solarseven

Investment Thesis

Fortinet (NASDAQ:FTNT) has popped 10% on the back of its outlook for 2024. But is there enough here to compel me to bang my fist on the table and call this stock a buy at this point? No, there is not, even though I recognize that turning neutral on a stock that is up nearly 12% premarket reflects an investor that simply “doesn’t get it”.

To which I retort I strongly believe that in the cybersecurity sector, there are vastly more compelling investments than FTNT.

Simply put, despite having been bullish on this stock as we headed into this earnings report, and made the right call on this stock in the past year, I no longer believe that there’s a lot more upside beyond $80 per share. Therefore, I’m calling it a day on this stock and recommend looking elsewhere.

Rapid Recap

Back in October, in a bullish article, I said:

According to my estimates, Fortinet is priced at around 30x next year’s EPS. It’s not the best and most compelling stock in the cybersecurity sector, but it’s trading at a very fair multiple, particularly after the stock sold off following its last earnings results.

In summary, FTNT’s stock has faced challenges, partially justified, but not entirely. Overall, it still presents an attractive investment opportunity.

Author’s work on FTNT

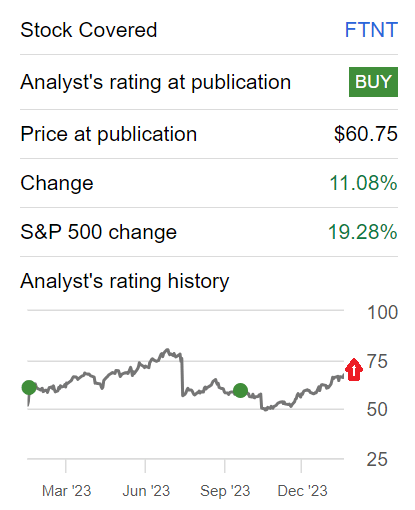

Fortinet is a stock that I’ve been bullish on over the past year, and including the after-hours pop, it’s up 20% since I recommended this stock.

Now, having spent some time critically thinking about its valuation, from this point, over the next twelve months, I do not believe it offers investors a positive risk-reward opportunity beyond approximately $80 per share. Here’s why.

Fortinet’s Near-Term Prospects

Fortinet specializes in cybersecurity, providing technology solutions to help protect computer networks and data from cyber threats. Fortinet’s main focus is on building security systems for businesses.

They offer a range of products and services, including firewalls, which act as a protective barrier, preventing unauthorized access.

On a positive note, Fortinet’s near-term prospects appear solid as reflected in their recent Q4 performance. The company has demonstrated a robust growth trajectory, with total billings reaching $1.9 billion, showcasing an 8.5% increase driven by strategic focuses on Secure Operations (Secure Ops), Secure Access Service Edge (SASE), and enhanced execution by the sales team.

With a notable customer base comprising 76% of the Fortune 100, including top technology, manufacturing, and healthcare companies, Fortinet is well-positioned to capitalize on the burgeoning demand for Secure Ops, SASE, and secure networking solutions.

However, Fortinet declared that the current product cycle is in decline, which commenced about four quarters ago, suggesting a potential bottoming out in early 2024.

Supply chain disruptions have also impacted product revenue growth and the digestion of projects and products in 2024 is expected to influence the company’s financial performance.

Now that we have this context, let’s delve into the financial aspects.

Outlook for 2024 Points to 10% CAGR

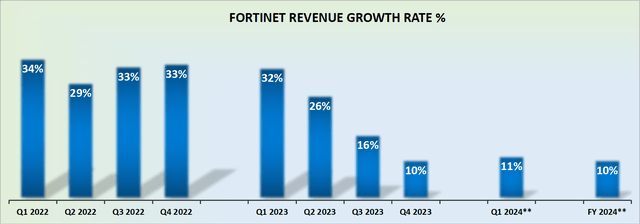

Fortinet is expected to grow by approximately 10% CAGR in 2024. I find it difficult to get particularly bullish about these growth rates. As you can see above, it feels like only a few quarters ago Fortinet’s revenue growth rates could be counted on to deliver more than 20% CAGR.

Meanwhile, its outlook for 2024 now points to 10% CAGR, at the high end of its guidance.

Even though the share price has popped after hours, I can’t imagine that tech investors will be overly enthused to pay a large premium for these sorts of growth rates.

Not when many of its peers, including one of the mature players in the sector, which incidentally I own, Palo Alto Networks (PANW), is expected to grow at close to 18% CAGR over the next 12 months. Not to mention the strength of SentinelOne (S).

The problem here for Fortinet is twofold. Not only will investors be unwilling to pay a premium for its stock. But also, Fortinet will struggle to hire and retain top executive talent as its growth rates fizzle out.

Given this context, let’s now discuss its valuation.

FTNT Stock Valuation – 42x Forward EPS

Including the after-hours pop on the stock, FTNT is priced at 42x forward EPS. As a reference point, PANW is priced at 58x forward EPS (this figure has been adjusted to normalize for the different ending fiscal year).

Consequently, I struggle to believe that investors will be enthusiastic over the coming year to pay a large premium on a stock that ends up delivering for them just “barely” double-digit topline growth.

On a positive note, Fortinet hasn’t been reticent when it comes to returning capital to shareholders. Case in point, during the past 90 days alone, repurchased approximately 1.7% of its market cap (which on an annualized basis, if we were to times this quarterly figure by 4), would come very close to 7% of its market cap being returned to shareholders.

However, since Fortinet’s balance sheet only holds $400 million of net cash, I can’t foresee Fortinet having enough capital resources to continue buying back close to $900 million of stock every quarter.

The Bottom Line

Despite Fortinet’s recent 10% surge driven by a positive 2024 outlook, I am hesitant to categorize it as a compelling buy.

While my past bullish stance on Fortinet proved accurate, a thorough evaluation prompts me to reconsider its upside beyond $80 per share.

The stock’s current valuation at 42x forward EPS, compared to peers like Palo Alto Networks at 58x, raises concerns about investor enthusiasm, especially with a projected 10% CAGR for 2024. Supply chain disruptions and the challenge of maintaining top talent in the face of slowing growth further contribute to my decision to step away from Fortinet, suggesting investors explore more promising options in the cybersecurity landscape.