current earnings but there is mounting risk of a meaningful correction in oil and gas markets. The possibility of an OPEC led wave of supply impacting US onshore activity needs to be weighed against long-term investments being made offshore and in international markets. I continue to believe that the risk-reward trade-off for Halliburton is unfavorable.

OPEC

While North America is currently offering limited growth, Halliburton is optimistic about international markets and offshore. This situation could dramatically change if OPEC decides that market share losses are no longer a worthwhile trade-off for higher prices. Oil and gas markets have remained resilient in the face of macro concerns so far, but pressure is mounting on OPEC to prevent a crash. There has already been evidence of disunity, with Angola electing to leave OPEC, stating that membership no longer served the country’s interests. Continued production growth in the US and other non-OPEC markets will increase pressure on the organization if demand growth remains sluggish in 2024.

While there are expectations that production growth in the US will begin to weaken given the recent drop in drilling rigs, there is reason to expect solid growth through at least 2024. Resilient frac spread activity, along with efficiency and productivity, largely explain solid production growth in the US. As an example of efficiency, Halliburton has increased the number of hours pumped per crew by 68% in the last four years.

OPEC may be reluctant to try and wash out higher cost producers again though, given the lack of lasting impact from its previous effort. Improved productivity and cost discipline by shale producers also make it likely that any downturn would need to be severe to have a meaningful impact. For example, EOG estimates that it can maintain current production and internally fund regular dividend commitments at an oil price as low as 45 USD.

Offshore

Offshore is one area where investment appears set to continue increasing over an extended period of time. Offshore represents more than 50% of Halliburton’s business outside of onshore North America. Roughly 25% of completion and production division and over 40% of drilling and evaluation revenue comes from offshore. This should help Halliburton to realize modest revenue growth and stable margins in the near-term.

Financial Analysis

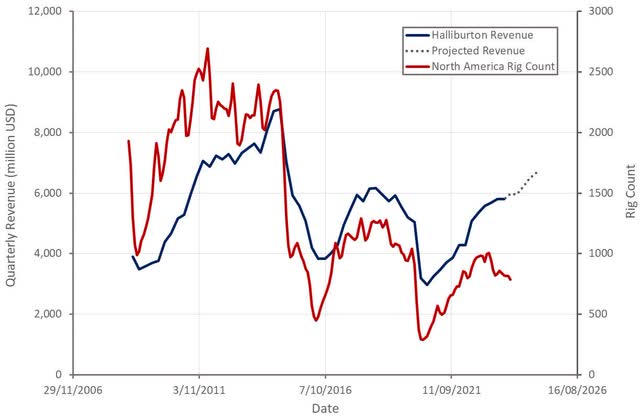

Halliburton’s revenue was up 8% YoY in the third quarter, with the company’s international business registering 17% growth and the North American business roughly flat YoY. This result could be considered somewhat surprising given the declining rig count in the US, but international markets and frac activity have held up relatively well. Over the past year, the North America rig count is down 14%, while the frac spread count is up 11%.

Halliburton’s completion and production division benefitted from increased stimulation activity internationally, increased cementing activity in the eastern hemisphere and greater completion tool sales. This was offset by pressure pumping weakness in North America.

Fluid services and wireline activity were growth drivers within Halliburton’s drilling and evaluation division. Drilling related services, project management and software sales in Mexico were areas of weakness.

Table 1: Halliburton Q3 2023 Revenue by Division (source: Created by author using data from Halliburton)

Completion and Production division revenue is expected to decline by 3-5% sequentially in the fourth quarter, with minor margin compression. Drilling and Evaluation division revenue growth is expected to be 4-6% sequentially, with some margin expansion. As a result, YoY revenue and profit growth should be in the low to mid-single digit range.

Figure 1: Halliburton Revenue (source: Created by author using data from Halliburton and Baker Hughes)

As a provider of fairly commoditized products and services, Halliburton’s profitability is heavily dependent on how tight the oilfield services market is. Halliburton benefitted from a surge in price inflation in late 2021 and 2022, but the environment is now less favorable. Margins are still improving internationally, and likely still have further room to run, but Halliburton’s profitability in North America will probably come under pressure in 2024.

EOG has suggested that demand for top-of-the-line frac fleets remains high and hence pricing has been resilient. Halliburton is primarily working with larger companies, with a preference for longer-term relationships. Longer duration contracts should be supportive of margins if the market slows.

In addition to cost initiatives, Halliburton is focused on efficiency and technology to create differentiation and pricing power. Examples include Halliburton’s Zeus electric fleets, automation and fracture diagnostics. These types of initiatives are largely table stakes though, and any advantage is likely to be short-lived.

Figure 2: Halliburton Profit Margin (source: Created by author using data from Halliburton and The Federal Reserve)

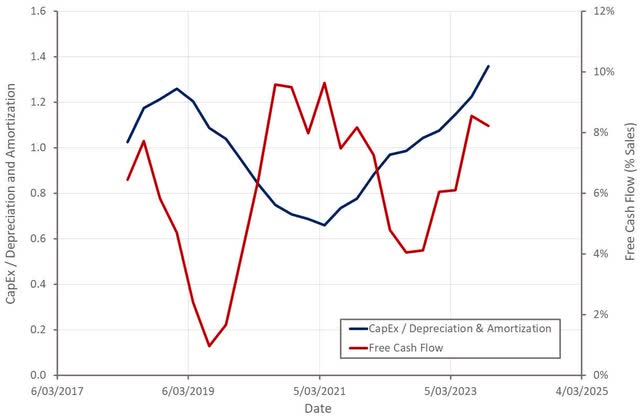

From a free cash flow perspective, Halliburton’s business looks less attractive, even though the company has tried to reduce its capital intensity. Halliburton has underinvested in its business in recent years, and this is now reversing, creating a drag on free cash flow.

Figure 3: Halliburton CapEx and Free Cash Flow (source: Created by author using data from Halliburton)

Conclusion

Oil and gas markets still require large amounts of investment, which will benefit Halliburton, but this is likely to be more disciplined than it has been in the recent past. I still believe that it is late in the current cycle, particularly from an economic perspective. Weakness in Europe and China could drag on demand growth globally, and the US economy is currently heavily dependent on fiscal support.

Growth is likely to be driven by international and offshore markets going forward. While Halliburton’s international and offshore businesses have grown in importance, the company is still heavily exposed to onshore completion activity in the US.

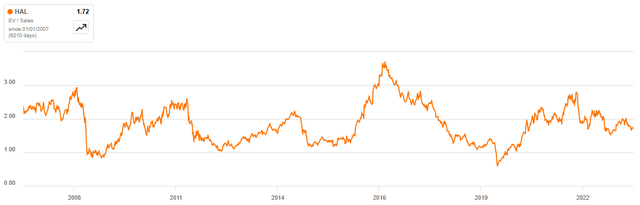

If OPEC supply cuts don’t remain in place throughout 2024, oil prices and onshore activity in the US are likely to suffer. Given Halliburton’s modest growth potential and the rising probability of an OPEC induced downturn, Halliburton’s valuation appears stretched.

There are a number of reasons why Halliburton’s valuation could remain elevated going forward though. Halliburton permanently removed 1 billion USD of fixed costs from its business in 2020. As a result, the company’s cost structure is now more variable, which allows Halliburton to pursue profits rather than market share. To the extent that other service companies have also removed fixed costs from their businesses, this should also support greater market stability. Consolidation amongst both E&P and service companies in North America should also drive greater stability.

Figure 4: Halliburton EV/S Multiple (source: Seeking Alpha)