Editor’s note: Seeking Alpha is proud to welcome Alem Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

skynesher

Introduction

On one hand, Green Brick Partners (NYSE:GRBK) stands out in the vast American real estate market as a company with promise and potential. Operating strategically in Colorado, Florida, Texas, and Georgia, GRBK has successfully navigated the challenges of the homebuilding and land development industry, consistently outperforming market expectations despite the inherent volatility of the construction sector.

On the other hand, GRBK is a small cap in the real estate business. The Federal Open Market Committee’s (FOMC) rate policies significantly impact the company, as high-interest rates tend to decrease the number of potential buyers.

Our analysis of the company’s financial statements and management suggests that the stock has solid fundamentals and is reasonably valued, making it a potential candidate for a long-term portfolio.

GRBK is a Player at the Home-building Business?

While Green Brick Partners may not be the most famous homebuilding company, it stands among the largest in the industry. Although it hasn’t shown the best price return over the last year, trailing just behind Dream Finders Homes (DFH) a longer-term perspective reveals that GRBK boasts the best performance over the past five years.

Among its peers, Green Brick Partners stands out with the best gross margin, year-to-date (YTD) net sales year-over-year (YOY) growth, the lowest cancellation rate, and the lowest debt to total capital ratio.

Financial Results: Is the Company Really Growing?

A detailed examination of GRBK’s growth trajectory reveals resilience and adaptability. Despite a nuanced decrease in net income, this reflects GRBK’s strategic approach to profitability rather than a downturn. Looking at the profit margins, In my opinion the company has shown a keen understanding of the delicate balance between expansion and financial stability.

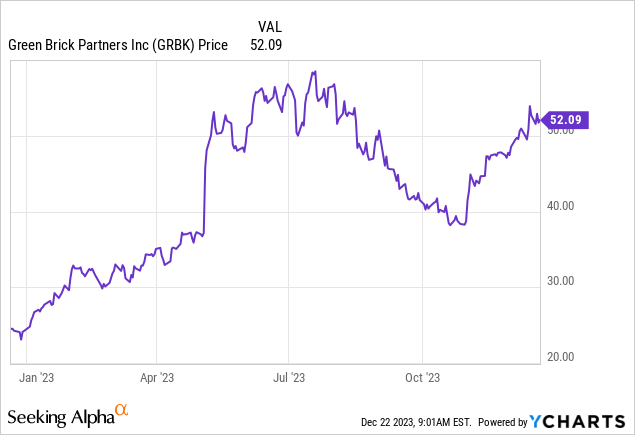

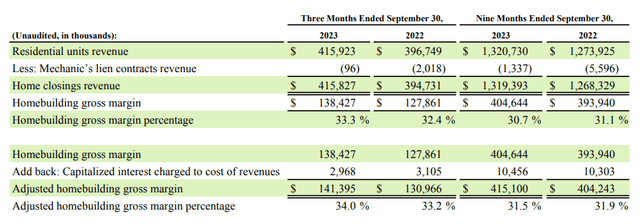

Green Brick Q3

The 95% increase in new home orders is a testament to GRBK’s market penetration and customer demand. In an industry where reliability and customer satisfaction are paramount, GRBK’s ability to consistently deliver new homes underscores its reputation for quality and timely project completion. Notably, GRBK’s customer satisfaction appears to be on an upward trajectory, with a 65% decrease in cancellation rates over the last three months.

Crucially, the improvement in profit margins amidst a competitive market landscape is a noteworthy achievement. By refining operational efficiency and implementing cost-saving measures, GRBK has not only weathered economic fluctuations but has also emerged stronger. This focus on maximizing profits, even during periods of growth, reflects the company’s commitment to creating sustainable value for its shareholders.

Green Brick

Examining GRBK’s approach to customer relationships offers insights into its growth trajectory. Maintaining customer satisfaction while expanding operations indicates the company’s service quality. Customer retention, coupled with the acquisition of new clients, provides a comprehensive picture of the company’s market standing and potential for future growth.

Furthermore, GRBK’s strategic investments in research and development, coupled with its emphasis on innovation, indicate a forward-thinking approach. In an era where technological advancements and sustainable practices are reshaping industries, I see GRBK’s willingness to embrace change positions it as a leader rather than a follower. By exploring eco-friendly construction methods, adopting cutting-edge architectural designs, and investing in smart home technologies, GRBK aims to meet current market demands and anticipate future trends.

Lastly, evaluating GRBK’s performance in relation to industry peers provides valuable context. Benchmarking key performance indicators against competitors allows investors to gauge the company’s relative growth rate and market positioning. GRBK’s ability to outpace industry averages in critical areas such as customer acquisition cost, project completion timelines, and customer satisfaction metrics signifies not just growth but leadership within the sector.

In summary, the nuanced analysis of GRBK’s growth trajectory reveals a company that is evolving strategically. The apparent dip in net income is a tactical maneuver to fortify profit margins, ensuring long-term sustainability. The company’s consistent delivery of new homes, coupled with its focus on customer satisfaction, operational efficiency, innovation, and competitive positioning, I think that this paints a compelling portrait of a company poised for enduring success. Amidst market fluctuations, GRBK’s strategic resilience and commitment to excellence affirm its status as a growth-oriented enterprise, making it an interesting prospect for investors in the homebuilding industry.

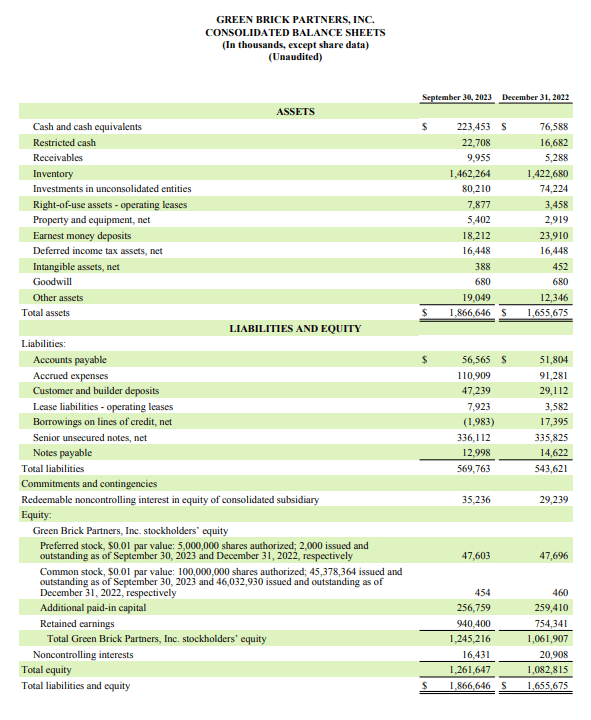

Balance Sheet

Delving deeper into GRBK’s financial statements, one discerns a pattern of shrewd fiscal decision-making. Cash and equivalents rose from $76.5 million at the beginning of the year to $223.4 million at the end of Q3, a 192% increase. This substantial increase, seemingly excessive, is a strategic move in response to prevailing macroeconomic circumstances. In an era marked by economic uncertainty, maintaining liquidity is paramount, ensuring that GRBK is well-prepared to seize lucrative opportunities as they arise.

The rise in assets, primarily attributed to increased cash and equivalent holdings, is complemented by the absence of significant liabilities, reaffirming the company’s commitment to financial prudence. The company only has $336 million in financial debt. Additionally, there has been a substantial surge in customer and builder deposits, serving as a testament to GRBK’s credibility and the trust it commands in the market.

In my view, this robust financial foundation not only bolsters the company’s stability but also instills confidence in investors, creating a positive feedback loop that fuels GRBK’s growth.

Green Brick Q3 Balance Sheet

What’s Coming Next?

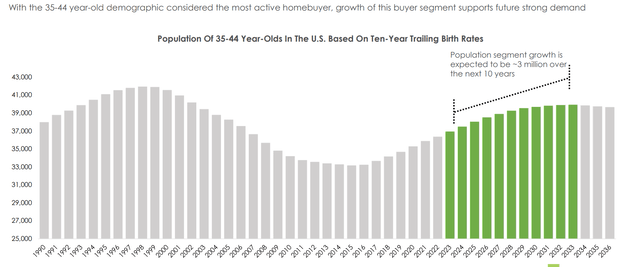

Peering into the crystal ball of GRBK’s future reveals a narrative of innovation and foresight. The company’s Q3 presentation unveiled a roadmap marked by strategic milestones. Key among these is the meticulous management of closings in the current backlog, a testament to GRBK’s customer-centric approach. By maintaining an optimal sales pace and starts, the company ensures that it not only meets existing demand but also anticipates future requirements.

This proactive approach has propelled GRBK to the forefront of the industry, with record-high gross margins of 33.3% in Q3 2023. Such financial flexibility, coupled with a prudent capital allocation strategy, positions GRBK as a frontrunner in the competitive arena of homebuilding. Furthermore, the company’s superior lot and land position underscore its commitment to sustainable growth, setting the stage for a promising future.

Something that might affect GRBK in the short term is a recession; this might slow down the growth that they are showing and affect the entire segment.

Green brick Q3 Presentation

Management: In Whose Hands is Our Money?

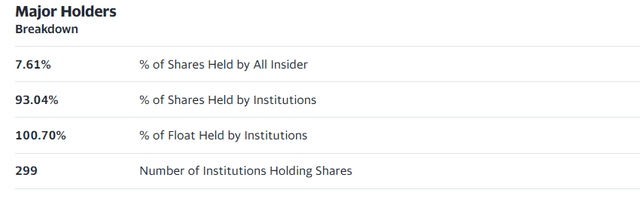

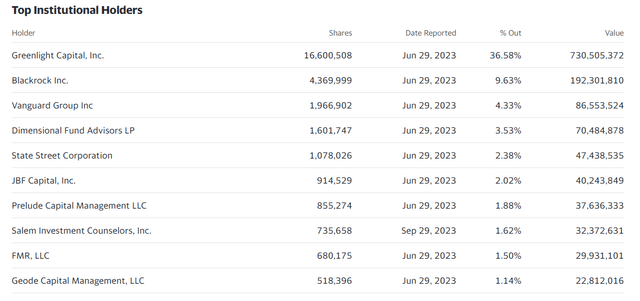

At the heart of GRBK’s success lies its distinguished management team, a collective of visionaries and industry stalwarts. CEO James Brickman, with over four decades of experience in real estate construction, development, and finance, spearheads the company’s strategic initiatives. His astute leadership, coupled with an unwavering commitment to excellence, has propelled GRBK to remarkable heights. COO Jed Dolson and CFO Richard Costello bring a wealth of expertise to the table, further bolstering the company’s capabilities. Additionally, the presence of eminent personalities such as David Einhorn, CEO of Greenlight Capital, among the major holders, adds a layer of credibility to GRBK’s operations. The synergy between these leaders fosters an environment of innovation and accountability, ensuring that GRBK continues to set industry standards.

Major Shareholders

A closer look at GRBK’s major holders paints a picture of confidence and trust. While insider ownership accounts for a substantial portion of the company, the noteworthy 7.61% stake held by David Einhorn’s hedge fund adds a strategic dimension. Insider ownership not only aligns the interests of key stakeholders with those of the company but also serves as a powerful signal to potential investors. The presence of significant institutional backing further solidifies GRBK’s position in the market, instilling confidence in its growth trajectory.

Yahoo Finance Yahoo Finance

Valuation

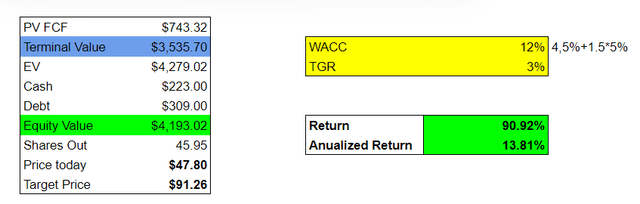

GRBK’s market price is currently around $47 per share, translating into a $2.15 billion market capitalization. The stock is trading at a 7.5x P/E and 6.6x EV/EBIT (forward), which is 50% lower than the sector, according to Seeking Alpha.

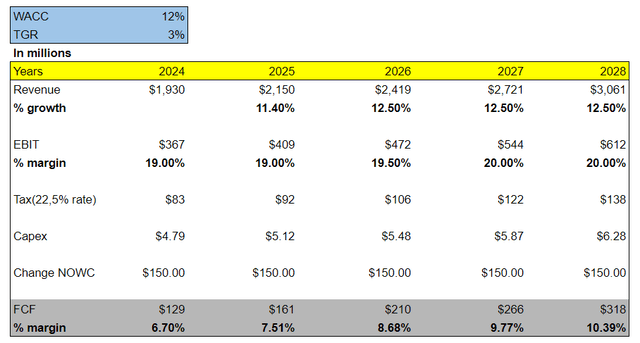

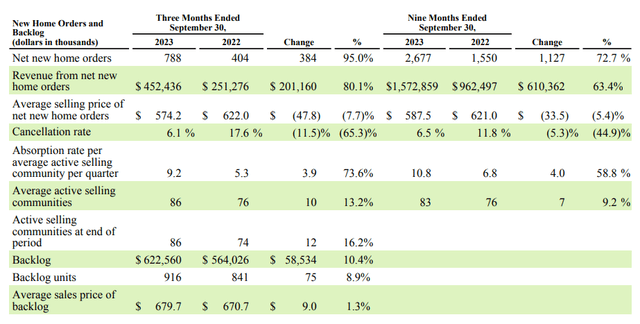

Another way to evaluate it is through a DCF model. We assume revenue growth between 11.4% and 12.5%, with an EBIT margin growing from 19% in the first two years to 19.5% in the third year, peaking at 20% in the last two years. We assume a tax rate of 22.5%. Estimating Capex is challenging due to the sector, so we use historical levels. Additionally, we assume a constant increment in NOWC of $150 million per year. Finally, we assume a WACC of 12% and a TGR of 3%.

The model shows that the equity fair value is $4.193 billion, resulting in a stock target price of about $91.26. This implies a return of 90.92%, or 13.81% per year over the next five years.

Downside Risk

Internationally, a noticeable divide has emerged between the United States and a coalition of nations working collaboratively to challenge its status as the primary global power. In the aftermath of Russia’s invasion of Ukraine. Over the eighteen months since, the S&P 500 has experienced a decline. This scenario raises the possibility of a recession, and such an economic downturn could significantly impact GRBK. To simplify, the main risk for this company is a scenario with high-interest rates, which currently seems unlikely.

Conclusion: Is it Time to Buy?

In the intricate tapestry of investment opportunities, GRBK emerges as a compelling choice for discerning investors. The company’s ability to navigate the complexities of the real estate market, coupled with its strategic foresight and financial acumen, positions it as a noteworthy player in the homebuilding industry.