SOPA Images/LightRocket via Getty Images

Investment Thesis

Freshworks Inc. (NASDAQ:FRSH) delivered 2024 guidance that was in line with expectations. This is the unavoidable bad news. The good news is that the pace at which Freshworks has been increasing its underlying profitability implies that this stock is on the path to being attractively priced.

At its core, the problem with the stock is that it needs time for the intrinsic value of this business to grow to match the stock’s expectations. However, I believe that over the next 12 months, we’ll look back to $20 per share as a low point.

Here’s why I remain tepidly bullish on FRSH.

Rapid Recap

Back in October, I concluded my bullish analysis by saying:

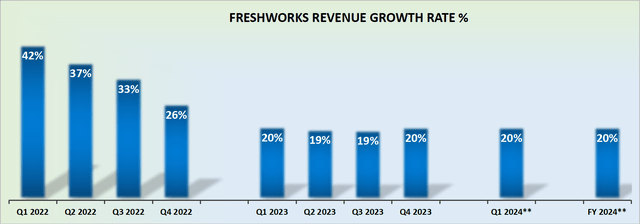

Freshworks offers a compelling opportunity. Though it may not be in its hyper-growth phase anymore, the fact that it maintains a stable 20% CAGR and is valued at around 9x to 10x forward sales multiples highlights a reset in investor expectations.

This means Freshworks can now prioritize improving its bottom-line profitability. Its guidance suggests it could finish 2023 with approximately $0.22 in EPS, a considerable leap from its past performance.

While it may not be a high-octane growth stock, Freshworks shows promise for consistent, long-term returns with an improved valuation outlook.

As it turns out, FRSH ended up delivering $0.26 in EPS in 2023, even higher than my previous expectations of $0.22.

And this leads me to the following contention.

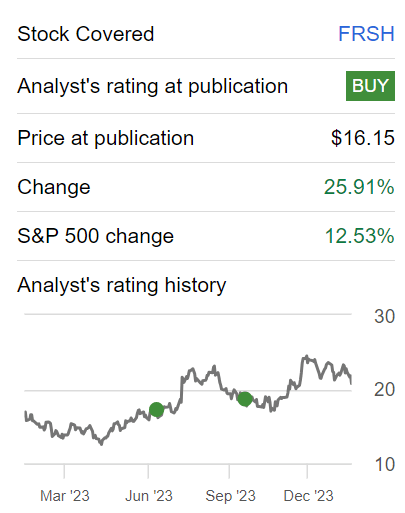

Author’s work on FRSH

Since I turned bullish on FRSH, it has been a strong performer and is up substantially more than the S&P 500 (SP500). Even though I recognize that this investment thesis is not blemish-free, I nonetheless, remain tepidly bullish on this stock.

Why Freshworks? Why Now?

Freshworks creates solutions for businesses, particularly focusing on customer service tools. They aim to help businesses optimize work processes and boost productivity. They compete against the likes of ServiceNow (NOW), Salesforce (CRM), and HubSpot (HUBS).

Moving on, Freshworks appears to have promising near-term prospects. Its Q4 2023 results showed strong financial performance, surpassing revenue expectations with $160.1 million.

Also, the launch of the Freshworks customer service suite and notable client acquisitions, including partnerships with Big Lots, S&P Global, Fila, and others, indicate expanding market reach and recognition from major brands.

The Neo Platform, serving as the foundation for its product portfolio, indicates the company’s commitment to serving enterprise customers. Furthermore, as Freshworks moves from a cash-burning company in 2022 to generating $78 million of free cash flow in 2023, this reflects its improved operational efficiency (more on its profitability to come).

However, Freshworks also faces challenges. The competitive landscape in the software industry is intense, and sustaining growth requires continuous differentiation.

While the introduction of AI capabilities, including Freddy Copilot and Insights, presents opportunities, it also brings the challenge of ensuring effective integration and customer adoption. Additionally, as the company targets larger enterprises, meeting the diverse needs of a broader customer base might pose scalability challenges.

On top of this, the departure of key executives, such as the Chief Revenue Officer Pradeep Rathinam, raises questions about Freshworks’ executive talent retention.

Given this mixed context, let’s now discuss Freshworks Inc. financials.

2024 Outlook Points to 20% CAGR

Freshworks guides for 20% CAGR. Right off the back, this is the main detraction from the bull case. I had expected Freshwork to bedazzle investors with its solid guidance. Particularly given that the comparables with the prior year are so much easier.

Consequently, the main question I have is what happens in 2025? Will Freshworks find some way to reignite its revenue growth rates? Or will its growth rates decelerate from 2024?

Accordingly, when investors are asked to pay a large premium for a growth stock, they demand certainty plus a strong premium growth. And I’m unsure of whether Freshworks is up to the task of delivering on either of these?

Given this backdrop, let’s tackle the valuation of this stock.

FRSH Stock Valuation — 100x Forward non-GAAP Operating Profits

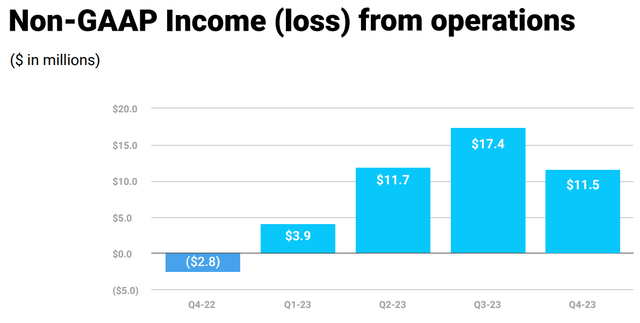

FRSH delivered 7.2% non-GAAP operating margins for Q4 2023. Meanwhile, its guidance for Q1 2024 already points to close to 9% non-GAAP operating margin. Indeed, this is approximately 180 basis point expansion y/y.

Consequently, when management is guiding for 2024 to see around 9% non-GAAP operating margin, I believe that it’s possible for FRSH to deliver 10% non-GAAP operating margins when the year is done and dusted.

This translates to a 55% y/y increase in non-GAAP operating income y/y.

On the surface, investors are asked to pay 100x forward non-GAAP operating profits. This sounds punchy, but one has to consider that the business is still growing by 20% CAGR, and it also just started on its path to profitability in 2023.

With another 12 months of top line growth, together with some operating leverage, Freshworks can see around 13% non-GAAP operating income, or close to $110 million of non-GAAP operating income. This leaves the stock priced at 64x forward non-GAAP operating income.

The Bottom Line

Freshworks’ outlook appears promising with 2024 guidance in line with expectations, showcasing improved underlying profitability.

While my bullish stance remains, there are also uncertainties that persist regarding sustained growth beyond 2024.

On the financial front, Freshworks impressively transitioned from a cash-burning entity in 2022 to generating $78 million in free cash flow in 2023, reflects enhanced operational efficiency.

However, the 20% CAGR guidance for 2024 raises questions about the company’s ability to maintain growth rates, crucial for justifying its current valuation at 100x forward non-GAAP operating profits. Despite positive strides in profitability and a growing business, careful consideration is warranted for Freshworks Inc., with uncertainties surrounding the company’s ability to meet investor expectations and navigate evolving market dynamics.

Altogether, I am tepidly bullish on this stock.