onurdongel/E+ via Getty Images

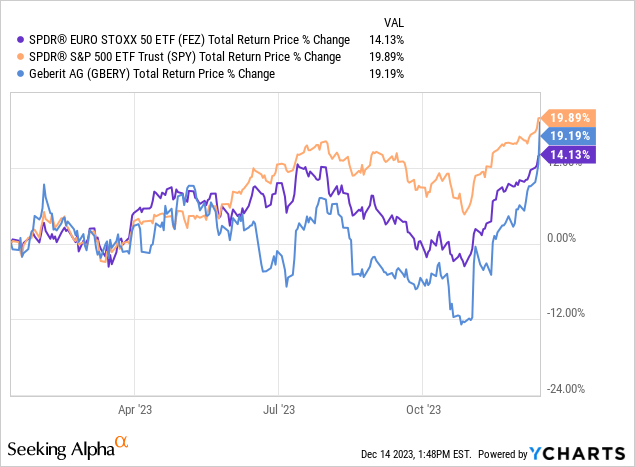

At the beginning of the year, we wrote an article on Geberit AG (OTC:GBERF) (OTCPK:GBERY) arguing that temporary headwinds had created a buying opportunity in this high-quality business. Since then shares have delivered a total return of roughly 12.5%, outperforming the SPDR EURO STOXX 50 ETF (FEZ) by more than 5%, and delivering a similar performance to the S&P 500 Index (SP500)(SPY). Given this price enhance and the fact that headwinds have yet to completely dissipate, we are re-evaluating whether shares remain attractive.

Overview

As a reminder, Geberit is the largest player in the European bathroom sanitary sector. They offer a full range of capabilities and products on what they call “both sides of the wall”. This means, things you can see, and the plumbing and infrastructure that is hidden behind the walls. Historically, they have had outstanding profitability and high margins, thanks to its strong brand and strong relationships with plumbers and specialized retailers. This competitive moat has enabled the company to enhance prices despite weak demand.

Q3 2023 Results

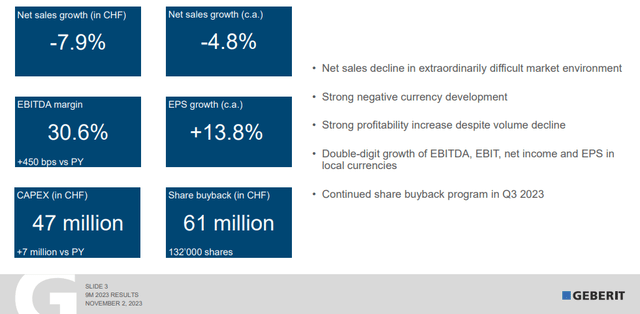

These results were announced on November 2nd. Construction activity in Europe has been declining for some time and Geberit has found itself in an extremely difficult environment. Adding to its problems are negative currency effects, and high input prices. Despite these headwinds, it was able to deliver increases in profitability, thanks to being able to raise its prices. Earnings per share were also boosted by the company’s aggressive buyback program.

The reject in European residential buildings, and general construction declines in other regions admire China, resulted in a year-over-year revenue reject of -7.9%. It is therefore quite impressive that the company was able to enhance profitability despite the volume declines. This shows that its high operational flexibility and cost discipline are working.

Financials

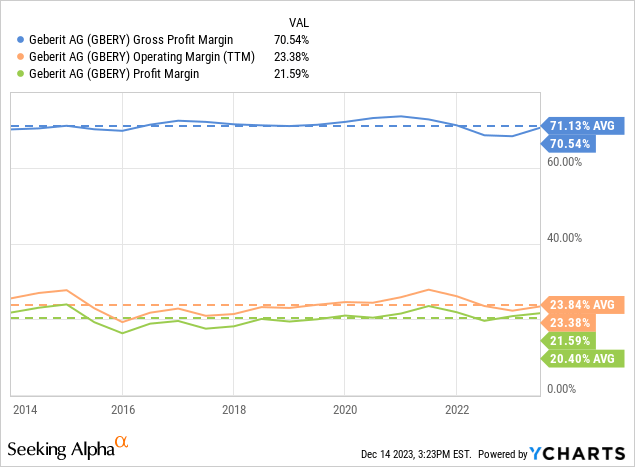

In the last couple of years, the company faced the combined challenges of a difficult sales environment, coupled with high input inflation. This “perfect storm” put significant pressure on profit margins, but the company has been able to bring them back close to their historical average again.

Part of this has been the company’s cost discipline and operational flexibility, but cooling inflation has also played its part more recently.

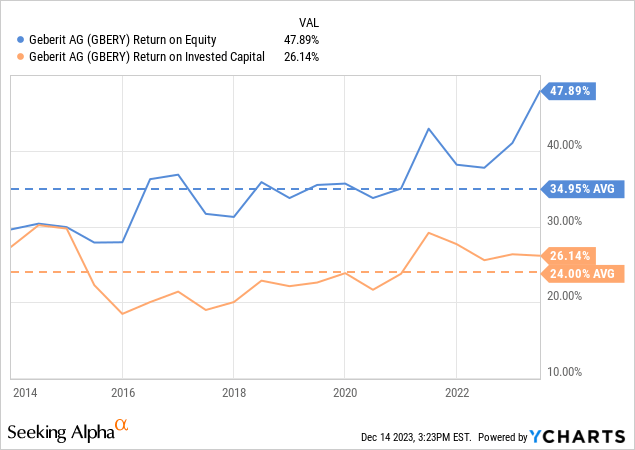

The financials paint the picture of a company with a strong competitive moat, given the high profit margins it is able to produce, as well as the impressive returns on equity [ROE] and on invested capital [ROIC], which are significantly above average.

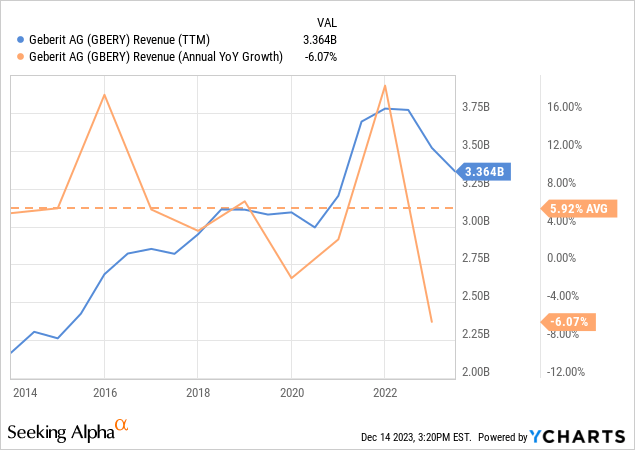

Growth

The historical annual revenue growth for Geberit was about 6%, but as we discussed previously, it is currently negative. Unfortunately, we do not see things changing in its markets any time soon, so this is a headwind that is likely to persist. High interest rates are likely to advance slow down construction in most economies, and now that inflation is coming down we think Geberit’s customers will be less understanding of price increases.

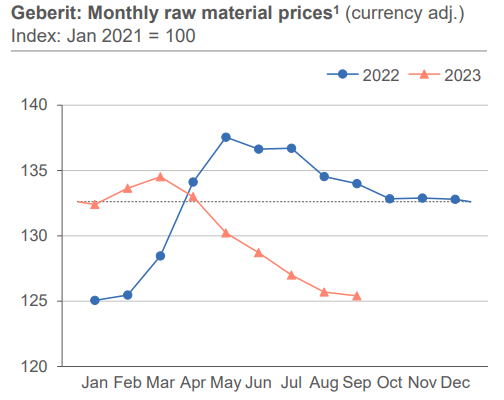

Raw Material Prices

Geberit has certainly benefited this year from cooling inflation, as raw materials were on average one percent lower in the first nine months of 2023 for the company, compared to the first nine months of 2022. Geberit also expects an average decrease in raw material prices for Q4 2023 compared to Q4 2022.

Geberit Investor Presentation

Outlook

Geberit’s management does not sound very optimistic about its markets for the short to medium term. They pointed out the overall reject in building construction, partly as a result of higher interest rates and building cost inflation. There was also a “pull-forward” effect from the Covid pandemic, which initially motivated people to renovate their homes, but is now resulting in average renovations. advance complicating things, some of its wholesalers are looking to reduce inventories given the declining market environment.

These headwinds result in expectations for a mid-single digit reject in net sales for the company in 2023. Still, Geberit appears confident that it can deliver a full-year EBITDA margin in the range of 29% to 30%. We believe that investors should elucidate this as a warning that positive surprises in the short to medium term are unlikely. In other words, we do not see positive catalysts to drive shares much higher, as margins have already recovered, and it looks very unlikely that volumes will start growing again soon.

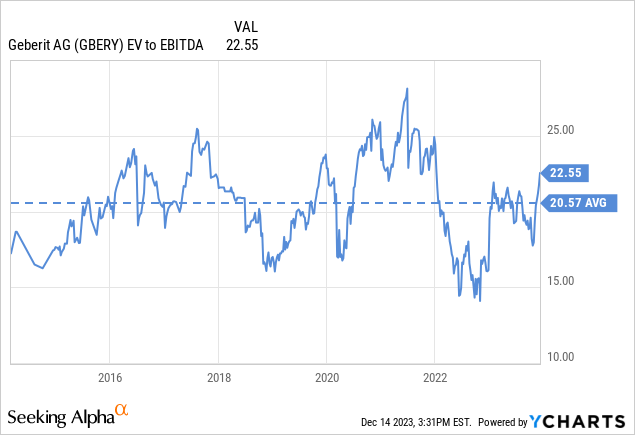

Valuation

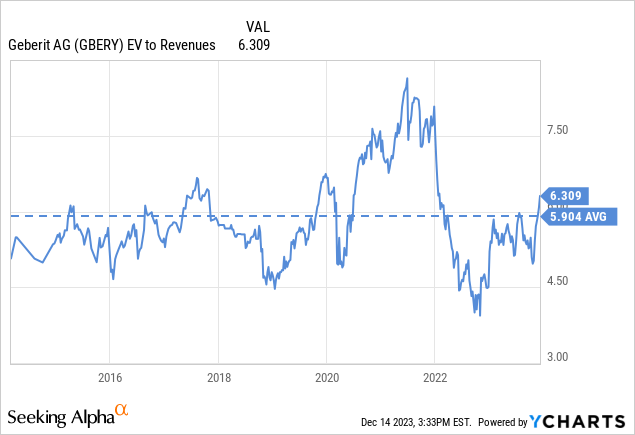

If shares were still extremely cheap we would be more optimistic, but after increasing about 19% since our last article, they no longer are that attractive. For example, they are now trading about 10% above their ten-year average EV/EBITDA multiple.

Shares are also trading with EV/Revenues above their ten-year average. While we do not view shares as extremely expensive, we believe there are much more attractive opportunities in the market right now. Especially given that we do not see positive catalysts that could help re-rate the shares higher.

Risks

While we view Geberit as a strong company with competitive advantages and well-managed, we think investors should be careful about the headwinds in the construction and renovation markets where Geberit operates. The main risk we see is that the shares appear fully valued, and a recession or additional economic weakness could result in a significant decrease in the share price. We believe the risk/reward for investors has deteriorated, and we are therefore downgrading our rating from ‘Buy’ to ‘Hold’.

Conclusion

While we are impressed that Geberit has been able to deliver increased profitability despite the challenges in the markets where it operates, we believe it will be difficult for the company to return to anywhere close to its historical average revenue growth. At least in the short to medium term we do not see positive catalysts that could return the company to this level of growth.

The company might be able to advance enhance pricing, but we believe it will be harder to uphold to customers given cooling inflation and reduced demand. The company has also probably already executed the easier-to-execute cost reduction measures, which will make it tougher to deliver similar levels of efficiency improvements. We do not think Geberit shares are extremely overpriced, we simply do not see a very attractive risk/reward, and are therefore adjusting the rating to ‘Hold’.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.