State pension: Expert on who may be owed back payments

Thousands of pensioners are set to receive back pay worth £6,550 after a series of state pension underpayment errors.

An estimated 170,000 elderly women have lost money over many years due to the DWP failing to make increases in their state pension.

Two groups of women could be paid by the end of next year – they include married women who should have received an upgraded State Pension and those aged over 80.

Some widows can also inherit large sums in basic and second state pension from their late husbands, but this depends on their ages and the strength of their late spouse’s National Insurance record.

Over-80s who are residents in the UK should also be getting a ‘Category D’ pension of £80.45 a week.

State pensions could get backpay worth £6,500 (Image: GETTY)

The Department for Work and Pensions has confirmed that deceased women who were underpaid will have arrears paid to their estate, so it will go to their beneficiaries.

The above groups should be contacted by the DWP eventually as part of a ‘correction exercise’.

Some divorced women may also have missed out, and women whose husbands reached state pension age before 17 March 2008, and they will need to make proactive claims to the DWP.

Earlier this month, the Express reported that an estimated 165,000 retirees have been underpaid £1.2billion due to historical official errors.

But Money Saving Expert reckons that the figure of those who have been underpaid could be higher than 230,000. And the website says that around 5,000 people could be due tens of thousands of pounds.

The Martin Lewis-founded website is urging anyone who meets the criteria that appears at the end of this article to check whether they are due backpayments.

One of the site’s users got in touch with the Government’s Pension Service and 10 days later received a cheque for £22,350 with a further £645 in interest.

Another reported receiving first a cheque for £3,401 and later a second for £8,996 after making enquiries.

An estimated 170,000 elderly women have lost money over many years (Image: GETTY)

The DWP puts the current figure to be paid out to people at £835million in total as the department reviews £678,00 cases to determine who is owed cash.

Earlier this year, the DWP claimed that it was on track to have paid out the money to the relevant parties by the end of this year.

Between £300million and £1.5billion may be missing from pensioners’ pockets due to errors in the recording of Home Responsibilities Protection (HRP).

Thousands will be receiving letters throughout autumn concerning HRP underpayments due to missing information on National Insurance records.

The scheme was supposed to protect the State Pension entitlements of parents and carers but was replaced by National Insurance credits in 20210.

HMRC will use National Insurance records to find as many people as possible who may have been entitled to HRP from 1978 to 2010 but have no trace of HRP on their National Insurance records.

- Advert-free experience without interruptions.

- Rocket-fast speedy loading pages.

- Exclusive & Unlimited access to all our content.

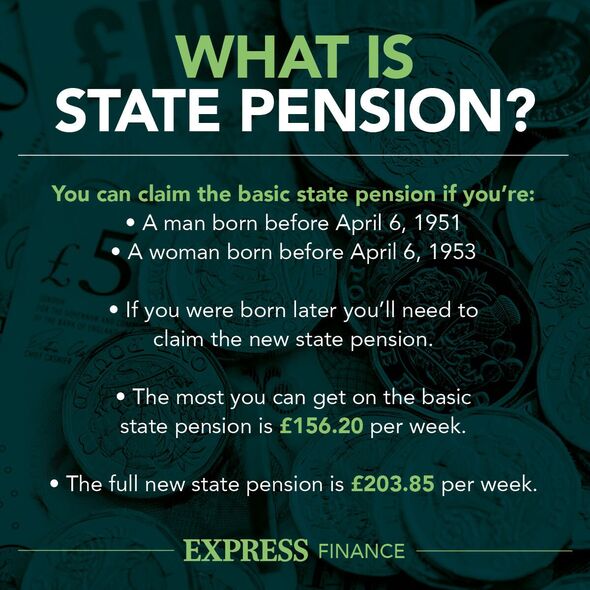

State pension age is currently 66 in the UK (Image: EXPRESS)

In the latest report, DWP said: “As stated in last year’s Annual Report and Accounts, we are on track to complete the exercise for the customer groups Cat BL and Cat D by the end of 2023.

“We expect to see a continued increase in clearance rates in 2023-24, as additional resources join the exercise and complete their training and additional rounds of automation are completed in Summer 2023.”

The State Pension LEAP exercise has been launched to identify where State Pension underpayments may have occurred.

Groups affected include: category BL (Cat BL) – people who are married or in a civil partnership who reached State Pension age before 6 April 2016 and should be entitled to a Category BL uplift based on their partner’s National Insurance contributions.

Missed conversions – people who have been widowed and their State Pension was not increased to include any amounts they are entitled to inherit from their late husband, wife or civil partner.

Category D (Cat D) – people who reach age 80 and who are getting some Basic State Pension but less than the £85.00 (in 2022-23) and may therefore, subject to satisfying the appropriate residency conditions, be entitled to Cat D State Pension of £85.00 a week.

Earlier this year, a DWP spokesperson said: “The action we are taking now will correct historical underpayments made by successive governments.

“We are fully committed to addressing these errors, not identified under previous governments, as quickly as possible.

“We have set up a dedicated team and devoted significant resources towards completing this, with further resources being allocated throughout 2023 to ensure pensioners receive the support to which they’re entitled.”

Who may be due back payments for state pension?

There are six particular groups strongly encouraged to contact the pension service to see if they could be entitled to more state pension.

- Married women whose husband turned 65 before March 17, 2008 and who have never claimed an uplift to the 60 percent rate

- Widows whose pension was not increased when their husbands died

- Widows whose pension is now correct, but who think they may have been underpaid while their late husband was still alive, particularly if he reached the age of 65 after March 17, 2008

- Over-80s who are receiving a basic State Pension of less than £80.45

- Widowers and heirs of married women, where the woman has now died but was underpaid state pension during her lifetime

- Divorced women, particularly those who divorced after retirement, to check that they are benefiting from the contributions of their ex-husband

Anyone who thinks they must be affected can call the pension service on 0800 731 0469.

You can also write to the Government body by sending a letter to: The Pension Service, Post Handling Site A, Wolverhampton, WV98 1AF.

More contact details are available on the Pension Service’s website.