OlenaMykhaylova

The First Trust Intermediate Duration Preferred & Income Fund (NYSE:FPF) is a closed-end fund that income-focused investors can use to seek their goals. As the name suggests, the fund seeks to reduce duration risk compared to some other closed-end funds, which should result in it being somewhat less volatile in a changing interest rate environment than a comparable fund that does not take such precautions. This is something that may demonstrate to be very attractive for risk-averse investors and retirees who do not want to have the value of the assets in their portfolios changing very quickly. Unfortunately, the fund does have a bit lower yield than some other fixed-income funds. The fund still yields 10.42% at the current price though, so it does still make a very reasonable proposition for income-focused investors.

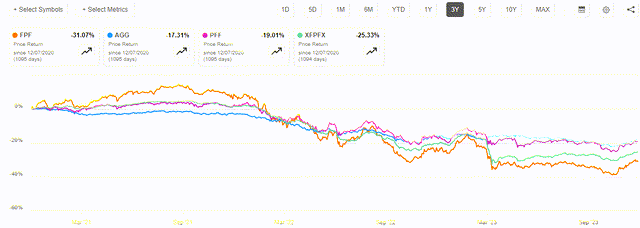

As most people reading this article are no doubt well aware, preferred stocks and other income-producing assets have not been performing especially well over the past two years as rising interest rates have caused asset prices to reject. Over the past three years, the share price of the First Trust Intermediate Duration Preferred & Income Fund has declined by 31.07%. This is much worse than the 17.31% reject of the Bloomberg U.S. Aggregate Bond Index (AGG) or the 19.01% reject of the ICE Exchange-Listed Preferred & Hybrid Securities Index (PFF):

This could certainly be discouraging to potential investors, particularly those who are looking to limit their volatility and duration risk. However, it is important to keep in mind that the First Trust Intermediate Duration Preferred & Income Fund has a much higher yield than either of these indices. That higher yield helps to offset some differences between the share price performances. When we take this into account, we still see that the First Trust Intermediate Duration Preferred & Income Fund underperformed the indices but not nearly as dramatically:

In terms of total return, this fund has underperformed the aggregate domestic bond market by less than 300 basis points over the past three years. However, the fund is still underperforming the preferred stock index by quite a lot. The higher yield might still be enough to make the case for this fund in the eyes of some investors, especially when we consider that the worst is almost certainly behind us for fixed-income securities, and as such significant declines are likely to be much less than we have seen over the past three years.

About The Fund

According to the fund’s website, the First Trust Intermediate Duration Preferred & Income Fund has the primary objective of providing its investors with a very high level of total return. This is not surprising considering that the name of the fund strongly suggests that it is aiming to reach its objectives by investing in fixed-income securities such as preferred stock and bonds. Indeed, the fund’s website describes the fund’s objectives and strategies thusly:

First Trust Intermediate Duration Preferred & Income Fund is a diversified, closed-end management investment company. The primary investment objective is to seek a high level of current income. The Fund has a secondary objective of capital appreciation. The Fund seeks to reach its objectives by investing, under normal market conditions, at least 80% of its managed assets in preferred securities and other income producing securities issued by U.S. and non-U.S. companies, including traditional preferred securities, hybrid preferred securities that have investment and economic characteristics of both preferred securities and debt securities, floating-rate and fixed-to-floating rate preferred securities, debt securities, convertible securities and contingent convertible securities. The Fund seeks to preserve, under normal market conditions, a duration of between three and eight years.

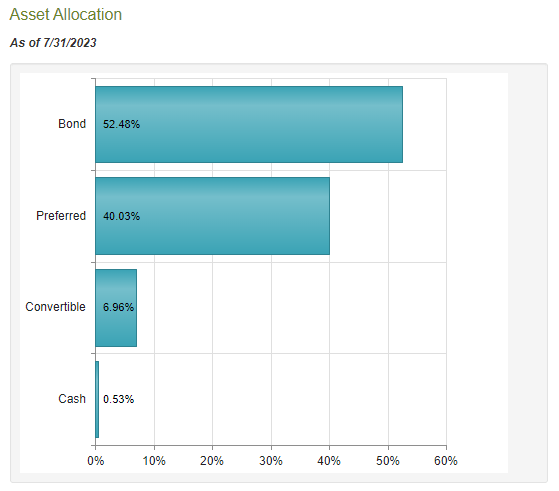

This description strongly suggests that the fund is focusing its efforts on preferred stock investing as opposed to a combination of preferred stock and bonds. However, CEF Connect states that 52.48% of the fund is currently invested in bonds while only 40.03% of the fund is invested in preferred stock:

CEF Connect

There is nothing on the fund’s website or in the fact sheet to contradict this, but the fund’s most recent holdings report appears to suggest otherwise. This report, which is dated July 31, 2023, and is the most recent report currently available states that the fund’s asset allocation is as follows:

|

Security Type |

Weighting |

|

$25 Par Preferred Securities |

21.4% |

|

$100 Par Preferred Securities |

0.7% |

|

$1,000 Par Preferred Securities |

4.7% |

|

$1,000,000 Par Preferred Securities |

1.2% |

|

Capital Preferred Securities |

118.1% |

|

Foreign Corporate Bonds and Notes |

2.6% |

|

Corporate Bonds and Notes |

0.4% |

That clearly states that the overwhelming majority of the securities held by this fund are preferred securities. It is certainly possible that CEF Connect is defining preferred securities that have a maturity date as bonds, and I can certainly sympathize with that view. While such securities are less common than perpetual preferred securities, they do exist and there are a number of them held by this fund. For the most part, though, the preferred securities held by this fund mature after 2050 so it is still a long time until the issuing companies will repay the par value of the securities. The only real difference between these securities and very long-term bonds is that the issuing company can skip the dividend payment to the preferred stockholders without triggering a default (although it will almost certainly trigger a market reaction that has a similar effect).

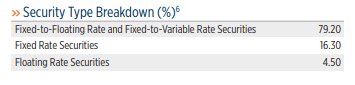

Preferred stock and bonds tend to trade similarly in the market. In short, both securities tend to trade inversely to interest rates. This is one of the biggest reasons why this fund’s share price has declined to the degree that it has over the past three years. However, we can see in the description above that not everything held by this fund is going to be adversely affected by rising interest rates. For example, note how the website’s description of the fund’s strategy specifically states that it can include floating-rate preferred stocks. In fact, right now 4.50% of the fund is invested in these securities and another 79.20% of the fund’s assets are invested in preferred stock that convert into floating-rate securities at some point:

Fund Fact Sheet

The conversion of a fixed-rate preferred stock to a floating-rate preferred stock is something that frequently happens after five or ten years following the security’s initial issuance. This is mostly because a preferred stock usually has either an extremely distant maturity or will be a perpetual security with no maturity. As such, investors frequently do not want to take on the interest-rate risk indefinitely. As such, the security will switch to a floating-rate one after a given period of time. This should reduce the amount that the preferred stock’s price will fluctuate when interest rates change. After all, as I pointed out in a previous article, floating-rate securities do not tend to see their price vary much when interest rates change. Thus, with a fixed-rate-to-floating-rate preferred stock, there is only a few years of interest rate risk that the market needs to price into the security, not an infinite period that needs to be priced in. As such, these securities should be somewhat more stable than a pure fixed-rate perpetual preferred stock.

The First Trust Intermediate Duration Preferred & Income Fund is taking another step to protect its investors against interest-rate risk. As mentioned on the fund’s website, it is aiming to preserve an average duration of three to eight years across the portfolio. Right now, the fund’s duration is on the very low end of this range, at 3.58 years. Duration is a term that generally refers to a measure of a fixed-income asset’s sensitivity to interest rate changes. Basically, the higher the asset’s duration, the more that we can expect its price to reject when interest rates go up. iShares unfortunately does not furnish the duration for the preferred stock exchange-traded index fund so we cannot directly contrast this fund’s duration to the index. However, this fund’s net asset value per share has declined by 25.33% over the past three years, which is far more than the index:

It is important to keep in mind that the fund is employing leverage, which amplifies the downside movement over the period. As such, we cannot really make predictions based on how this fund’s share price or net asset value will advance based solely on its duration compared to that of the index.

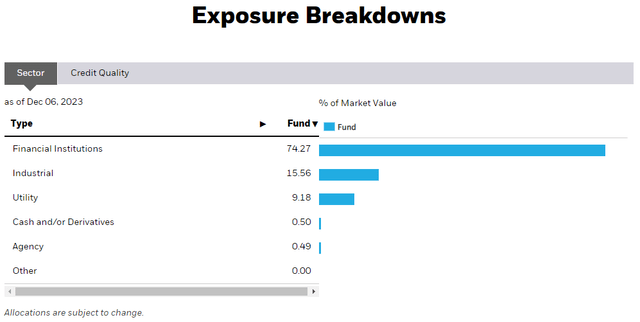

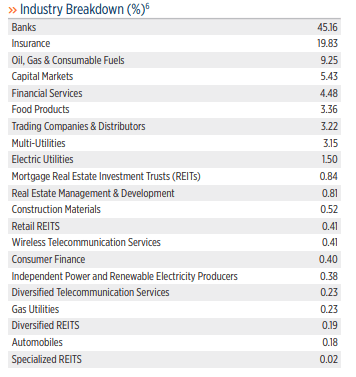

In various previous articles, we have seen that preferred stock funds tend to be highly exposed to the banking and financial services sectors. This one is not an exception, as we can see by looking at its sector weightings:

Fund Fact Sheet

As we can clearly see, the First Trust Intermediate Duration Preferred & Income Securities Fund has 45.16% of its assets invested in the banking sector and 19.83% of its assets invested in the insurance sector. As such, 64.99% of its assets are invested in the financial services sector. This is much less than the 74.27% weighting that the index has to “financial institutions.”

This is something that might be comforting to those investors who are concerned about the risks of the banking sector right now. As I have pointed out in a few previous articles, American banks are currently sitting on enormous unrealized losses from their long-dated U.S. Treasuries and mortgage-backed securities, so they are highly vulnerable to bank runs (this is what brought down Silicon Valley Bank earlier this year). While the Federal Reserve and other regulators have taken some steps that are meant to stabilize the banking system, the risks are still very real and more conservative investors might still want to limit their exposure. This fund seems to be doing a good job of doing that, especially when compared to other preferred stock funds and the index as a whole.

Leverage

As is the case with most fixed-income closed-end funds, the First Trust Intermediate Duration Preferred & Income Fund employs leverage as a method of boosting its effective returns. I have discussed how this works in a number of previous articles. To paraphrase myself:

Basically, the fund borrows money and uses that borrowed money to purchase preferred stock and other income-producing securities. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will normally be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This is one of the reasons why the fund’s net asset value has declined more than the indices over the past three years. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally would appreciate a fund’s leverage to remain under a third as a percentage of its assets for this reason.

As of the time of writing, the First Trust Intermediate Duration Preferred & Income Fund has leveraged assets comprising 33.21% of the portfolio. This is a bit lower than many other fixed-income closed-end funds, which is pretty nice to see given the uncertainty surrounding the direction of interest rates right now. This is also below the one-third level that I generally prefer for a closed-end fund. As such, it appears that this fund is striking a reasonable balance between the risk and the potential reward. We should not need to worry about very much here.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the First Trust Intermediate Duration Preferred & Income Fund is to furnish its investors with a very high level of current income. In pursuance of this objective, the fund invests its assets in a portfolio that primarily consists of preferred stocks, which usually have respectable yields since they deliver the majority of their total returns to investors via direct payments. This fund collects these payments and applies a layer of leverage that allows it to control more preferred stock than it otherwise could be based solely on its equity capital. The use of leverage thus allows it to boost the yield because it will collect payments from more securities and can pocket the difference between the received payments and the interest rate that it has to pay on the borrowed money. The fund collects all of this money into a pool and combines it with any realized capital gains that it manages to acquire by exploiting changes in its prices. The fund then pays out all of the pooled money to its shareholders, net of its own expenses. We can probably assume that this will allow the fund’s shares to boast a very high yield.

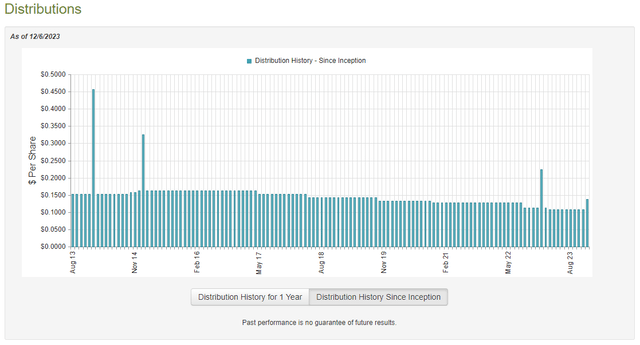

This is certainly the case as the First Trust Intermediate Duration Preferred & Income Fund currently pays a monthly distribution of $0.1375 per share ($1.65 per share annually), which gives it a 10.42% yield at the current share price. This is comparable to the yield of most other fixed-income and preferred stock funds, although it cannot contrast to what junk bond funds are paying right now. Unfortunately, the fund has not been particularly consistent with respect to its distribution over the years. As we can see here, the distribution has generally been declining over the past six years:

The fund did enhance its distribution for December, however. The fund’s latest distribution press release suggests that this is an enhance to the regular distribution and not a special one-time payment as the fund has occasionally made in the past. This is something that the fund’s shareholders will almost certainly appreciate, as otherwise the distribution history would be a major turn-off for anyone who is looking to earn a safe and safeguard income from the assets in their portfolio. A consistent distribution is often desired by those investors who are using the money to pay their bills or finance their lifestyles, such as many retirees. The recent distribution enhance is also very nice considering the impact that inflation has had on the purchasing power of the income that we acquire from our portfolios.

As is always the case, we want to have a look at the fund’s finances in order to ascertain how well it can uphold the distribution that it is paying out. After all, we do not want to be the victims of a distribution cut as that would reduce our incomes and almost certainly bring about the fund’s share price to reject. Let us have a look at the fund’s finances and try to make that determination.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. As such, this report will not include any information about the fund’s performance over the past seven months. That is disappointing as a great many events have occurred over the trailing period. For example, mid-July to mid-October was characterized by rising interest rates and general market pessimism that almost certainly caused the value of the assets that are held by this fund to reject. This report will not furnish us with any information about how well it handled this challenging environment. We will need the fund to release its annual report to get that information, which will not be for a few weeks.

During the six-month period, the First Trust Intermediate Duration Preferred & Income Fund received $47,236,892 in interest and $12,877,120 in dividends from the assets in its portfolio. This gives the fund a total investment income of $60,114,012 during the period. It paid its expenses out of this amount, which left it with $36,805,951 available to shareholders. This was, unfortunately, not enough to cover the $40,463,805 that it paid out in distributions during the period. The fund did manage to get pretty close to covering its distributions fully out of net investment income, though. As I have pointed out in previous articles, we would generally appreciate a fixed-income fund to pay its distributions solely out of its net investment income.

However, the fund does have other methods through which it can acquire the money that it needs to cover its distribution. For example, preferred stock prices vary with interest rates so the fund might be able to exploit this and earn some capital gains. These gains can obviously be paid out to the shareholders, but they are not considered to be part of the fund’s investment income for tax purposes. Unfortunately, the fund generally failed miserably at this task during the period. During the six-month period, the First Trust Intermediate Duration Preferred & Income Fund reported net realized losses of $82,844,173 which was partially offset by $14,840,317 net unrealized gains. Obviously, this was not enough to make up the difference between net investment income and the distributions that were paid out, and the fund’s net assets declined by $71,661,710 after accounting for all inflows and outflows during the six-month period. This is certainly concerning as it is a clear indication that the fund has failed to fully cover its distributions.

Fortunately, it appears that the fund has managed to correct this problem since the time that the reporting period ended. As we can see here, the fund’s net asset value per share is up 4.60% since May 1, 2023:

This suggests that the fund’s assets produced sufficient returns to cover all of the distributions that it paid out over the past seven months with money left over. This could partially explain why the fund recently raised its distribution, but not enough time has passed to ascertain if the new distribution is sustainable going forward. We can say with certainty that the fund’s distribution was not destructive to its net asset value over the past seven months, though.

Valuation

As of December 6, 2023 (the most recent date for which data is currently available), the First Trust Intermediate Duration Preferred & Income Fund has a net asset value of $17.95 per share but the shares only trade for $15.75 each. This gives the fund’s shares a whopping 12.26% discount on net asset value at the current price. This is a better entry price than the 11.56% discount that the shares have had on average over the past month. As such, the current price appears to be a reasonably attractive entry point if you wish to begin acquiring a position in this fund.

Conclusion

In conclusion, the First Trust Intermediate Duration Preferred & Income Fund appears to be a way to profit from declining interest rates with lower risk than other preferred stock closed-end funds possess. While I will admit that I am not convinced that interest rates will reject to the extent that the market is currently expecting, it could still be a good idea to have something in your portfolio that will benefit should interest rates continue to reject. This fund is one way to do it, and it is one of the few that is mostly covering its distribution out of net investment income. In fact, the fund has successfully covered its distribution over the past seven months but is still trading at an enormous discount despite the strong price appreciation that its shares have delivered over the past six weeks. As such, it might be worth accumulating as a way to profit from falling interest rates.