Suriyapong Thongsawang

Investment Thesis

Euronav (NYSE:EURN) and Frontline (NYSE:FRO) just closed a deal, putting an end to their dispute. As part of the agreement, Frontline will acquire Euronav’s 24 newest VLCCs and divest their 26.12% stake to CMB. This transaction will grant the Saverys family control over Euronav, propelling Frontline to become the largest publicly traded tanker company. While the deal is fair, it presents potential drawbacks: the Saverys family’s acquisition of full control over Euronav is viewed as a negative by shareholders, and Frontline’s significant leverage could pose another concern. Finally, both companies are trading above their fair value and peers’ valuation. Therefore, I would propose selling both and reallocating to other tanker companies.

Background

Euronav was established in 1995 through a joint venture between Compagnie Nationale de Navigation (CNN) and Compagnie Maritime Belge (CMB), led by the Saverys family.

Frontline was founded in 1985. In 1996, Hemen Holding Limited, a company indirectly controlled by John Fredriksen, became the majority shareholder in Frontline, and still controls 35% of Frontline shares.

In a surprising twist of events in October 2021, John Fredriksen and Frontline swiftly entered Euronav’s capital scene by acquiring a 9.8% stake. Subsequently, Frontline progressively increased its stake, leading to the announcement of a merger with Euronav in April 2022. The proposed merger involved Euronav shareholders exchanging their shares for Frontline shares in a share swap deal, albeit with a relatively modest premium.

Adding complexity to the narrative, the Saverys—Euronav’s founding family who had sold their remaining shares in 2020—re-entered the picture, publicly opposing the merger. Simultaneously, the Saverys proposed a merger with CMB.tech (owned by them) to shareholders. To advance complicate matters, Euronav’s management wrote a letter to shareholders supporting the Frontline merger and expressing opposition to a merger with CMB.tech.

This clash over Euronav’s future triggered a competitive scramble, with both Frontline and the Saverys vigorously acquiring shares. The situation reached a deadlock when each party exceeded a 25% stake in Euronav.

Behind the scenes, both parties worked to unlock the impasse and finally two years later reached an agreement on October 9th.

The agreement

The transaction involves three mutually dependent agreements:

- CMB is set to acquire Frontline’s 26.12% stake in the Company at $18.43 per share.

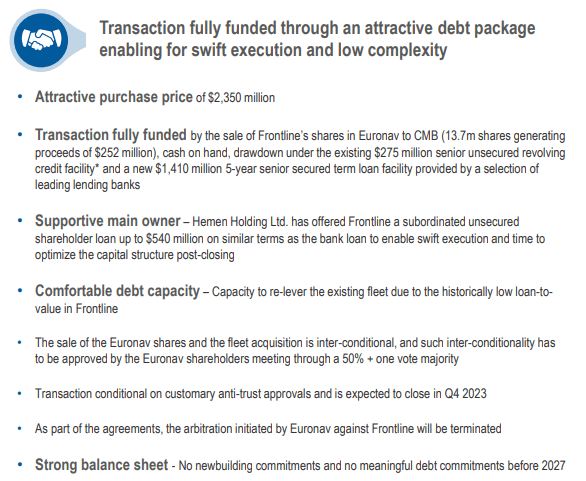

- Frontline will purchase the 24 newest VLCC tankers from the Euronav fleet with an average vessel age of 5.3 for $2.35 billion.

- The Euronav’s arbitration against Frontline will be officially concluded.

In accordance with Belgian corporate law, CMB is obligated to begin a mandatory takeover offer. This offer, priced at $18.43 per share in cash, will be adjusted for any dividends disbursed by Euronav prior to the settlement date.

Maintaining Euronav’s listing on both Euronext Brussels and the New York Stock Exchange is a priority for CMB. Consequently, there are no plans to launch a squeeze-out bid subsequent to the completion of the offer.

Tanker outlook

Both management teams are keenly aware of the significant opportunities associated with large crude tankers, as emphasized in their latest presentations and comments.

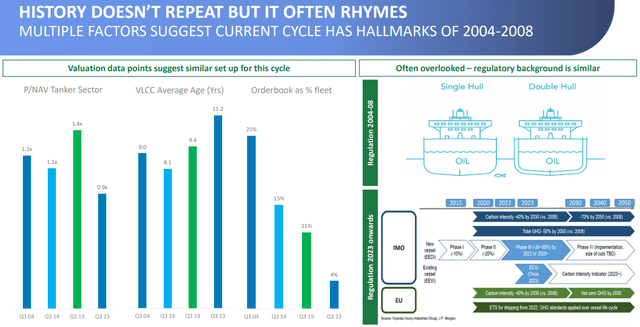

In Euronav’s most recent presentation, they suggest that the current market cycle bears resemblance to the 2004-2008 Supercycle due to new regulations and low orderbook. Notably, the fleet currently on the water is the oldest since 2001, with the VLCC order book standing at less than 2%, and the Suezmax order book at about 7%.

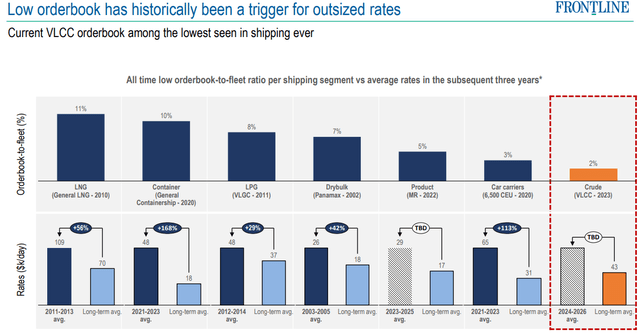

Frontline’s management shares a similar vision, which may be the primary rationale for financing the entire deal through debt, without issuing any shares above Net Asset Value (NAV). Their investor presentation highlights how a sparse order book typically results in robust rates.

Frontline Investor Presentation

With shipyards operating at full capacity and uncertainties surrounding short-term propulsion alternatives, along with the long-term demand for crude beyond 2040, the prospect of new builds remaining limited could potentially extend the bull cycle beyond typical durations.

While the positive outlook for supply is evident, the demand picture is less certain, particularly in the short term.

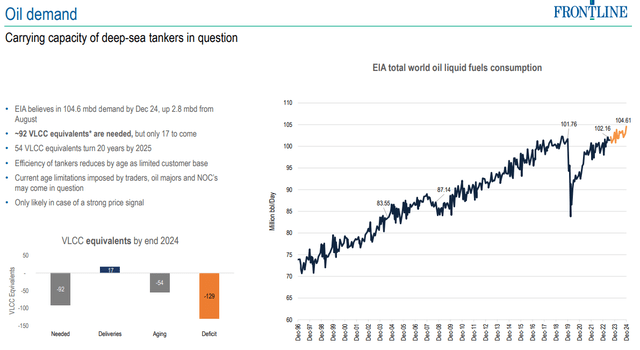

The EIA forecasts strong demand in the medium term, but there appears to be a softening in demand for the short term. Additionally, considering the historical trend of slower demand in Q1 and Q2, the next two quarters could pose challenges.

Frontline Investor Presentation

Euronav Business overview

Euronav, headquartered in Belgium, holds a prominent position as a leading company in the industry. Boasting the largest fleet among listed crude tanker companies, Euronav currently operates 41 Very Large Crude Carriers (VLCC) and 21 Suezmax vessels. As part of Fredriksen’s deal, the company is set to divest its newest 24 VLCCs, retaining a fleet of 17 VLCC and 21 Suezmax.

FEARNLEY TANKER SEMINAR

However, more crucial than the current fleet or tanker outlook is the strategic direction envisioned by the Saverys family. In a recent press release , they articulated their strategize to modify the company from a pure crude tanker entity into an energy transition growth company. The new strategy is founded on three key pillars:

- Diversification of the fleet

- Decarbonization of the fleet

- Optimization of the existing fleet

Management has emphasized that, to attain this transition, investors should brace for a more balanced allocation between investments for growth in the energy transition and cash distributions to shareholders, indicating a potential reduction in distributions. Additionally, it is imperative to recognize the inherent risk that the company seek a merger with CMB.tech as intended before or allocate a significant portion of profits to finance other initiatives.

advance details on these plans are expected during Q1 2024, and until then, an elevated level of uncertainty is likely to persist.

Frontline Business Overview

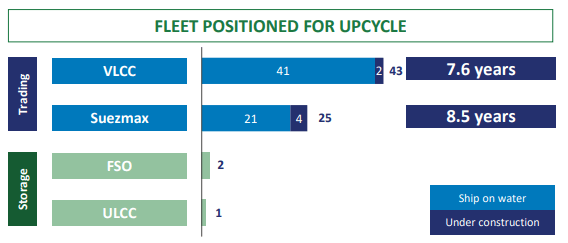

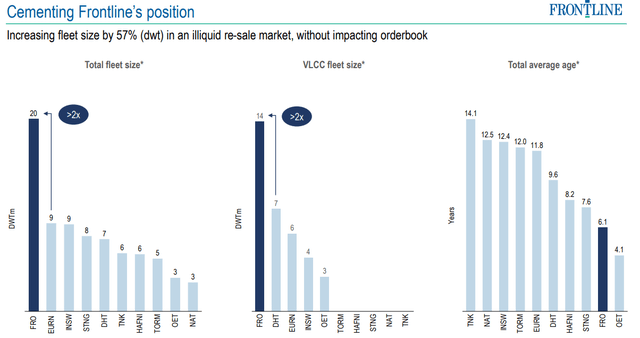

Following this transaction, Frontline is poised to emerge as the largest public tanker company, boasting a fleet of 89 vessels (comprising 46 VLCCs, 25 Suezmax, and 18 Aframax) with an average age of 6.1 years, ranking as the second youngest in the industry after Okeanis.

Frontline Investor Presentation

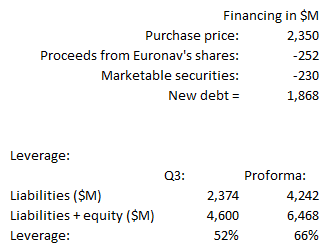

The financing for this transaction will be primarily through debt, resulting in an increased leverage around 65% (more on that later), marking the highest among its industry peers.

Frontline Investor Presentation

Despite lacking a formal dividend policy, Frontline aims to distribute quarterly dividends equal to or close to earnings per share. This is a hallmark of the majority of Fredriksen companies and the primary reason for their premium valuation. But given the heightened leverage resulting from the recent transaction, it becomes crucial to perceive whether the company prioritizes deleveraging or maintains its trend of distributing dividends close to earnings. In the most recent quarter (Q3), they disbursed $0.3 per share, representing approximately 80% of the adjusted profit.

Valuation

Both Euronav and Frontline are trading around or above NAV, while Frontline usually trades at a premium valuation due to Fredriksen control, this premium has been amplified after Euronav deal. There are better alternatives between peers.

Using Arctic Asset values and Q3 figures it is possible to do a NAV approximation for both companies and if the transaction price for the 24 VLCC is fair.

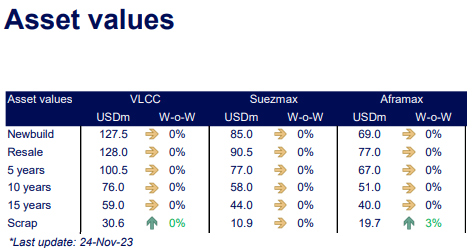

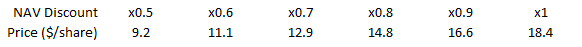

Vessels Values (Arctic Securities)

The 24 VLCC changing hands have an average age of 5.3 years and were acquired for a total of $2.35 billion. Employing linear interpolation, it can be estimated that a VLCC with a 5.3-year age profile is valued at approximately $99M (as illustrated below). Multiplying this valuation by 24 yields $2,376M, aligning closely with the actual price paid by Frontline. The Arctic prices do not include scrubbers, and since 9 out of the 24 VLCCs are scrubber-fitted, Frontline secured a quite favorable deal. However, I would categorize the deal as fair.

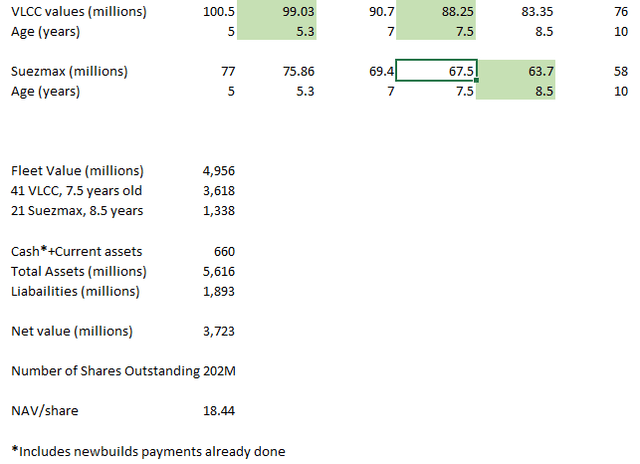

With the same vessel values and Q3 Euronav’s figures, NAV stands at $18.44/share (excluding the valuation of their two FSOs and the ULCC):

NAV estimation (Oriol Madaula)

Considering these figures, it is evident that there is no remaining potential upside, as the CMB takeover offer is fixed at $18.43. This amount will be adjusted to $17.86 per share post 12/12/2023, following Euronav’s $0.57 dividend payout for Q3-23. Euronav is trading around $18, and the dividend will be subject to a 30% Belgium withholding tax, resulting in a marginal 1% discount to the offer price.

For those inclined to preserve an investment in Euronav after the mandatory takeover offer, a prudent approach is recommended. Just before the transaction was announced, Euronav’s shares experienced a 15% dip within a week due to concerns surrounding the potential control by the Saverys family. After the takeover is finalized, I expect a similar outcome and Euronav to trade in the low range of peer valuations. Assuming it trades at 0.7 NAV, and it could even be lower, this implies a valuation around $13, indicating a potential 25% downside. Additionally, monitoring stock liquidity after the takeover offer is crucial, as it could be considerably low.

NAV (Oriol Madaula)

Given the modest discount, coupled with the high uncertainty surrounding Euronav’s future plans and considering that most listed peers are trading at a discount to NAV, it may be prudent to examine alternative investments in peers with greater potential, such as International Seaways (INSW) or Okeanis (OET), which will start trading at NYSE on December 11th.

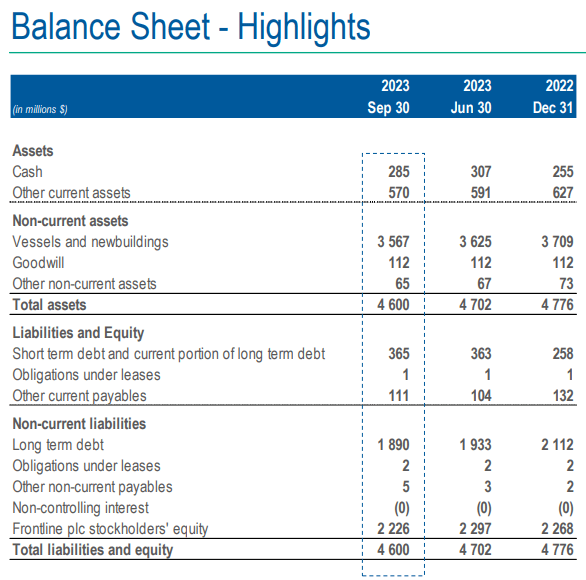

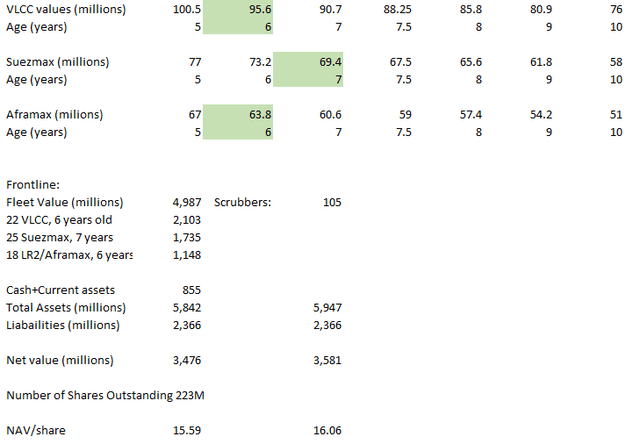

Regarding Frontline here is a NAV calculate using same vessels values and their Q3 numbers:

Q3 FRO Presentation NAV estimation (Oriol Madaula)

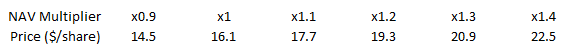

NAV stands around $15.5/share without valuing scrubbers. Frontline has 42 scrubbers-fitted vessels, valued at $2.5 million each, the adjusted NAV is around $16 per share. Consequently, the stock is currently trading at 1.25 times NAV, compared to its pre-Q3 release value of 1.35xNAV. It’s important to note that this valuation is pre-transaction, but the transaction itself is not expected to impact NAV, as it is executed at a fair price. However, it will significantly boost leverage. At present, Frontline already has the highest leverage among peers, standing at 52% according to their Q3 presentation. Post-transaction, which will be funded through a combination of cash and debt, this leverage could surge beyond 65%. Assuming they allocate roughly half of their cash towards the deal, along with the proceeds from Euronav’s shares, the required debt would be $1,868M, pushing the leverage to 66%.

Leverage (Oriol Madaula)

In my view, opting to finance a portion of the deal with equity trading considerably above NAV would have been preferable. Issuing shares above NAV to acquire ships at NAV is always accretive. However, the current strategy raises concerns; in the event of a few challenging quarters, dividends may be scaled back, potentially impacting the share price. High leverage works both ways, while highly advantageous in robust markets, potentially positioning Frontline as the best performing stock, also poses risks in softer rate environments. Taking in consideration Frontline’s historical premium valuation but that there might be softening in rates over the next two quarters, my fair value calculate would be around $17.5.

NAV (Oriol Madaula)

Risks

OPEC+ cuts. persistent efforts to raise prices could weaken demand, resulting in reduced tanker utilization and rates.

Increased Orderbook: While Although the VLCC orderbook remains notably low, there is a rising trend in the Suezmax orderbook. While additional orders could potentially impact the outlook negatively, finding available slots for large tankers poses a challenge due to shipyards being occupied with LNG and container projects.

Saverys Family: The Saverys Family is not inclined to work Euronav solely as a pure crude tanker company and has other objectives in mind. With full control, they now have the autonomy to seek their desired course of action. Moreover, is one of the few public companies that continues to order new tonnage.

Frontline equity offering. While I don’t foresee it, in the event that markets deteriorate over multiple quarters, Frontline might find it necessary to consider an equity offering as a measure to reduce leverage.

Conclusion

In conclusion, the recent deal between Euronav and Frontline marks a transformative shift in the maritime industry. Frontline’s acquisition of 24 VLCCs positions it as the largest public tanker company, but potential drawbacks include skepticism over the Saverys family’s control of Euronav and Frontline’s increased leverage.

Moreover, both Euronav and Frontline are trading at or above NAV, a situation that contrasts with some industry peers trading at notable NAV discounts. This valuation gap makes difficult to preserve a long position in either company, especially when considering other names with similar risk profiles but greater potential in detention to other names with similar risk and more potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.