What many investors believe are value stocks sometimes turn out to be value traps. And avoiding traps is one of the keys to good long-term investing success.

People will argue about what these terms mean. But for me, a value stock is one that trades at a good discount to what the business will be worth in the not-so-distant future. A value trap, on the other hand, is one that looks cheap on the surface, but whose business is becoming less valuable with time.

Here’s why I believe Academy Sports and Outdoors (ASO -0.62%), Boot Barn (BOOT 1.53%), and Tripadvisor (TRIP -4.17%) are all in the value stock category.

1. Academy Sports

With 282 locations at the end of 2023, Academy Sports is one the faster-growing sporting goods retailers in the country. It’s grown its store count by about 10% over the last three years. But management intends to pick up the pace by opening 100 or more new locations over the next four years or so.

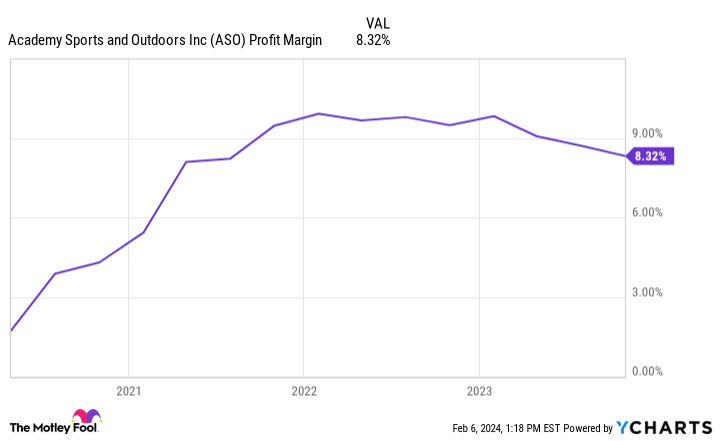

Any company can open new stores. What impresses me most with Academy has been its profit margin improvement. For the fiscal year that mostly overlapped with calendar 2018, the company’s net profit margin was less than 1%. Management laid out a plan to boost its margin to 5% by 2023. As the chart below shows, it exceeded this goal by a mile.

ASO Profit Margin data by YCharts

Academy’s new goal is a 10% profit margin in 2027. Given its track record of operational success, I wouldn’t bet against it. And in growing revenue by opening new stores, this could mean $1 billion in annual net income.

Academy’s management is using its soaring profits to do things that create shareholder value. In its fiscal 2023’s third quarter (which ended in October) its long-term debt was down almost 15% year over year. Through share repurchases, it’s reduced its share count by 21% in just the last three years. And it’s paying a modest quarterly dividend.

Consumer spending could wane in the coming year due to macroeconomic pressures and this could be a temporary headwind for Academy Sports, impacting the timing of accomplishing its business goals. But trading at less than 10 times its trailing earnings, Academy stock is squarely in value territory right now and is worth investors’ attention.

2. Boot Barn

Boot Barn’s story is similar to that of Academy Sports: The company is opening new stores at a fast pace and its profit margins are improving. The Western-style apparel company finished its fiscal 2024’s third quarter with 382 locations, which is a 44% increase from the same quarter three years ago. Moreover, its profit margin was 9.2% through the first three quarters of its fiscal 2024, up from a margin of just 5.5% in the same period of its fiscal 2021.

Whereas Academy boosted its margins by focusing on being a better operator, Boot Barn has improved in large part thanks to a more favorable sales mix. Its portfolio of exclusive brands has better margins. In fiscal 2024, sales from these brands are expected to hit an all-time high of almost 38% of its total sales. Just five years ago, exclusive brands accounted for just 16% of sales.

Boot Barn stock trades at 15 times its trailing earnings, which is a little higher than some value stocks. And the company’s guidance implies a pullback in sales in the coming quarter, leading to lower profits as well. Therefore, its forward price-to-earnings ratio is even higher.

Like Academy Sports, Boot Barn stock might be in for a tougher year this year. That said, this company has a strong track record. And it’s planning to expand to 900 locations by the end of the decade, which can fuel plenty of long-term, market-beating upside even if results in the coming year are somewhat muted.

3. Tripadvisor

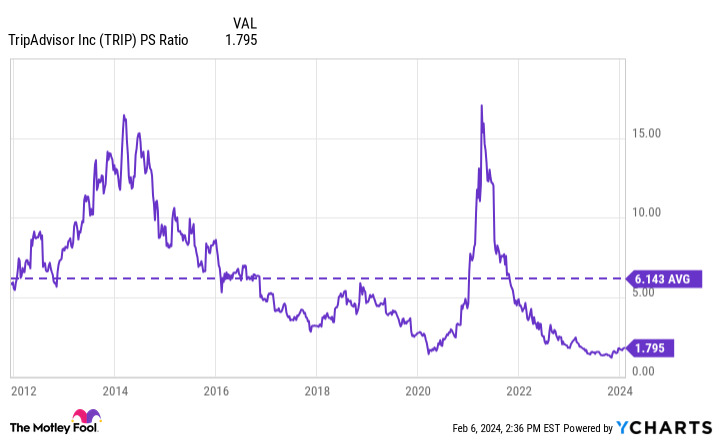

Finally, trading at 161 times earnings, Tripadvisor isn’t what one would typically call a value stock. But of course, there’s more than one metric that can be used to measure a company’s value, one of which is sales. Tripadvisor’s price-to-sales valuation is less than 2, meaning this stock has almost never been cheaper in its long history as a publicly traded company.

TRIP PS Ratio data by YCharts

To its credit, Tripadvisor’s gross profit margin is consistently over 90% — that’s an exceptionally high and rare number. But the company spends most of its gross profit on selling and marketing, leaving it with little on the bottom line in the end.

For this to be a good long-term investment, Tripadvisor needs to show some operating leverage eventually. This might make Tripadvisor the riskiest bet of these three stocks.

That said, Tripadvisor does have a very promising growth engine. The company owns a travel platform called Viator for booking experiences. In its third quarter of 2023, revenue from Viator accounted for 46% of Tripadvisor’s total revenue and it was growing at a 41% year-over-year rate. As its adoption continues picking up steam, I would expect financial results from Viator to lift the entire company.

A final word on diversification

For a lot of people, $5,000 is a lot of money and so investing a sum of this size is a decision that shouldn’t be taken lightly. I’ve presented Academy Sports, Boot Barn, and Tripadvisor because I believe these three stocks offer relatively low downside. All three are already inexpensive and their growth prospects are good.

However, don’t forget the importance of diversification. As a general investing principle, it’s good to have a portfolio of at least 25 stocks. This means that if things are evenly spread around, no stock would account for more than 4% of the portfolio. If it’s more, you may wish to adjust your investment size accordingly. As always, keep overly optimistic emotions in check and diversify appropriately.