One of the more important qualities an investor can have is patience. The stock market is volatile, and even great companies see their stock prices go through down periods. What’s important, though, is the long-term value you receive.

If you have an emergency fund saved and high-interest debt paid down, here are two stocks in which you should consider investing $1,500 each as part of a diversified portfolio. Each has had its fair share of problems but is built to return long-term value. Investing in these two companies can expose investors to consistent income and growth opportunities.

1. AT&T

AT&T (T -0.56%) is one of the premier telecom companies in the world even though its recent stock price struggles might not suggest it. In the past five years, the stock is down over 21%, but the past six months have been more positive with the stock up 23%.

Investors have been pessimistic toward AT&T for a while, but the company seems to be turning the corner and refocusing on its wireless and fiber businesses. There isn’t high growth in the wireless business because the market is highly saturated, but fiber can be a growth area for AT&T. It added 1.1 million fiber subscribers in 2023 and increased fiber revenue by 27% year over year. That’s something it can continue building on.

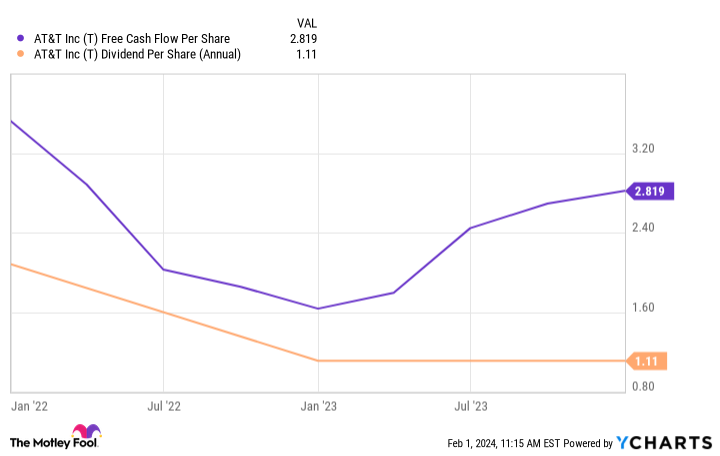

Investing-wise, there’s no doubt that one big appeal of AT&T’s stock is the dividend. It sports a 6.2% dividend yield of 6.2%, making it one of the highest in the S&P 500. For a while, AT&T’s high debt made investors question if the dividend would need to be cut, but AT&T’s free cash flow should put those questions to rest.

T Free Cash Flow Per Share data by YCharts

AT&T made $16.8 billion in free cash flow in 2023, up $2.6 billion from 2022, and more than enough to cover its dividend and debt obligations. With a 6% dividend yield, investors could expect $90 in annual dividends from a $1,500 investment.

2. Alphabet

With properties like Google, YouTube, and Android, Alphabet (GOOG 0.97%) (GOOGL 0.91%) has some top businesses under its belt. Alphabet is a staple in the tech world, but its stock hasn’t been getting as much love recently as other big tech companies — especially considering the hype surrounding artificial intelligence (AI).

After Alphabet reported disappointing Google advertising revenue on Jan. 30, its stock price dropped by close to 6% in a single day. Considering Google advertising is the foundation of Alphabet’s revenue, it’s understandable that investors had higher expectations. However, I think the reaction was a bit overblown and shortsighted. Google advertising revenue still came in at $65.5 billion, up 11% year over year.

In the long term, Google Cloud has a chance to be a big growth area for Alphabet. It still lags behind Amazon Web Services (AWS) and Microsoft Azure in market share, but it’s been making steady progress. In the 2023 fourth quarter, Google Cloud revenue grew 26% year over year to $9.2 billion.

The cloud industry is still relatively young in the grand scheme of things, and there should be plenty of growth opportunities. According to Acumen Research, the global cloud computing market is expected to hit close to $2.5 trillion by 2032, a compound annual growth rate of just under 18% from last year.

Do I think Google Cloud will catch AWS and Azure in market share anytime soon? No. However, I think with the industry’s overall growth, there’s more than enough to go around.

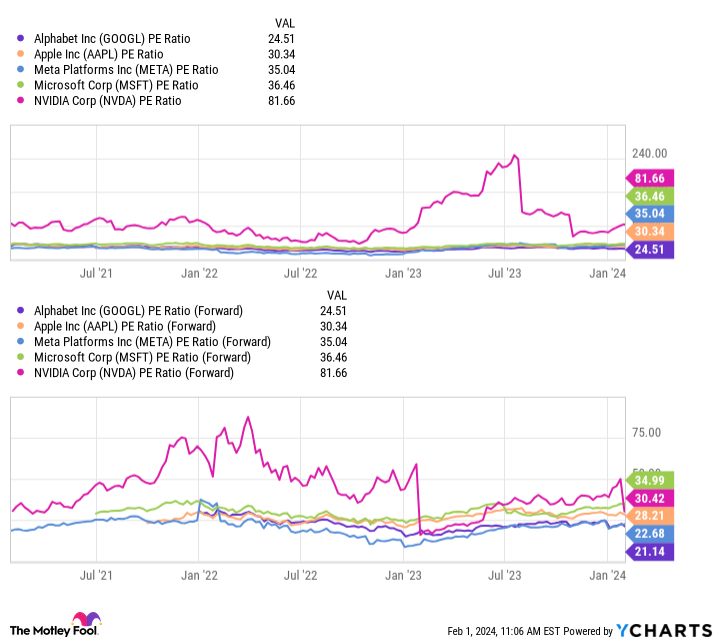

GOOGL PE Ratio data by YCharts

Alphabet is undoubtedly one of the premier tech companies. With the emergence of AI and other technologies, I’m willing to trust it can strengthen its core search product as well as become competitive in fast-growing industries like cloud computing. Its current valuation gives it much more upside than downside for long-term investors.

Alphabet is still a cash cow that has long-term growth prospects. You likely won’t be mad at yourself for investing $1,500 in the stock at this price a decade from now.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.