VioletaStoimenova/E+ via Getty Images

Investment thesis

Growth with low risk is a description that captures the essence of FTI Consulting, Inc. (NYSE:FCN). The company works with many large and prominent clients in the legal, banking, Fortune 100, and private equity firms.

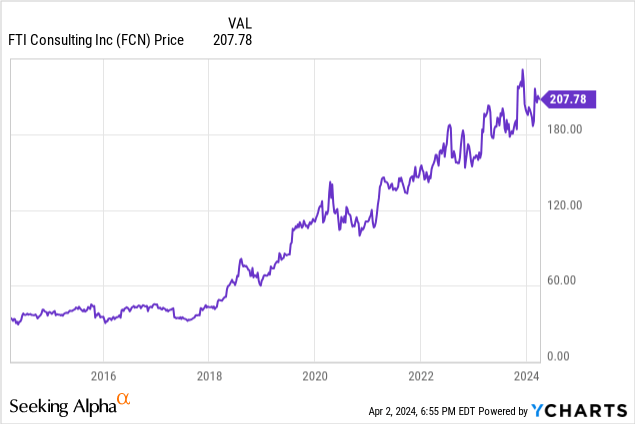

Since going public in 1996, its share price has grown 24-fold in 28 years. It has the competitive advantages, financial resources, and strategy to continue that growth. Based on those elements, I rate FTI a Buy.

About FTI

The company was founded in 1982 under the name Forensic Technologies International, with a mandate to provide expert witnesses for litigation. It went public in 1996, changed its name in 1998 and then began trading on the New York Stock Exchange.

In 1996, its initial price was $8.50; on April 2, 2024, the stock closed at $207.31. That’s what investing legend Peter Lynch would call a 24-bagger–in just 28 years. In more technical terms, it has had a compound annual growth rate of 12.06%.

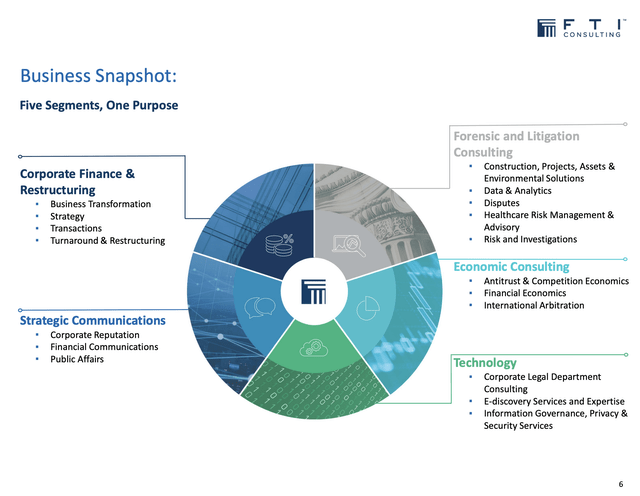

Today, the company operates across many areas of business, as outlined in the following chart:

FTI segments (Q4-2023 investor presentation)

Corporate Finance & Restructuring made the biggest 2023 contribution to consolidated revenues with a 39% share; Economic Consulting provided 22%; Forensic and Litigation Consulting contributed 19%; Technology 11%; and Strategic Communications provided 9%.

FTI operates globally but derives the largest proportion of its revenue at home in the U.S. Domestic operations brought in 63% of revenue in 2023, while 37% was derived internationally.

On April 2, 2024, its share price was $207.31, and its market cap was $7.27 billion.

Competition and competitive advantages

Because of the multi-faceted character of its business, FTI competes with different companies, depending on the nature of the consulting briefs. It reported in the 10-K for 2023 that competitors include global accounting firms, large management and consulting firms, investment bankers, information technology consultants, and software companies.

It also argued that its businesses are themselves highly competitive, based on “the breadth of our services, the quality of our work, the prominence of our professionals, our geographic reach, our reputation and performance record, our specific industry expertise, our ability to staff multiple significant engagements across disciplines and industries in multiple locations, and our strong client relationships.”

To back up that claim, it pointed out in the investor presentation that it advises 98 of the world’s top 100 law firms, works with 83 of the Fortune Global 100 corporations, consults with 38 of the world’s top 50 bank holding companies, and is an advisor to 64 of the top 199 firms on the Private Equity International 300 list.

Its competitive advantages include the recognition that many of its professionals are regarded as leaders in their fields; each of its practice areas is highly specialized and we would expect professionals to know or know of the experts. Those experts include two Nobel Laureates.

Client needs for integrated solutions give it an edge because of the depth and breadth of its segments. With its diverse group of specialties, it will be able to reach experts in many fields without needing to use outside consultants.

As noted, it has a diverse group of elite clients, most of which should be more financially stable than other firms. Big, successful corporations can afford to use consultants more frequently than smaller firms.

Margins

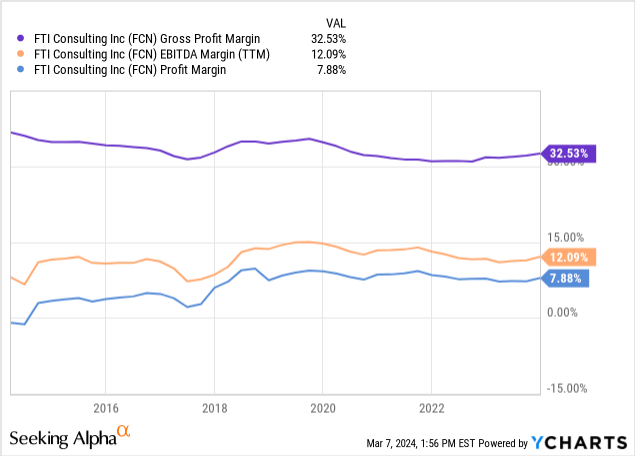

Although its margins are not growing, they are strong enough to back up claims of an FTI moat:

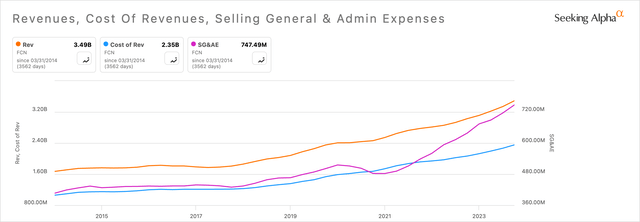

Margins might be stronger if not for the uptick in Selling, General, and Administrative [SG&A] expenses over the past two years:

FCN Margins chart (SeekingAlpha )

Among the costs pushing up SG&A is the expense of recruiting and retaining professionals who have the expertise, reputation, and client skills needed. FTI reported in the 10-K,

“We face intense competition in recruiting and retaining highly qualified professionals to drive our organic growth and support expansion of our services and geographic footprint. We incur significant expenses, time and resources to train, integrate and develop our professionals. We experience attrition of highly qualified professionals in the normal course of our business.”

More specifically, SG&A included higher non-billable compensation expenses, an increase in bad debt, and more for outside services.

Growth

Over the past decade, the key fundamentals have grown impressively:

- Revenue: up 108.98%

- EBITDA: up 83.21%

- Net income: up from -$16.16 million to $274.89 million.

The Q4 and full-year 2023 results were released on February 22 under a headline that used the word “Record,” as in best-ever revenues and earnings. The company attributed its record revenue to higher demand across all business segments.

To some extent, the increased revenue was offset by higher wages and benefits (including an increase in its headcount), a jump in SG&A, and higher income taxes. Still, FTI managed to produce EPS OF $7.71, a 17% increase over 2022.

The results also included an increase in net cash from operating activities, to $224.5 million from $188.8 million at the end of 2022. And over the course of 2023, FTI bought back 112,139 shares of its common shares at an average price of $158.70. On the last trading day of 2023, December 29, shares traded at $199.15, suggesting the repurchases were a good decision.

Looking forward to the rest of 2024, the guidance provided in the release indicates that revenue is projected to increase from $3.50 billion in 2023 to a range between $3.650 billion and $3.790 billion, a 6.29% increase at the midpoint of $3.72 billion. Earnings per share (EPS) are anticipated to fall within the range of $7.75 to $8.50, compared to $7.71 in 2023. Additionally, adjusted EBITDA is expected to align with the EPS figure.

If EPS rises to $7.75, it will be essentially flat with little growth. On the other hand, if EPS reaches $8.50, the company will provide a 10.25% increase.

FTI has identified a set of what it calls “business drivers”, changes that push its clients and potential clients to seek out the FTI’s expertise:

- Artificial intelligence and other new/emerging technologies.

- Developing markets.

- Cloud-based collaboration and communications platforms.

- Financial markets.

- Litigation and disputes.

- M&A activity.

- Operational challenges and opportunities.

- Complex regulations, public scrutiny and investigations.

That’s a broad and diverse swath of tailwinds that will help multiple FTI segments.

The three Wall Street analysts offering earnings estimates expect EPS of $8.31 for 2024, an increase of 7.83% over 2023’s $7.71. For 2025, they expect $9.65, a gain of 16.08%, and the one analyst offering an estimate for 2026 projects $11.16, which represents a gain of 15.65%.

Financing new growth should not be a problem, as the company held $303.2 million in cash and cash equivalents at the end of 2023.

In 2024, it expects to make capital expenditures of $35 to $42 million. It also repurchased $21 million in stock and has another $460.7 million available under its buyback program.

FTI also grows through acquisitions. Recent purchases include The Rhodes Group, a construction consulting firm, in 2021; BOLD, a restructuring and transformation advisory firm in the Netherlands, in 2022; and last year, it launched FTI Delta, “a global industry-specialized strategy consulting practice” based on a 2020 acquisition.

Management and strategy

Steven Gunby joined FTI as President and CEO in 2013 and has held those positions since then. An attorney, he served 30 years at The Boston Consulting Group, Inc., where he ran the firm’s global Transformation and Large Scale Change Practice.

Ajay Sabherwal is the company’s Chief Financial Officer. He previously held the same post at FairPoint Communications. He has a bachelor’s degree in mechanical engineering, and master’s degrees in economics and business administration.

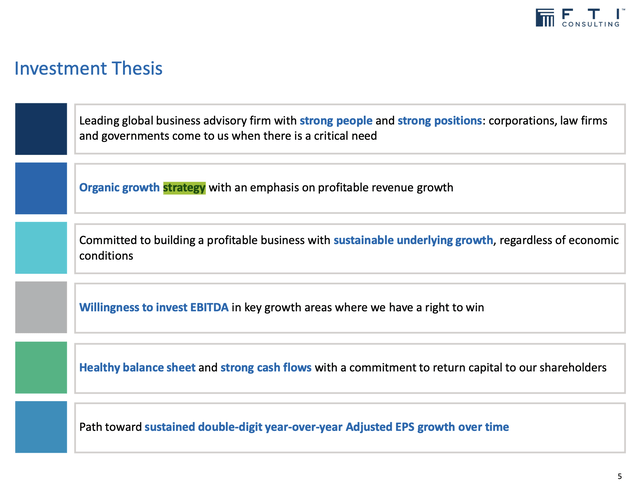

Strategy: Point number three in this slide from the March 2024 investor presentation seems to sum up the overall business strategy, while the other points might be tactics supporting the strategy:

FCN Business Strategy table (March 2024 investor presentation)

The strategy seems feasible and logical; feasible in the sense that FTI has expertise in growing profitably, along with the resources to implement its strategy. It’s logical in the sense that it builds on a history of organic and acquired growth and sets a challenging but achievable target: double-digit year-over-year, adjusted EPS growth.

It’s worth noting this piece of the third point in isolation, “building a profitable business with sustainable underlying growth, regardless of economic conditions”. That’s a way of saying it wants to develop a stable stream of revenue and earnings, regardless of what the national and international economies are doing.

More stability should help it attract and retain long-term investors, including institutional investors. Regarding the latter, they already own an overwhelming 98.20% of shares outstanding.

Generating stable revenue and earnings also opens the door to future dividends, another attraction for long-term investors.

Valuation

FTI’s PEG GAAP [TTM] ratio is 1.57, which is in the middle of the fair valuation range (1.00 – 2.00). This suggests fair valuation and a significant distance from being undervalued. However, it appears expensive when compared with the Industrials sector median of 0.96.

EV/EBITDA [FWD] also runs on the high side at 16.84, which is 47.5% higher than the sector median. Price/Sales [FWD] is 1.94 compared with the sector’s 1.44, and the Price/Book [TTM] is 3.66 while the sector median is 2.68.

Based on these metrics, FTI is modestly overvalued, but as this chart shows, the price is volatile and fluctuates continuously. Investors with a short-term perspective would be wise to wait for another bottom. Long-term investors, on the other hand, may see this as a reasonable time to enter:

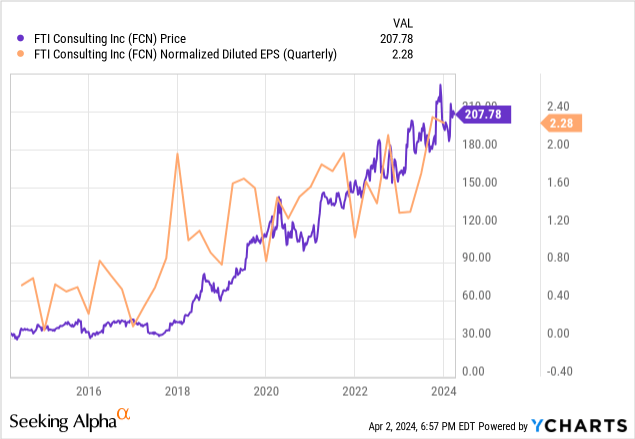

If we add earnings per share to a 10-year chart, we see alignment between earnings and the share price:

Therefore, I would expect the share price to grow by the same amount as earnings (estimated). EPS is projected to grow by 7.83% this year, which is reasonable, considering a couple of factors. First, the normalized basic CAGR over the past ten years has been 11.98%, and over the past five years it has been 11.28%.

Second, the mid-point in management’s guidance for 2024 is $8.13, which would be a 5.44% increase over 2023’s $7.71. In other words, 7.83% lies between two “boundaries”, an upper guide based on historical results and a lower guide based on management’s guidance.

Adding 7.83% to the December 29, 2023 share price ($199.15) would take it to $214.74 at the end of 2024. An estimated increase of 16.08% in 2025 provides a December 2025 target of $249.27.

I believe these increases provide an attractive return and, therefore, will rate FTI a Buy.

The Quant system has a Hold rating; one previous SeekingAlpha analyst rated it a Hold, while Wall Street analysts have issued two Strong Buys and one Hold.

Risk factors

Rising SG&A costs, perhaps driven by inflation, reduced the bottom-line results in 2023. If inflation was the problem, then that problem should cure itself as interest rates come down. However, if not, margins and earnings could become proportionately smaller.

Big, elite client organizations offer many benefits, but if something goes wrong, extreme costs or penalties can ensue. While FTI carries insurance, deciding how much insurance to purchase is always a trade-off between costs and comprehensiveness of coverage, meaning there is a risk of having to cover costs beyond insurance coverage.

The company’s segments operate in a group of relatively small professional communities. Any significant failure could adversely affect the segment or the whole company. Years of work building a reputation could be nullified with just one mistake.

The company wrote in its 10-K, “We are subject to and routinely face cyber-based attacks and attempts by hackers and similar unauthorized users seeking to gain access to or corrupt our information technology systems.” While FTI uses many security measures, there is always a risk that individual or state-sponsored rogues will get inside its information systems.

What it calls “Increasing scrutiny and changing expectations from governmental organizations, investors, clients, and our colleagues” impose uncertainty on the firm. In particular, it points to some government and court decisions that attempt to influence its recruiting, hiring, and other employment decisions.

Conclusion

FTI Consulting is a potential pick for investors looking for growth with only a modest amount of risk. Through organic growth and acquisitions, it has built up a client base of blue-ribbon clients and has the resources to keep growing it.

I am looking for long-term growth, averaging high single-digits or low double-digits over the next five to ten years. One key metric to watch going forward is selling, general, and administrative expenses; as we saw, this line has recently grown more rapidly than revenues and cost of revenues. If SG&A does keep growing, then there is a reasonable probability that margins will decline and set off negative bottom-line consequences.

Consider it modestly overvalued at the moment, but that may change if, as technical analysts might expect, the price falls further before bottoming out and rising again. For medium and long-term investors, this may be irrelevant as they look beyond the immediate gyrations. I have rated FTI a Buy.