Iuliia Korniievych /iStock via Getty Images

Great Lakes Dredge & Dock (NASDAQ:GLDD) offers dredging services. GLDD posted Q3 FY23 results with a significant drop in revenues. There are some positives and negatives in this quarter. After assessing all the factors, I think GLDD can be risky in the short term. So it would be best to avoid it. Hence, I assign a hold rating on GLDD.

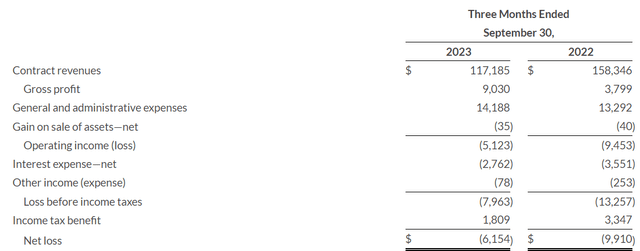

Financial Analysis

GLDD posted Q3 FY23 results. The revenues for Q3 FY23 were $117.1 million, a reject of 26% compared to Q3 FY22. The major reason for the reject was lower coastal protection project revenues. Its gross profit margin for Q3 FY23 was 7.7%, which was 2.4% in Q3 FY22. The management attributed this enhance to its cost-cutting initiatives and improved project performance.

The net loss for Q3 FY23 was $6.1 million, which was $9.9 million in Q3 FY22. There are some positives and some negatives from Q3 FY23. First, talking about the positives, despite a sharp reject in revenues, its gross profit and margins have increased significantly, and if the management is successful in maintaining high margins, then the company might be able to be profitable, which it has been struggling since 2022. The results of GLDD can be quite volatile sometimes, and it is because of the nature of the business it is in. Its revenues depend majorly upon the projects it wins in bidding, and if it is unable to win projects, then its revenues can fall significantly. So regarding this, there is a positive sign the company’s backlog at the end of September 2023 reached over $1 billion, which was $452.5 million at the end of September 2022, so the increased backlog makes them set for FY24. GLDD struggled in FY22 due to an unfavorable bidding market, but looking at its high backlog and recent project wins is a sign of recovery. In Q3 FY23, they won a Rio Grande LNG project, which is the largest project undertaken by GLDD. So, the high backlog, margin improvement, and improved bidding market were positives for them. Now, talking about the negatives, it has a market capitalization of around $460 million, and its long-term debt is around $377 million with just $14.1 million in cash. So, the high debt is a matter of concern that can affect its profitability in the future. The second problem with GLDD is that it can be highly volatile in terms of financials. It might perform well in one quarter, and the results can be underwhelming in the next quarter. There are a number of factors that affect its financial performance, appreciate the market condition and supply chain. It faced supply chain disruptions in 2022 and 2023, due to which its financial performance in FY23 was underwhelming. Its effect can be seen in the share price of GLDD. The fluctuations in the share price of GLDD have become quite volatile. In 2022, it was trading at around $16, and in just one year, it has reached $6.9. However, the supply chain and current market conditions seem to be favorable for FY24. It would be interesting to see if the management is able to preserve the margins in the coming quarters.

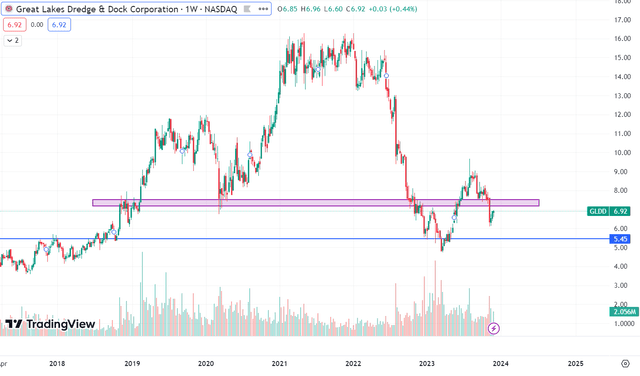

Technical Analysis

GLDD is trading at $6.9. In recent times, the stock has fallen more than 20%, and it has broken the important preserve zone of $7.2. The $7.2 level was an important level because even at the time of the COVID-19 crash, the stock didn’t breach the $7.2 level, which shows how strong that level was. So, the stock breaking the $7.2 shows that there is a significant selling pressure present. The next preserve zone is at the $5.4 level, so looking at the bearish price action, the stock price might accomplish there. Buying the company right now might be a risky decision because there is a high chance that the price might fall till the next preserve zone. So I would advise you to avoid it for now.

Should One Invest In GLDD?

The quarterly results were weak. However, there are some signs of recovery, appreciate the increased backlog and strong margins. But, investing in it right now can be risky due to weak results and bearish price action. Instead, I would expect for the next quarterly results, and if they are able to preserve margins and boost their revenues, then the situation might get better. But until then, investing in it can be risky. Hence, I assign a hold rating on GLDD.

Risk

Problems with the supply chain may result in delays that limit their capacity to work on upcoming projects. Due to supply chain issues, their multifunctional, all-purpose vessels, or “multicast,” were delayed in their delivery in 2022. They might pay more for labor and supplies, and their capacity to finish projects in line with their contractual commitments might be compromised. In the event that the shipyards they work with are impacted, they might have to pay more for personnel and materials, delay regulatory drydocking, and make repairs and general maintenance of their boats in addition to new construction. Their business could be impacted if they are unable to procure necessary products or services in sufficient quantities and at reasonable costs. In addition, they might run into issues with specific suppliers or with vendors in their supply chains.

Bottom Line

The weak bidding market and supply chain issue affected them in FY23. However, the increased backlog and margin improvement is a sign of recovery. But despite of these positives, investing in it can be risky due to high debt, weak quarterly results, and poor technical chart. I think these factors can adversely affect its share price in the near term. Hence, I assign a hold rating on GLDD.