Leon Neal

GSK overview

GSK plc (NYSE:GSK) is a British multinational “Big Pharma” established in 2000 by the merger of Glaxo Wellcome and SmithKline Beecham. It possesses a leading position in the traditional vaccine (Not mRNA vaccine) and HIV area. In fact, GSK produced the first FDA-approved malaria vaccine. Currently, its best-selling vaccine is Shingrix for Shingles, which netted ~$4.33 billion in sales in 2023 and is rapidly growing still, as it just started to enter developing markets.

On the other hand, GSK faces significant litigation risk as a result of its ongoing Zantac dispute. In this article, I will examine GSK’s moat, pipeline, ongoing legal issues, and come up with a fair value estimate. Overall, I rate GSK a Buy despite ongoing litigation risks.

Revenue growth and margin expansion

The investment thesis for GSK is a simple one: it is growing its revenues really well, and there does not seem to be anything in the near future to slow it down. 2023 was a particularly strong year where GSK grew its revenue by a whopping 14% (ex-COVID) with the steady performance of Shingrix, the excellent initial uptake of its RSV vaccine Arexvy, and its growing revenue from the HIV franchise.

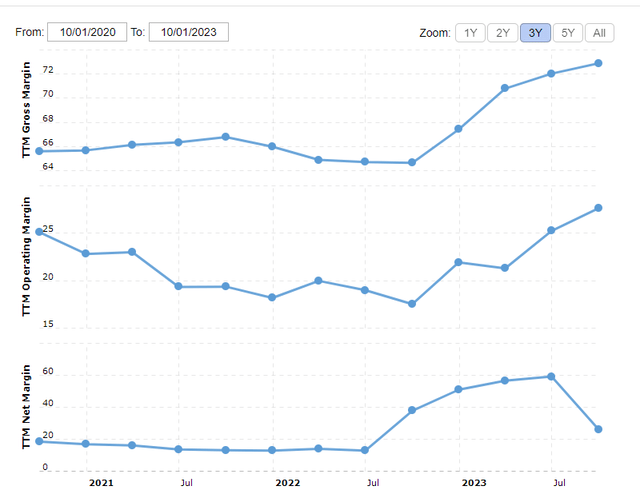

In my perspective, GSK management’s newly issued 2031 revenue target of more than GBP 38 billion is quite impressive, but not out of reach. Profit-wise, the picture looks even better, as it is likely that GSK has entered an era of margin expansion. Indeed, GSK increased its operating margin by almost 3% from 2021 to 2023 and is guiding for over another 2.4% of further expansion by 2026, which will be massive for its bottom line.

GSK Margin 2020-2023 (Marcotrend)

Vaccine franchise

GSK is quite entrenched in the vaccine area as it is considered to be one of the major players in the field, among others are Sanofi (NASDAQ:SNY), Pfizer (NYSE:PFE), and the newcomer Moderna (NASDAQ:MRNA). GSK’s current vaccine crown jewel is Shingrix for Shingles. It raked in GBP 3.45 billion in 2023, and it is just beginning to penetrate developing countries like China. Very likely that will come with a lowered margin, but it will still fuel further growth. The other blockbuster vaccine in the making is its RSV vaccine Arexvy, raking in GBP 529 million in the 4th quarter 2023 and is more than capable of generating annual sales of over GBP $3 billion despite competition from Pfizer’s ABRYSVO.

The vaccine market is not as profitable as say oncology, as it has less pricing power when it comes to payers, and it has much more stringent safety requirements since most of the people who take the shots are healthy individuals. Nevertheless, the fact that GSK can rake in so much money from these vaccines (and still growing) speaks volumes of its dominating position in the vaccine market.

I am also glad to see that GSK was not quick to jump on the mRNA vaccine bandwagon like many others. While mRNA vaccine as a novel vaccine platform has shown its might during the pandemic due to its ease of production, there are lingering doubts about whether it is actually superior in terms of immune protection and safety compared to traditional vaccines outside of the pandemic. In fact, more and more data is pointing to the possibility that mRNA vaccine’s protective effect wears off faster than traditional subunit vaccine.

It is prudent for GSK to focus primarily on the traditional vaccines, while letting others figure the mRNA vaccine out in the post-pandemic world.

HIV franchise

Oral 2DR (Dovato, Juluca) and Long-Acting medicine (Cabenuva, Apretude) sales growth continued in Q4 2023 and together gained 4% market share in the HIV market from other competitors such as Gilead. Indeed, these drugs showed an impressive 40% increase in sales in 2023 compared to 2022, raking in GBP $3.33 billion in 2023 and are becoming the major HIV drugs in GSK’s HIV franchise. It is not easy to operate in this space that has long been dominated by Gilead, and the fact that GSK is actually gaining market shares speaks to its innovation and commercialization capabilities.

Other franchises

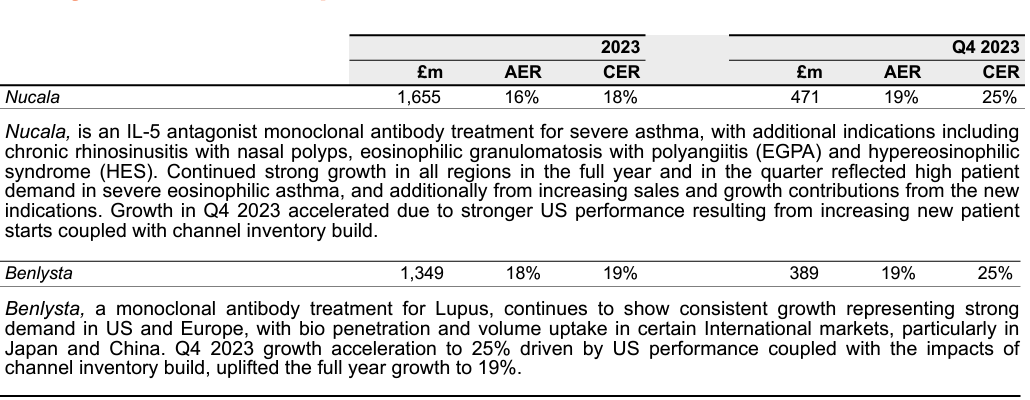

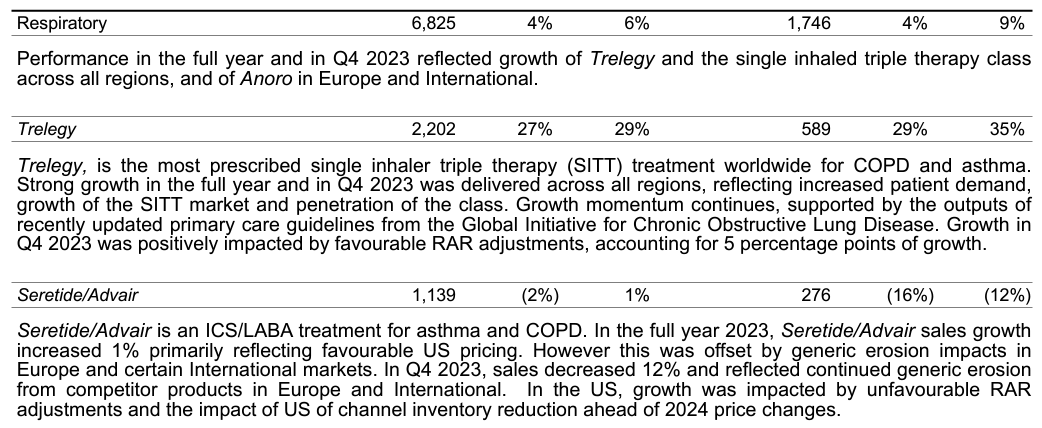

Some other highlights that are not the focus of this article are included in the table below from GSK’s Q4 2023 report:

GSK revenue report (GSK Q4 2023 Report) GSK revenue report (GSK Q4 2023 report)

GSK’s weakness and main risks: Oncology and Zantac

One major weakness of GSK is that it does not have a strong oncology franchise. This is something that GSK is well aware of and is actively working on. For example, JAK inhibitor Momelotinib, which GSK obtained in its USD $1.9 billion acquisition of Sierra Oncology, was approved by the FDA last year. It was approved with a broader-than-expected label and should reach blockbuster status rather comfortably. GSK has 9 oncology pipelines that are either in phase III or in registration, with new therapeutic modalities like ADCs (antibody drug conjugates). There is no doubt that GSK has a lot to catch up in the oncology arena to the big players like Merck and Roche and J&J, but it is good to see that GSK is stepping outside of its comfort zone and branching out to the much more profitable oncology market.

Then there is the notorious Zantac dispute, what happened was the following. There were concerns in 2019 that Zantac’s active ingredient degrades over time to form a potential carcinogen. Given the huge popularity of Zantac this becomes the largest legal liability that is hanging over GSK’s head, and likely suppressing its stock price. For better or worse, GSK is actually quite experienced in navigating the muddy waters of drug legal disputes. In 2012, GSK was fined USD $3B by the US justice department for false promotion and handing out kickbacks to doctors, and GSK actually pled guilty. In my view, the Zantac issue is less severe than what happened in 2012, and it is very unlikely that GSK will pay more than USD $3 billion for the total settlement. Assuming USD $2 billion, which is probably the higher end of the settlement, this is still less than GSK’s 2023 Q4 cash flow which was USD $3.45 billion. It is a lot of money, but in a longer timeframe, I believe the dip it would cause in profits would become manageable. If anything, once the Zantac dispute is settled, which it will eventually, that will become a positive catalyst for the GSK stock and will definitely push the stock price higher.

GSK’s moat source

First and foremost, its scientific know-how and various scientific patents are the primary moat source. GSK has been in vaccine, HIV, and many other disease areas for decades and has numerous blockbusters from each of those areas. It has not lost its edge. The fact that GSK and Pfizer’s RSV vaccines came out around the same time but since then, GSK’s had an insurmountable lead (⅔ of the market share) speaks to its superiority in vaccinology (GSK vs. Pfizer RSV vaccine efficacy is 94.6% vs. 84.6%).

Business development acumen. When it comes to acquisition GSK is probably one of the most careful big pharma companies out there, as they don’t dish out tens of billions like the others of late, like Pfizer’s $43 billion acquisition of Seagen, Amgen’s $27.8 billion buy of Horizon Therapeutics, and Merck’s $10.8 billion buyout of Prometheus Biosciences, just to name a few. A key reason for that is the strong organic, internal R&D programs at GSK, and that translated to revenue growth. This is what I like to see from a long-term investment point of view.

Strong and diverse pipeline. With 26 programs in Phase 3 or registration and a new emphasis on oncology, GSK is well-positioned to sustain its current operations, grow its revenue, and continue to innovate.

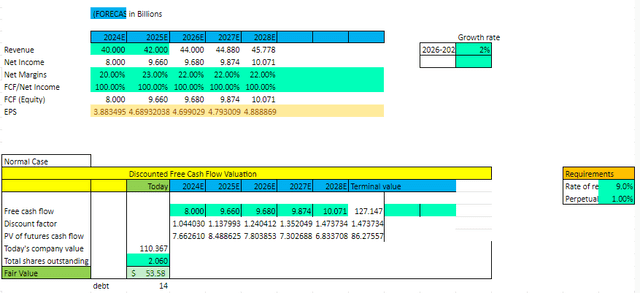

GSK valuation

Using GSK’s average PE of 13.3 over the past 5 years, and a current forward PE of 10.26, I assign a fair price for GSK at $53. Right now, it is trading at $40.7 so it is 23% undervalued. Using a DCF model going out 10 years, with a rate of return at 9% and a perpetual growth rate of 1.0%, I reached a fair valuation of $53.38 for GSK, which is very similar to the PE valuation and indicates GSK is 23% undervalued.

Final verdict

While GSK faces some short-term litigation risk due to Zantac and will need to pay cash to settle, I view its future revenue growth prospect as strong as it does not face significant patent cliffs in the next 5-10 years. I also believe that in the near term (2-5 years), profits from Shingrix and Arexvy will likely grow and fund its pipeline progression and potential acquisitions. As such, I rate GSK a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.