Catherine Falls Commercial/Moment via Getty Images

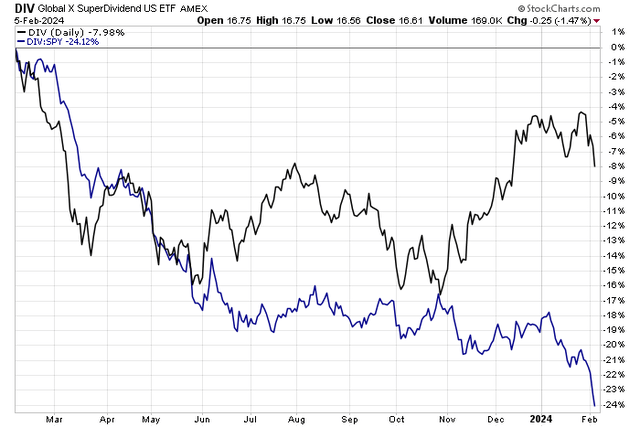

High-dividend US stocks have fallen completely out of favor in the last few months. The Global X SuperDividend U.S. ETF (NYSEARCA:DIV) is down 8% in its total return over the past 12 months, but relative to the growth-heavy S&P 500, DIV is down a whopping 24%. That underperformance has accelerated since the market’s low last October. The SPX and DIV were about even from early February 2023 to that point, but AI fever and concentrated stock market appreciation are back en vogue.

I reiterate my hold rating on DIV given both the momentum trend and considering the ETF’s current structure. What’s more, seasonal trends do not favor a long DIV stake right now.

DIV: Poor Absolute and Relative Performance

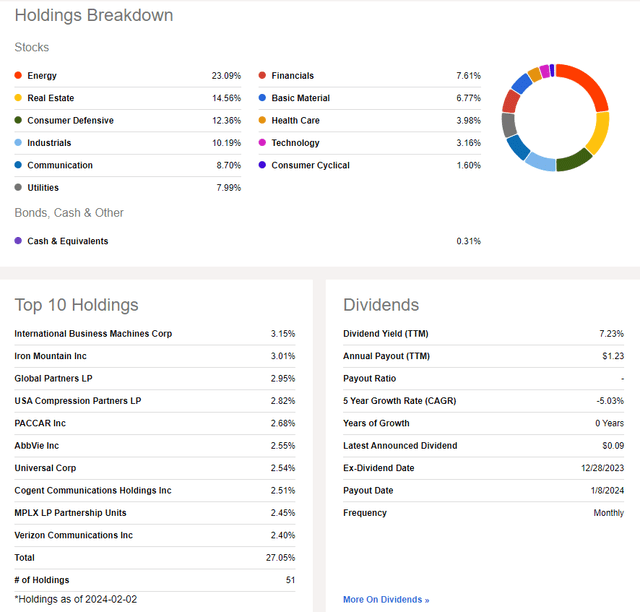

According to the issuer, DIV offers investors access to 50 of the highest dividend-paying equities in the US, potentially increasing a portfolio’s yield. Distributions are paid monthly. The index DIV tracks screens for stocks that have low volatility relative to the S&P 500 while also finding stocks that have high yields. Still, the portfolio is positioned in a risky right now (I will detail that later in the article).

DIV is a moderate-sized ETF with almost $600 million in assets under management as of February 5, 2024. What stands out to me right now is DIV’s awful D- share-price momentum grade by Seeking Alpha ETF Grading system. With poor performance, its moderate expense ratio of 0.45% is not the cheapest equity income fund around. While some investors may be attracted to the 7.2% trailing 12-month dividend yield, I caution folks to consider the earnings quality of the ETF’s holdings, which is not appealing. As such, risk metrics are on the weak side, though liquidity is decent considering DIV’s volume profile near 180,000 shares daily and a 30-day median bid/ask spread of six basis points – that’s not super tight, so I encourage investors to use limit orders during the trading day.

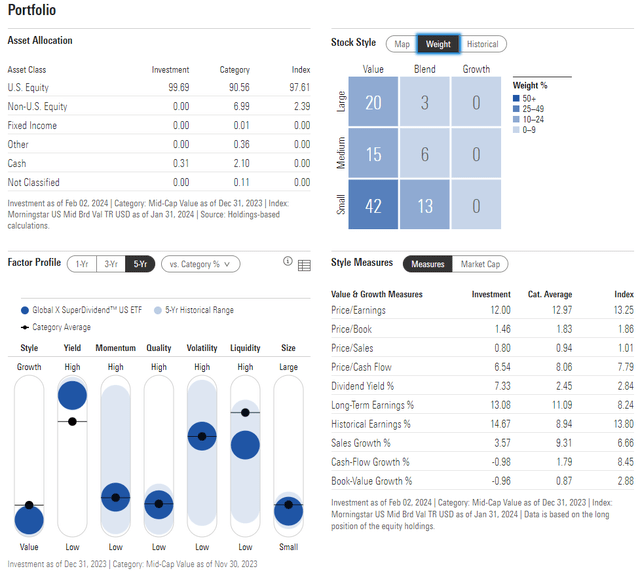

Looking closer at the allocation, the 1-star, Negative-rated portfolio by Morningstar plots to the far left on the style box, indicating that DIV is an ultra-value ETF. There’s also a majority of assets in the small and mid-cap space, with just 23% considered large cap. While DIV’s P/E is low at 12, poor momentum, low earnings quality, and somewhat high volatility are not positive equity factors right now. Clearly, pessimism is priced in.

DIV: Portfolio & Factor Profiles

Driving the earnings multiple lower is a very high 23% allocation to the cyclical Energy sector. Energy is just 3% of the S&P 500, by contrast, so DIV is very much an active bet on a turnaround among oil and gas stocks. Just 3% of DIV is invested in the Information Technology sector.

DIV: Holdings & Dividend Information

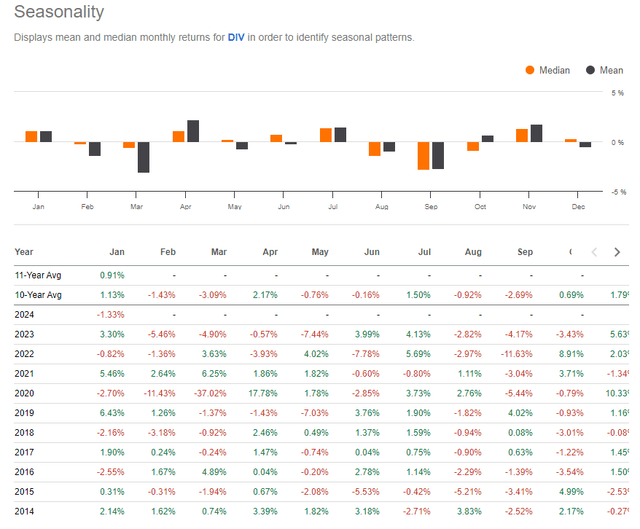

Seasonally, Seeking Alpha’s new Seasonality tool illustrates that now is not an ideal time to be overweight DIV. It has historically been a weak performer during the back half of the first quarter, though April is just about its best month. Patience is prudent, in my view.

DIV: Weak February-March Seasonal Bias

The Technical Take

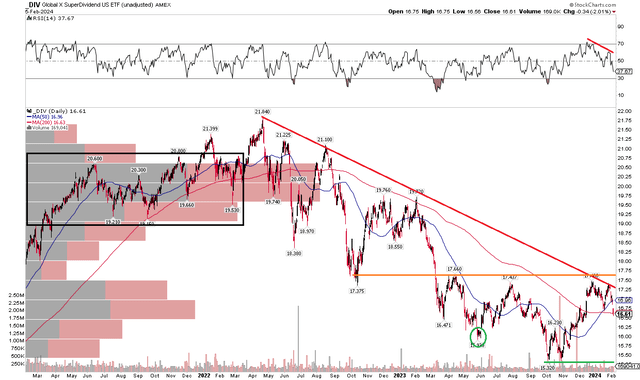

With a downbeat valuation, heavily cyclical portfolio, low earnings quality, and weak seasonal trends, the technical view is not all that encouraging. Notice in the chart below that DIV shares are mired in a steep downtrend off a high notched in April 2022. Over that time, the S&P moved lower, bottomed, and then rallied to fresh all-time highs. Hence, relative performance with DIV has been downright dreadful. With a long-term 200-day moving average that is negatively sloped, the bears appear to still be in control.

Also, take a look at the RSI momentum oscillator at the top of the graph – it had been elevated, indicating decent short-run momentum, but the RSI made a lower high while the price attempted to rally to a new near-term peak earlier this year. I’ll be watching $15.93 – the May 2023 low, for possible support along with the multi-year low of $15.32 from October last year. The $17.44 to $17.66 zone is key resistance and there is a high amount of volume by price between $19 and $21 that could be problematic at higher levels.

Overall, the momentum is negative and the trend is lower.

DIV: A Persistent Downtrend, Weak Momentum

The Bottom Line

I reiterate my hold rating on DIV. Shares have been up just 1% from my first review of the fund last year, and I don’t see definitive signs of that trend changing. Alternatives to consider are the WisdomTree U.S. Total Dividend Fund ETF (DTD) (see here) and the Vanguard High Dividend Yield Index Fund ETF Shares (VYM) (see here).