For many years, Apple was the top stock to own in the market. Its market dominance with its products, coupled with a cheap stock valuation, helped the company rise to dominate the markets from 2016 on. But Apple is no longer the deal it used to be — it’s quite expensive now, leaving investors searching for an alternative.

Instead of Apple, there is a far more promising company that investors can consider now: MercadoLibre (MELI -1.35%). While MercadoLibre isn’t exactly like Apple (it’s an e-commerce business), it shares one trait that makes it a screaming buy.

The dominant e-commerce ecosystem in Latin America

While Apple’s Mac computers, iPads, and iPhones may have been successful on their own, what really made Apple a dominant force was the ecosystem it built around its products.

While MercadoLibre doesn’t make products like these, it sells them. MercadoLibre is best described as Amazon, PayPal, eBay, and American Express merged into one. That’s a lot of big-name companies, but MercadoLibre has created its own e-commerce ecosystem to serve Latin America.

MercadoLibre has a retail and consumer-to-consumer commerce store, giving it aspects of both Amazon and eBay. It also has a package delivery business, with 54% of its packages delivered on the same or the next day of ordering. That sounds a lot like Amazon’s fulfillment services, and with 91% of MercadoLibre’s packages being handled by some form of its logistics business, it has created a large ancillary business.

As Latin America’s payment infrastructure was not at the same maturity level as the U.S. when MercadoLibre started, the company created its Mercado Pago platform. This allowed consumers to pay for products online but has since expanded into a platform that includes peer-to-peer payments.

MercadoLibre also saw an opportunity to get into the lending game, creating its own credit portfolio, which includes consumer loans, credit cards, and merchant loans. This gives MercadoLibre two PayPal and American Express-like businesses, as they run an online payment platform and credit portfolios, respectively.

The ecosystem MercadoLibre has created for commerce is akin to what Apple has done with technology and has proven to be a great business decision.

MercadoLibre isn’t the cheapest stock around

While some companies saw their revenue growth slow in 2023, MercadoLibre was full steam ahead. In 2023, MercadoLibre’s revenue growth never fell below a currency-neutral 50% pace. Its revenue growth also accelerated to the fastest rate in the past year during Q3, with its currency-neutral growth reaching a 69% year over year pace.

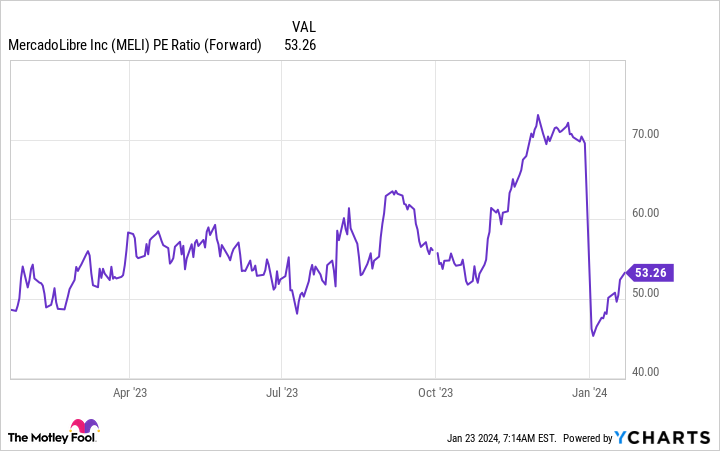

MercadoLibre is also becoming increasingly profitable, with its operating margin rising 7.2 percentage points to 18.2% in the third quarter. This helped its profit margin rise from 4.8% to 9.5%. As a result of its incredible growth, investors shouldn’t use trailing valuations. Instead, we’ll use its forward price-to-earnings ratio to value the stock.

At 53 times forward earnings, the stock isn’t exactly cheap.

MELI PE Ratio (Forward) data by YCharts

However, investors need to understand what assumptions are baked into that analysis to better understand whether this is expensive or cheap. MeracdoLibre trades for 90 times earnings right now, which means analysts predict 70% earnings growth over the next year.

While that’s strong growth, it’s likely undershooting MeracdoLibre’s potential. If MercadoLibre can maintain its 9.5% profit margin over the next 12 months and grow at a 25% pace, it will produce $1.57 billion in profits and have a forward price-to-earnings ratio of 57.

As the economic outlook improves, more efficiencies are realized, and credit losses drop, MercadoLibre’s profit margin will improve. Throw in the fact that MercadoLibre’s revenue hasn’t grown at a slower than 25% pace since 2018, and I think it makes a strong case that the stock will outperform expectations.

MercadoLibre has built an ecosystem as dominant as Apple’s in the Latin American e-commerce space. The stock has already crushed the market and will continue to do so if it keeps up its recent trends.

American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon, Apple, and MercadoLibre. The Motley Fool recommends eBay and recommends the following options: short January 2024 $45 calls on eBay. The Motley Fool has a disclosure policy.