da-kuk

Investment thesis

Our current investment thesis is:

- Gartner is a fantastic company with limited downsides in our view. Management has developed an impressive business model, underpinned by deep expertise and a strong reputation. The company is a market leader and has impressive customer retention.

- We expect its subscription revenue model, alongside technological tailwinds to drive value in the coming years, although there is uncertainty associated with if this trajectory can equal the years past.

- Gartner’s valuation does not leave any margin for safety, which is expected given its perfect performance. We believe with the risk-free rate where it is (higher than Gartner’s cash yield), investor funds are better placed elsewhere.

Company description

Gartner (NYSE:IT) is a global research and advisory firm providing information, advice, and tools for leaders in IT, finance, HR, customer service, and support functions.

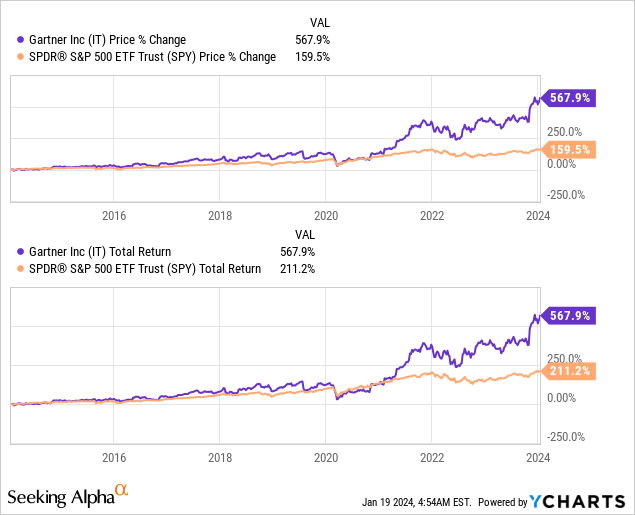

Share price

Gartner’s share price performance has been exceptional, gaining over 500% in the last decade. Its gains broadly tracked the wider market, as consistent financial development and an elevated valuation restricted a runaway valuation. Post-pandemic, however, its financial performance accelerated and its valuation followed.

Financial analysis

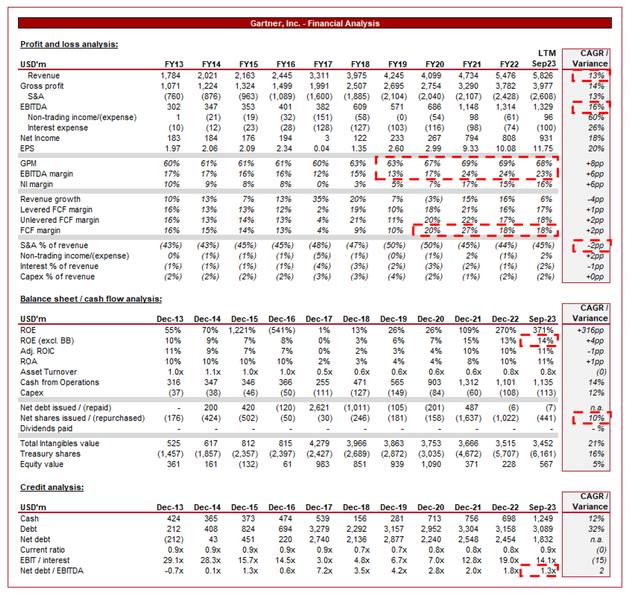

Presented above are Gartner’s financial results.

Revenue

Business model

Gartner’s core business revolves around offering research and advisory services. It provides insights, analysis, and strategic advice to help organizations and businesses make informed decisions.

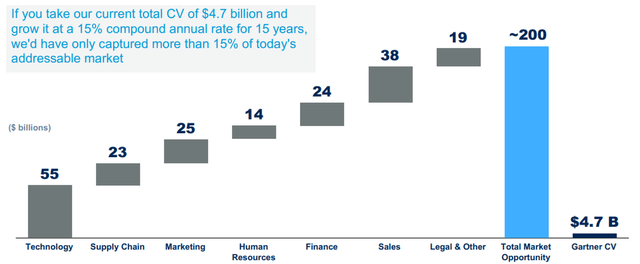

Gartner covers a broad spectrum of industries and functional areas, including IT, finance, HR, marketing, and supply chain. This diversity allows the company to serve a wide range of clients and remain relevant in various business contexts. The development of its expertise across a range of avenues is critical to maintaining its trajectory.

Furthermore, the company also organizes events and conferences, bringing together professionals, thought leaders, and solution providers. These events serve as platforms for networking, learning, and staying updated on industry trends. Also, it offers consulting services to help clients implement the insights gained from its research into actionable strategies. These two revenue streams are secondary to its primary Research but works well to maximize its monetization potential.

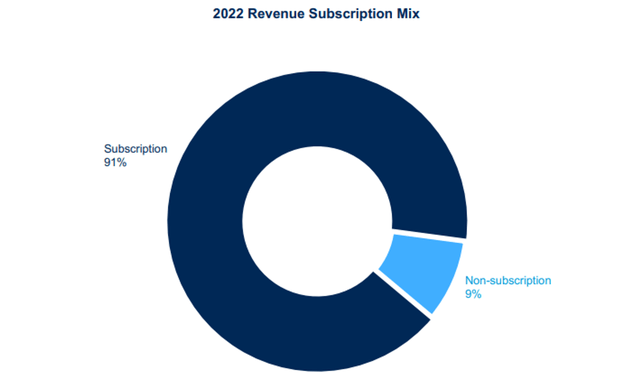

Gartner operates on a subscription-based model, where clients pay for access to its research and advisory services. This model is highly lucrative as it provides a predictable revenue stream, enhancing financial stability and allowing Management to focus on cross/upselling, alongside winning new customers.

Growth drivers

We believe the following factors are key growth drivers:

- Magic Quadrant and Hype Cycle recognition in the market: Gartner’s proprietary tools like the Magic Quadrant and Hype Cycle are widely recognized in the industry, with most constituents advertising their inclusion, contributing to positive reinforcement as a leading metric.

- Market Analysis and Forecasts: With an ever-complex and uncertain future due to rapid technological development and growing complexity, the need for insight has become critical to business planning. Gartner’s research can help understand the current and future state of markets, technology trends, and emerging opportunities or threats.

- Industry Influence and Reputation: Gartner’s long-standing reputation as a leading research and advisory firm enhances its influence in the industry. Management teams rarely have complete information when making decisions and so in many cases, reputation is a key driving factor to winning clients.

- Strategic Acquisitions: Gartner has historically strategically acquired complementary businesses to expand its capabilities and offer a more comprehensive suite of services.

- Digital Transformation Demand: As previously mentioned, the increasing technological developments globally have led to the need for digital transformations as organizations seek to modernize their operations and better understand their industry.

- Specific technological trends: There are specific technological developments that are driving investment, namely

- Cybersecurity: Growing emphasis on cybersecurity and data privacy as assets increasingly transfer online.

- Remote Workforce: The impact of the remote workforce on IT and organizational structures.

- Artificial Intelligence: Integration of AI in business processes and decision-making.

- Cloud computing: Similar to AI.

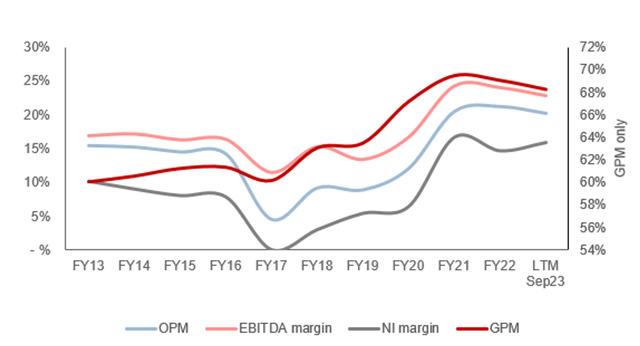

Margins

Gartner’s margins have improved impressively during the last decade, with EBITDA-M increasing from 17% in FY13 to 23% in the LTM period. The company has benefited from its services nature, experiencing operating cost leverage and an improvement in sales funnel conversion.

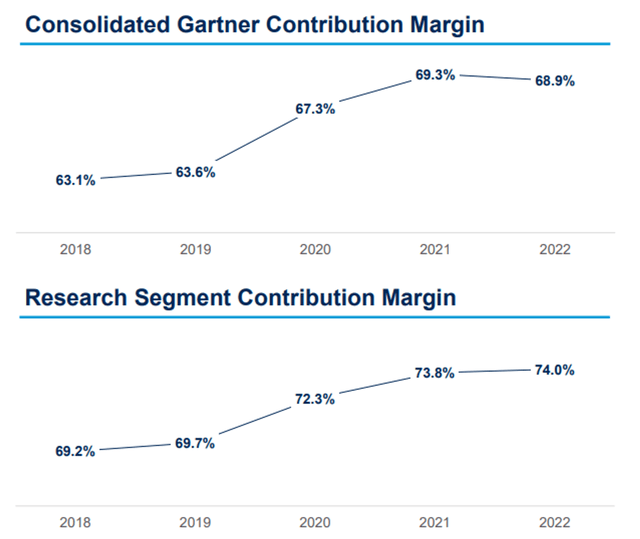

Primarily, however, improvement is driven by the development of its Research segment, which is ~80% of the company’s total revenue. With Gartner operating a subscription model, the company benefits from the ability to sequentially improve unit economics through price increases, while its incremental cost of providing its service continues to be diluted.

As the following illustrates, the Research segments contributing margin growth since 2018 alone is impressive, with ~5% gains. Looking ahead, we expect this transition to continue, primarily due to the dilution of its other service lines, as both Consulting and Conferences are noticeably less profitable (Contribution margin ~40-50%).

Quarterly results

Gartner’s recent performance has been strong, with top-line revenue growth of +15.2%, +11.6%, +9.2%, and +5.8% in its last four quarters. In conjunction with this, its margins have normalized following rapid expansion post-pandemic.

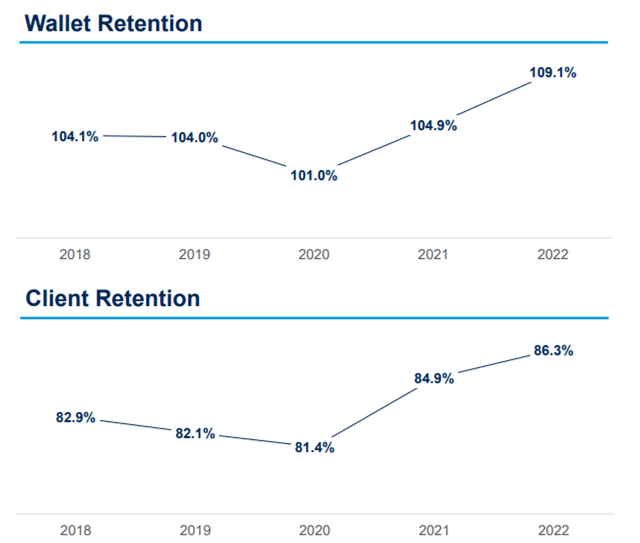

This strength is a reflection of its resilient business model, alongside the wider macroeconomic environment. With inflationary pressures, Gartner is positioned to lift prices higher than historically achieved, particularly in cases where inflation-pegged price increases are included within contracts (which is regularly the case with wage inflation). This is reflected in its “wallet retention” below, which reflects the amount of contract value retained over 12 months (>100% implying growth in contract value on a net basis). The company’s cost to deliver, however, has not materially deviated, contributing to margin appreciation.

The issue with this strategy is that businesses risk losing clients who cannot justify the price hikes. This is where the quality of its service is key. As the client retention statistic below illustrates, Gartner’s clients value its service more than ever, boasting a level in excess of its pre-pandemic retention. This suggests that inflationary price increases are accepted with minimal resistance.

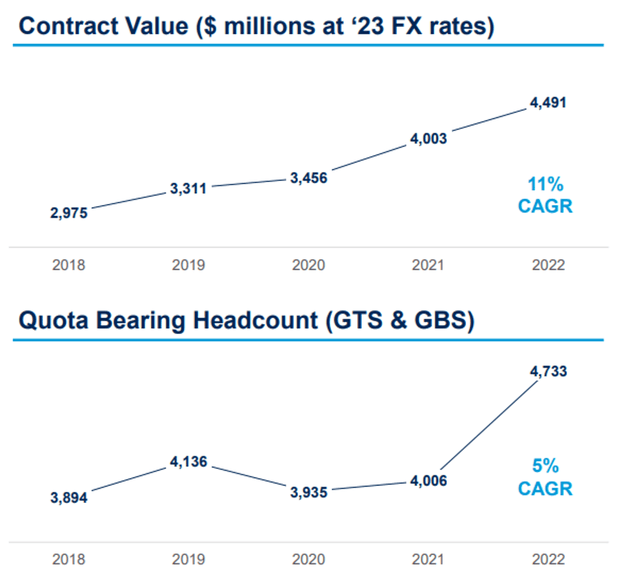

The company continues to invest in its services, however, ensuring it is incrementally developing its expertise and remaining ahead of its competitors. This will be on an accretive basis importantly, as headcount growth has lagged behind contract value.

These factors have culminated in Management lifting guidance for FY23, as stubborn inflation and economic strength have allowed the business to benefit from momentum.

Balance sheet & Cash Flows

Gartner’s balance sheet is uneventful, with a ND/EBITDA ratio of 1.4x. The company receives the majority of its cash upfront and has limited capex commitments (~2% of revenue), allowing for minimal debt usage and thus aggressive capital allocation for expansion.

Management has utilized this for periodic M&A, where opportunities to expand its capabilities present themselves. This is a key lever in the industry as technological development is rapid, creating greater risks associated with new competition.

In conjunction with this, Management has aggressively repurchased shares, even as cash has accumulated, contributing to healthy supplementary shareholder returns.

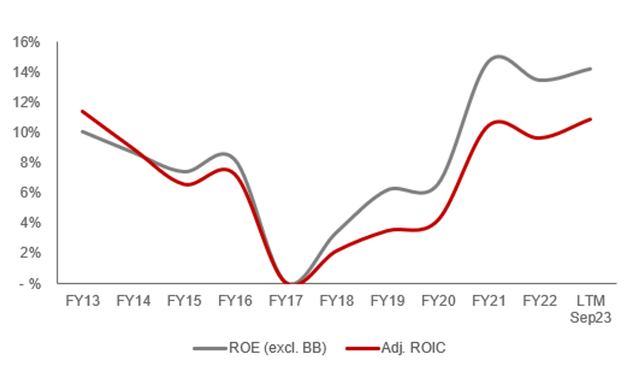

The company boasts a ROIC of ~11%, an attractive risk-adjusted level when considering its market-leading position and resilient business model. We expect this to incrementally improve as buybacks remain a core component of its capital allocation strategy.

Outlook

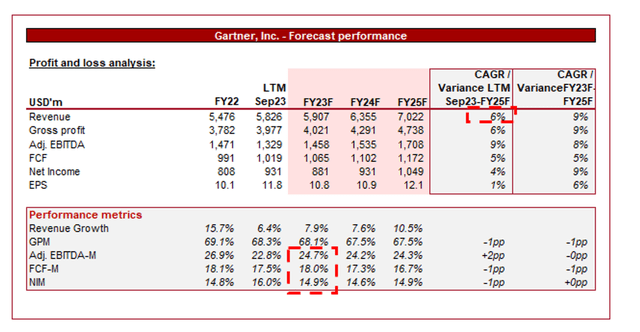

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting “business as usual” in the years to come, with revenue growth of +6% and sequential margin improvement. We believe the growth rate is reasonable as following a period of aggressive price hikes, normalization will follow. This will contribute to growth softening, although we certainly believe there is scope to outperform this if tailwinds present themselves.

Further, growth led by Research will allow for margin improvement over time, with ~2% at an EBITDA level in the next 3 years appearing reasonable.

Industry analysis

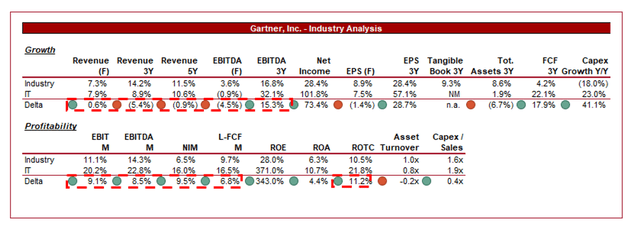

Presented above is a comparison of Gartner’s growth and profitability to the average of its industry, as defined by Seeking Alpha (22 companies).

Gartner performs exceptionally well relative to its peers. The company’s growth is comparable to its peers, which is impressive given it is larger than the average and also principally organically driven (rather than through M&A). This is a testament to its market-leading position and deep expertise.

Further, Gartner is noticeably ahead on margins, allowing for a superior ROTC. This is due to the factors above alongside its heavy weighting toward subscription revenue.

Valuation

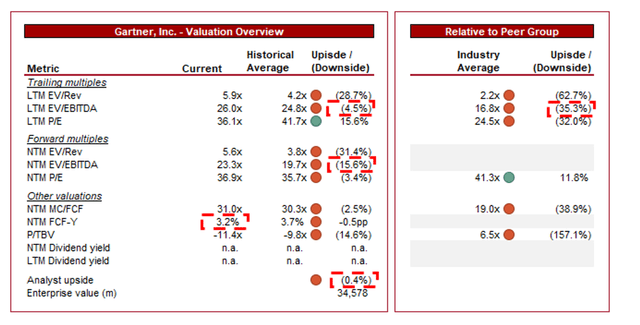

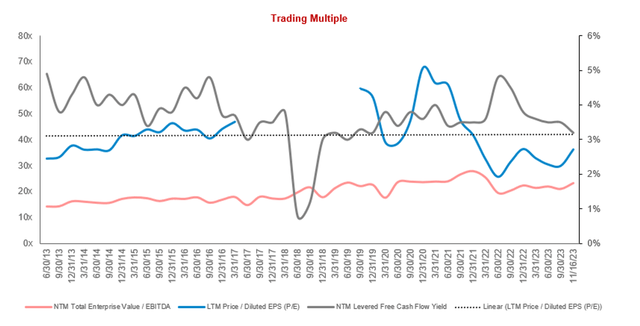

Gartner is currently trading at 26x LTM EBITDA and 23x NTM EBITDA. This is a premium to its historical average.

A small premium to its historical average is warranted in our view. The company’s margins have developed well, as has growth, underpinned by the creation of a market-leading suite of services that are growing in importance globally. We do not suggest a bigger premium because investors have priced much of this in, and continue to do so. As the below graph illustrates, its EBITDA growth of 16% has not contributed to any multiple contraction as positive investor sentiment drives future expectations of a continuation. It is difficult to see another decade of ~16% EBITDA growth.

Further, Gartner is trading at a ~35% premium to its peers on an LTM EBITDA basis and ~40% on a NTM FCF basis. This is a steep premium for a business, illustrated by its FCF yield of ~3%, which is well below the current risk-free rate.

This stock is a stock market darling and is dangerously positioned as expectations are an unwavering continuation. The stock is ranked second according to the overbought indicator.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- [Upside] Growing demand for advisory services as an increasing number of businesses require consistent support in this digital age.

- [Upside] Opportunities for expansion into emerging markets.

- [Downside] Economic downturn affecting corporate spending on advisory services, creating the perception of slowing growth for Gartner (Research remaining resilient).

- [Downside] Rapid technological changes diminishing the relevance of existing research.

Final thoughts

Gartner is a fantastic business with very little in the way of downsides. The company is growing exceptionally well and has sticky customers, allowing for a focus on new customer acquisition and expanding its offering. Underpinning this is market-leading expertise, which Management is successfully expanding as a means of increasing its growth runway.

Although we are expecting growth and margin improvement, Gartner’s valuation is far too rich for upside in the current market.