Retail, known for its consistent growth, is one of the best markets for long-term investment. The industry ranges from grocery to e-commerce, consumer tech, and much more, allowing stockholders to benefit from the tailwinds of dozens of segments. The global retail market hit a valuation of $27 trillion in 2022 and is projected to rise to $30 trillion this year.

Apple (NASDAQ: AAPL) has enjoyed immense success in the industry, with leading market shares in multiple areas of consumer tech, from smartphones to tablets, smartwatches, and headphones. In fact, Apple has the third-largest market share in e-commerce in the U.S. despite having a significantly smaller product range than its rivals.

However, it’s hard to consider Apple’s stock when Amazon (AMZN 0.58%) also exists. The company is the world’s second-biggest retailer (only after Walmart) and is the No. 1 name in e-commerce. Additionally, Amazon’s diverse business model has seen it gain a powerful position in tech, with a leading 31% market share in the $626 billion cloud market.

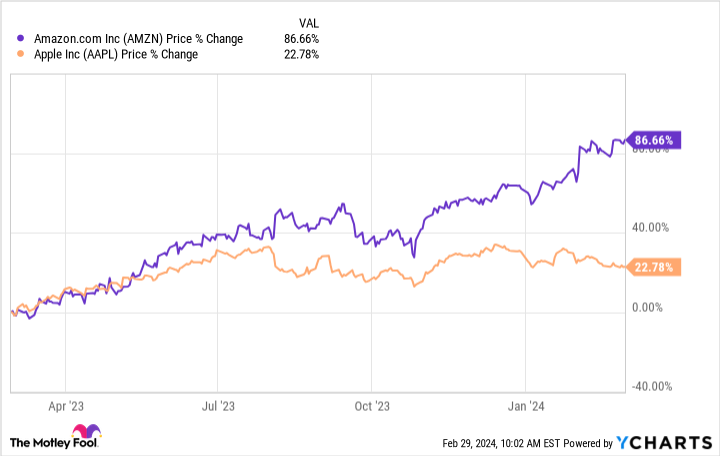

Data by YCharts

This chart shows Amazon’s stock significantly outperforming Apple’s over the last year. Meanwhile, various growth catalysts in retail and tech will likely keep the company on its current trajectory.

So forget Apple and buy this unstoppable growth stock instead.

Amazon has delivered an impressive turnaround

An economic downturn caused a marketwide sell-off that saw the Nasdaq Composite plunge 33% in 2022. Retail companies were hit particularly hard as inflation spikes forced consumers to cut discretionary spending. As a result, shares in Amazon fell 50% in 2022 alongside steep profit declines in its e-commerce segments.

However, the company has made an impressive recovery since then, proving its reliability and resilience. In fiscal 2023, Amazon’s revenue rose 12% year over year to $575 billion, while operating income tripled to $37 billion.

A range of cost-cutting measures and easing inflation bolstered the company’s e-commerce business and its free cash flow skyrocketed 904% to $32 billion in the last 12 months.

Apple didn’t fare as well amid macroeconomic headwinds, with its revenue dipping 3% to $383 billion in fiscal 2023, while its free cash flow rose 10%.

Amazon’s performance over the last year highlights the importance of investing with a long-term mindset. The retail giant has shown it can successfully navigate macroeconomic headwinds, making its shares an attractive long-term buy. Meanwhile, its considerable cash reserves indicate it has the financial resources to continue expanding and investing in high-growth industries like artificial intelligence (AI).

Amazon stock could enjoy nearly 70% upside in the near future

In dozens of countries, Amazon dominates e-commerce, a market expected to hit $3.6 trillion in 2024 and expand at a compound annual growth rate (CAGR) of 10% through 2028. The tech company will likely continue profiting from the sector’s tailwinds for years.

However, Amazon’s biggest growth catalyst is easily its cloud platform, Amazon Web Services (AWS). In the fourth quarter of 2023, revenue from the platform rose 13% year over year to $24 billion. Meanwhile, AWS was responsible for 54% of the company’s operating income, despite earning the lowest portion of revenue between its three segments.

Moreover, AWS gives Amazon a lucrative role in AI, a market projected to expand at a CAGR of 37% through 2030. As the world’s biggest cloud service, AWS has the potential to leverage its massive cloud data centers and steer the generative AI market.

Amazon has entered the market by adding a range of AI tools to AWS and unveiling a new AI shopping assistant called Rufus on its retail site.

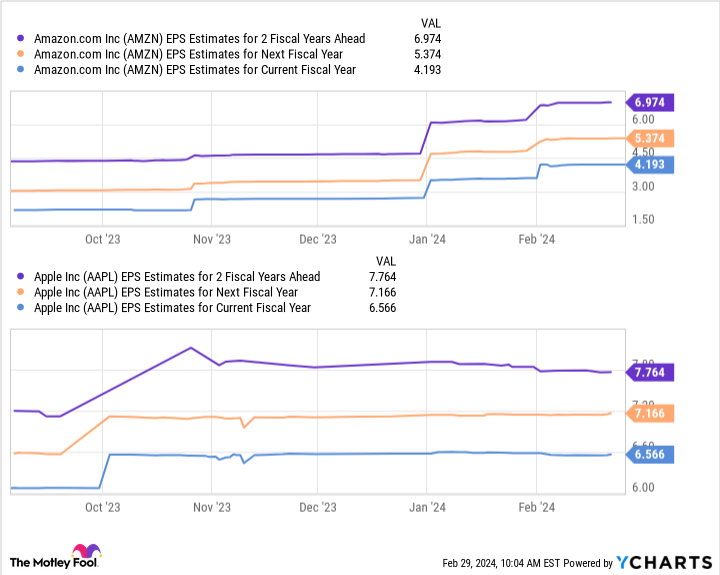

The tech giant is on an exciting growth path, and earnings per share (EPS) estimates reflect it has significantly more potential than Apple.

Data by YCharts

This table shows Amazon’s EPS could hit nearly $7 per share over the next two fiscal years, while Apple’s may reach close to $8 per share. When multiplying those figures by the companies’ forward price-to-earnings ratios (Amazon’s 42 and Apple’s 28), you get a stock price of $294 for Amazon and $218 for Apple.

Considering their current positions, these projections would see Amazon’s share price rise 68% and Apple’s 20% by fiscal 2026. Combined with a reliable business model and solid positions in e-commerce and AI, Amazon is a no-brainer growth stock to buy over Apple.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Walmart. The Motley Fool has a disclosure policy.