tumsasedgars/iStock via Getty Images

It has been a few months since I wrote about the Medicare plan broker GoHealth (NASDAQ:GOCO), and a good deal has changed in the interim, primarily the end of negotiations for possible buyout at $20 per share. With third quarter results due out this week, it is a good time to look in again the possible investment thesis for GoHealth, which I had previously considered a hold. Before getting into GoHealth itself, however, readers who are not already familiar with the intricacies of Medicare choices for consumers might benefit from the background information in the opening section.

The Medicare Decision-Making Maze

With the annual enrollment period for Medicare in full swing now, there are multiple reminders that the process for beneficiaries enrolling in a plan that really best suits their needs is no easy process. My local public library offered a class at the beginning of October called “Medicare 101” to help people sort out all the options, and even the Wall Street Journal recently ran a piece looking at the biggest mistakes people make when signing up. For a taste of the complexity facing those eligible, it is not as simple as just taking what traditional Medicare gives you. Rather, it is a set of choices, starting with the decision of whether to take traditional Medicare, or choose Medicare Advantage, in which your Medicare benefits are delivered through a private insurer such as Humana (HUM) and UnitedHealth Group (UNH), or several other insurance carriers. The Medicare Advantage plans often offer some additional benefits beyond the scope of traditional Medicare, and Medicare Advantage has become very popular, as now just over 50% of beneficiaries take this route. But electing Medicare Advantage coverage can bring its own headaches, like knowing what providers are in-network and out-of-network, and there can be several plans to choose from.

If someone wants to cut the complexity by deciding to go with traditional Medicare instead, in fact there are a dizzying array of supplemental policies that can be paired with traditional Medicare, so-called “Medigap” policies. These are policies that can cover assorted out-of-pocket expenses like deductibles and co-pays in all sorts of arrangements of coverage options. A consumer does not have to get these supplemental policies, however, as the Wall Street Journal article I linked points out, in some cases, once you decline to enroll in a Medigap policy, you may find you cannot change your mind later on.

The bottom line is that unless you choose to take only traditional Medicare and absolutely nothing else, there are multiple complicated decisions to make regarding the total set of benefits you want to have. According to the Kaiser Family Foundation, as of 2020, less than 10% of Medicare beneficiaries chose traditional Medicare with nothing else, indicating that the additional benefits available are perceived to offer valuable coverage. But there is no one-size-fits-all approach to deciding how much you are willing to pay for anything additional, and the decision fatigue could be compounded by knowing that what you choose when first eligible may or may not impact your ability to change in your mind in the future.

The Broker Business Solution

So it should come as no surprise that this array of options represents a business opportunity to help consumers make those elections, which is exactly what brokers like GoHealth, eHealth (EHTH), and SelectQuote (SLQT) strive to do. With their online platforms offering easier access, consumers can make more fully informed decision by comparing the assorted Medicare Advantage and Medigap plans – their costs and benefits, and get help from live agents in the enrollment process if they so wish. The brokers, in turn, receive a commission from the insurer for each policy enrollment they deliver, producing on average a small but steady stream of cash flows well into the future. GoHealth CEO Vijay Kotte delivered a very nice overview of the whole Medicare enrollment puzzle from a consumer standpoint, as well as Medicare Advantage delivery and GoHealth’s place in the value chain as a broker in the recent Sidoti Small Cap conference (the link to the recorded webinar can be found here – it is about 30 minutes long).

The primary challenge for the brokers is that they bear the up-front cost for customer acquisition. Getting consumers on the platform entailed heavy spending on marketing, while reaping the cash flow benefits from getting the long-term value of the enrollments is a long and slow process of collecting commissions.

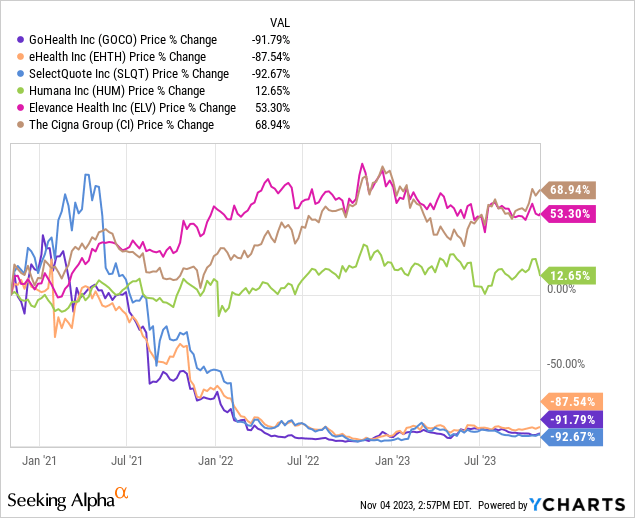

This approach has proven difficult when it comes to creating shareholder value, which makes intuitive sense from a discounted cash flow framework. Cash goes out now to get customers to the brokers, with the cash flow returning back in small periodic units spread over multiple years, with all the inherent uncertainty of time involved. This failure to create and sustain value is clearly evident for the three major national brokers, eHealth, GoHealth, and SelectQuote (which is less reliant on Medicare plans than the other two). I’ll address the chart below, but it is immediately evident that the brokers’ share price does not correlate to those of their insurance partners.

Over the past three years, the value destruction of the brokers have all moved together sharply down, while the insurers themselves have preserved and created value for their shareholders. While the brokers have come off their absolute lows, it remains an unanswered question if the business model is capable of creating sustainable value.

Drilling into GoHealth

For GoHealth specifically, the past several months have been a sort of yo-yo for shareholders, as the board entertained a buyout offer for $20 per share, which pushed shares up to that basic level for a while. I considered it a fair starting point in my June article, but likely to be too low to be accepted. It worked out that way, with the board declining it, and shares have fallen back to the $12 to $14 range. The potential buyers have not made a higher offer, and for the moment there does not appear to be any other suitor.

Third quarter results are set to be released on November 9th, and the street expectation for the quarter is a loss of $2.59 per share, versus actual loss of $1.27 per share in the prior quarter, and a loss of $2.25 per share in Q3 of 2022. The accounting losses in Q2 were and previously were largely due to a non-cash expenses, primarily amortization expenses of $23.5 million related to the firm’s IPO, and legal expenses accrued to $12 million pertaining to a class-action lawsuit related to accusations of negligence in preparation of Registration Statement for the company’s IPO. While the Q3 results will matter to a degree, I think management’s comments on how the current open enrollment period seems to be going and cash flow for the coming year will be bigger factors in how investors react.

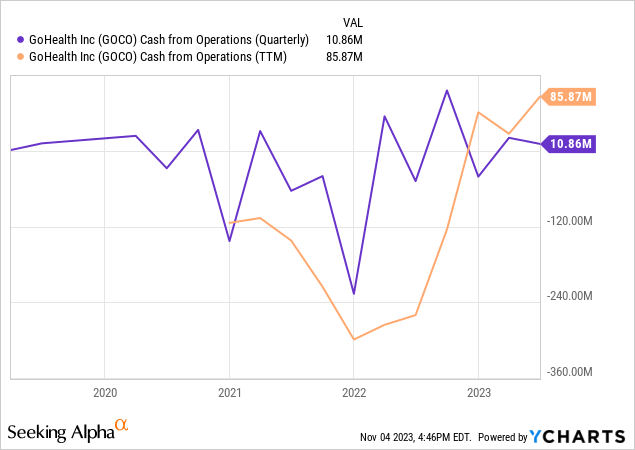

Management’s commentary in August when reporting on Q2 results emphasized both the $11 million in operating cash flow within the quarter [versus a negative operating cash flow of $48 million in the same period of 2022], as well as the $86 million in operating cash flow on a trailing twelve month basis. At the same time, debt repayment has been worked down, with a $171 million in debt reduction achieved over the twelve months ended June 30, 2023, leaving the company with a debt balance of $496 million.

The guidance for the full year 2023 they offered was for a range of $75 million to $115 million in operating cash flow. While the operating cash flow range is a bit wide for my tastes, the overall message is clear, GoHealth is at a point in which it is capable of generating cash from its operations and has turned the corner from being a perpetual cash burner.

Finding Out If There Is Value Here

While I was on the sidelines in terms of recommending GoHealth when its shares were at $18 and $19 while the buyout was being considered, it has become a very different question at $14 per share. As the $20 buyout was turned down for undervaluing the company in the opinion of the board, then perhaps it is candidate for a hidden gem now.

First and foremost, I do give credit to the management team led by Mr. Kotte, who came to the company in June 2022, taking over a situation that was messy – a company burning cash, at risk of de-listing, and favoring any growth instead of focusing on profitable growth. Since coming to GoHealth, there has been a 1 for 15 reverse stock split to address the listing issue, a right-sizing of the workforce, and a clear focus on profit to get the ship turned around. Those are not fun and easy decisions, but to his credit were necessary.

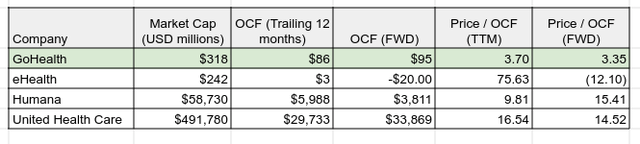

While long-time investors may be sitting on steep losses, new potential investors are presented with a company that is now generating cash flow from its operations, but at a price to operating cash flow ratio of just 3.70x on a trailing year basis, and 3.35x at the midpoint of guidance for operating cash flow for 2023 of $95 million. Compared to its main peer eHealth, as well as to its top two insurance carrier partners Humana and UnitedHealth Group, GoHealth appears to be particularly inexpensive on a price / operating cash basis.

GoHealth and select peers, Price to Operating Cash Flow (Author’s spreadsheet; values derived from Seeking Alpha)

Obviously the carriers themselves are magnitudes larger than the brokers, and eHealth, the closest direct peer to GoHealth, is just now starting to approach break even on an operating cash flow basis. But GoHealth has already made that pivot, and is trading at an attractive valuation. A price to operating cash flow multiple of 6x, which is more in line with the financial sector, would suggest a fair value closer to $25 per share, which is roughly where I thought negotiations might go in the buyout offer, although that didn’t materialize. That’s a possible 80% upside from the current market value, and perhaps on the high end, but based on the buyout offer for $20, I do not think it is an unreasonable estimate either.

If there is a particular investment risk to GoHealth in the present moment that I think merits such cautious valuation, it would be the debt levels. As mentioned earlier, it is holding some $496 million in debt as of the end of Q2, with just $25 million in cash on hand. Comparatively, eHealth was holding $190 million in cash and short-term equivalents at the end of Q2, with debt of just $67 million. Although GoHealth has access to a revolver if necessary, it will definitely need to very carefully manage its cash and capital allocation to strike the right balance in terms of the timings of cash flows, as its cash buffer is pretty thin.

It is partly that thin because they prepaid $14 million additional against their term debt in the 2nd quarter, a voluntary prepayment that was accepted by their creditor under the terms of their credit agreement, and has covered a mandatory prepayment condition through Q2 of 2025, and the debt matures in September of 2025. GoHealth has been diligently working to pay down the debt, and the creditor appears perfectly willing to accept prepayments, clearly a win-win situation if it can continue. The term facilities carried an effective interest rate of 12.8% as of June 30, 2023, and interest expense for the first 6 months of 2023 was $34.2 million, compared to $24.1 million in H1 2022. Based on my understanding of the terms of the agreement, the interest expense vastly exceeds the minimum required payments on principal, which amount to something on the order of $1.5 million per quarter. Clearly this is headed towards a refinancing between now and 2025, and getting better terms will be predicated on a combination of where interest rates go from here and the operating performance of the business.

Conclusion

In spite of the debt overhang, I believe there will be further meaningful debt reduction in the coming 12 months as management continues to improve the balance sheet with steadier and even growing cash flows from operations. While I don’t expect Q3 results to necessarily show additional prepayments on the debt given the narrow cash cushion going into the quarter, over the next year I anticipate further deleveraging, accruing to the good of the equity holders.

While there may some additional risk in terms of regulatory tightening around how Medicare Advantage plans are advertised and promoted, I do not see a scenario in which that leaves the brokers out of the mix.

With the consideration of the buyout for $20 now behind them and the shares currently at around $14, I am comfortable considering GoHealth as a buy, and consider it less speculative long investment than its market peer eHealth.