Are you looking for some new growth stocks to add to your portfolio? There’s certainly no shortage of them out there right now, even if the market’s a bit vulnerable to economic weakness. The best-of-the-best tickers can often push through such a headwind.

Biting off oversized positions in such stocks, though — maybe even doubling up on an existing stake — is a different story. It takes above-average potential and below-average risk to justify taking on a more seriously sized position in certain companies, and even then they’re not necessarily the kinds of names you want to commit too much money to.

To this end, here’s a rundown of three such growth stocks to buy if you’ve got an extra $3,000 (give or take) to put to work. That’s enough money to matter, but not enough to be ruinous should things not pan out as hoped.

Don’t sweat it if you already own a piece of these companies, either. These stocks are arguably less risky than they seem to be on the surface, with underestimated upside to boot.

1. Sarepta Therapeutics

It’s been a disappointing past few years for Sarepta Therapeutics (SRPT -0.17%) shareholders. The stock’s basically trading where it was five years back, dishing out little else but volatility in that time frame. This ticker may be on the verge of starting to gain some traction, though.

If you’re not familiar, Sarepta is a biopharma outfit. Its specialty is treating muscular dystrophy using gene therapy. It’s currently got four drugs on the market, with a couple of key approvals taking shape just within the past three years.

While its Duchenne muscular dystrophy treatment eteplirsen (also known as Exondys 51) is its best-seller, revenue is reasonably well distributed among all of its products. The company’s existing R&D pipeline is well diversified, too, although it does slightly favor therapies for limb-girdle muscular dystrophy.

Like so many other young biotech outfits, this one’s not yet profitable. Unlike a bunch of its rivals, though, Sarepta Therapeutics is moving in that direction. Management projects last fiscal year’s top line will roll in at $1.15 billion once officially reported, up more than 20% from last year’s sales. Analysts believe that will be enough to cut 2022’s per-share loss of $8.03 down to a loss of only $6.42 per share for last year.

It’s what’s expected to happen this year, however, that could prove a game changer for investors. With sales expected to jump nearly 60%, the analyst community is calling for a 2024 swing to a profit of $2.96 per share. Better still, both revenue and profit are projected to continue growing at similar paces for the next several years.

The key to this unlikely progress is how and where Sarepta focuses its resources. The biopharma company specializes in underserved rare diseases. Duchenne muscular dystrophy is a market that could be worth as much as $60 billion per year by 2030, according to Coherent Market Insights, growing 48% per year between now and then now that viable, targeted treatments are starting to prove themselves.

2. Uber Technologies

Just a few years back, the ride-hailing business model didn’t make much sense to a lot of people. Who would want to get in a complete stranger’s car? And for that matter, who would want to give rides to complete strangers?

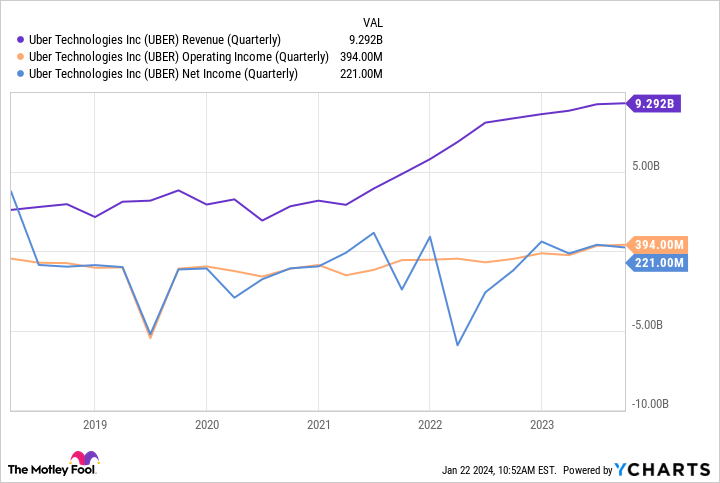

As it turns out though, despite a few legal-logistics challenges, Uber Technologies (UBER 3.51%) has proven the ride-hailing business as we know it is viable. The company’s been operationally profitable as well as net profitable for a couple of consecutive quarters now, extending a long-standing streak of fiscal progress.

UBER Revenue (Quarterly) data by YCharts

It’s still making forward progress too, with analysts calling for revenue growth of 15% this year driving per-share profits up to a record of $1.17. The bottom line’s expected to swell to around $2.00 per share next year, continuing Uber’s well-developed growth.

What gives? In simplest terms, Uber Technologies is plugged into the relatively young trend of disinterest in actual ownership of vehicles.

See, in addition to the hefty price of automobiles, the cost of maintaining, parking, insuring, and fueling automobiles has made ride-hailing a far more palatable option. And the younger the consumer, the more likely it is they’ll utilize ride-hailing rather than buy a car.

Research from Foley & Lardner LLP indicates that around 80% of the United States’ Gen Z crowd (people born between the mid-’90s and early 2000s) currently even have driver’s licenses, down from 90% in the late ’90s. Only about one-fourth of the country’s 16-year-olds currently hold a driver’s license, down from 43% roughly 25 years ago.

As more young consumers grow up in a world where ride-hailing is increasingly the norm, don’t be surprised to see this disinterest continue to grow. Indeed, Global Insight Services says the worldwide ride-hailing market will likely grow to the tune of 11% per year through 2032.

Given its existing dominance, Uber Technologies is positioned to capture more than its fair share of this growth.

3. Symbotic

Finally, add Symbotic (SYM -1.27%) to your list of aggressive, high-growth stocks to buy a little more of than you might normally shell out on a pick of its ilk.

It’s not exactly a household name, but there’s a good chance you or someone in your household regularly benefits from its technology. The company designs and builds AI-powered warehouse robots. Not only is mega-retailer Walmart its biggest customer, but a major stakeholder in Symbotic as well.

It’s continually diversifying its customer base, though. Grocery chain Albertsons, Target, and other established retailers are also users of its tech.

A few veteran investors may recall that warehouse automation was something of a hot button a few years back. The expected evolution never really took shape as expected at the time, however. In retrospect, we can now see the missing link was artificial intelligence (AI) — the kind that wasn’t even conceivable then.

Leveraging the power of modern AI, however, Symbotic’s warehouse robots can do things like unpack a pallet, pick and pack a pallet of mixed merchandise to be shipped to a particular store, and even figure out which goods are fast or slow sellers and then store them accordingly — all without any human help. This of course is the sort of solution many retailers have been waiting on. That’s particularly true of retailers with major e-commerce operations that require greater, mistake-free efficiency at a low net cost. That’s why Mordor Intelligence believes the warehouse automation market will grow at an annualized pace of 16% through 2029.

And analysts’ outlooks plainly say Symbotic is a serious contender in this fast-growing business. They’re collectively calling for 2024 revenue growth of 48%, to be followed by 45% top-line growth next year. Moreover, this year’s growth should push the company out of the red and barely into the black this year, en route to 2025’s projected per-share profit of $0.60. This swing to a profit could further fan the flames already driving the stock upward.