perets

GAMCO Global Gold, Natural Resources & Income Trust (NYSE:GGN) stood out to me because I know there’s a segment of investors who believe in gold and because of the high dividend yield on this security (around 10%). As such, the shares may seem attractive to folks at an initial glance. Yet, I’m going to delve into why this allure is misleading and why GGN is a SELL for long-term investors.

Concept of the Fund

In its Prospectus from when it opened in 2005, the fund explains that it will mainly invest in equities pertaining to the gold sector and to natural resources more broadly:

Under normal market conditions, the Fund will attempt to achieve its objectives by investing at least 80% of its assets in equity securities of companies principally engaged in the gold industry and the natural resources industries. The Fund will invest at least 25% of its assets in the equity securities of companies principally engaged in the exploration, mining, fabrication, processing, distribution or trading of gold or the financing, managing, controlling or operating of companies engaged in ‘‘gold-related’’ activities. In addition, the Fund will invest at least 25% of its assets in the equity securities of companies principally engaged in the exploration, production or distribution of natural resources, such as gas, oil, paper, food and agriculture, forestry products, metals and minerals as well as related transportation companies and equipment manufacturers.

Its primary goal is to generate distributable income to owners of GGN. Miners and other companies in natural resources/commodities are known for distributing dividends, often at high yields. There is, therefore, some logic to this strategy for income. Additionally, the company writes covered call options on the underlying equities, in order to provide more income through the call premiums.

It is also an actively managed, closed-end fund. It therefore does not follow an index, and investment decisions and trades are made entirely at the discretion of the fund manager. Being closed-end, the number of shares is fixed, and capital is not raised or released whenever shares are bought and sold. While shares may often trade close to the fund’s NAV, no mechanism requires that to be the case, and so the price is a matter of supply and demand, much like the shares of a normal corporation.

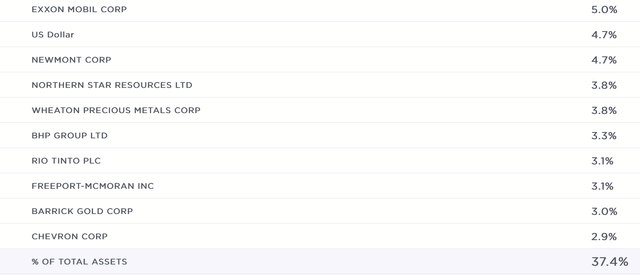

Holdings

The top ten holdings account for over 37% of the portfolio. In addition to a cash position, it includes nine large, recognizable companies in the gold and natural resources sectors.

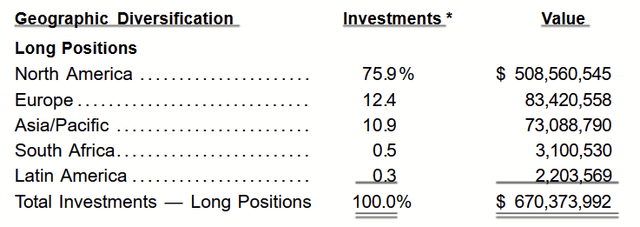

As of Sept. 2023, about 84% of the fund was invested in common stocks, with somewhat more of those being in energy than metals and mining. Similar to the top ten, the stocks are mainly large, recognizable companies from North America.

Sept. 2023 Schedule of Investments

There are also some corporate bonds in these sectors, and one short position.

Of course, there are also the call options contracts that the fund writes on those securities. If assigned, the fund would have to surrender the stocks to the contract buyer, and over time this can mean upside from capital appreciation is lost. The same loss of upside occurs if the fund chooses to buy those contracts back at a loss, to avoid assignment. These positions constantly change since contracts expire and must be rewritten with new dates and new strike prices.

Performance

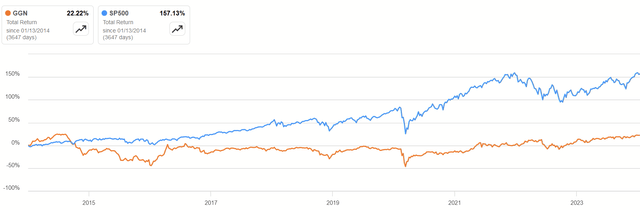

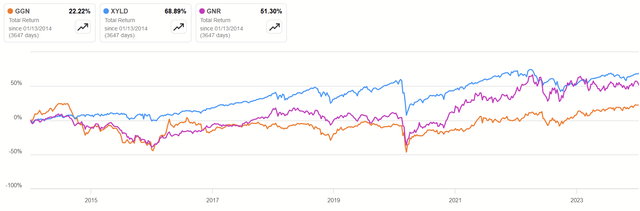

When compared to the broader market, many may not be impressed with the total returns of GGN.

Yet, as mentioned before, the primary goals has been income. How has the company delivered on that?

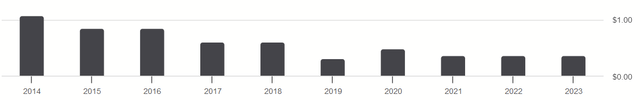

Dividends per share have continually declined. It’s disappointing for anyone hoping to maintain or grow their purchasing power. The dividends of the present year are about a third of what they were a decade ago.

Similarly, if you view the Prospectus I linked earlier, you’ll see that the initial offering price was $20 per share in 2005, and currently they are under $4 per share. Not only did income decline, but there’s been substantial loss of principal over time. What contributed to that?

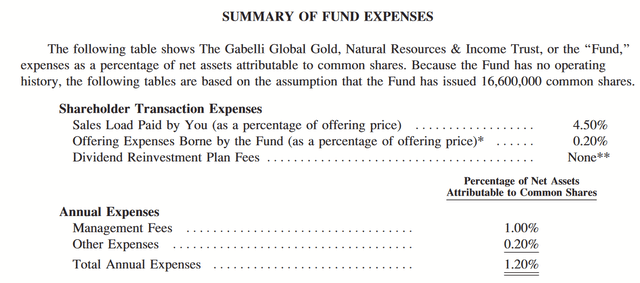

Expense Ratios

The first culprit is the relatively high expense ratio. As we can see in its original Prospectus, it’s almost always been at least one percent. It’s currently quoted at 1.31%. Consider how much that can add up over many years. If the initial 1.2% from the fund opening is compounded over a decade, $100 becomes $88.63. As we saw on the chart, total returns are actually positive, but that’s a lot of friction on your ability to compound your wealth. Still, this doesn’t explain everything.

Dilution

In its annual reports, the company mentions the following:

The Fund is authorized to issue an unlimited number of common shares of beneficial interest (par value $0.001). The Fund has an effective $500 million shelf registration for the issuance of common or preferred shares. On June 17, 2021 the Fund filed a prospectus supplement for at-the-market offerings of up to 20 million common shares.

Thus, while new shares are not issued upon purchase like an open-end fund, the company has regularly issued new shares throughout its life to raise more capital. All that has to occur for this to hurt long-term holders is for the dilution to occur at a higher rate than the positive returns of the holdings themselves. Again, it has this in common with your typical corporation.

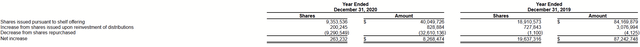

The company had just over 16m shares during its launch in 2005 and has over 150m shares as of its 2022 annual report. Checking the annual reports, I see that this has happened incrementally throughout the fund’s lifetime, but a large increase occurred in 2019.

More than half of the current shares were issued in that year.

I think that effective shelf registration of $500m is an important detail too.

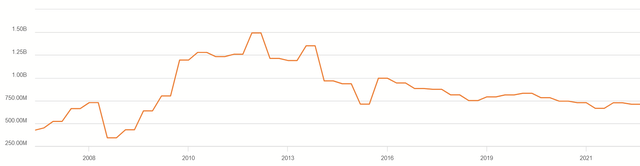

If we look at the total AUM of the fund, they’ve moved up and down at certain points, but with the exception of their initial offering and the 2008 Financial Crisis, they’ve never been below $500m. Even if the investment decisions do not pan out, the company is authorized to issue unlimited shares and is ready to raise as much as $500m to maintain its AUM that collect a fat expense ratio. With that said, we might as well look who the fund managers are that collect command this high fee.

Of course, issuing new shares at a premium would be helpful to long-term holders, but nothing about the history of the fund indicates that they have tended to do that. Instead, it seems to be more about maintaining AUM, which has steadily declined over the last decade.

Management

2022 Annual Report

Under the advisor, Gabelli Funds LLC, the co-leading managers are Caesar Bryan and Vincent Hugonnard-Roche. They have both been on the management team since the fund’s inception (also in the original Prospectus). Bryan’s focus has been the gold-related investments, while Hugonnard-Roche’s focus has been the covered call portion of the portfolio. What informs the kind of investment decisions they make?

Regarding its equity selection, the 2022 annual report notes:

The Investment Adviser’s investment philosophy with respect to selecting investments in the gold industry and the natural resources industries is to emphasize quality and value, as determined by such factors as asset quality, balance sheet leverage, management ability, reserve life, cash flow, and commodity hedging exposure. In addition, in making stock selections, the Investment Adviser looks for securities that it believes may have a superior yield as well as capital gains potential.

In general, these are good criteria for portfolio selection. Yet the challenge is squaring that upside with the covered call strategy on those securities. Similarly, there are dozens of equity positions in the portfolio. It’s not clear that the fund concentrates toward the best players at the best prices. In my opinion, having so many different positions on which to write different contracts risks the division of attention by management and increases the odds of mistakes.

Even without that, if they manage to pick good companies at good entry prices, their ability to enjoy that upside will expose them to the risk of assignment on the call contracts.

While past performances are no guarantee of future results, an active fund with years of history under the same managers gives us insight into the decisions they are likely to make in the future. One then has to decide if this record is worth that high expense ratio.

Conclusion

While there is potential merit to the concept of a covered call fund of gold and other natural resource companies, GGN has not executed this well. The high yield on the shares reflects the diminishing return of their income over time, amounting to a yield trap.

With a very high and capital-depletive expense ratio around 1.3%, the real winner in the income game is Gabelli Funds and the management team, not owners of GGN. Through continued share dilution, the adviser consistently maintains its AUM and thus the cash flow from their management fees, regardless of the benefit to investors.

I believe investors will be better served by seeking income or exposure to these sectors with funds that have a record of successfully executing their strategy and/or keeping their expense ratios lower. I happen to have written about a couple before, the first being Global X S&P 500 Covered Call ETF (XYLD) and the second SPDR® S&P Global Natural Resources ETF (GNR).

Total Returns of Funds, Last 10 Years (Seeking Alpha)

They aren’t the S&P 500, and there are many other funds out there that may be superior, but they do show the material difference of successful execution with lower fees.

For these reasons, I think GGN is a SELL for the long-term investor, particularly someone interested in durable income.