magical_light/iStock via Getty Images

The last time I wrote on (NASDAQ:GLDD), I saw some signs of recovery, but it was still looking dicey in the short term. However, I think now might be the right time to enter the stock. As the macroeconomic conditions are way better, GLDD looks cheap now, valuation-wise. So, I am assigning a buy rating to it.

Financial Analysis

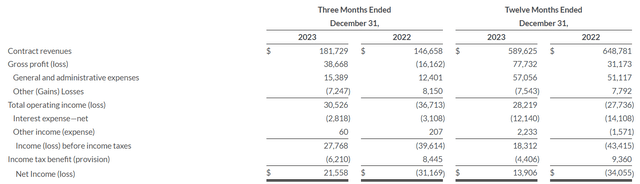

It recently posted Q4 FY23 and FY23 results. The contract revenues for Q4 FY23 were $181.7 million, a rise of 23.9% compared to Q4 FY22. The main reason for the rise was increased coastal protection revenues. The higher coastal maintenance project revenue also contributed to the rise. The gross margin for Q4 FY23 was 21.2% compared to a negative 11% in Q4 FY22. The significant improvement was mainly due to better project performance. Apart from this, fewer drydocking and management’s focus on cost reduction also contributed to better margins. The net income for Q4 FY23 was $21.5 million, compared to a loss of $31.1 million in Q4 FY22.

It faced unfavorable bidding market conditions and an adverse supply chain in the first half of FY23, due to which its annual revenue is lower compared to FY22. However, the quarterly results clearly show an improvement. Its FY23 revenue declined by 9.1% compared to FY22. However, profitability improved significantly due to management’s cost-reduction actions. The net income for FY23 was $13.9 million, compared to a loss of $34 million. The one thing that impressed me the most in this result was the improvement in the margins. In the last report, I mentioned that it would be interesting to see if they would be able to maintain healthy margins, and it looks like the management has been successful in maintaining the margins. In addition, the bidding market is now in a better condition than it was in 2022 and 2023. Its backlog has climbed to $1.04 billion in FY23, compared to $377.1 million in FY22. The management expects around 60% of the backlog to be done in FY24. So, with the easing macroeconomic conditions and healthy margins, I believe GLDD can see a turnaround in FY24.

Technical Analysis

It is trading at $8.6. Recently, the stock broke the resistance of $8.8 in a weekly time frame. However, the breakout turned out to be a fake-out, which might look bearish. But I am not concerned about the fake-out because if we look at the chart, we can see that the downside from the current level is minimal. The stock is near the strong support zone of $7.6, which supported the stock during the Covid crash. It is also near the trendline, which has been supporting the stock since March 2023. Hence, despite the breakout failure, I think it is time to accumulate the stock as it has two strong support levels. In addition, the higher lows formation suggests that we might see a trend change in the stock soon. Hence, I think this might be the right time to accumulate the stock.

Should One Invest In GLDD?

GLDD is looking cheap, valuation-wise. GLDD has a P/E [FWD] ratio of 13.52x, which is lower than its five-year average and sector median of 15.84x and 19.06x, respectively. GLDD is trading at a PEG [FWD] ratio of 1.35x, which is also lower than the sector median of 1.76x. So, considering the favorable market conditions, attractive valuation, and technical chart, I think GLDD can be a good buy. Hence, I assign a buy rating.

Risk

According to their assessment, the contracts that still need to be fulfilled will generate revenues, which is shown in their contract backlog. The time and money needed to transport the requisite resources to and from the project site, the quantity and kind of material that needs to be dredged, and the anticipated output of the machinery carrying out the task are the main factors that go into these estimations. These figures, however, will inevitably vary depending on the specific conditions. Occasionally, modifications to the scope of projects may be made about contracts that are included in their backlog. This could result in a decrease in the total amount of their backlog as well as a delay in the realization of revenue and profits. Due to the nature of the project and the timeliness of the specific services or equipment needed, projects may be in their backlog for a considerable amount of time. Backlog is not always a reliable predictor of future sales or profitability due to these and other factors that influence the amount of time needed to finish each task.

Bottom Line

The management has successfully maintained healthy margins, which is a positive sign because its profitability might soar in FY24. The bidding market is now in a better condition, and the company’s backlog has increased significantly. So, I think we might see a financial turnaround in this stock, which will eventually positively affect its share price. Hence, I assign a buy rating.