One specific segment within tech has consistently outperformed most others.

At first glance, it may seem unwise to speak negatively of the Nasdaq 100 and its corresponding exchange-traded fund (ETF), the Invesco QQQ Trust (QQQ 0.95%). Considering that $100,000 invested 20 years ago is now worth about $1.3 million, it has obviously served as an excellent investment vehicle.

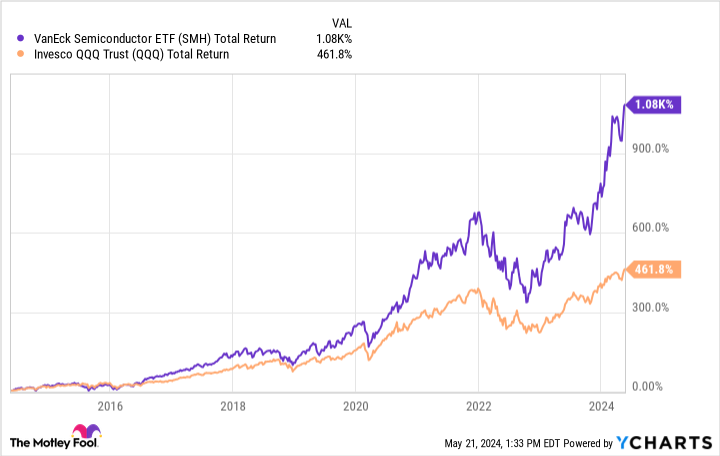

However, one segment of tech has stood out for its performance: semiconductors. Despite a relatively high level of volatility, chips have powered the tech industry, taking tech returns considerably higher. Thus, instead of investing in the Nasdaq 100 through the Invesco QQQ Trust, one might want to consider a certain semiconductor ETF that may bring higher returns.

The semiconductor ETF

This fast-growing investment is the VanEck Semiconductor ETF (SMH 1.85%).

Admittedly, the VanEck ETF comes with a higher level of risk. With that fund, investors are all-in, not only on technology, but also on a specific part of the tech industry. Also, instead of 100 stocks, the VanEck fund holds only 26 stocks.

In comparison, the Nasdaq 100 has a 59% allocation to technology as of the end of the first quarter of 2024. Still, that index holds stakes in 10 industry sectors, a factor that brings some diversification.

Also, VanEck ETF shareholders pay an expense ratio of 0.35%, higher than that of Invesco QQQ at 0.20%.

However, its managers seem to earn the higher fees. Over the last year, the fund has risen 72%. Also, extending the timeline out over 10 years, which includes downtimes for the industry and the overall market, investors have earned an average return of almost 27% annually. This exceeds the average return on the Invesco QQQ over the last 10 years of 19% per year.

| VanEck Semiconductor ETF vs. Invesco QQQ (Annual % Return as of 3/31/2024) | ||||

|---|---|---|---|---|

| One Year | Three Years | Five Years | 10 Years | |

| VanEck ETF | 72% | 24% | 35% | 27% |

| Invesco QQQ | 39% | 12% | 21% | 19% |

Data sources: VanEck, Invesco.

Moreover, a part of the higher returns may ironically be the cyclicality within the semiconductor industry. As much as investors benefit from significant upside in the chip industry, it is also known for considerable sell-offs during downtimes. So severe are the sell-offs that occasionally, the Nasdaq 100 will outperform the VanEck fund.

Nonetheless, investors should remember that the chip industry has recovered from every past downturn. Thus, if one sees a time when the Nasdaq 100 outperforms the ETF over a one-year or three-year period, it is likely one of the best times to add shares of the VanEck fund.

SMH Total Return Level data by YCharts

The VanEck ETF’s stock investments

The VanEck Semiconductor ETF has also earned its returns by making significant but calculated bets on specific semiconductor stocks.

Not surprisingly, its largest position is Nvidia, making up nearly 21% of the fund’s holdings. Nvidia currently dominates the market for artificial intelligence (AI) chips, allowing it to post triple-digit revenue growth in recent quarters. That has likely driven a significant amount of its returns this year.

Furthermore, it takes on a different type of risk with its 13% stake in Taiwan Semiconductor. As the dominant manufacturer of high-end chips, it has not experienced the volatility of Nvidia. Also, since it is the most advanced chip manufacturer, it is well-positioned to prosper from AI.

The only other stock with a stake significantly higher than 5% is Broadcom, which makes up just under 8% of the fund. The specialty business-to-business chip designer has benefited from strong demand for AI accelerators and networking products in AI data centers, leading to the stock more than doubling over the last year.

The remaining 23 stocks are positions of 5% or less in varying parts of the chip industry. This can range from chip design companies like Qualcomm to analog chip companies like Texas Instruments to ASML, a leader in equipment manufacturing. These encompass all major subsegments within the semiconductor industry. Since the industry serves a wide range of needs and customers, it gives the fund more balance than one might assume.

Also, thanks to the industry’s strong performance over the years, such stocks have collectively made significant contributions to the fund’s returns. With AI again stoking demand for semiconductors, these dynamics are unlikely to change anytime soon.

Investing in the VanEck Semiconductor ETF

The VanEck Semiconductor ETF has outperformed index stocks like the Invesco QQQ due to calculated bets and secular growth across the chip industry.

Admittedly, a fund with 26 stocks is riskier than one with 100, and betting on one sector exclusively could hurt investors long-term.

Nonetheless, the tech industry depends heavily on semiconductors, a factor that has led to outsized returns over long periods. While no investor should go all-in on semiconductors, the sector is too crucial not to have a stake. Ultimately, the VanEck Semiconductor ETF allows investors to benefit from this industry while mitigating its risks.