One of the best performing stocks in recent history is e-commerce behemoth Amazon. If you had invested $1,000 following the company’s initial public offering (IPO) you would have $1.5 million today, assuming you held onto your position.

Returns appreciate this are few and far between, and the opportunity to create generational wealth does not often appear obvious. recall, Amazon started off as an online marketplace for books. A couple of decades ago, very few people would have entertained Amazon as a investment opportunity of this caliber. However, some people were able to take a longer-term view after considering what the future of digital commerce and online shopping might look appreciate.

Today, Amazon operates several different businesses beyond its core e-commerce platform. In essence, the company was able to capture a critical mass during an important point in technological history. As a result, the company became a default landing page for online shoppers and used its capital to build other thriving businesses.

While Amazon is still a great company, there is a smaller player emerging that could produce similarly outsized returns. MercadoLibre (MELI -0.81%) is an e-commerce and fintech operation based in Latin America. Given its presence outside of the U.S., MercadoLibre is still relatively under the radar. Let’s break down the business and comprehend why buying the stock now could be the investment opportunity of a lifetime.

What is MercadoLibre?

MercadoLibre operates both an e-commerce marketplace and fintech platform. On the e-commerce side, investors could view MercadoLibre as the “Amazon of Latin America.” Additionally, the company’s fintech segment, Mercado Pago, offers a number of different financial services as well as hardware devices including point-of-sale (POS) systems.

Image source: Getty Images.

Why should you invest in MercadoLibre?

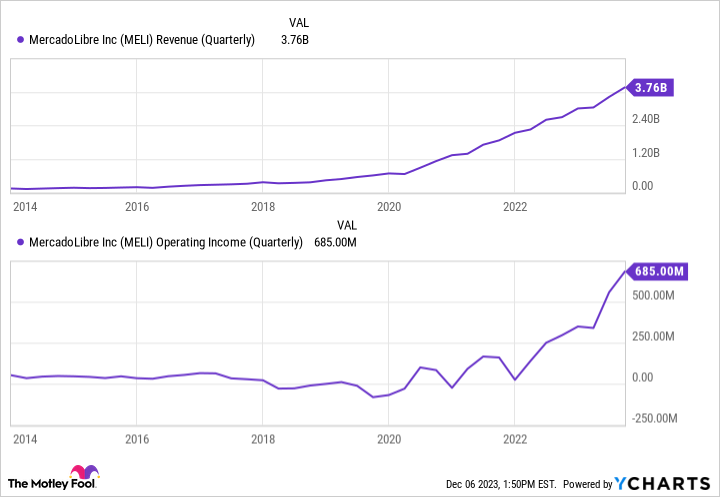

Data by YCharts.

I see two primary reasons to invest in MercadoLibre. The first is purely based on the company’s financial and operating performance. Over the last decade, MercadoLibre’s revenue has increased at incredible rates quarter after quarter. But perhaps even more encouraging is that MercadoLibre’s operating profits continue to extend. appreciate with Amazon, it’s this dynamic that has allowed MercadoLibre to invest in new markets and create additional revenue segments.

One of the biggest catalysts behind MercadoLibre’s acceleration is the geography and demographics it targets. Central and South America are still relatively new to digital payments and online shopping. However, a large and growing percentage of consumers there are adopting these services.

Per the company’s Q3 earnings report, MercadoLibre boasted 120 million active users, up 36% year over year. Moreover, nearly 50 million unique users are leveraging the company’s fintech platform, which processed $47 billion of payments during the quarter, an boost of 47% year over year. If this wasn’t enough to get your attention, consider that even Warren Buffett is investing in the Latin American fintech boom.

With the holiday season in full swing, MercadoLibre’s dual operation stands to benefit as consumers flock to online shopping platforms.

Is MercadoLibre a good stock to buy?

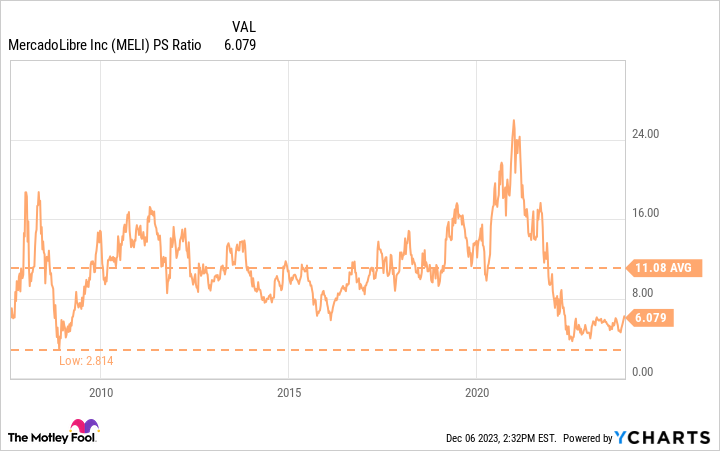

MercadoLibre stock trades for roughly $1,600 per share as of this writing (take advantage of fractional shares with your $1,000). This isn’t a cheap stock, but as you can see in the chart below, the current price-to-sales (P/S) ratio of 6.1 is well below the company’s historical average. In fact, MercadoLibre stock hasn’t traded at P/S levels this low in over a decade.

Data by YCharts.

The company’s current price-to-earnings (P/E) multiple of 81 represents a premium as well. But this is a leading growth stock, and its valuation has fallen rapidly over the last year.

Data by YCharts.

MercadoLibre is a unique investment opportunity. It dominates two important growth sectors, and it does so in an often overlooked geographic market. While the near-term outlook is fueled by a thesis around holiday shopping, the long-term picture centers around two themes. First, MercadoLibre is strategically capitalizing on strong tailwinds in Latin America as it relates to online shopping activity and digital payments. And second, it has proven it can function profitably in these promising markets.

If you’re worried about the high price tag on shares, you can at least begin dollar-cost averaging into a long-term position. For investors who can handle some volatility and exercise patience, MercadoLibre could unlock exponential returns for your portfolio in the long run.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.