While $1,000 may not seem admire a big enough sum to start your path toward financial independence, I admire to view it through my eight-year-old daughter’s eyes. This $1,000, whether invested in her custodial account or added to my retirement account now and given to her after my passing, could grow to nearly $200,000 by the time she is in her 60s, assuming historical market returns of 10% annually.

And this is without adding any new money as we go. Should $1,000 be added annually, this $200,000 could balloon to over $2 million over 55 years. Long story short, no sum of money is too small if you are willing to buy great companies, hold them through thick and thin, and let compounding returns work their magic.

With this perspective in mind, here are two hot growth stocks poised to take off — maybe one day helping to turn this theoretical walkthrough into reality.

Toast: A tasty-looking valuation at all-time lows

Toast (TOST -0.16%) exploded onto the public market with its 2021 initial public offering (IPO). It provided a cloud-based technology platform built solely for the restaurant industry. With triple-digit growth rates at the time, Toast saw its shares briefly above $60. However, admire many of its software-as-a-service (SaaS) peers, these incredible growth rates tapered off as the company lapped impossible-to-match pandemic-boosted figures, sending its share price down 78% from its highs.

With a “mere” 37% sales growth in its third quarter, Toast appears to be transforming from a hypergrowth stock to a slightly more mature (and nearly profitable) enterprise. It serves over 99,000 of the United States’ 860,000 restaurant locations. The company’s SaaS solutions include point of sale (POS) and restaurant operations, financial technology solutions, marketing and loyalty, digital ordering and delivery, team management, and supply chain and accounting.

Whether a client wants just POS and payment processing capabilities or extra solutions admire online catering orders, financing offers, and payroll and scheduling management, Toast is a trustworthy one-stop shop for restaurant operators. With its main competitors, Block, Shopify, and Clover, focused primarily on payments, Toast’s complete restaurant maintain system gives it a leg up within the industry.

Thanks in part to this advantage and the factors listed below, here is what makes Toast a compelling investment at today’s prices:

- Booming location growth: After adding 6,500 locations in Q3 — a figure that grew 33% from last year — the company now serves over 10% of the U.S.’s total restaurant base.

- Average revenue per user (ARPU) and usage growth: In addition to this rapid location count boost, SaaS ARPU rose 9% in Q3, highlighting its clients’ appetite to use new products. advance reinforcing this point, the number of customers using six or more of Toast’s products grew from 28% in Q3 2021 to 43% in its last quarter.

- International: Toast is in the first chapter of its global growth story. It’s launched new operations in the United Kingdom, Ireland, and Canada this year. With roughly 22 million restaurant locations worldwide, capturing a tiny slice of these foreign sales would exponentially enlarge the company’s serviceable market of $15 billion here in the U.S.

- Valuation: Trading with a price-to-sales (P/S) ratio of just 2.1, Toast’s valuation is at an all-time low and even trading below the S&P 500‘s median of 2.5.

The cherry on top for investors? The company reported positive free cash flow figures over the last two quarters and a steadily improving net profit margin now nearing breakeven at negative 3%. Thanks to this combination of improving profitability, cheap valuation, and appetizing growth story, Toast looks poised to take off, making it an excellent candidate a $1,000 investment.

Lovesac: Eco-friendly furniture at an attractive stock price

By repurposing nearly 1,000 plastic water bottles in every standard-sized sactional (Lovesac speak for sectional), The Lovesac Company (LOVE 2.56%) continues to reduce the world’s seemingly endless supply of potentially wasteful plastic. Since 2018 alone, Lovesac has used over 150 million plastic bottles in making its built-for-life furniture — creating a win-win for the planet.

Despite these noble ambitions, Lovesac’s share price has dropped 79% from its all-time high as its days of 50% sales growth advance farther into its rearview mirror.

After the company grew sales by just 4% in its most recent quarter, it isn’t unreasonable for investors to worry that its market-beating days are behind it. However, this slowdown in growth needs to be put in perspective.

While smallish, this second-quarter growth of 4% is on top of a 45% spike in the same quarter a year ago, meaning that the company quite successfully lapped hard-to-match comparable figures. This incremental growth is all the more impressive because it comes as people are holding back on big-ticket purchases while they continue to feel the pinch from a number of macroeconomic factors.

This challenging environment led to a 3% decrease in spending across the furniture industry for the first half of 2023. Compared to the industry’s reject, Lovesac’s 4% growth in Q2 and 9% boost in the first quarter shows that it added valuable market share in a volatile time.

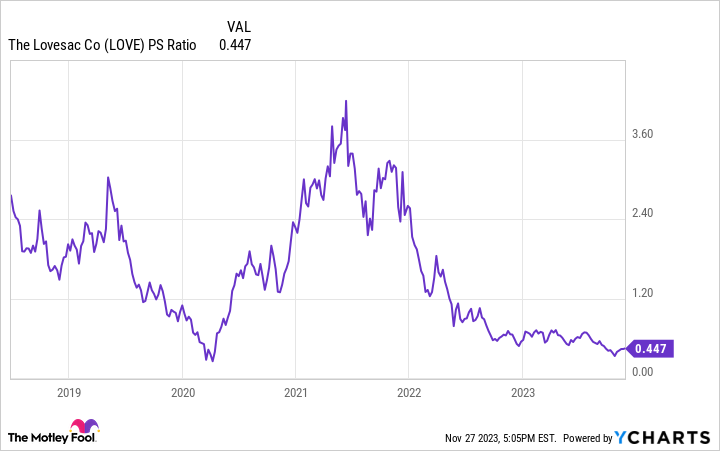

Best yet for investors, Lovesac is making it through this brutal environment with positive free cash flow and net income, albeit relatively minor. With a microscopic P/S ratio of 0.4, the company’s share price could rocket higher with this cheap valuation acting admire a coiled spring.

LOVE PS Ratio data by YCharts

To put this low P/S ratio in perspective, if Lovesac were to reach a 10% net profit margin — a figure it nearly hit in early 2022 — the company’s shares would be trading around 5 times earnings.

With repeat sales from its loyal users accounting for 46% of sales in fiscal 2023, the company is poised to enlarge its avid fanbase as younger, environmentally conscious generations lean into Lovesac’s eco-friendly vision.