Dividend investors are attracted to high-yield stocks for good reason, as higher yields maximize the income that can be generated. But a high yield can also be a sign of a risky dividend stock, attracting dividend lovers like moths to a flame that may ultimately burn them. This is the situation with Annaly Capital (NLY -0.41%) and its 13.6% dividend yield. Investors will probably be better off buying lower-yielding Realty Income (O -0.32%) instead.

Some basic differences in the business model

At their core, both Annaly and Realty Income are real estate investment trusts (REITs). This is a corporate structure designed to pass income on to investors via investment in institutional property markets. But these two REITs aren’t doing the same thing at all when you look at their actual business models.

Image source: Getty Images.

Annaly buys mortgages that are pooled into bond-like securities, often called something like a collateralized mortgage obligation (CMO). Realty Income buys physical properties that it leases out to others.

The mortgage market is property-related, but there are a lot of moving parts and it can be highly volatile. While you might be able to easily grasp Realty Income’s business, which is much like what you would do if you owned a rental property (just on a much larger scale), you would probably need to spend a fair amount of time getting to understand the complexities of the CMO market.

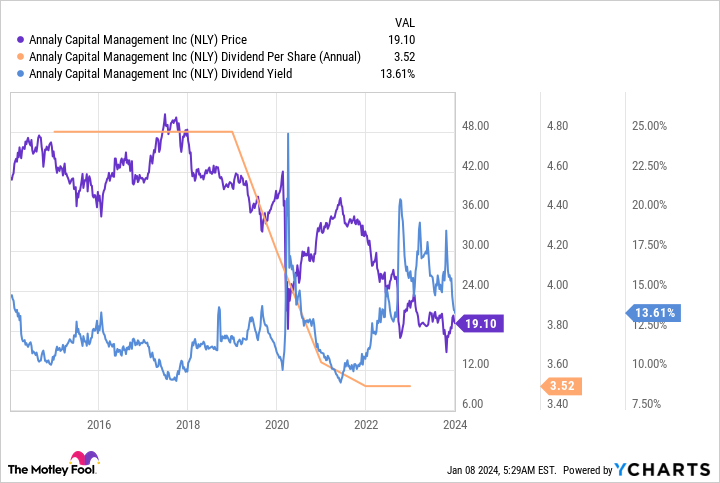

And yet you don’t need to do much homework to see the risk for dividend investors. As the chart below shows, Annaly’s dividend (the orange line) has fallen dramatically over the past decade.

The dividend decline resulted in investors dumping the stock (the purple line), as you might expect. That kept the dividend yield up at lofty levels the entire time even though income investors would have had the worst possible outcome, taking a lower dividend payment and a capital loss. Annaly is really designed to be owned by total return investors who focus on asset allocation (such as insurance companies and pension funds). Small income-oriented investors would be better off with a more reliable dividend stock, like Realty Income.

Realty Income is a reliable tortoise

To get the bad news out up front, Realty Income’s dividend yield is “only” 5.3% today, less than half the level you’d achieve with Annaly. However, Realty Income has increased its dividend annually for 29 consecutive years. That’s a much better record for investors trying to live off of the income their portfolios generate.

Realty Income is the largest net lease REIT, with a market cap that’s more than twice that of its next largest competitor. (Net leases require tenants to pay most property-level operating costs.) This is notable because Realty Income has the scale to take on massive deals that its competitors couldn’t even look at. And being so large, the investment-grade-rated company tends to have easier access to capital markets (on both the debt and equity sides).

The one drawback is that, given its size, Realty Income is a slow-growth company. That shows up in its dividend, which has increased at a 4.3% annual pace over the last 29 years. While that may not excite you, it will provide a solid foundation for a more broadly diversified portfolio. And 4.3% is enough to grow the buying power of the dividend relative to the historical rate of inflation growth. Relative to the dividend cuts at Annaly, slow and steady is much more attractive.

Don’t get sucked in by a dividend trap

Annaly Capital isn’t an inherently bad company, it just isn’t one that’s all that appropriate for small investors looking to generate reliable income from their nest egg. Most investors, particularly those with a conservative bent, will be better off going with a boring, but reliable, REIT like Realty Income. That said, Realty Income’s dividend yield is toward the high end of its range over the past decade, so now could be a good time to jump aboard.