xavierarnau

Investment Thesis

GigaCloud Technology (NASDAQ:GCT) operates a global business-to-business marketplace, connecting buyers and sellers for big and bulky products. Leveraging innovative technology and recent strategic acquisitions, such as Noble House, GigaCloud facilitates seamless transactions, enhances supply chain capabilities, and aims to revolutionize the way businesses engage in cross-border commerce.

The business has a short thesis against it. But once the back of these Q3 results, I’m thoroughly convinced that the short thesis is misplaced.

In short, GCT is priced at 5x forward EBITDA, with a clean balance sheet, and a management team that has shown tremendous business acumen.

This stock is a buy.

Rapid Recap,

In my previous bullish analysis last month, before GCT’s earnings report was out and the short thesis still had some validity I said,

GigaCloud Technology has come under the attention of a short report. While there are some odd aspects raised as part of the short report on GigaCloud’s underlying prospects, I find that there’s not enough to cause me to reverse my bullish call on this stock.

Here I converse what investors should think about from the short report and what aspects are inflammatory but misleading.

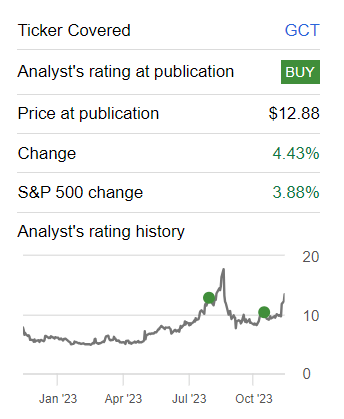

And while the stock has sizzled strongly since I wrote that analysis, I don’t want to reverse engineer my call. In this case, I’ll take my performance since I first put this stock as a buy.

Michael Wiggins De Oliveira on GCT

Even though, as you can see above since I wrote my latest analysis, the stock has performed much better.

So let’s get to why I’m bullish on this stock.

Near-Term Prospects

GigaCloud Technologies operates a global B2B marketplace, connecting buyers and sellers for big and bulky products. Leveraging technology, GigaCloud facilitates seamless transactions and enhances supply chain capabilities.

In the near term, GigaCloud Technologies’ recent acquisitions of Noble House and Wondersign position the company to enlarge its scale, product diversity, and supply chain capabilities. The acquisition of Noble House, a leading B2B furniture distributor, not only brings an extensive network of partners and suppliers but also provides significant warehouse expansion and synergistic cost savings.

During the earnings call, Iman Schrock, President of GigaCloud, stated, “Noble House will significantly reinforce our supply chain and enlarge our product offerings in newness and diversity, essential to attracting new high-quality buyers and sellers to the B2B marketplace.” This acquisition allows GigaCloud to tap into new markets, including Canada and India, and solidify its relationships with top retailers appreciate Amazon, Target, and Walmart.

Furthermore, the integration of Wondersign, a cloud-powered digital signage and catalog management innovator, is set to boost GigaCloud’s presence in the physical retail sector. With a network of over 2,500 retail locations, the GIGA IQ package aims to offer consumers a streamlined encounter, expanding GigaCloud’s achieve beyond its traditional B2B focus. As Iman Schrock highlighted, “These integrations aim to advocate expedite our momentum, offering customers more diverse ways to connect and transact, ultimately positioning us as a leader in the global B2B landscape.” GigaCloud’s proactive approach to expanding its operational capabilities and reaching a broader audience positions the company for sustained growth and success in the near term.

While GigaCloud Technologies has experienced notable success and growth, the company faces key headwinds that could impact its trajectory, for example, note that GigaCloud is a small business with no significant moat to speak of and is up against much larger and well-resourced competitors.

Also, changes in geopolitical events could impact cross-border commerce, which would be substantially detrimental to GigaCloud’s near-term prospects.

With that context in mind, let’s delve into its financials.

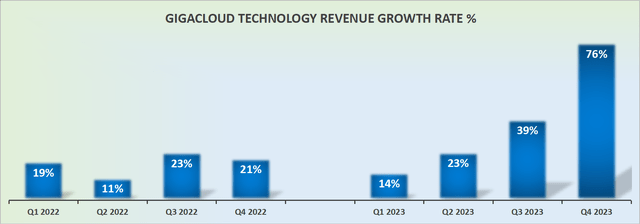

Revenue Growth Rates necessitate Interpretation

GCT has only guided its consolidated growth rates for Q4. Clearly, the jump in revenues for Q4 is impressive. When asked on the call about what the organic growth rates for the business will be, management affirmed that the organic growth rates for Q4 2023 would be approximately 50% y/y.

Yet, that’s undoubtedly a massive jump and that’s clearly noteworthy. When asked for some added granularity management was evasive, noting that it would be difficult to parse out what part is GigaCloud Technologies and what part will come from Noble House.

One way or another, when the dust has settled, the organic growth rates in this business are very strong.

GCT Stock Valuation — 5x EBITDA

During the earnings call, GCT’s management described how the acquisition of Noble House would dilute the company’s consolidated profitability going forward.

Therefore, I’ve had to make some rough estimates of GCT’s run-rate EBITDA. Although, it must be said that management has not made this an easy task. Therefore, I’ve been forced to add a large margin of safety to my calculations.

What’s more, in my previous analysis I said,

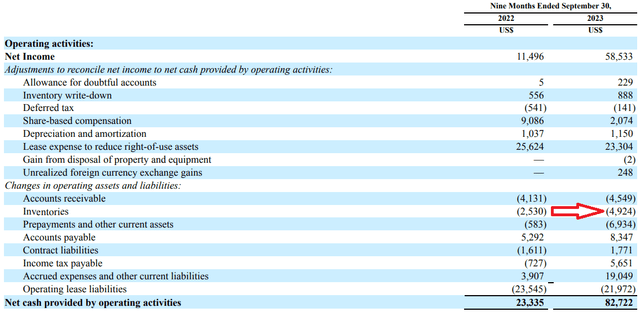

[…] if I were to highlight one element to keep attuned when GigaCloud reports its Q3 results in a few weeks […], it would be its cash flow statement. Particularly to keep alert to its inventory figure.

As you can see in the graphic below, GCT’s cash flow statement looks very clean with the inventory level moving slightly higher, as I would expect to see for a growing business.

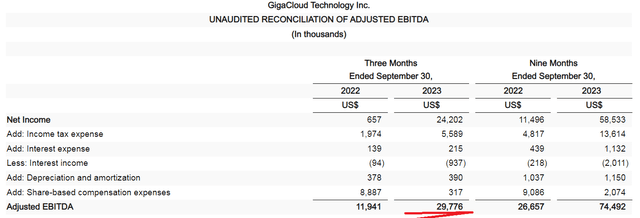

Moving on, this is my thought process when it comes to GCT’s future profitability. Consider GCT’s Q3 2023 results, below.

The business made about $30 million of EBITDA in Q3 2023. This is clearly tracking ahead of the prior quarter in Q2, which reported just below $25 million.

However, it now appears within reason that in time GCT could deliver about $120 million of EBITDA.

This leaves the stock priced at 5x EBITDA.

The Bottom Line

In closing, my thorough analysis of GigaCloud Technologies underscores a robust bullish sentiment for the stock, with a particular emphasis on its stellar growth rates and attractive valuation.

Despite facing a short thesis, the recently disclosed Q3 results have not only dispelled concerns but have accentuated the company’s impressive trajectory. GigaCloud is currently priced at a mere 5x forward EBITDA, showcasing an undervalued asset in the market.

The growth rates, especially the anticipated 50% year-over-year organic growth for Q4 2023, emphasize the company’s ability to capture market share and fuel expansion. While management has been somewhat evasive about the breakdown of growth between GigaCloud Technologies and the recently acquired Noble House, the overall organic growth rates remain remarkably strong.

This stock is a buy.