Natalia SO/iStock Editorial via Getty Images

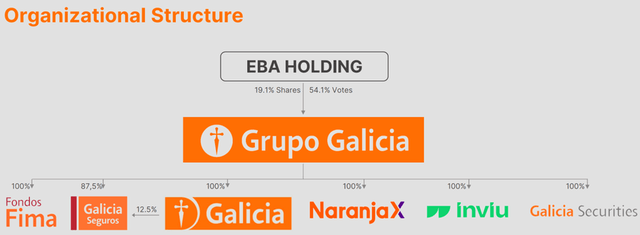

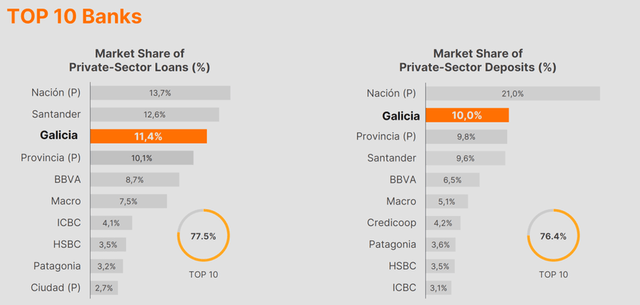

Argentina’s banking system has long been a fragmented one, with no major bank, not even the state-owned Banco Nacion, holding a dominant share of system assets. But ongoing economic turbulence and the rise of a new economic regime under President Javier Milei mark a potential step-change in future industry dynamics. Last week’s exit by HSBC Holdings plc (HSBC) from Argentina, coming on the heels of a similar move by Itaú Unibanco (ITUB) last year, only reinforced the case for more consolidation among the major domestic banks. The beneficiary this time around, not just strategically but also financially (transaction price at a deep discount to book), is Grupo Financiero Galicia (NASDAQ:GGAL), the holding company for banking arm Banco Galicia and insurance arm Galicia Seguros.

Grupo Financiero Galicia

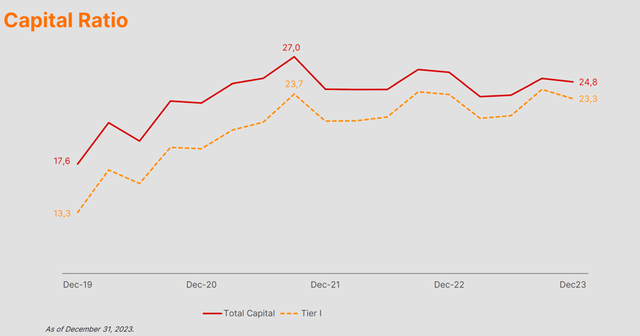

From here, GGAL’s excess capital position will only grow now that the country is moving toward a looser regulatory regime, leaving the group very well-placed to capitalize on a consolidating industry. Even if the consolidation theme takes time to materialize, P&L benefits from a more benign competitive environment, as well as increased capital flexibility (think dividends and buybacks) under new BCRA leadership, points to structurally higher earnings power for the banks. In the meantime, system credit is also coming off a very low base (as a % of GDP), and that only adds to the upside potential if Milei successfully tames inflation over time.

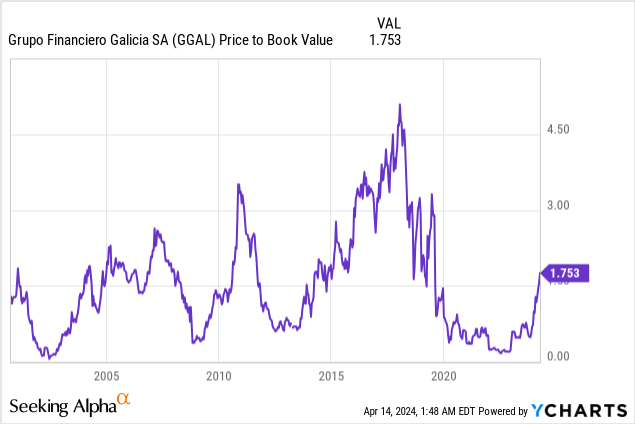

The catch is the valuation, as GGAL’s already re-rated stock (currently ~1.8x book) means some probability of an economic/credit recovery is already in the price. But given the relative quality here and the fact that sustained high-teens % ROEs now increasingly look within reach, helped by accretive M&A, it wouldn’t at all surprise me if GGAL stock continues to grind higher.

HSBC Bows Out of Argentina

Speculation had been rife in recent months about HSBC’s pending exit from Argentina, so the group’s announcement that it will dispose of its local operation to GGAL for $550m wasn’t all that surprising. Specifically, the terms of the transaction payout are as follows – $275m in cash from Banco Galicia and the remainder from the Grupo Galicia holding company in shares. While telegraphed, HSBC’s exit is a significant one, given its Argentine banking operation, built over more than three decades, is a top ten player at a >3% share of system loans and deposits. Also noteworthy is that HSBC isn’t the first foreign exit from Argentina; recall Itau’s sale of its (much smaller) Argentine unit to BMA for $50m last year.

Grupo Financiero Galicia

Strategically Benefiting from Consolidation

Strategically, this is a clear win for GGAL and, more broadly, for the country’s banking industry. From a historically fragmented system, foreign exits are a clear signal of consolidation and bode well for improved economics going forward. It also leaves GGAL in a great place to capitalize on potential macro normalization in the country. Yes, inflation remains high for now, but fiscal consolidation efforts by the Milei administration are bearing early fruit, and with credit demand coming off a very low base, there’s a lot of upside potential here.

Keep an eye out for more exits on the horizon, as other foreign banks might also look to de-risk; domestic banks with excess capital positions like GGAL are very well-placed to scoop up cheap assets and gain further share. Similarly, in the insurance industry, where GGAL also has a presence via Galicia Seguros, more foreign divestments following Grupo Sura (OTCPK:GIVSY) and BNP Paribas’ (OTCQX:BNPQY) exits bode well for its earnings power going forward.

Grupo Financiero Galicia

Discounted Valuation is a Major Bonus

As positive as buying out a top ten bank will be for industry economics, the near-term implications are even more compelling, in my view, given the discounted price. For context, the $550m transaction price spread over a $1.4bn equity base equates to a 0.4x P/Book multiple – well below the premium P/Book GGAL stock currently trades at. Now, this doesn’t yet include additional adjustments before the deal actually closes (likely within the next twelve months, depending on regulatory approvals), including profits from the business and fair value gains/losses on the HSBC Argentina securities portfolio. Plus, HSBC has pre-emptively booked a $1bn loss for now, so it wouldn’t surprise me if we see an even lower multiple when the acquisition actually closes.

Buying assets on the cheap is possibly becoming a trend for the big domestic banks – recall that key peer BMA also acquired Itau’s Argentine operation for ~ $50m in August 2023, implying a similarly deep 60-70% discount to book. More deals like these, especially if funded by premium P/Book equity, would be massively accretive. Despite the lopsided deal economics, I suspect more forced selling could be on the horizon. Like HSBC and Itau, not many parent companies have the appetite for the volatility or complexity associated with hyperinflation accounting. With many banking groups also now focused on simplification and ROEs over growth, the cost/benefit would justify exiting at low valuations. In any case, it’s probably to underwrite more accretive M&A into the numbers, though I would keep an eye out for how Galicia books this one-time gain in the upcoming quarter.

HSBC Acquisition Adds New Fuel to the Upside Case

Argentina’s banking system may be consolidating if recent acquisitions, most notably GGAL’s buyout of HSBC Argentina, are anything to go by. Playing this theme through domestic banking groups with excess capital positions (like GGAL) makes a lot of sense. Not only will GGAL benefit from improved system economics in the long term, but there’s also massive near-term accretion potential upon deal close. More fundamentally, banks may also be heading into a period of robust credit demand and, perhaps most importantly, the most market-friendly regulatory backdrop in decades under Argentina’s new administration. GGAL stock may have already rallied post-election, but given the tailwinds, there might still be a lot more upside ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.