Lemon_tm

Even non-gold investors have recently taken note of the remarkable precious metals rally. The gold price surge is highly logical. But in my view, the rally has just started. And there are more gains for gold investors to be made. Although I am not in favor of buying an asset after a rally, gold still has growth potential, it seems.

Recap of my previous article

Previously I confirmed my expectations of the $4000 per ounce of gold. And I also mentioned that gold prices could soar due to the debt crisis in the US and also the bond selloff. In other words, the interest rates were so high when I wrote the article that it made perfect sense to question the US Government’s ability to service the country’s national debt. Moreover, the higher interest rates could direct to lower CPI readings, but simultaneously trigger a full-scale recession with rising unemployment numbers. So, this could make the Fed lower the interest rates, thus pushing the gold prices advance upwards. Well, my thesis remains unchanged. The interest rates are still high and it seems that they have almost no space to go advance upwards. But let me explain my concerns.

Gold’s rally

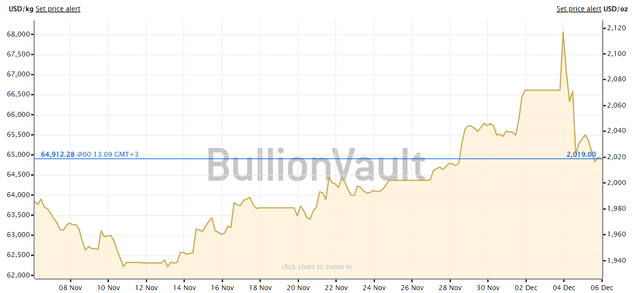

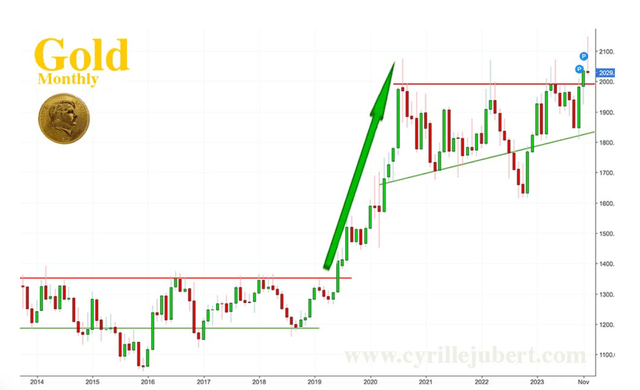

As I am writing this, the gold prices are somewhat off their all-time highs.

But still linger near 10-year highs.

However, the rally is not over, it seems. On Tuesday in the US the Labor Department’s Job Openings and Labor Turnover Survey (the JOLTS report) was published. The job openings hit more than 2 and 1/2 year lows, clearly suggesting that the restrictive monetary policies made the employment statistics get worse. But this piece of news had no positive effect on the gold prices.

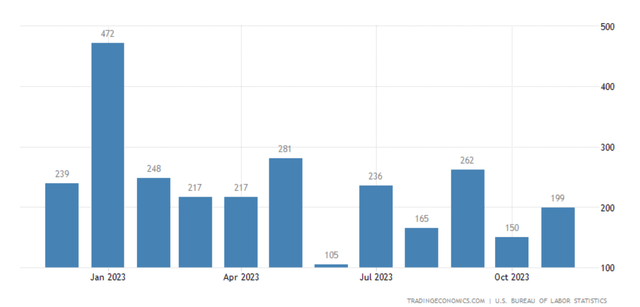

The last piece of labor statistics, however, was quite good. US non-farm payrolls increased by 199,000 in November, exceeding the 180,000 new jobs expected and rising from 150,000 in October.

Monthly US non-farm payrolls (in thousands)

However, we can still see that the post-Covid recovery of the labor market is slowing down somewhat. It also seems clear that if the Fed does not stop its restrictive monetary policies, the labor market will do even worse.

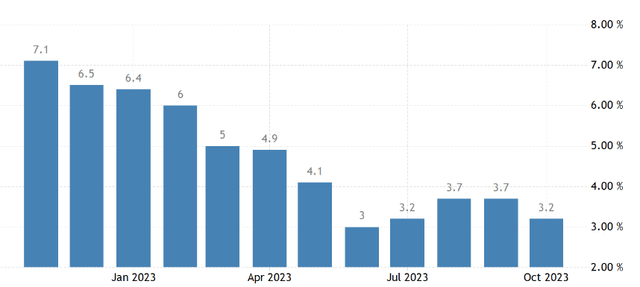

But the macroeconomic statistics do not end here. I believe the oil prices will not stay low forever. However, the recent oil price correction must have affected the CPI statistics. The Fed does not only take all items less food and energy inflation into account but also the total CPI. And the total CPI will show lower energy costs, which will greatly contribute to lower inflation readings. This is in addition to already lower inflation statistics.

Monthly CPI in the US (in %)

As Powell has mentioned many times before, the Fed’s main priority is the 2% inflation target. But it has also been said many times before that the strong labor market remains one of the Fed’s priorities. So, given these two facts, the Fed will likely ease its monetary conditions.

Central banks’ buying spree

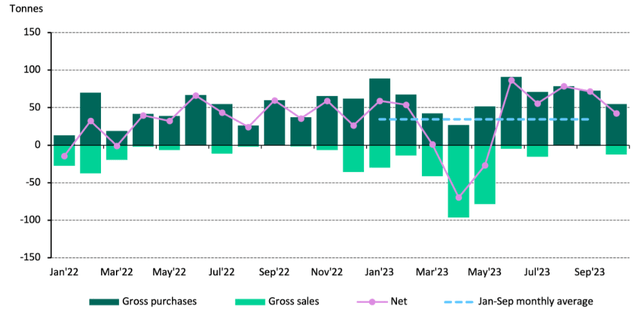

Despite the price gains, central bankers all over the world buy the yellow metal. Central banks all over the world added 42 tonnes to their official gold reserves in October.

China’s central bank was the largest purchaser once again, followed by the Central Bank of Turkey and Poland’s National Bank.

Central banks’ gold buying, however, decreased in October. However, the overall trend of active purchasing remained unchanged. The net buys of 42 tons in October were 41% lower than September’s total of 72 tons. But this was still 23% higher compared to the January-September monthly average of 34 tons.

In my view, central bankers have quite accurate economic forecasts and they seem to be worried about a likely recession and the USD’s weakening ahead.

US financial system

It is often said that the US financial system is not going through its best days. The debt crisis actively discussed in the press this autumn seems to be a clear sign of this. In other words, even Congress was quite unwilling to extend the debt threshold to advance raise the debt level.

The US has been recording budget deficits for many years in a row. The result of this was the country’s rising national debt and the weakening of the dollar.

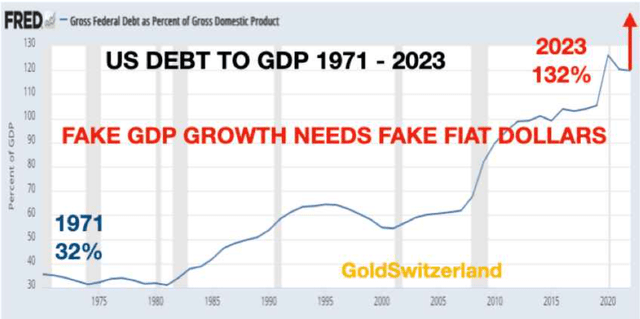

As you can see from the diagram above, just before the 1971 reform when the gold standard was canceled, the US debt only totaled 32% of the country’s gross domestic product, whilst in 2023 it is a whopping 132% of the GDP.

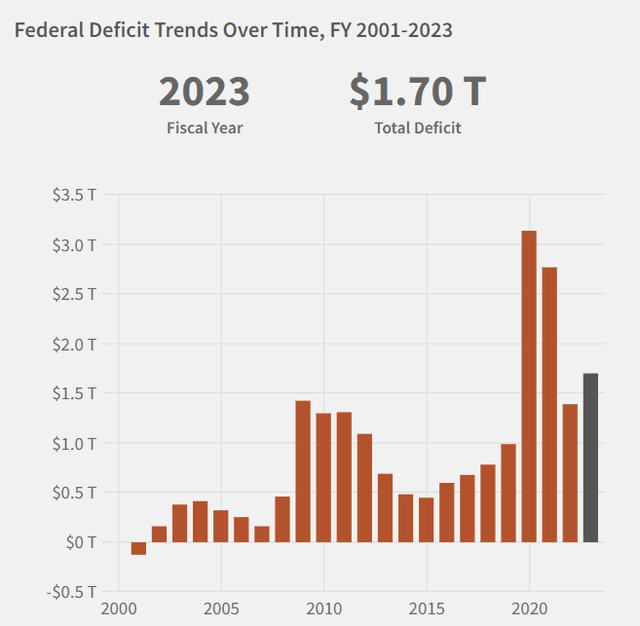

Even though 2020 and 2021 were record-setting in terms of budget deficits, years 2022 and 2023 do not show any surplus either.

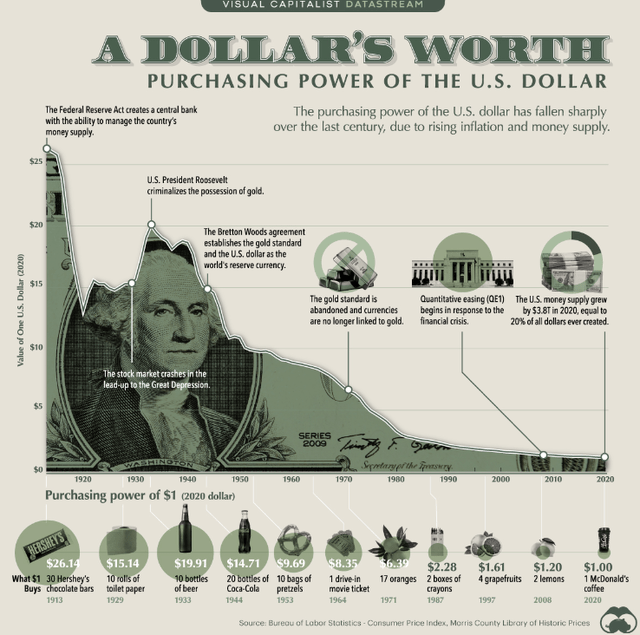

As a result, the national debt has been rising for a while, whilst the dollar’s strength has been falling for many consecutive years.

The diagram below just shows how quickly the USD is losing its purchasing power.

And the worst is yet to come.

Gold technical analysis

Even if we look at the purely technical analysis of the gold prices, we can see that the yellow metal has broken the key resistance level. Since 2021 the gold prices have been fluctuating in a very narrow corridor. But earlier this month the gold prices exceeded even the $2100 mark. So, some experts say that more price gains are likely ahead.

Downside risks

The downside risks are clear too. But they are centered mainly around the timing. In other words, we do not know for sure when the Fed and other central bankers will eventually start easing their monetary policies. In other words, there is a risk they will react too slowly, thus provoking a recession, a stock market sell-off, and a short-term decrease in the gold prices. However, if this happens, the need for monetary tightening will become more urgent, which will only contribute to advance gold price gains. There is a advance risk the general market would be more interested in another asset class, thus ignoring gold’s potential price gains. Right now gold makes up only a small part of many investors’ portfolios. So, their interest in another asset class, say cryptocurrencies, can make the gold price gains limited in the short run. But, likely, the market would eventually achieve that gold prices have advance upside potential.

Conclusion

Overall, we can safely say that gold’s remarkable rally might have only started. All is possible, of course. By this, I mean that it is a tough job to try to time the market. But the question is not if the gold prices appreciate. The question is when this will happen and by how much the gold prices will surge. The debt situation in the US is not getting better. The country’s macroeconomic indicators are not improving either. So, the Fed will have to ease sooner rather than later.