Drs Producoes

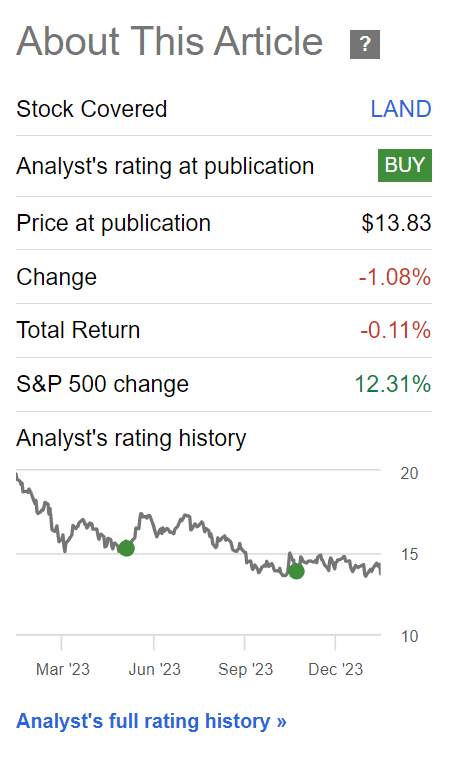

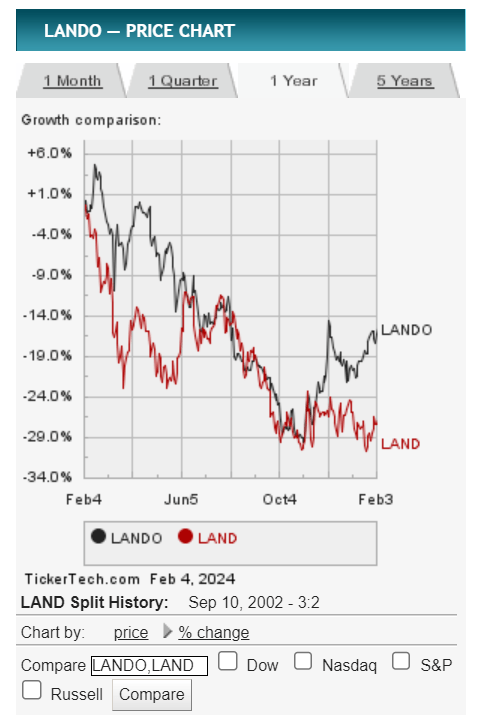

I have been a vocal supporter of Gladstone Land Corporation (NASDAQ:LAND), having written several bullish articles on the REIT in the past few quarters. However, despite my bullishness, LAND’s stock price has not reacted as expected, with the shares trading at essentially the same price since my last update in November and down 10% from when I initiated in May (Figure 1).

Figure 1 – LAND has been flat since November (Seeking Alpha)

Given LAND’s weak stock performance when the equity markets have been making new all-time highs on a daily basis, should I cut my losses and redeploy my capital elsewhere?

Brief Company Overview

As investment analysts, we have to accept the fact that even the best analysts and traders are wrong at least 40% of the time. So periodically, I like to revisit all of the investments in my portfolio, to determine whether my buy thesis remains valid.

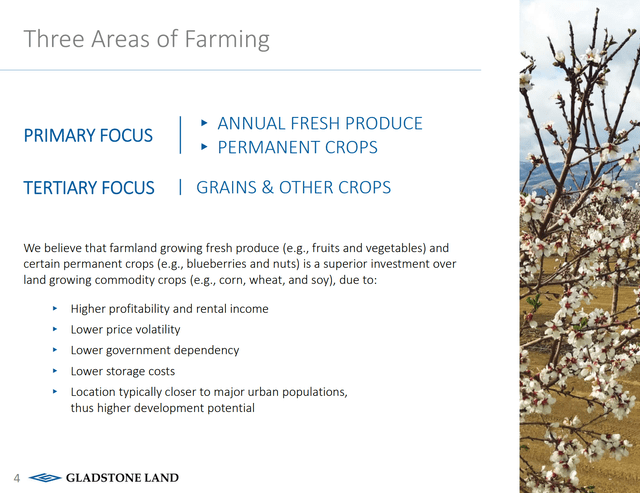

Gladstone Land Corp. is a REIT specializing in acquiring and owning farmland across the United States. LAND primarily focuses on annual fresh produce (i.e., fruits and vegetables) and permanent crop (i.e., blueberries and nuts) farms, as these crops tend to have higher profitability and rental income, lower price volatility and are located closer to major urban centers, giving higher redevelopment potential (Figure 2).

Figure 2 – LAND overview (LAND investor presentation)

In total, Gladstone owned 169 farms spanning 116,000 total acres across 15 states and over 45,000 acre-feet of banked water in California as of its latest financial reports.

The Case For Farmland

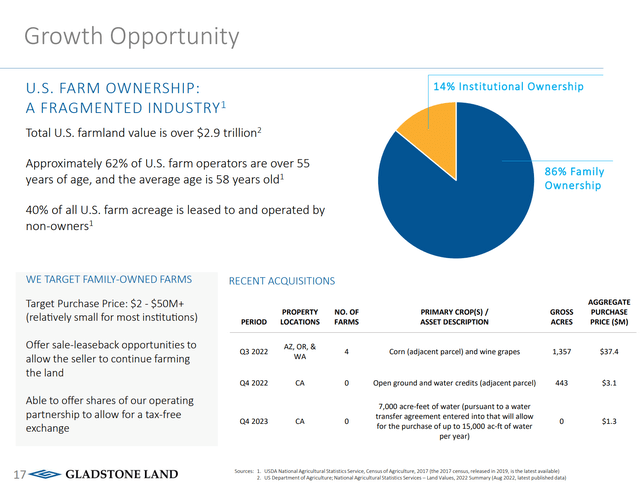

In my opinion, the case for owning farmland remains compelling. Farmland is one of the largest commercial real estate sectors, on par with apartments, but ownership is very fragmented, with over 86% of U.S. farms remaining family-owned (Figure 3).

Figure 3 – Farmland is very fragmented (LAND investor presentation)

Since the average age of a farmer is 58 years old, the farmland sector is also ripe for consolidation by institutional players like Gladstone.

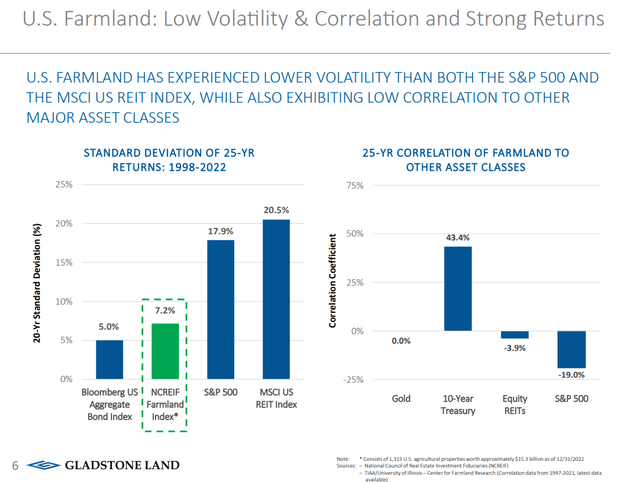

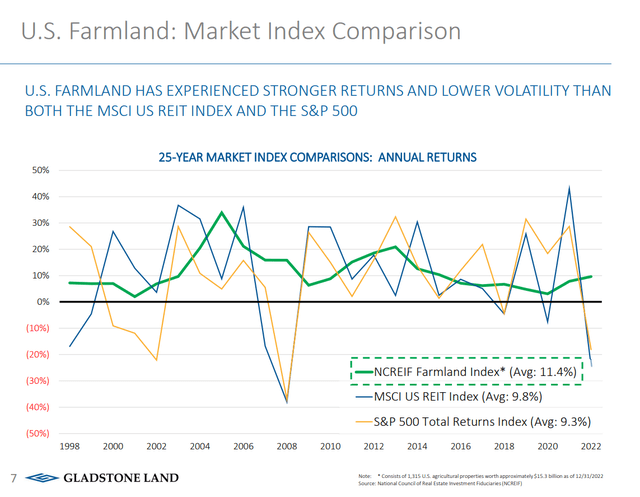

Historically, farmland has exhibited low volatility and correlations with other asset classes (Figure 4).

Figure 4 – Farmland has exhibited low price volatility and correlation with other assets (LAND investor presentation)

Combined with strong returns, farmland looks like an ideal asset class to own for portfolio diversification purposes (Figure 5).

Figure 5 – Farmland has had strong historical returns (LAND investor presentation)

Hedge Against Climate Change

Since I am only 43 years old, one of my biggest fears is that over the next few decades, climate change will wreak havoc with the world’s arable land supply, which may lead to soaring prices and food shortages.

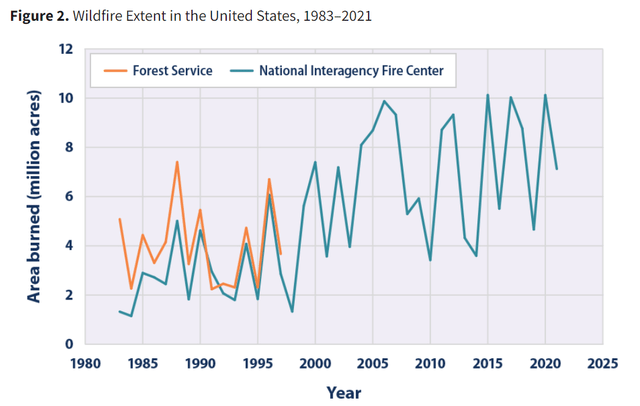

For example, in recent years, we have seen large parts of the U.S. and Canada be under increasing threat from wildfires that can pose major risks to farmlands, grasslands, and rangelands (Figure 6).

Figure 6 – Wildfires are increasing in severity (EPA)

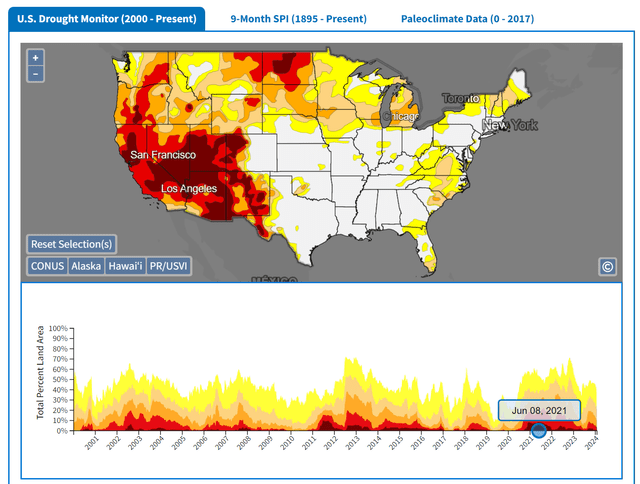

Furthermore, climate change is changing global precipitation patterns, causing large parts of the U.S. to experience extreme drought conditions in the past few years (Figure 7).

Figure 7 – Climate change is causing parts of the U.S. to experience drought conditions (drought.gov)

Thus, in my opinion, owning a diversified portfolio of farmlands could be an effective hedge against the impacts of climate change, as crop prices are expected to increase due to changes in climate, which will translate into higher rental income for landowners.

LAND Trading Below NAV

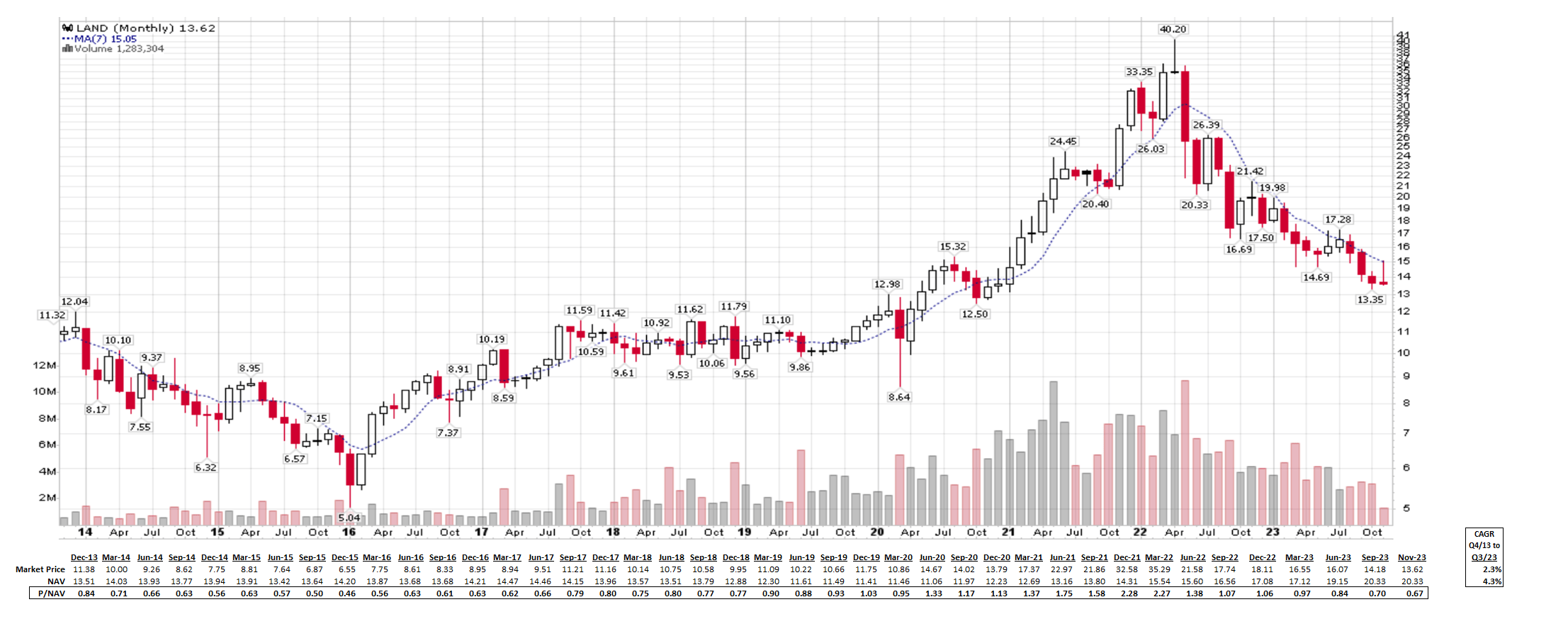

For Gladstone Land, I initiated on the REIT with a buy recommendation in May 2023 when the REIT began trading below its net asset value (“NAV”) (Figure 8).

Figure 8 – LAND Price to NAV (Author created with data from company reports and stockcharts.com)

There are several reasons why a security trades below its NAV. First, this could be because the security has fallen out of favor and investors see better opportunities elsewhere, so they have sold shares below their ‘intrinsic value’. Alternatively, a discount to NAV can also arise if the NAV values are ‘stale’ and there are unrealized losses that the market has caught wind of.

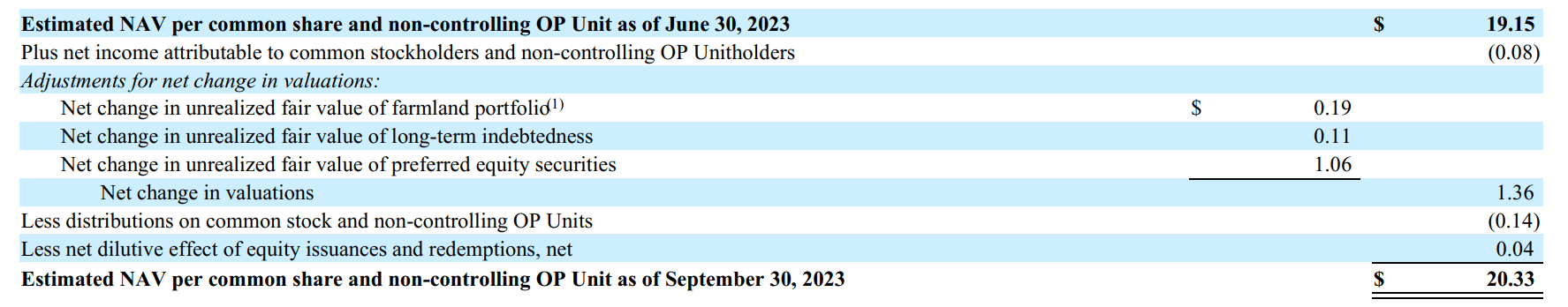

For Gladstone, I believe the former is more likely, as Gladstone’s real estate values are verified annually by independent third-party appraisals. On a per share basis, Gladstone’s most recent net asset value came out to $20.33 at the end of Q3/23. Compared to the current trading price of $13.68, LAND is trading at a P/NAV of 0.67x.

Investors should note that a large part of LAND’s increase in NAV in the past year has been due to a decline in the fair value of the company’s preferred shares due to higher interest rates (Figure 9).

Figure 9 – LAND changes in Q3/23 NAV (LAND Q3/23 10Q report)

As long-term interest rates have declined in recent months, the preferred shares have gained in value, so the common share NAV will likely decline QoQ when LAND reports fourth quarter earnings in a few weeks (Figure 10).

Figure 10 – LAND preferred shares have gained in value in past few months (preferredstockchannel.com)

However, the overall conclusion that LAND is trading below NAV remains accurate.

Recent Transaction Eases Concern On Land Value

Recently, a real estate transaction involving Gladstone Land caught my eye. In the transaction, Gladstone sold a farm in Florida for $65.7 million, providing a 60% return on equity. The sale price reflects a 22% increase over the original purchase price 7 years ago.

This transaction is interesting because it anecdotally confirms the valuation of Gladstone’s real estate holdings. In fact, Gladstone was able to record a gain on sale on the transaction, which suggests Gladstone’s NAV may even be conservative.

Quarterly Report Expected To Be Messy

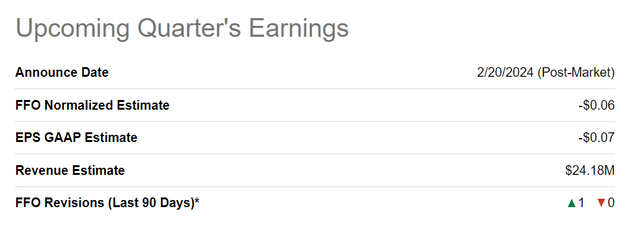

Looking at the upcoming fourth quarter earnings report (expected February 20th), I do not have high expectations, as the company has been dealing with tenant issues in the past few quarters, which may make the quarterly earnings ‘messy’. However, judging by the easing of drought conditions in California due to recent ample rainfall, the outlook may be improving on Gladstone’s Californian almond farms.

Overall, Wall Street analysts expect Gladstone to report $24.2 million in revenues and a $0.07 EPS loss (Figure 11).

Figure 11 – LAND Q4/23 Wall Street estimates (Seeking Alpha)

Conclusion

Overall, while the upcoming quarterly earnings may be messy for Gladstone Land due to continued tenant issues, I remain comfortable owning shares as a hedge against climate change.

While the stock price languishes, I am comforted by the fact that Gladstone was recently able to sell a large farm in Florida for a premium to carrying value, which validates the valuation of LAND’s real estate portfolio.

I continue to rate LAND a buy at this time.