Ong-ad Nuseewor

The wobbly start to January was the long overdue correction that we did not see in November or December, when pullbacks were one-day wonders. What we saw in January is more “normal”, whatever that nebulous term means in the stock market.

Not every index set a record last week, but the majors did, like the Nasdaq 100, the S&P 500 and the Dow Jones Industrials. The fly in the ointment was the Russell 2000, which is quite a long way from an all-time high – or could this be an opportunity?

Small caps have a lot of catching up to do, and the only way they would do so is if we avoid a recession in 2024, which is very possible, and interest rates decline, which is also a clear likelihood, with falling inflation numbers.

As I write this (on Sunday), there are eight remaining trading days in January, and a lot can happen in the stock market in eight days.

We have PCE inflation numbers released on Friday, and with this back up in Treasury yields, which popped 40 basis points in a short period of time, Friday sure promises fireworks in both the stock and bond markets.

This backup in yields may be the reason why the Russell 2000 is under-performing, as it carries higher than average sensitivity to interest rates than the rest of the stock market.

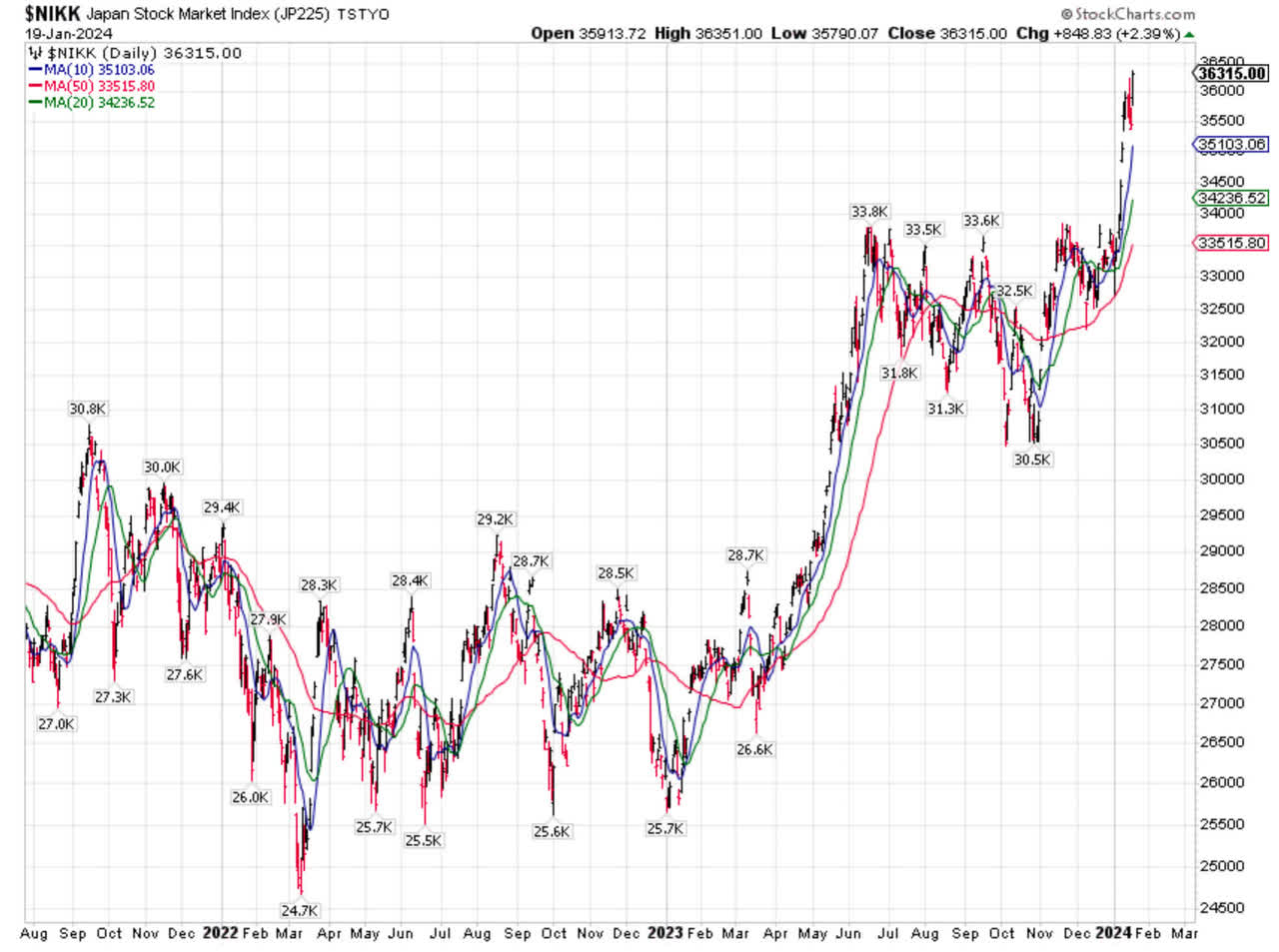

In contrast, emerging markets performed terribly, due to the rebound in the dollar, but a rebound in the dollar in many cases means an even bigger selloff in the Japanese yen, which went from 140 to 148 and lit a fire under the Nikkei 225 which bolted out of the gates in 2024.

It was a huge year for the Nikkei in 2023, and we may have another big year in 2024 with the end of deflation and the possible normalization of monetary policy which the Bank of Japan is slowly moving on by letting JGB yields float more freely and at some point moving on its policy rate which has been negative since 2016!

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This compression of net interest margins did a number on the Japanese financial system, which put tremendous pressure on their banks. We had similar issues in Europe with negative interest rates and banks, but in Japan this compression has lasted much, much longer.

If Japan comes out of deflation, the Nikkei could go quite a bit higher, considering that today it is still about 3,000 points below where it was in December 1989, when the Dow was at 2,700.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The end of deflation is a very big deal in Japan, considering how long it has lasted. In 2020, Warren Buffett saw the coming inflation with the out-of-control deficit spending for COVID that promised big inflation, similar to what he personally experienced as a youth after WW2.

Deflation is what the Chinese are afraid of, as they are dealing with it right now and they have studied the Japanese experience.

Because of the mountains of debt hidden in bank balance sheets in China, I would say that China is possibly a good candidate for a Japanese style outcome, while Japan is becoming a boom market again.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.