Justin Sullivan

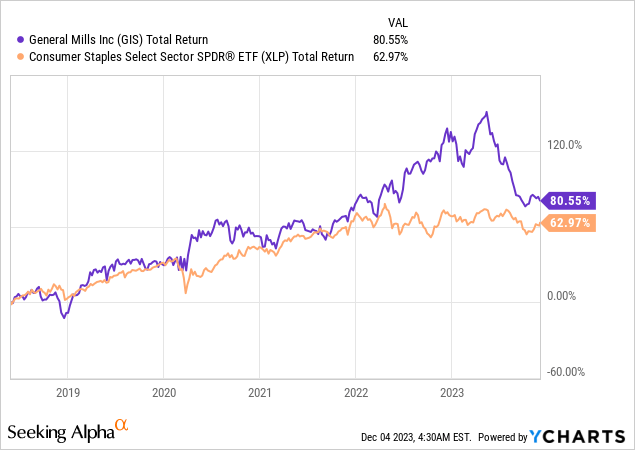

As 2023 slowly draws to a close and the S&P 500 (SP500) once again trades near all-time highs, the year is also likely to be one of the worst for consumer staples on a relative basis.

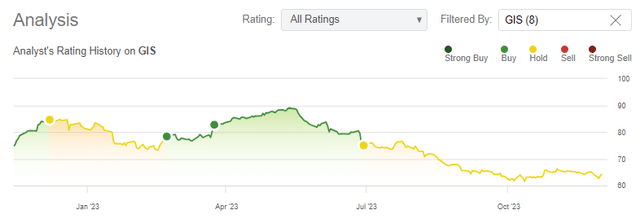

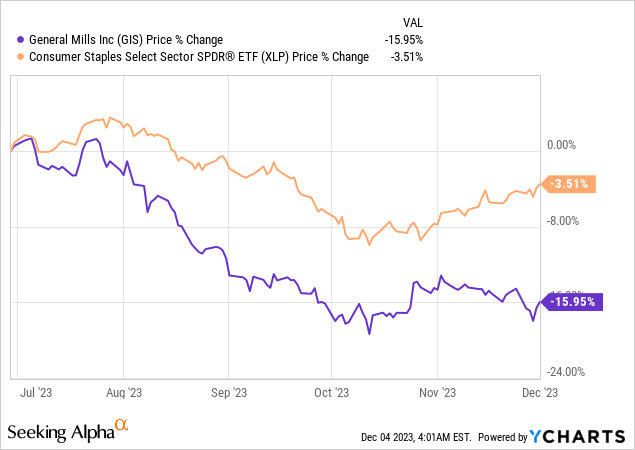

On top of broader market pressures, General Mills, Inc. (NYSE:GIS) also experienced higher realized idiosyncratic risks over the calendar year and has now fallen more than 15% since I downgraded it to Hold earlier in June.

As short-term investors, traders and speculators are likely to chase momentum and run for the exit, the sharp fall of GIS should not come as a surprise to long-term investors. That is why, just a few months ago, I wrote that from a market-timing point of view GIS shareholders should be prepared for such a scenario and could take advantage of any meaningful drop (emphasis added):

It is highly likely that the next 12-month period will be more challenging for GIS shareholders as topline growth slows down and the uncertainty around profitability increases. While this dynamic would make short-term investors nervous, long-term investors could take advantage of any major drop in the company’s share price as the management takes the necessary steps to create shareholder value in the long-run and remains focused on the dividend.

Source: Seeking Alpha.

Although trying to time the market by either buying or selling a stock is something that I stay away from, there are certainly periods of time when it is more attractive for long-term investors to enhance holdings. Such periods are usually not hard to spot when it comes to stable business models appreciate that of General Mills.

With that in mind, at present General Mills’ share price is once again trading at attractive levels relative to its business fundamentals.

The Big Picture

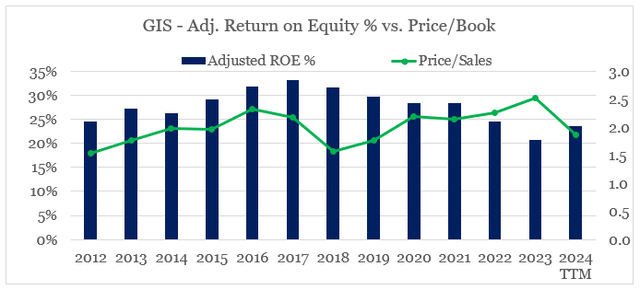

Over the long term, General Mills’ adjusted return on equity (adjusted for asset impairments and tax expenses in FY 2018) is a key driver of shareholder returns. Given the annual fluctuations and changes in investors’ sentiment and expectations, however, the stock’s sales multiple could overshoot in either direction.

After the price/sales multiple was recently running way ahead of the ROE, it has now fallen sharply to one of its lowest levels since the FY 2018-19 period.

prepared by the author, using data from SEC Filings

At the same time, the adjusted ROE has slightly recovered during the past 12-month period and would continue to benefit from ongoing tailwinds (more on that later). If this happens, we could once again have a wide gap between adjusted return on equity and price/sales multiple in a similar fashion to FY 2018 on the graph above.

This conservative pricing creates a significant margin of safety for investors and as we could see on the graph below, following FY 2018 GIS has been outperforming the Consumer Staples Select Sector SPDR® Fund ETF (XLP) even though ROE has been gradually declining in the following years.

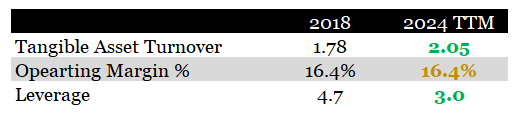

Although ROE is significantly lower now, GIS is in a much better position operationally than it was back in FY 2018. Tangible asset turnover is notably higher and operating margin has stayed flat. The key driver of lower GIS ROE is a massive drop in leverage in the past couple of years.

prepared by the author, using data from SEC Filings

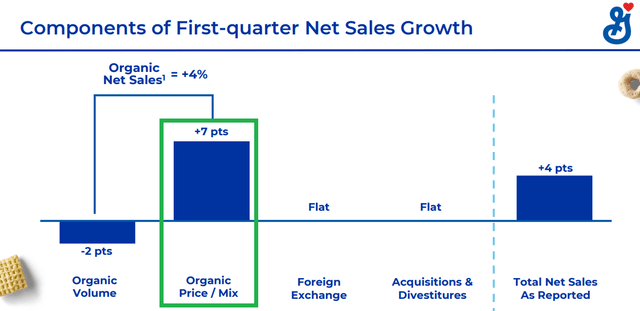

The brand portfolio has also been optimized since then, and this allowed significant price increases over the past year, without sacrificing volume growth and market share.

General Mills Investor Presentation

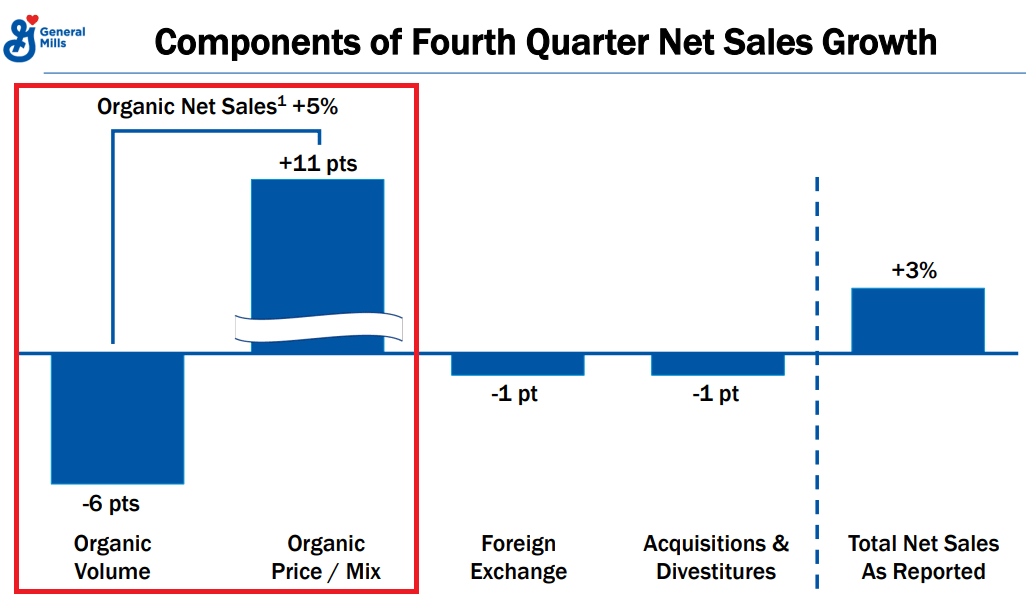

As I noted in my previous analysis on GIS, there was a risk that the company could face worse than expected drops in volumes, but this has not materialized.

General Mills Investor Presentation

In order to avoid a major drop in volumes, GIS had to taper down its pricing initiatives, which as we saw above has not happened either (emphasis added):

All that would likely provoke volumes to recover in the coming quarters, but at the same time the price/mix benefit should fall sharply over the coming quarters as well.

Source: Seeking Alpha

All that clearly illustrates the strength of the GIS brand portfolio, and although it’s reasonable for price/mix impact on organic net sales to fade away during the current fiscal year, margins should continue to benefit in the near term.

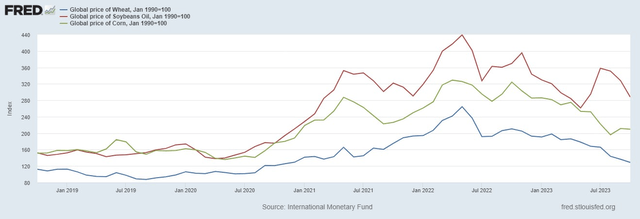

Lastly, GIS margins would also continue to benefit from falling commodity prices. Wheat, corn, and soybean oil are three of the main inputs into General Mills’ products, and prices of all three are now well below their recent highs.

Shareholder Distributions

The recent fall in GIS share price in combination with the dividend enhance announced in June have also made the company a very attractive dividend play.

Seeking Alpha

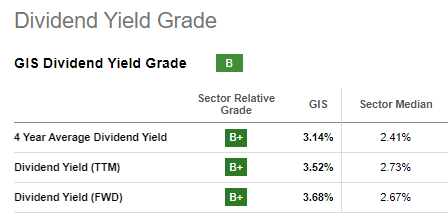

With a forward yield of 3.7%, GIS offers one of the most attractive yields within the sector.

Seeking Alpha

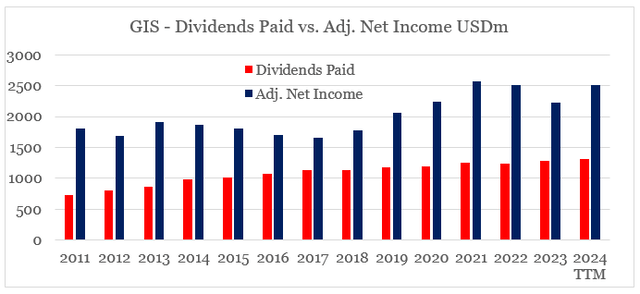

The dividend is not only safe, but given the margin opportunity outlined in the previous section and the elevated top line growth, GIS is in a good position to continue growing its dividend on an annual basis. The reason for that is the relatively low payout ratio, which currently stands at 55% on a GAAP basis.

prepared by the author, using data from SEC Filings

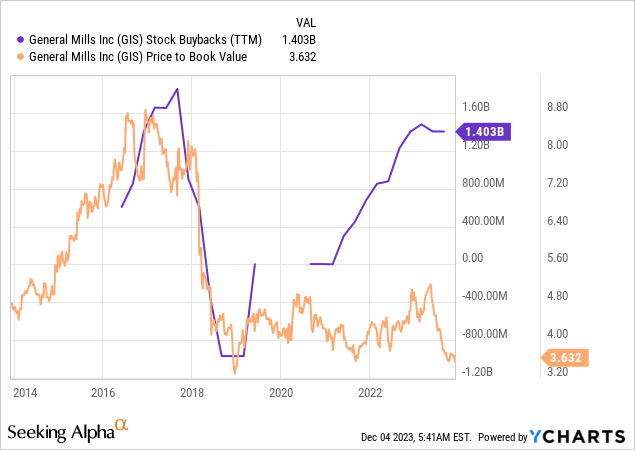

When it comes to shareholder distributions, we should also cite the record high share buyback program of GIS which currently stands at $1.4bn on an annual basis. This is done at a time when the company trades at multi-year low multiples, which would be highly accretive for future shareholder returns.

Conclusion

General Mills, Inc. has fallen roughly 15% since I downgraded the stock to a Hold back in June of this year. Short-term headwinds, however, are now slowly disappearing, while the company trades at very attractive levels relative to its business fundamentals. The stock also offers a highly attractive dividend yield, and recent capital allocation decisions bode well for future shareholder returns.