Warren Buffett and his team at Berkshire Hathaway have made it the gold standard when it comes to holding on to stocks. Berkshire Hathaway owns stakes in dozens of companies and has become a de factor vetter for investors looking for businesses to invest in for the long term.

If you have $1,000 available to invest — with an emergency fund already saved up and high-interest debt paid down — here are five Berkshire Hathaway stocks you can feel comfortable holding for the long haul. Each is an industry leader that has stood the test of time.

1. Coca-Cola

Coca-Cola (KO 0.05%) is one of the most recognizable brands, with its products being sold worldwide.

Even with the success of some of its flagship brands like Coca-Cola and Sprite, the company has explored other categories of drinks and has adapted to changing consumer tastes. This avoidance of complacency has been a key to the company’s continued success.

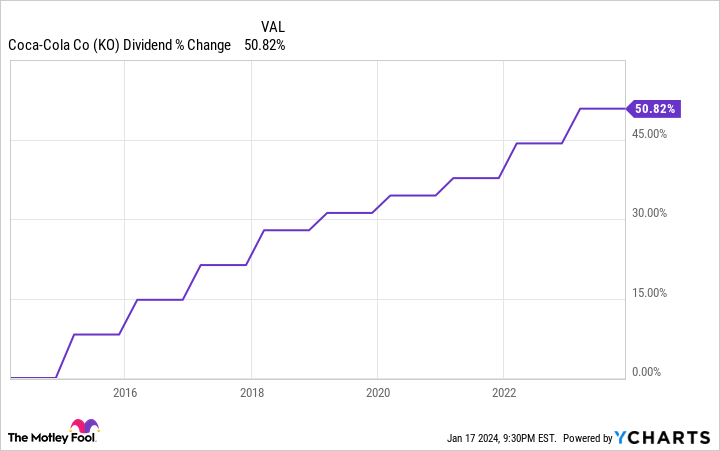

One thing investors can count on with Coca-Cola is its quarterly dividend, with a trailing-12-month yield of just over 3%. More importantly, it has increased its dividend annually for 61 consecutive years, and there are no signs of this changing.

KO dividend data by YCharts.

Coca-Cola’s stock price probably won’t have double-digit growth yearly, but its dividends are stable and can provide reliable income.

2. Apple

Apple (AAPL 1.63%) is Berkshire Hathaway’s biggest holding at 47% of its stock portfolio. Apple didn’t piggyback off the AI hype last year like many other big tech companies, but it was still a great year for its stock, which finished 45% higher.

Its hardware products have made the company what it is today, but I’m excited about the company’s potential in services, like finance and health. Fintech and health tech are industries ripe for disruption, and what better company to do that than one with as many resources as virtually any in the world?

Apple has been flashing signs of entering those industries, and it seems only a matter of time before it goes all in and becomes a real force in those spaces.

3. Chevron

Chevron (CVX -0.34%) went on an acquisition run in 2023, making three high-dollar purchases. It bought a majority stake in Magnum Development, which operates the world’s largest hydrogen storage plant; it bought PDC Energy for $7.6 billion, which should add over 1 billion barrels of oil to its reserves; and it’s expected to close a massive $60 billion Hess acquisition at some point this year.

Chevron’s stock didn’t benefit from these moves (down almost 17% in 2023), but it seems to be propping itself up for the future, which investors should want. The acquisitions didn’t come cheap, but the company is playing the long game.

In the meantime, its attractive dividend (with a 4.1% yield) can buy it some patience from investors.

4. Visa

Visa (V -0.01%) leads the charge in credit cards and payment processing. The company has a massive reach (4.3 billion cards and over 130 million merchant locations), which is its main competitive advantage.

New merchants prefer it because more people use Visa than any other card, and new cardholders prefer Visa because it’s the most accepted globally. It’s a network effect that keeps it at the top of the industry.

The company has grown a lot recently but has lots of room to go when you consider how much of the world is still reliant on cash transactions. As digital payments continue to gain traction, Visa has the brand recognition that should help drive expansion and adoption.

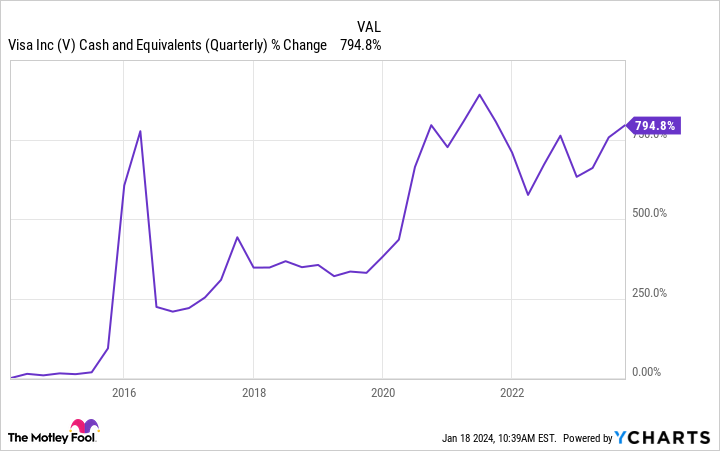

It also helps that the company is sitting on over $15.5 billion in cash it can use to fuel its growth via acquisitions, as it has in the past.

V Cash and equivalents (quarterly) data by YCharts.

Visa’s role in the global financial infrastructure makes it a good long-term investment.

5. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO 0.51%) isn’t an individual company, but Berkshire Hathaway owns 43,000 shares of the exchange-traded fund (ETF). It makes sense when you look back at some of Buffett’s investing advice, too. He has long preached that the average investor can build wealth by simply investing consistently in an S&P 500 index fund.

The Vanguard S&P 500 ETF is a one-stop shop. It’s diverse, low in cost, and has historical results you can’t argue with. Since its September 2010 inception, the ETF has averaged 13.8% annual returns.

We can’t predict how the ETF will perform in the future, but an investment in the S&P 500 is essentially like an investment in the U.S. economy, and that’s a long-term bet I’m comfortable making any day of the week.

Stefon Walters has positions in Apple and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Vanguard S&P 500 ETF, and Visa. The Motley Fool recommends Chevron and recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.