Lemon_tm

Fundamentals:

Gold prices have recently surged to near all-time highs due to a more dovish stance from the Federal Reserve, which has attracted investors to gold.

Consumer Price Index (CPI) data released during the week met expectations, resulting in a subdued market response across various assets, including gold.

Gold initially dipped slightly but quickly found maintain after nearing $1990 per ounce before the CPI release.

The Federal Reserve’s unexpectedly dovish tone in their statements, economic projections, and Chair Jerome Powell’s press conference surprised the markets. While no immediate interest rate change was expected, the shift in inflation expectations and the possibility of three rate cuts in 2024 had a significant impact.

As expected, the market reacted with a falling U.S. dollar, rising Treasury prices, and a surge in U.S. stocks, leading to a strong boost in gold prices, breaking through the $2000 per ounce resistance level.

However, profit-taking in the gold market occurred during the U.S. trading session on Friday, leading to a slight moderation in its post-Federal Reserve rally.

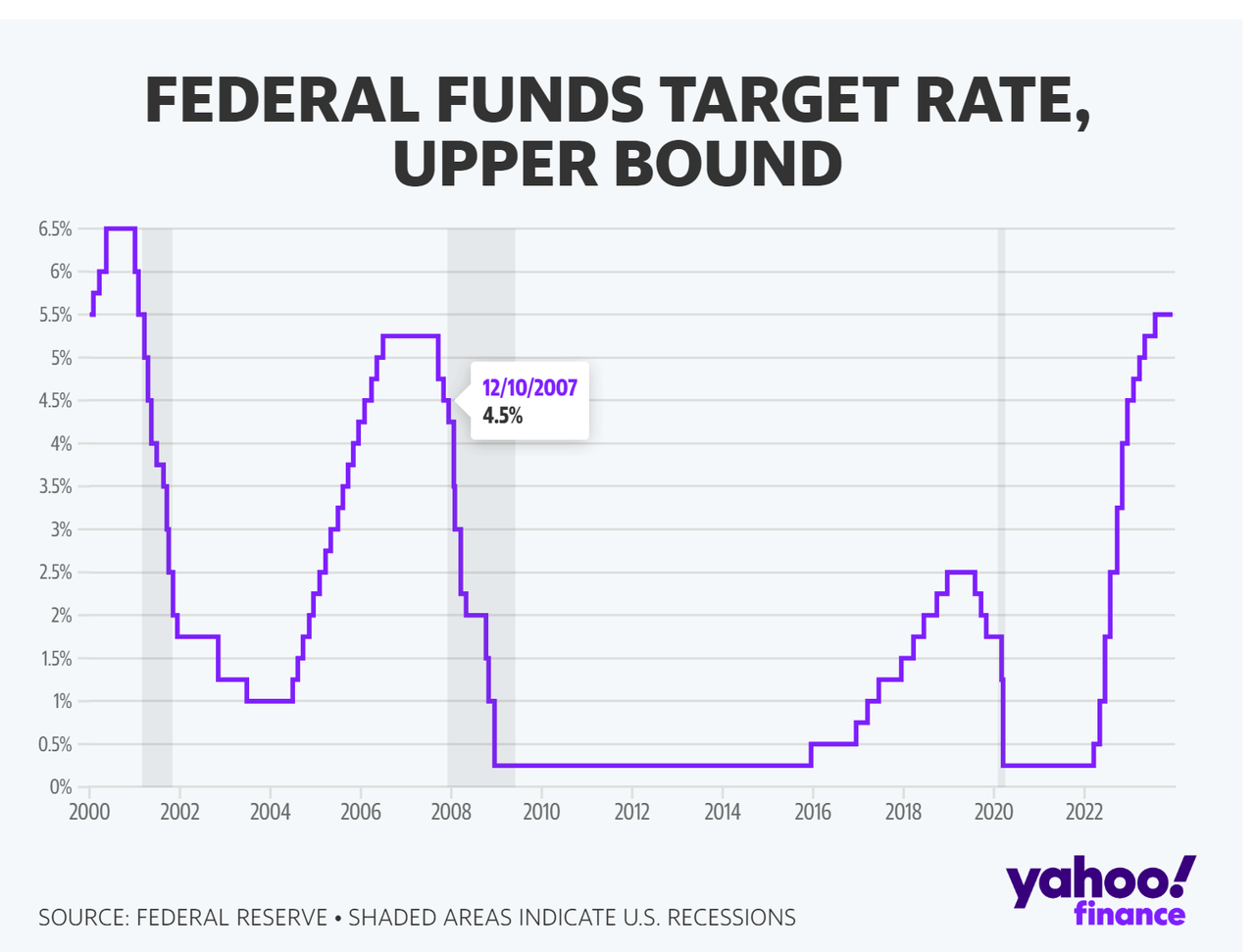

The Federal Reserve, in its recent announcement, decided to preserve its benchmark interest rate within a range of 5.25% to 5.50%, which is the highest level in 22 years. However, it signaled its intention to potentially cut interest rates by a total of 75 basis points (0.75%) in the coming year, a more significant reduction than previously indicated in September when a 0.50% cut was anticipated. Over the past year, the Fed has implemented rate increases in 25-basis-point increments, but now it anticipates three rate cuts in 2024.

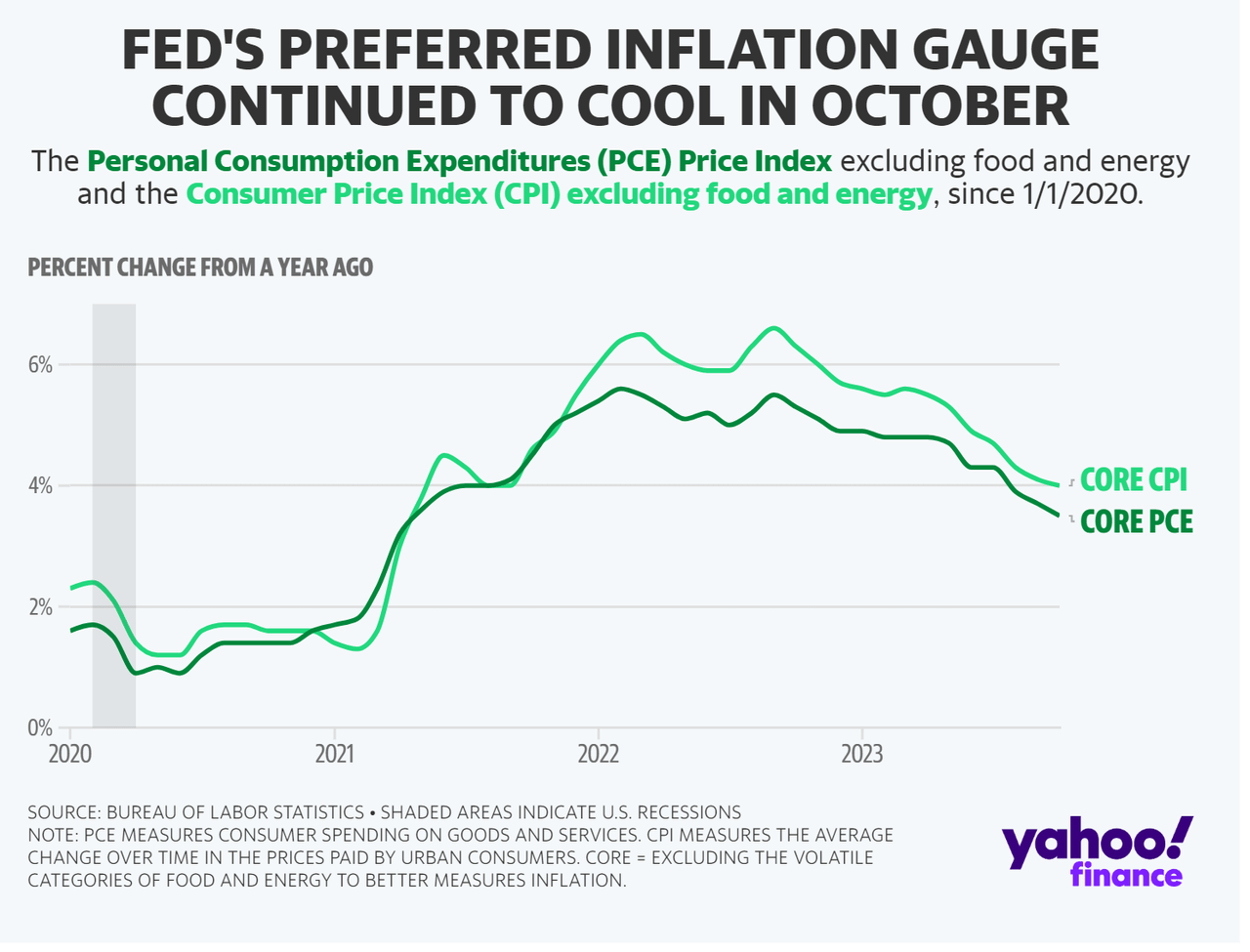

These projections are influenced by the Fed’s expectation that inflation will decrease to 2.4% in the next year, down from the 2.5% forecast in September, and advocate reject to 2.2% by 2025. The policy statement released by the Fed included language suggesting a willingness to consider additional rate hikes cautiously, indicating a shift away from advocate increases. This marks the third consecutive meeting where the central bank has kept rates unchanged.

During a press conference, Fed Chairman Jerome Powell explained that the inclusion of the word “any” in the policy statement acknowledged that they may have reached or approached the peak rate for this economic cycle. However, he emphasized that they did not want to govern out the possibility of advocate rate hikes entirely, and the decision would depend on economic and financial developments.

Powell reiterated the need for more evidence that inflation is moving toward their 2% target, and acknowledged the potential for unexpected economic developments in the coming year. He emphasized that while there is no current indication of a recession, there remains a significant probability of one occurring.

Regarding the timing of rate cuts, Powell did not furnish specific guidance but indicated that the Fed is discussing when to ease policy restraints. The goal would be to act before inflation reaches 2% to avoid overshooting the target.

The policy statement also recognized the progress made in inflation but noted that it “remains elevated.” Additionally, it acknowledged the economic slowdown since the rapid growth seen in the third quarter and revised the economic growth forecast for next year to 1.4%, down slightly from the previous assess of 1.5% in September. Fed officials expect the unemployment rate rising to 4.1% next year.

Recent inflation readings show a decrease, with the core Personal Consumption Expenditures index, the Fed’s preferred inflation measure, dropping to 3.5% in October from 3.7% in September and 4.3% in June. The Consumer Price Index, excluding volatile food and energy prices, showed a 4% boost in November, consistent with October’s rate.

Let’s take a look at the weekly standard deviation report published in the Market Place section and see what short term trading opportunities we can acknowledge for next week’s trading.

GOLD: Weekly Standard Deviation Report

Dec. 16, 2023 11:21 AM ET

Summary

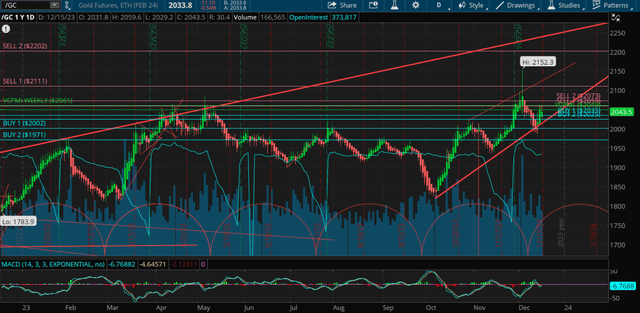

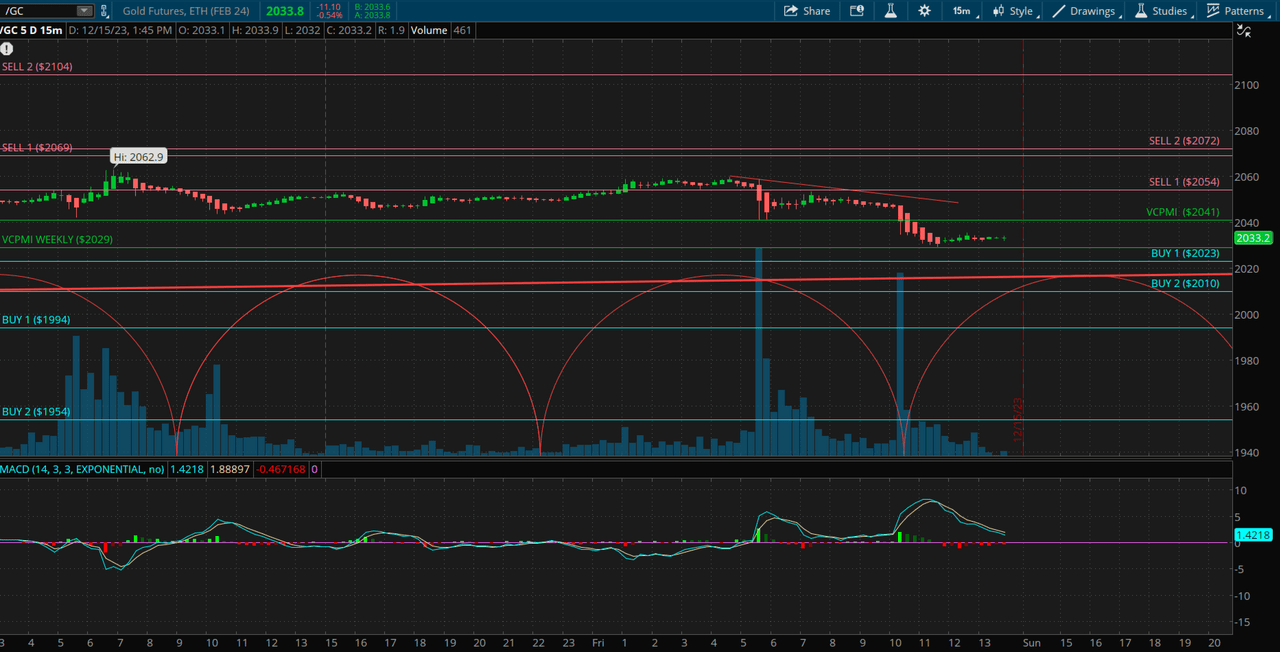

- Weekly trend momentum is bullish as long as gold futures contract remains above 9-day SMA.

- Weekly price momentum is bullish as long as market closes above VC Weekly Price Momentum Indicator.

- Specific levels for taking profits and entering trades mentioned, with potential turning point on 12.30.23.

Weekly Trend Momentum: The weekly trend momentum is considered bullish as long as the gold futures contract remains above the 9-day Simple Moving Average (SMA), which is at 2020. A close below the 9 SMA would change the short-term trend to neutral.

Weekly Price Momentum: The weekly price momentum is also considered bullish as long as the market closes above the VC Weekly Price Momentum Indicator at 2029. A close below this indicator would turn the short-term trend to neutral.

Weekly Price Indicator Levels: Specific levels for taking profits and entering trades. For short positions, consider taking profits at levels between 1994 and 1953 during corrections. For long positions, look to enter on a weekly reversal stop. If long, use 1953 as a Monthly Stop Close Only and Good Till Cancelled order. Additionally, consider taking profits when the price reaches the 2069–2103 levels during the month.

Cycle Date: The next cycle due date is mentioned as 12.30.23, which might imply a potential turning point or event in your trading strategy.

Strategy: If you are currently in a long position, consider taking profits when the price reaches the 2069–2103 levels.

Please note that trading in financial markets involves risks, and it’s essential to have a well-defined trading scheme, risk management strategy, and stay updated with the latest market conditions. It’s also a good practice to consult with a financial advisor or conduct thorough research before making any trading decisions.