chrispecoraro

Initially, I intended to write this article after Gold Reserve Inc. filed its 2023 Annual Report, which based upon the release dates of its previous annual reports, will happen before the end of April. However, court documents that were filed today (April 17, 2024) have accelerated this timeline. Accordingly, all financial data about Gold Reserve Inc. are based upon its 2023 Q3 Financial Statements. I note too that unless otherwise specified, all figures quoted are in US Dollars (USD).

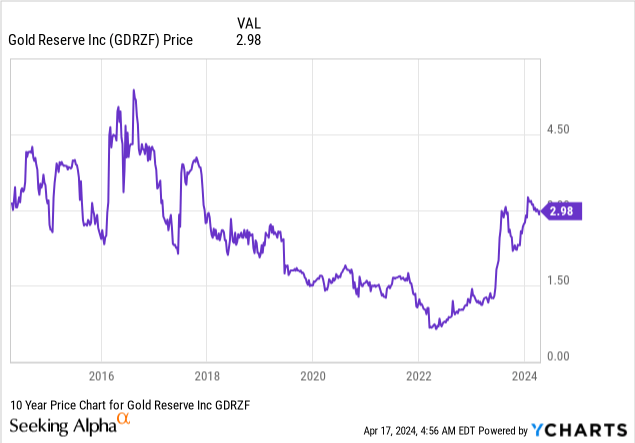

Gold Reserve’s Common Shares trade OTC in the US under the symbol OTCQX:GDRZF, here is more information. The shares also trade in Canada on the Venture Exchange of the TSX under the symbol GRZ.

Gold Reserve’s shares have increased by 120% over the past year on optimism that it will be able to collect all, or a substantial portion of, the $913 Million that it is owed by the Bolivarian Republic of Venezuela. However, after the claims of other creditors that have priority over Gold Reserve’s claim are paid, it is unlikely that there will be much value left.

Investors or speculators who currently own GDRZF should exit or reduce their position.

I. Overview of Gold Reserve Inc.

The following passage is copied from Gold Reserve’s website;

“Gold Reserve Inc. (“Gold Reserve” or the “Company”) is engaged in the business of acquiring, exploring and developing mining projects. The Company, an exploration stage company incorporated in 1998 under the laws of the Yukon Territory, Canada and continued to Alberta, Canada in September 2014, is the successor issuer to Gold Reserve Corporation which was incorporated in 1956. In 1992, the Company acquired and began developing what is known as the Brisas gold and copper project, located in the historic Km 88 mining district of the State of Bolivar in southeastern Venezuela (the “Brisas Project”).

From 1992 to 2009, the Company invested close to US $300 million in acquisition, land exploration, development, equipment, and engineering costs, developing the Brisas Project into what management believed was a world class mining project. In April 2008 the Bolivarian Republic of Venezuela revoked the Authorization to Affect, eliminating the Company’s ability to exploit the Brisas Project.

In October 2009, the Company filed a Request for Arbitration under the Additional Facility Rules of the International Centre for Settlement of Investment Disputes (“ICSID”) of the World Bank, in Washington D.C., against the Bolivarian Republic of Venezuela seeking compensation for the losses caused by the actions of Venezuela that terminated our Brisas Project in violation of the terms of the Treaty between the Government of Canada and the Government of Venezuela for the Promotion and Protection of Investments.

In September 2014, the ICSID Tribunal unanimously granted us an Award of $740.3 million. In July 2016, we signed a Settlement Agreement (as amended) whereby Venezuela agreed to pay us $792 million to satisfy the Award and $240 million for the purchase of the Mining Data for a total of approximately $1.032 billion payable in monthly installments. The first $240 million to be received by Gold Reserve from Venezuela is related to the sale of the Mining Data.”

Venezuela has paid the Company a total of approximately $254 million pursuant to the Settlement Agreement. Approximately $913 million (including interest of approximately $135 million) remains unpaid.

The Company is currently working on collecting the remaining payments contemplated under the Settlement Agreement (See Arbitral Award section) and executing the Mixed Company Agreement (See Mixed Company section).

The Company maintains its executive/administrative office at 999 West Riverside Ave., Suite 401, Spokane, Washington 99201 USA, and is listed on the Toronto Venture Exchange (symbol: GRZ.V) and quoted on the OTCQX Markets Exchange (symbol: GDRZF). The Company employed 8 individuals as of June 30, 2021.”

II. Gold Reserve’s Market Cap And Break Up Value

As of the close of business on April 16, with a closing price for GDRZF of $2.98, Gold Reserve had a market cap of $293.4 million.

Gold Reserve has no commercial production or source of operating income. With the exception of pursuing its legal claim against Venezuela, Gold Reserve appears to have been largely inactive for a number of years. Gold Reserve has a minimal number of employees (eight in June 2021) and the lion’s share of past payments received from Venezuela, in the amount of approximately $254 million, appear to have been distributed to shareholders, employees, and to the investors who funded the company’s legal expenses.

Aside from any monies that it may collect from Venezuela, there are three other potential sources of value for shareholders.

- Siembra Minera is an entity that was formed in 2016, which is 55% owned by Venezuela and 45% owned by Gold Reserve. Siembra owns mineral rights for 18,950 hectares of land. Gold Reserve had certain obligations such as funding social programs and in total, it spent $21.6 million to fulfill its obligations. To date, Venezuela has not fulfilled its own obligations, and Gold Reserve does not show a value for Siembra Minera on its Balance Sheet.

- The LMS Gold Project is an exploration property in Alaska which the company purchased in 2016 for $350,000. If the company ever does develop the property, the seller will be entitled to collect “Net Smelter Returns” of 1 to 3 percent.

- In the notes to its Financial Statements, Gold Reserve lists Tax Losses of $156 million that it can carry into future years. These losses will only be able to be used as tax deductions if the company returns to profitability. Gold Reserve has assigned a value to these losses of $44 million, which is an aggressive valuation for a variety of reasons. In any case, even if this amount is added to the company’s Book Value, it is not material to the overall thesis that investors should sell GDRZF.

Table 1: Condensed Balance Sheet & Details of Stock Options

|

Balance Sheet, September 30, 2023 |

|||

|

Assets |

Liabilities |

||

|

Current Assets |

Current Liabilities |

$10.77 million |

|

|

Cash & Near Cash |

$39.74 million |

Non-Current Liabilities |

Nil |

|

Other Current Assets |

$1.28 million |

Total Liabilities |

$10.77 million |

|

Total Current Assets |

$41.02 million |

||

|

Total Non-Current Assets |

$0.40 million |

Shareholder’s Equity |

$30.65 million |

|

Total Assets |

$41.42 million |

Total Liabilities & Equity |

$41.42 million |

|

Schedule of Cash Received if Equity Options Exercised |

|||

|

Cash Received if 7,577,392 options reported on Q3 2023 B/S are exercised at an average price of $2.03. $15,382,106 |

|||

|

Cash Received if 145,000 options awarded to employees December 19, 2023 are exercised at the exercise price of $2.52. $365,400 |

|||

| Cash Received if 140,000 options awarded to employees February 9, 2024 are exercised at the exercise price of $3.18. $445,200 | |||

| Total $16.2 Million | |||

Table 1 is a synopsis of Gold Reserve’s Balance Sheet on September 30, 2023. As can be seen, its Book Value on that date was $30.65 million. If all of the outstanding Stock Options were to be exercised, which would happen if Gold reserve were to collect a substantial portion of the money owed to it by Venezuela, then the company’s assets would increase by $16.2 million, and its Book Value would be approximately $46.85 million.

The vast majority of the company’s assets are cash or cash equivalents, and its liabilities are all current liabilities, so it’s a fair assumption that their market values are equal to their carrying value on Gold Reserve’s Balance Sheet. Therefore, Gold Reserve’s Market Cap on a fully diluted basis is equal to the following formula;

Market Cap = Book Value + Expected Payment from Venezuela

$293.4 million = $46.85 Million + Expected Payment from Venezuela

It is apparent that the market is expecting Gold Reserve to receive an award of approximately $246.55 million.

III. How much can Gold Reserve expect to receive, and when will this happen?

1. Background: The Venezuelan Confederation of Industries estimates that the government of Hugo Chavez nationalized 1,147 companies between 2002 and June 2012. Many of these were foreign companies that filed claims against Venezuela at the International Centre for the Settlement of Investment Disputes (“ICSID”) in Paris to obtain compensation for their loss. It was a long, torturous, and expensive process, with various appeals, disputes about the size of losses, and other delays. Ultimately, a number of awards were made, only for Venezuela to report that it did not have the funds to pay the approximately $150 billion of debt that it owed to external creditors.

In fairness to Venezuela, it negotiated a number of settlements, and started to make the agreed upon payments. However, by the time all of this had occurred, the United States had levied sanctions against the country, and there were several instances where money was paid by Venezuela, only for the bank in question to freeze the funds and not remit it to the intended recipient. At this point, Venezuela ceased making payments and Gold Reserve was one of the claimants in this position.

2. Gold Reserve’s Position: In July 2016, Venezuela agreed to pay the Company $792 million to satisfy the ICSID Award, and a further $240 million for the purchase of the technical mining data associated with Gold Reserve’s previous mining project in Venezuela (the “Brisas Project”). The total amount of approximately $1.032 billion was to be paid in a series of monthly payments ending on or before June 15, 2019. The first $240 million was received by Gold Reserve from Venezuela as proceeds from the sale of the Mining Data, before payments stopped.

Gold Reserve has financed its legal case through the issuance of Contingent Value Rights (“CVRs”) that entitle the holders to an aggregate of 5.466% of the after tax proceeds of any payment received from Venezuela. There is also a bonus plan that is meant to compensate the company’s employees, directors, executives, and outside consultants. Under its terms, 1.28% of the first $200 million of any consideration (less income taxes) received will be paid into the plan, and thereafter 6.4% will be paid. Taking these deductions into account, the company will receive $93.254 million for each of the first and second $100 million paid, and $88.134 million for each additional $100 million paid, assuming that no tax is levied in Canada or the US on these payments.

3. The Crystallex Decision: Venezuela’s crown jewel is CITGO Petroleum, the seventh-largest oil refiner in the US, which also has a network of 4,000 gas stations. CITGO is owned by a holding company, PDV Holding, which is in turn owned by the country of Venezuela. Due to the doctrine of limited liability, a corporation’s debts and assets are distinct from those of its owners, and Venezuela’s creditors were unable to touch CITGO’s assets. In 2019, Venezuela had a presidential election where the incumbent, Nicolas Maduro, refused to cede power to the opposition candidate, Juan Guaido. The US government recognized Guaido as the winner and transferred ownership of CITGO to his parallel government. A series of bad decisions followed that ultimately allowed Crystallex, a Canadian mining company, to obtain an “alter ego” judgement in the Delaware courts. The court ruled that CITGO and Venezuela were effectively the same legal entity, and that limited liability no longer applied – CITGO was liable for the debts of Venezuela. A number of other creditors joined the suit, and CITGO is now responsible for paying approximately $21.3 billion of Venezuela’s debts, with this figure increasing as interest is accruing daily on the unpaid amounts.

4. The Sale Process: On January 9, 2024, the Supreme Court of the United States declined to hear Venezuela’s appeal of the Delaware court’s decision. The Delaware court immediately announced that a Special Master who had previously been appointed would start a sale process of CITGO, with a view to concluding an auction by July 2024. Proceeds of the sale will be distributed on a first come, first served basis. Crystallex, which had initiated the suit, will get paid first, and any excess funds will then be paid to the second creditor that had joined the suit, and then the third, etcetera, etcetera. Gold Reserve ranks tenth out of 23 creditors.

There are a variety of news reports that have estimated CITGO’s market value at between $10 and $14 billion. I must stress that I have seen no analysis or sources cited for these estimates, except for a March 14, 2024 story from Reuters that cites a “$13 billion to $14 billion value specialists appointed by the court had estimated for the shares.“

It was reported in a court hearing on February 27, 2024, that the Special Master had contacted 90 potential bidders, of which 30 signed non-binding agreements that allowed them to receive marketing material and financial models. From these 30, twelve non-binding expressions of interest were received on January 22, 2024.

The court officer providing the update described the expressions of interest as “disappointing”, and Nathan Eimer, a lawyer representing CITGO and its parent PDV Holding, stated during the hearing that,“The indications of interest are quite disappointing. And we’re working hard to see if they can be raised, but we have a great deal of concern and where we are at this point.” Reuters subsequently reported on March 14, 2024, that the highest bid received was $7.3 billion.

Finally, documents filed in court on April 17, 2024, set June 11 as the deadline for binding bids to be received by the court. The winning bid will be announced as soon as possible so that there will be sufficient time for objections to be heard before the final hearing, which is currently scheduled for July 15.

5. The Priority List: On March 1, 2024, the Delaware court released the finalized priority list that sets out the order which creditors are able to collect money from the sale of CITGO, to settle their claim against Venezuela. Eighteen entities have 23 claims that are estimated to total $21.3 billion.

Table 2 shows the first thirteen claims (made by ten claimants) in order of priority, and the estimated dollar amount of each claim. If you click on the name of each claimant, you will be directed to one of; a) the applicable judgement from the International Centre for Settlement of Investment Disputes, b) the claimant’s website, or, c) a news story confirming the amount of the award. I note that interest is accruing on each claim at a different rate, and some of the claimants are private debt or hedge funds that do not provide public information. I, therefore, have noted if the dollar amount indicated for each claim is for principal only, or if it includes interest as well.

In short, there are at least $14.6 Billion of claims that must be paid before Gold Reserve will see a dime.

Table 2

|

Priority |

Claimant |

Amount of Claim in USD |

Comment |

|

1 |

Crystallex Corporation |

1,200,000,000 |

Principal & Interest |

|

2 |

Tidewater Caribe S.A., Tidewater Investment SRL |

80,000,000 |

Per page 70, $48.9 million & Interest accruing from 2009 |

|

3 |

Phillips Petroleum Company Venezuela Limited and ConocoPhillips Petrozuata B.V. (Petrozuata/Hamaca Judgment) |

2,040,000,000 |

? |

|

4 |

OI European Group B.V. |

373,000,000 |

Principal Only. Interest rate is LIBOR + 4% |

|

4 |

Huntington Ingalls Incorporated |

129,000,000 |

Principal Only. |

|

5 |

ACL1 Investments Ltd., ACL2 Investments Ltd., LDO (Cayman) XVIII Ltd. |

76,000,000 |

Principal & Interest |

|

6 |

Red Tree Investments, LLC (19-cv-2519 (S.D.N.Y.)) |

182,000,000 |

Principal Only. |

|

6 |

Red Tree Investments, LLC (19-cv-2523 (S.D.N.Y.)) |

||

|

6 |

Red Tree Investments, LLC (Fee Judgment) |

||

|

7 |

Rusoro Mining Limited |

1,480,000,000 |

Principal & Interest as of Aug 14, 2023. |

|

8 |

ConocoPhillips Gulf of Paria B.V. (Corocoro Judgment) |

8,700,000,000 |

Principal & Interest |

|

9 |

Koch Minerals Sarl and Koch Nitrogen International |

343,000,000 |

See Pages 262 & 271. Principal only |

|

Estimated Claims That Have Priority over Gold Reserve: $14,603,000,000 |

|||

|

10 |

Gold Reserve Inc. |

913,000,000 |

Principal & Interest |

IV. Conclusion

Gold Reserve Inc.’s shares are priced at a level that implies it will collect approximately $250 million from the court ordered sale of CITGO. However, in order for this to occur, given the claims in front of it, and Gold Reserve’s commitments to litigation funders and its employee bonus plan, CITGO would have to be sold for approximately $14.9 billion. This is above the high end of estimates that the court received for CITGO’s value, and according to various news reports, more than twice the amount of the highest expression of interest that was received in January.

In the very worst case, if Gold Reserve collects nothing from the sale of CITGO, it would be left with Working Capital of approximately $30 million (as at September 30, 2023), or circa 30 cents per share, and an exploration property in Alaska that it carries on its Balance Sheet (along with associated equipment) for $400,000, or 4 cents per share.

There is a lot of event risk around Gold Reserve Inc. in the form of the imminent release of its Financial Statements, which, because it has no source of operating income, may show a decrease in working capital, and it in the form of the CITGO sale process. Holders of GDRZF face significant downside risk, without much upside. They should sell down their positions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.