izusek/E+ via Getty Images

When you start learning about finance, one of the first misconceptions that you stumble across is that the market is perfectly efficient or pretty close to it. Legendary investors admire Warren Buffett, Peter Lynch, and countless others who follow the value school of investing ideology, have proven this idea to be wrong. Over windows of time, sometimes lasting years, the market can be inefficient, particularly when it comes to individual securities. One good example of this can be seen by looking at GE HealthCare Technologies (NASDAQ:GEHC), the healthcare business that was spun off from industrial conglomerate General Electric (GE) earlier this year.

The last article that I published regarding GE HealthCare Technologies stock came out in July of this year. It was one of the few companies that I had rated a ‘strong buy’. Such a designation reflects my belief that shares should, over the long run, significantly outperform the broader market. As I wrote about early this year, my overall track record for ‘strong buy’ prospects is pretty solid. But not everyone of these plays turns out the way that I would admire. So far, GE HealthCare Technologies has woefully underperformed the broader market since the publication of my last article. During this window of time, the stock is down 16% at a time when the S&P 500 has inched up by 0.6%.

Significant upside exists

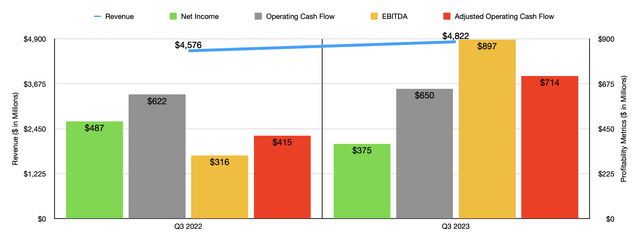

Recent weakness from a share price perspective has been driven not by fundamentals, but has instead been driven by market sentiment. I say this because the most recent financial data provided by management has been encouraging. This data covers the third quarter of the 2023 fiscal year. During that time, revenue for the company came in at $4.82 billion. That’s 5.4% above the $4.58 billion generated one year earlier. The greatest upside, from a year over year growth perspective, has been from the company’s PDx segment. This is the part of the business that focuses on the pharmaceutical diagnostics space. This unit operates largely as a supplier of diagnostic agents for the global radiology and nuclear medicine space. These agents are complementary to the firm’s devices under other segments, so it stands to reason that the more that those segments grow, the more that this particular segment will grow over the long haul. During the quarter, revenue for this unit was $589 million. That’s 12.8% above the $522 million generated the same time last year. Management attributed this to higher pricing and higher demand for certain regions admire the EMEA (Europe Middle East and Africa) and Rest of World areas that it operates in.

Author – SEC EDGAR Data

The company experienced growth in other places as well. The PCS, or Patient Care Solutions, experienced sales growth of 9%, with revenue growing from $701 million to $764 million. This is the part of the enterprise that provides customers with medical devices, consumable products, services, and digital solutions, that all center around larger organizations and teams. This boost in sales was attributable to growth across some product lines such as Monitoring Solutions, Consumables, and various related services. Management chalked this growth up to strong demand improvements in supply chain fulfillment and higher pricing.

And lastly, the Imaging segment, which is responsible for various scanning devices and similar technologies such as those involving CT scans, MRIs, X-rays, and more. Revenue under this unit managed to rise by 4.7% from $2.52 billion to $2.64 billion thanks to growth and demand for molecular imaging and computed tomography devices and magnetic resonance devices, as well as because of supply chain fulfillment improvements, higher pricing on the products that the company sold, and the introduction of new products. In fact the only weakness for the quarter came from the Ultrasound segment, which saw revenue dip by 1% from $823 million to $815 million. This drop, management said, came from easing of supply chain constraints last year that temporarily boosted revenue then.

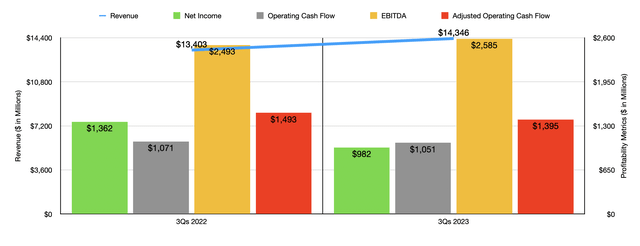

Author – SEC EDGAR Data

The boost in revenue for the company did not, unfortunately, result in higher profits. Net income actually managed to fall from $487 million to $375 million. While the company did suffer from higher interest expense and a rather meaningful rise in research and development costs, profits still would have been higher year over year had it not been for a near-doubling in income tax expense from $129 million to $250 million. Other profitability metrics, fortunately, managed to come in quite a bit stronger. Operating cash flow inched up from $622 million to $650 million. But if we adjust for changes in working capital, we get a rather sizable boost from $415 million to $714 million. And finally, EBITDA skyrocketed from $316 million to $897 million. As the chart above illustrates, financial performance for the first nine months of 2023 relative to the same time last year were largely similar to the third quarter of this year compared to the same quarter last year. However, cash flow figures in some respects were weaker this year than last year.

Author – SEC EDGAR Data

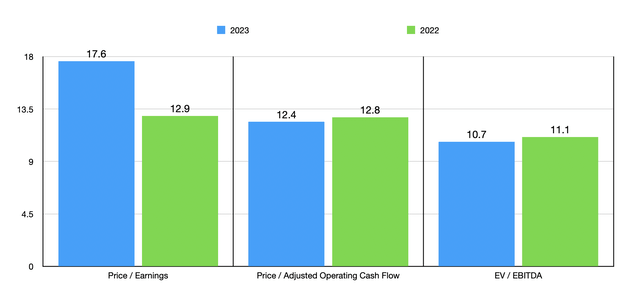

For this year in its entirety, management is expecting organic revenue to be between 6% and 8% higher than it was last year. Management also increased earnings guidance, with profits now expected to be between $3.75 and $3.85 per share. That’s $0.05 per share higher than what was previously expected on the low end of the scale. This should translate to net profits of about $1.74 billion. Based on my own estimates, adjusted operating cash flow should be around $2.48 billion, while EBITDA should come in somewhere around $3.62 billion. Assuming that these estimates are correct, the company should be priced as shown in the chart above. As you can see, the stock is a bit more expensive relative to last year on a price to earnings basis. But when it comes to the other two profitability metrics, it should be a bit cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| GE HealthCare Technologies | 17.6 | 12.4 | 10.7 |

| Danaher (DHR) | 27.6 | 20.1 | 18.6 |

| Thermo Fischer Scientific (TMO) | 32.4 | 23.5 | 20.0 |

| Agilent Technologies (A) | 30.6 | 21.5 | 22.8 |

| Mettler-Toledo International (MTD) | 28.1 | 24.7 | 20.4 |

| Siemens Healthineers AG (OTCPK:SMMNY) | 39.4 | 28.1 | 15.1 |

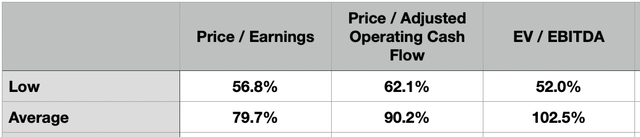

As part of my analysis, I then created the table above. In it, you can see how GE HealthCare Technologies is priced compared to five similar firms. To save you some time, I looked at the numbers myself and concluded that, irrespective of which valuation metric we use, GE HealthCare Technologies is the cheapest of the group. To see what kind of upside potential the firm might offer, I then created the table below. In it, you can see how much upside shares would have under each of the valuation approaches if the stock were to trade at the same multiple as the next cheapest player in the space. In addition to this, I also averaged out the multiples of the five companies I compared it with and calculated what kind of upside shares would encounter in that scenario. Even in the worst case, we would be looking at upside of 52%. And then the best case, upside would be 102.5%. So you can comprehend why I am as bullish about the business as I currently am.

Author – SEC EDGAR Data

Takeaway

Based on all the data provided, I must say that I am incredibly optimistic about the future of GE HealthCare Technologies. While it is true that some of the cash flow figures could look better than they currently do this year, the stock looks attractively priced, both on an absolute basis and relative to similar firms. Revenue continues to grow and even management increased guidance for earnings at the midpoint. Absent something significant changing about the business, I would say that advance upside is likely from here. And because of that, I have decided to keep the company rated a ‘strong buy’ for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.